This Portuguese Small cap is up 25% since entering.

Among the cheapest in the sector

Hi all, hope you are enjoying the summer.

I bought this company early this year and shared to subscribers that it was very cheap. After a small price run up, I will investigate how it is valued. It’s easy to buy something that is cheap but it is difficult to keep something once it goes up while a full analysis was not done. Therefore I will conduct the analysis below:

The company operates in a defensive sector and is building a good product offering internally and by acquisitions. An expansion beyond Spain and Portugal offers some runway, but the current price alone offers some good shareholder and dividend yield. While it has not worked in the past two years, buying higher shareholder yields than the market yield is historically proven to outperform, so I keep repeating the process like an idiot.

This is a very small cap.

P/E is 10 but P/FCF shows a bigger undervaluation

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

History

The company was "created more than 20 years ago by the Association of Pharmacies of Portugal , which decided to outsource and professionalise part of the services required by its associates.

Glintt Global (Glintt Global Intelligent Technologies) is a leading Portuguese technology company formed after the merging of ParaRede and Consiste in 2008.

(Consiste was controlled by the Portuguese association of pharmacies).

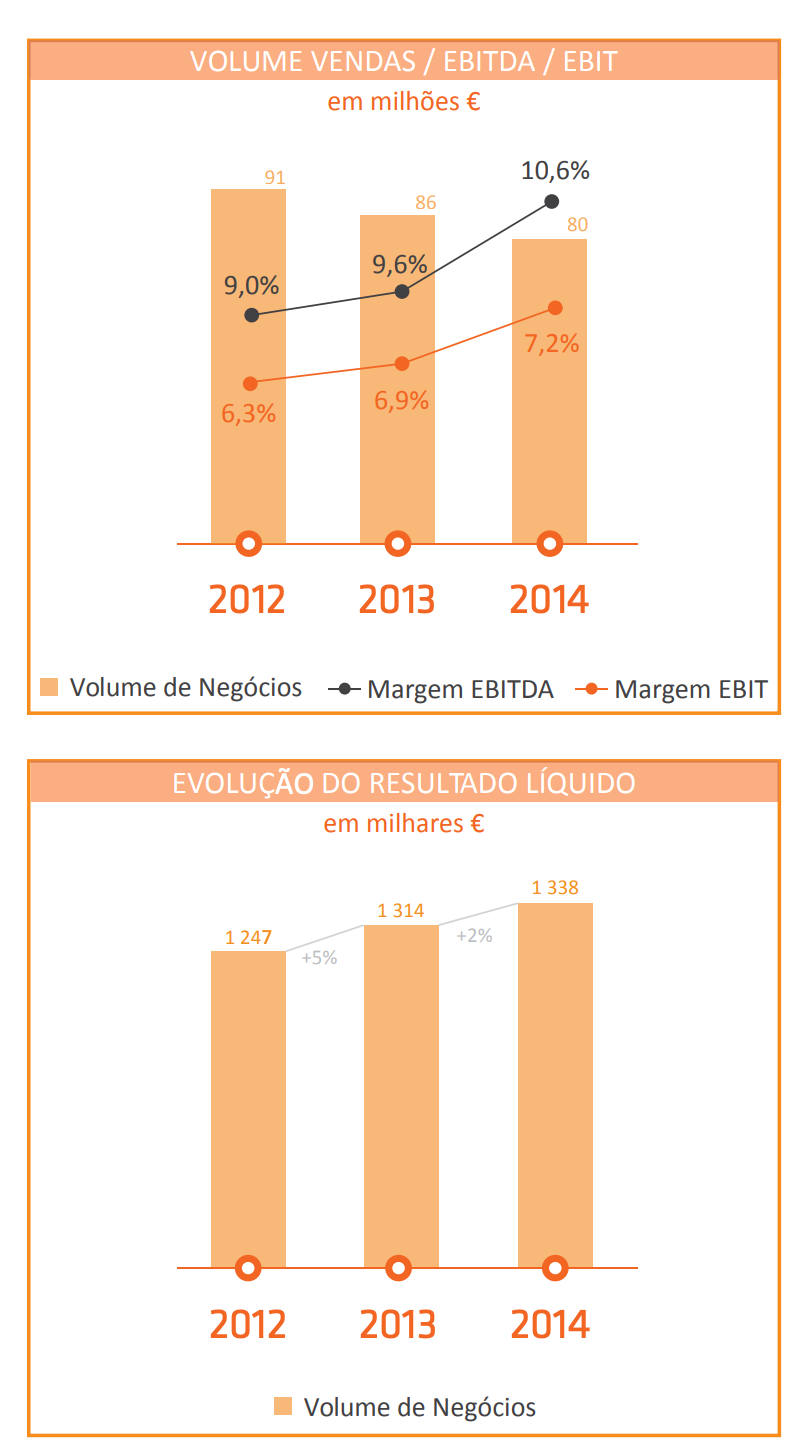

The company then saw sales go down after the 2008 crisis (Vendas) but results were improved (Resultado liquido) due to cost control and business restructuring in terms of offers to the market. The business is not fully recession proof, but is resilient due to the healthcare component.

Koyfin reports a drop in revenue too prior to 2014 but the company reporting does not go beyond 2014 so I don’t know what happened. Since 2014, the trend is good. The Koyfin numbers do not match fully with the

The internet has no news between 2008-2012, at least in Google.

The company conducted acquisitions in the past 2 years, notably the following.

Note that there is no news release for each acquisition, nothing. It’s only when in news articles that they mention the company acquisitions, or in the annual reports.

Overall Glintt has demonstrated an ability to grow sales and revenue in the Iberian Peninsula.

Business overview

Glintt is an IT service company.

The main business are Glintt Life (IT Healthcare) and Glintt Next (IT for non healthcare).

The company the leader in healthcare in Portugal and Spain. Here is a translated quote from Glintt.

Many healthcare professionals in Spain work with Glintt products or solutions on a daily basis, but they don't know it. The Portuguese multinational supplies 600 clinics and 400 hospitals (public and private), and 12,000 pharmacies, although it does so under the 11 companies that are part of the Glintt conglomerate, made up of more than 900 people in Portugal and around 220 in Spain, and whose turnover in 2022 reached almost 113 million euros.

