The curious case of Financiere de l'Ouest Africain at 1 or 2 times earnings.

Today we will cover an potentially incredibly cheap stock. Very cheap, but very obscure. Do not view it as an investment idea that is actionable, but as a fun Sunday email. And if you buy shares in the stock, you get a free emerging value subscription if you send a proof, because you are just too dam crazy.

If I showed you a company with a chart that looks like this?

Volumes spiked up in 2023, buying everything on the market, then the stock was suspended because Euronext did not adjust “les seuils” which are limits in adapting supply and offer within an acceptable band. Or something like that. It trades in Paris.

Then it dropped back.

The order book spread is actually not too bad, we have seen worse.

Ok, let’s check the company website…to know what the company does.

Apparently, the website is down since the day it was up.

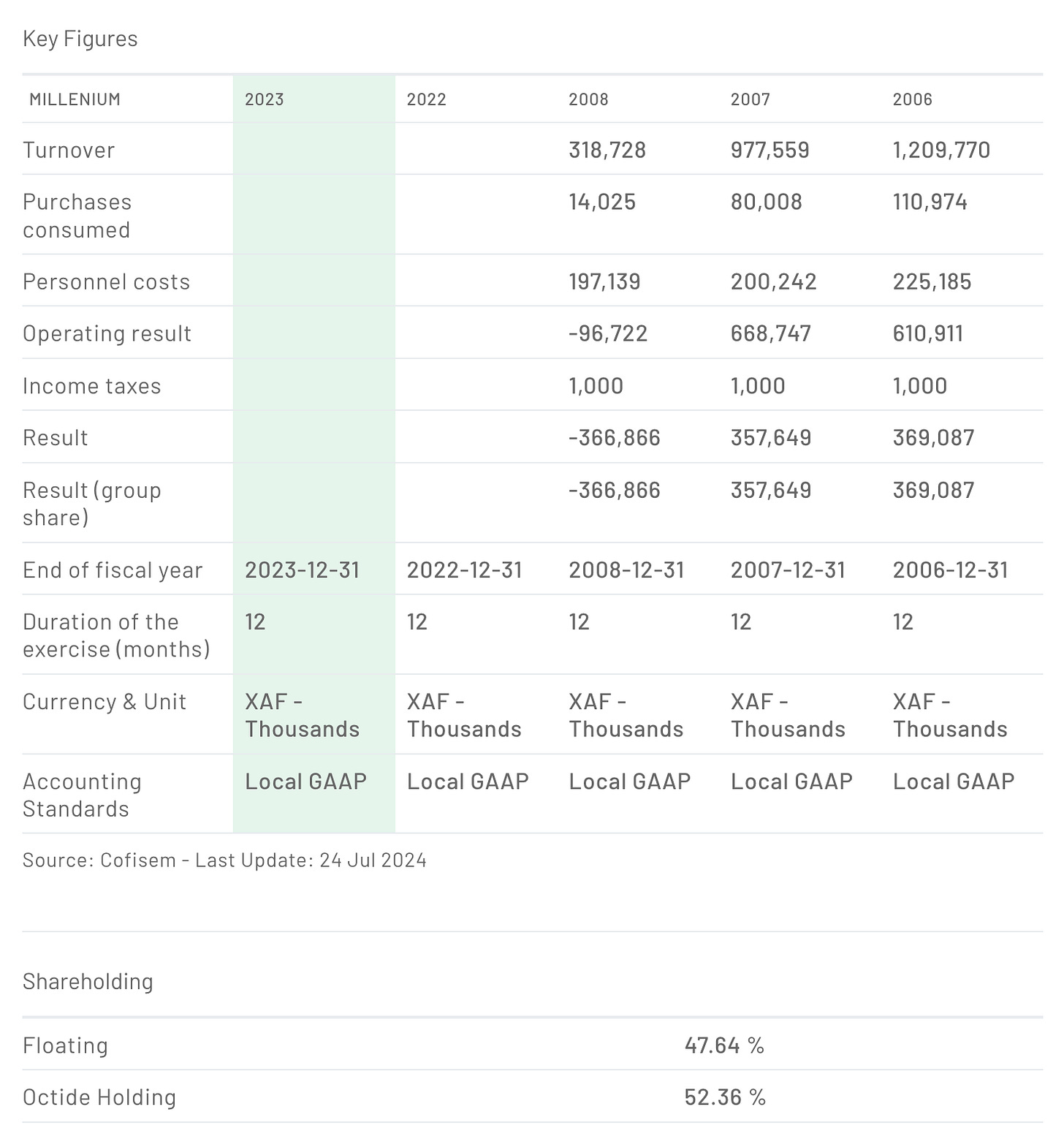

Ok, maybe we can check the financials or ?

