Summary.

Newsletter update

Company updates

Kulcs Soft

Beximco Pharma

PayPal

Write ups

Movements

Company updates, Members exclusive:

IMS SA

Portuguese nano cap

Emerging market Finance nano cap

-Thanks to anyone who subscribed! You are now over 4550!

I can more easily provide company updates now because I have created my automated script in google sheet to follow websites, so there will be a return to frequent update and summary emails.. This is number 1.

These will strictly follow my interests and not have an obligatory section like before. I find it more sustainable that way, to have fun with every update on my journal.

Before my tool, I had to register for emails (spam) or click on every link and it was hard to follow companies. I love following companies in the long term as an owner, so there will be more updates.

Here is an overview:

(https://emergingvalue.substack.com/p/tools)

This extracts a website page into google sheets and transforms it with rules and gemini AI.

I know some people may be interested in something to track keyword alerts based on a webpage, maybe for important changes, making some sort of modified version, we can talk in that case by DM.

The Chinese companies (such as Alibaba BABA 0.00%↑ ) ripped higher with the news of the Stimulus by the government. I have no intention to sell anything there as I believe in the long term future of these companies.

Kulcs Soft (Hungary).

Two years ago I used a diversified value investing to blindly buy a Hungarian software company named Kulcs. I had no time to make a write up but shared it in my portfolio reviews, Hurdle Rate did, Bought at 1544, now taken private at 2051, up 58% including huge dividends. Due to large dividends expected I will try to keep it privately. My short pitch was hilariously bad, but sometimes that is all you need:

Beximco Pharma (Bangladesh).

This one I am down -65%, due to the Bangladesh revolution, and a chairman being arrested. As part of a diversified portfolio, I am not specifically worried, and the business is doing fine. But government intervention is the highest risk. What can happen is a government stealing or delisting the share or giving huge fines to the companies. The stock now trades at something like 3 times PE in London. I hold, if that is my recommendation. It’s either a zero if there is a personal vendetta against the company disguised as an “investigation”, or a 5x.

To me it looks more like a personal vendetta because the investigation got some conclusions in a few weeks of new power in Bangladesh. A serious corruption investigation takes years. Caution. Of course they could end up axing a few “ennemies of the state” and leaving the company alone.

