Update - This french small cap executes

I have decided to keep the companies I talk about Public unless they are very small caps. However Poulaillon is a very small cap I talked about publicly before, so I will continue.

Market cap 27 million Euros.

Stock exchange: Paris.

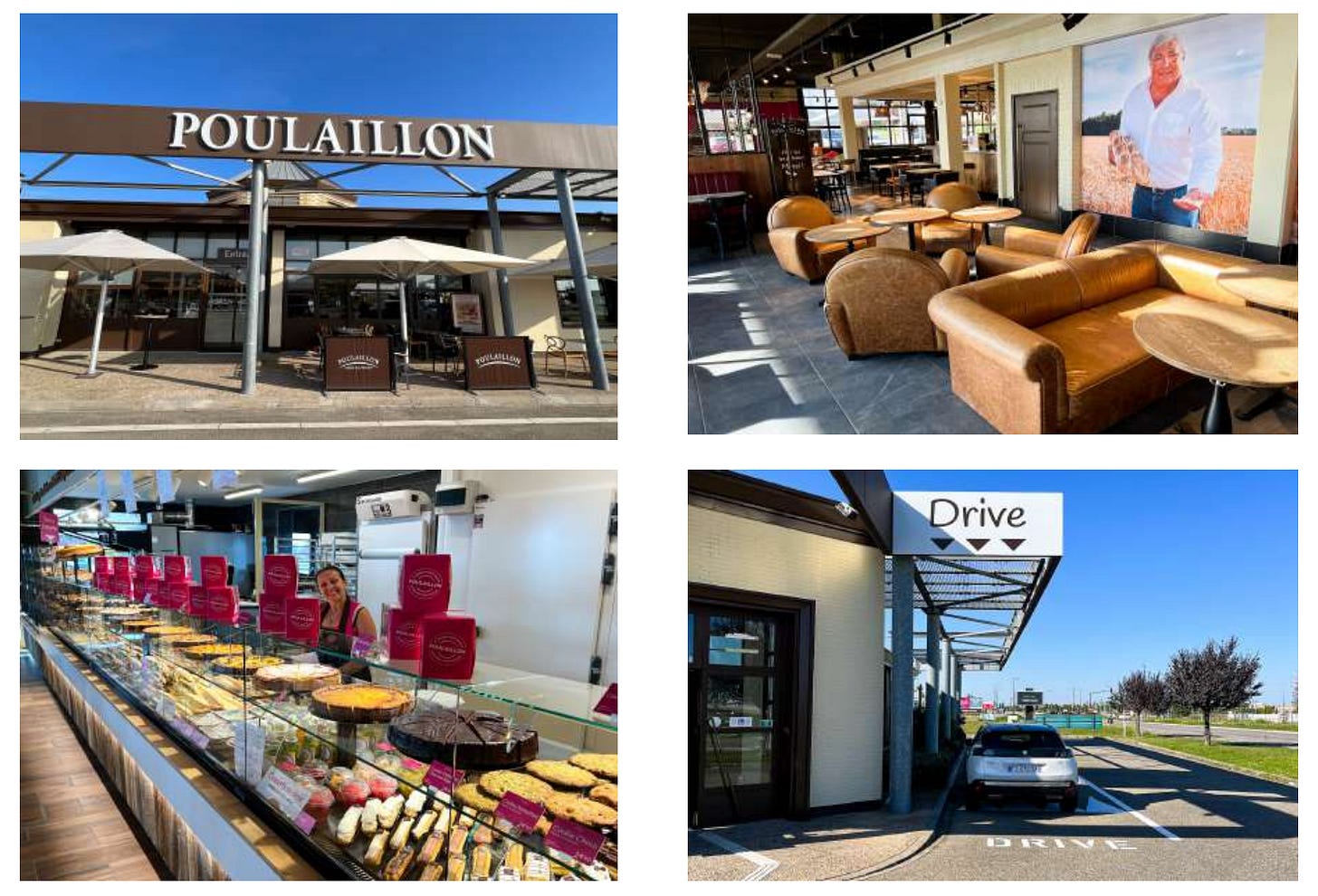

Poulaillon, a French bakery chain and food producer that I wrote up in the past.

Results were satisfactory. Revenues, net income, ebitda, everything keeps growing.

Revenue is up 21.6%, helped by inflation.

The company is losing money on the mineral water venture for a few years now. Water revenue is up 39.8% and results are slowly getting better at -1750k Euros versus -1918k last year.

EBITDA (EBE) is 10.9 million Euros verus 7.4 million Euro last year.

Net profit is up to 4 million Euros, on a 27 million market cap or a PE of 6.75. But there is an 1.4 million exceptional result, leaving a clean net result of 2.6 million on a market cap of 27 million.

D&A is 5.9 million Euros, and past analysis I did showed that half of the investments were growth investments, so I believe FCF and real earning power is higher than net profit.

Operating cash flow before working capital is 9.4 million.

Leverage went down.

Poulaillon declared a small dividend of 0.06 Eur again.

Business segments

Poulaillon has about 50% of revenue in the bakeries network and 50% in the b2b. For profits, it is about 60-40. Both saw similar growth.

B2B segment show great progress in snacking and supermarket sold products, and a rebound from the traiteur activity.

Water. The company initially launched water as a luxury item priced high and with unique cardboard packaging. It failed to reach scale needed to be profitable. This year the company switched to selling the water at normal prices in supermarkets with normal packaging. Therefore growth is increasing and we should see losses reducing in the future.

Bakeries: The company opened 4 and closed one establishment, and opened two more since the end of the September 2023 fiscal year. Some are Franchises.

Outlook for 2024

The electricity prices were blocked in 2023 but will increase 40 to 75% in 2024. It is hard to evaluate the impact as the energy costs are not disclosed.

Q1 showed a more measured revenue growth at +13%.

on the B2B side, we have more capacity expansion investments.

on the Bakeries side, we have two openings, one closure, one on going project under construction, and further projects planned. The company opens 3-5 location per year regularly.

Here is a recent video about the company - in French

You can get a feel for the company and products.

The main learning from this is that they have three projects of extension in their three production sites and portray themselves as “always investing”.

Another important thing is that the company bought a building they were leasing, saving 1.5 million of Ebitda per year or 400k of net cash flow for the future years. They did not really buy it but the court gave a decision to integrate it in the company retroactively and add debt for the acquisition. That is not really clear. But we will have more ebitda and cash flow and more debt.

Summary

The investments were 8.246 million euros, but only 2.618 were maintenance. Leases were also 0.8 million euros. The rest were new systems for the factories, new production lines, and new restaurants or bakeries.

In total that leaves us with 5.2 million of adjusted free cash flow for the year, or a P/FCF of 5.

I think that conservatively, some years will have more maintenance capex, but then EBITDA will have grown also in the mean time to make more free cash flow overall.

PROS: And I am hopeful that mineral water will cut losses in the future.

CONS: Increase in electricity prices and potential increase in interest costs (not enough details on this in the reports to estimate).

With an about 10% EBITDA margin and 2% net income margin, it does not classify as a quality company, but it has pricing power as a consumer defensive product, and it is a growth company. (annual revenue).

I keep holding.

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

Sponsorship - get 20% on Koyfin, the tool I use to visualize 15+ years of data

This is my personal opinion and not a buy or sell recommendation. Please carry your own analysis before buying shares.

Interesting business for sure, dividend is too tiny for me

How do you think the company will do if the French economy dips into recession? They be more defensive as a food producer, but I also think of retail bakeries as more expensive than the grocery store. And it sounds like they are also connected to the restaurant business.