WHAT?

After digging in the Boursorama forum, someone mentioned the latest financials…they are from 2008.

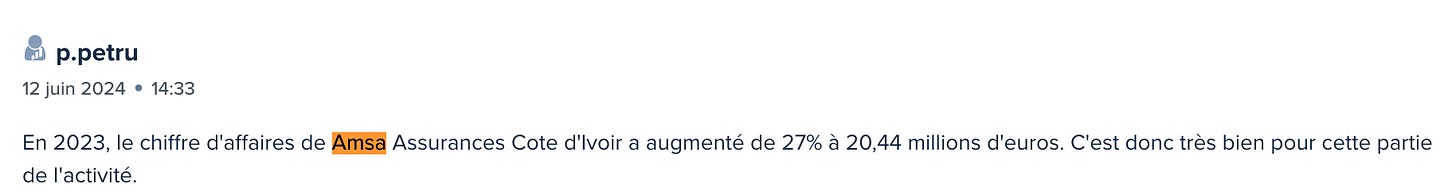

Someone also mentioned Amsa Assurances (Insurance).

Surprise, this website is operational and the company has a huge following on Linkedin and Facebook.. And the website confirms CFOA ownership!! Pfew, saved.

On Linkedin (see 1996 date at the Bottom, CFOA is confirmed owner).

We find on a eulogy somewhere that François Bakou is president of CFOA

So who is this guy.. François Bakou.

Here is a French article from 2018

So what is it worth?

So CFOA controls AMSA insurance in Ivory Coast, Cote d’Ivoire, and Senegal.

Apparently, according to user p.petru, which is a serious user and well followed on not only CFOA but other French small caps,

Amsa Cote d’Ivoire made 20 million Euros revenue, and Amsa Senegal made approx 40 Billion CFA in Gross premiums written, or 61 million Euros (in 2023).

There are some online sources about the turnover:

So, according to ChatGPT,

Across the industry, an average Net Income to GWP Ratio might typically range between 3-8%, with lower ratios in sectors with higher claims volatility (like P&C and reinsurance) and higher ratios in more stable sectors (like life insurance).

Lets say 3%. Amsa Senegal made at least 1.83million of net profit.

For the insurance sector, a 3-10% net margin is common, although this figure may be on the lower side when compared to other

Lets say 3%. Amsa Cote d’Ivoire makes at least 600k net profit.

There is also Amsa realty but we have not much details (Again)

Summary.

Two insurance operations in two leading West Africa economies with good prospects, plus some real estate investment.

2.5 million Euro profits in a low case scenario.

Market cap. 5 million.

PE of 2 maximum.

But, no financials, no dividend, no news, no transparency and take over protection.

There are a few other EM financials at similar valuations but with transparency and dividends, which I hold in the portfolio.

Therefore, I view this idea as too crazy for me.

Thanks! be sure to check other ideas:

2024 Write ups

03-24 Liberty Latin America (Neutral)

03-24 Pentamaster International

2024 Updates

10-24 - Ambra, Bastide, CCU, Text SA

09-24- Kulcs Software, Beximco Pharma, PayPal, IMS SA, and more

03-24 Bastide Le Confort update

03-24 Asian Real estate play Update

Subscribe below for full access to the research.

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

Just wanted to let you know, CFOA now has an actual website (in French and English). The website is https://www.cfoagroup.com/ The only problem is that the investor relations section is missing annual reports. But maybe they'll add them in the future.

After doing more research, it appears they also have an insurance business in Gabon as well as a Senegalese construction materials company. Also, it seems they have a market cap somewhere between $8M and $45M. But without clear financial info it's hard to say.

Interesting find. The website was apparently set up in 2016 and was no longer accessible after 2020. http://web.archive.org/web/20201128070839/http://www.cfoa.eu/