They develop software and technological solutions for hospitals and pharmacies, with solutions to early 50% of the Spanish pharmacies and to the majority of the hospitals.

The business areas are spread out with equipment and automation at 18%, non healthcare services (consulting) at 21%, healthcare solutions are 11%, physical pharmacy design at 12%, support services at 25%. Yes they also provide physical pharmacy design, and automation with robots like the ones pictured below, that I saw in use in my local pharmacies. Basically the pharmacist orders a medication and it comes out of a tube in 5-10 seconds.

70% of the business is in healthcare, an area that is historically doing well in recessions. However some of the spending can be related to the IT equipment cycle.

Some major tools are farmatools

Here is another description of the business: it is very extensive and complex.

Here are some more tools.

In their healthcare division, they not only have IT professionals but also people with a Healthcare background that help understand the needs of the customers and patients.

Glintt next:

The rest of the business is general consulting and IT services, with a base of workers in Portugal and Brazil (Remote). This is interesting because these countries offer low cost IT professionals that are of high quality, especially with western communication culture.

Strategy & Management

The company is controlled by another company, Farminvest (76.4%), also listed, and also very very cheap, while very indebted. They are focused on reducing the leverage. I like Farminvest, but they are a low margin business with high leverage and many moving parts, thus I prefer to invest in Glintt.

The CEO Luis Cocco has been in the company for 13 years and CEO for 2.

In the next three to four years, Glintt plans to make strong investments in Spain, including new acquisitions. For example in smart labeling, stock management software, automation and robotics.

Here is what Luis Coco had to say about acquisitions:

We would like it to be. In other words, yes implies that we have attractive opportunities for us. And we are objectively looking at them, because I think we know the markets we are in very well. Our acquisitions have gone well. I usually say that acquisitions start when you sign the contract, they don't end there. Whether they go well or not depends on how you manage them. Modesty aside, we have proven that we are good at managing acquisitions. And so I think acquisitions are a very interesting way to complement our offering and acquire more customers, because in our area there is a cost to acquiring customers. The customer feels comfortable with a supplier that has already proven to be useful. And so we are proactively looking at acquisitions in Portugal and Spain, and even abroad. Because we think it is a good way to increase growth.