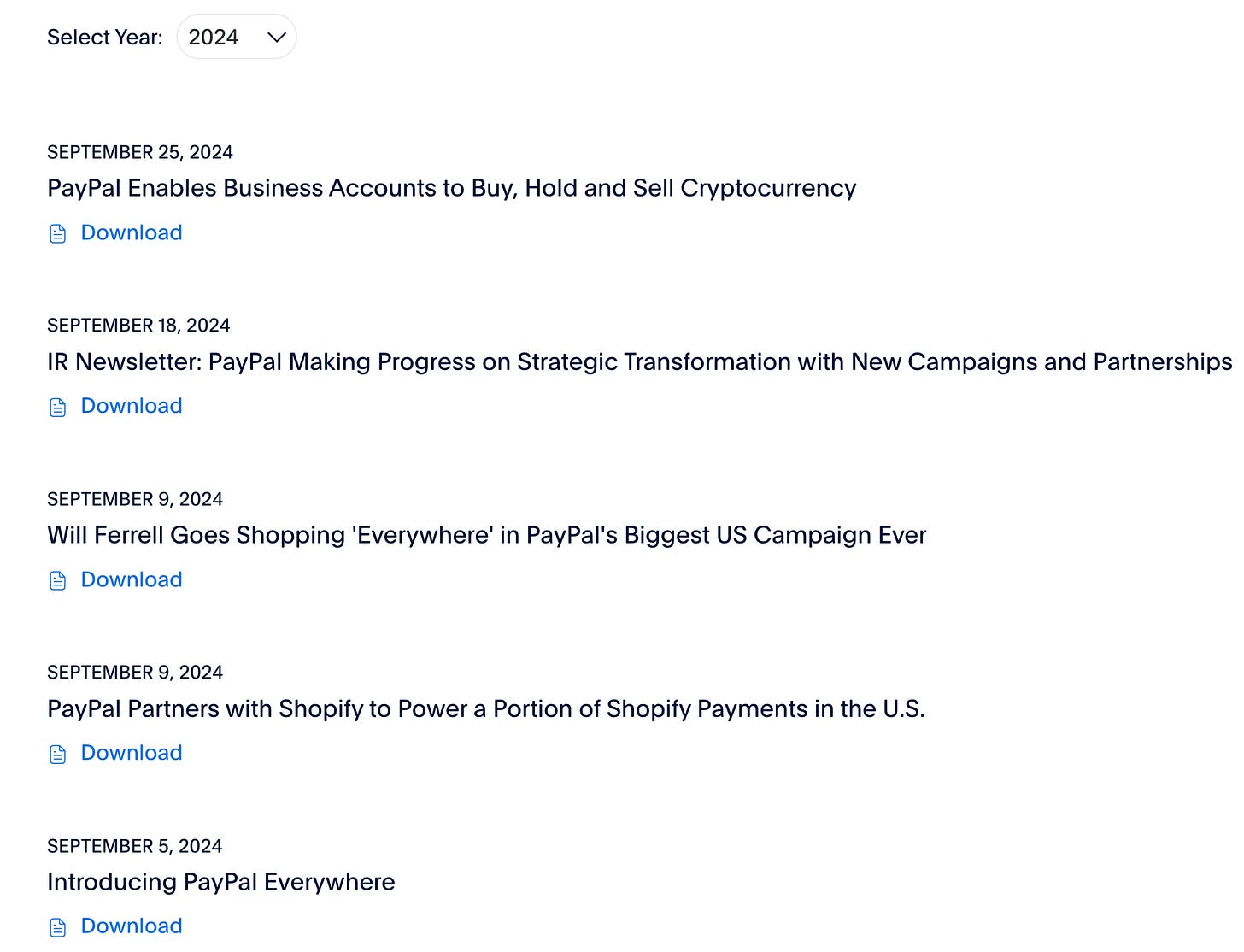

PayPal (USA)

up 26% This year.

PayPal has announced partnerships with Adyen, Shopify, Fiserv, PayPal Everywhere (Rewards program), PayPal Fastlane (Faster checkout).

This fury of execution and news releases propelled the stock higher to over 77$. While the company is executing well and fast, it’s the earnings releases that will confirm if the business accelerates growth, althought we don’t need much growth at current prices.

Apple Pay introduced pay in desktop browser, which is a risk to some of the market share. PayPal is always going to be a “win some market share here and lose there” company.

As I wrote a year ago, they need to use their data to provide value added ads targeting to their merchant user base, as well as make a marketplace using their convenience and customer base advantage. PayPal Article

This way they can evade the endless circle of trying to get transaction commission take rate higher, but can charge instead more for creating a purchase intention.

It was a busy summer, and wrote the following

Boustead Singapore - Holding company ($)

Unknown Portuguese nano cap ($)

I found great the following ideas:

I got two new German high growth value companies that I am still entering progressively. These are not my ideas but rather from the excellent Youtuber and investor Philipp Haas and also a substacker “Guyquity”. If you are German speaking, maybe check Philipp’s videos instead of subscribing for the premium membership for these ideas only !! However if you like the selection or are not German speaking, maybe I can guide you to other people’s ideas as I can listen to German, French, and Spanish, and you can subscribe below:

Sold: Melcor REIT got a take over offer. This company owns Retail and Office in Alberta Canada, the oil country. The thesis did not have time to play, the stock was long below my entry price as it got debt and paused the dividend due to high interest rates and struggles in office rentals. I knew the Parent company Melcor Development could eventually bail us out and it happened. I would have preferred waiting for a recovery, which will happen, but now it will happen inside Melcor Development. I sometimes buy postions to learn, and in REITS, I learned that I suck at REITS. I knew it already from my past but it was a last try. And I don’t like them due to high debt that needs to be rolled, they have no flexibility. I think it was a bit of a loss, or break even. If I buy real estate it will be normal companies with solid balance sheets such as Melcor Development or Asian conglomerates.

Reduced: Ly corporation: I wanted to make zero sales, and it’s not really a sale. After my write up update I found that it was not so cheap, and it was weighted higher than my other Japan tech companies. I had made some reinforcements in Ly corporation in the past. I sold the reinforcements. the reinforcements were profitable, but because overall I am down on the name, the first in first out rule made that I generated a tax loss on the sales while making a profit! Another good reason for me to do write ups is to get a clearer view myself, a double check on the companies I follow or own.

Added: small additions.

Berentzen (check the update)

Ecopetrol with terrible timing..with oil going down after.

Many companies just to complete the positions.. notably SDI PLC too at 70p (too early for the timing).

Full details on new positions below + more companies updates

Subscribe to the newsletter today and get exclusive access to the latest research and insights.