They aim to grow revenue by 8 to 10 million Euros a year.

Unfortunately the company does not communicate much with shareholders outside of news websites and a few blog interviews. There is no IR presentation and there are no press releases. It’s hard to visualise the strategy and the expected ROI from investments. This made analysing where the company is going much more difficult than analysing a company with some slide decks and clear strategy.

We did however see a good 7% dividend paid up in July 2024, showing a increased return to shareholders.

This is not a company with a serial acquiring strategy based on strict KPIs. This is a company more focussed on product and offering building.

Market

The Spanish and Portuguese healthcare IT market is quite big with a population of over 55 million people and aging.

Luis Coco mentions that they have 12000 pharmacies out of 22000, which present “brutal” growth opportunities.

For the hospital market and for non healthcare, a lot of the sales depend on public procurement and on the political environment.

The company plans to grow in the rest of Europe through joint ventures. This represent an opportunity for grow as the European market is many times the Iberian market.

Valuation:

Price: 0.5 €

Market Cap: 43 million Euros

Stock Exchange: Portugal Lisboa.

In terms of net profit, 2023 ended with 4 millions for a P/E of 10. However, there are 7.6 million Euros of depreciation and amortisation to analyse, as well as over 1 million of impairment costs.

To have a better idea, I looked at the cash flow statement, where I see a lot of cash flow being generated compared to the market cap:

I get to a 8 million of free cash flow.

Note that the Portuguese cash flow statement is very complex as it shows all payments together (interest and repayment of debt, new debt raised), and does not seem to show working capital movements.

Koyfin is calculating 16 million of free cash flow but it is in that case incorrect.

An impression of cheapness that would put the P/FCF in the 5 range is confirmed when looking at EV/EBITDA (4.5) and price to sales (0.35).

Compared to a famous IT service company in the Spanish sphere (Nagarro SE) where the price to sale is 1.16 and the EV/EBITDA is 10, this is very cheap.

In Q1 2024, the net profit grew 59% to 1.5 millions with sales down 1%, and if we would annualise this, we would get into 6 million of net profit or a P/E of 7.

Again, this shows the opportunity of companies with low P/S ratio and low net margins, because some cost cutting can improve profits greatly. Healthcare grew sales and non healthcare decreased, probably due to the economic environment or due to the elections in Portugal delaying projects.

Debt:

Total debt is 42m, the company is already paying about 5% on the debt, so I think the downside is covered there in terms of interest risk. This combined gives it about two turns of net leverage.

Opportunities:

Acquisitions

International joint ventures

Risks:

The consulting business (30%) is more cyclical and depends on the projects approved by companies or administrations.

Expensive acquisitions

The company shows low ROIC and ROE. This is because net income margin is low, and this was due to accounting treatment, since the FCF is double the net profit.

Conclusion

The company is still too cheap, especially when we also look at price to sales. This is a recurring theme in my portfolio with some small companies with huge sales related to market cap (3 times or more), high Ebitda and good Free cash flow, but lower net income due to accounting treatment (Berentzen, Poulaillon). In my opinion this type of set up will do well in the long term, but recently it has been slow and painful because you need to wait until the market realises it, or until the company changes size and becomes a mid cap, followed by more sophisticated analysts and investors looking at the statements.

While bought very cheap, the fact that the company is active in returning capital via dividends and acquisitions leads me to stay as a shareholder.

The downside is a hard to predict business due to the project based nature of a big part of the earnings, but healthcare and government spending in healthcare covers a lot of the downside.

Glintt still offers a very cheap company with a good business.

This is my personal opinion and not a buy or sell recommendation. Please carry your own analysis before buying shares.

Sources:

https://www.glinttglobal.com/estamos-a-olhar-proativamente-aquisicoes-ca-em-espanha-e-ate-fora/