Hello,

First of all thanks to the new subscribers and supporters of emerging value.

ADRs, or American depositary receipts are share equivalents to foreign companies, mostly from Emerging markets, that give owners the rights to dividends, but with a small annual fee. They trade on the US stock exchanges.

Investing in Emerging markets is not necessarily for predicting superior economic growth, it can also be sometimes just getting access to good businesses at lower valuations.

Here is an overview of the main ones that are interesting.

1.Coca Cola Femsa (Mexico)

The company bottles Coca Cola products for 270 million people in Latin America, with most profit coming from Mexico.

The company trades at a PE of 16 and a forward PE of 13, and a dividend yield in the 4% range. (The yield is not clear because they just changed the payouts to quarterly). The financial position of the company is strong. It continues with organic growth in new plant efficiency as well as small M&A (in 2018 in Uruguay ,and in 2022 in Brazil). In Brazil, it distributes alcohol, and Coca Cola Femsa also owns local brands.

A bit less than 2/3rd of the company revenue and profits are in Central America and the rest from the South America region.

I presented this company in 2021 on substack.

2.Femsa (Mexico)

Femsa is a holding company that owns 47% of Coca Cola Femsa. It fully owns a retail store branch containing 23 thousand Oxxo convenience stores, 4 thousand health centre, and a digital branch built out of Oxxo. The retail segment has a small presence in the rest of South America and Europe (Valora acquired in 2022).

The company has a 20% stake in the global beer company Heineken.

There has been doing acquisitions constantly, first in South America, but increasingly in the USA and Europe. Due to this, we have a low dividend yield.

This is a growth company. The normalised net income is not growing very fast.

At a Forward PE of 19, I don’t think it is a great entry point at a first glance, but it is a good quality company.

3.Mexican Airports

Grupo Aeroportuario del Pacifico PAC : P/E 18, Dividend yield 4.5%

Grupo Aeroportuario del Sureste ASR P/E 12, Dividend yield 3.2%

Grupo Aeroportuario-OMA OMAB P/E 13, Dividend yield 3.4%

Here are three listed ADRs representing different regions. These show good growth. They are not fully defensive in case of recessions, and remain subject to possible government intervention. But they can be good investments. Follow https://ianbezek.substack.com/ for more on these Airports with extensive coverage.

4.Ambev (Brazil)

This Beverage company is a subsidiary of global beer Giant AB inbev.

The main brands are Brahma in Brazil, Corona, Quilmes in Argentina, Budweiser and Spaten. They have soft drinks in Brazil as well with Guarana.

We can see that revenues grow quite well due to organic growth, but that profits struggle to grow because of the currencies. This has stabilised recently.

We are at a 12 forward P/E with a 6% dividend yield and no debt. The company is a bit sleepy: no debt, no acquisitions, no growth initiatives others than “sell more beer”, “premiumize”.

The Parent company AB Inbev is in a deleveraging process, this explains the conservative approach to cash.

They grew well with M&A, efficiencies and geographic expansion and now they are stalling because.. the parent company is telling them to stop to reduce it’s own leverage. But they use some excuses about needing to change the model.

For this reason, I view the company as not managed for the shareholders best interest at the moment.

They are notably growing the b2b marketplace and credit solution business “BEES”.

A negative point is that Heineken is also very aggressively growing on the continent with acquisitions in Colombia and Brazil. Ambev is on the defensive, but It could still have value with dividends and organic growth.

5.Telefonica Brasil

The biggest fixed and mobile phone operator in Brazil. Revenue is growing but only catches inflation, while earnings are flat.

Forward P/E is 11.5 and dividend yield is estimated at around 10%.

The company has new business lines but they are worth only 3 and 6.5% of the revenues so this is not yet a digital powerhouse. These new digital business lines are growing 40% and 27% respectively.

Without much total growth, it is hard to get excited, but if the Brazilian Real rerates it will be good for the ADR, or it can be good for a dividend portfolio. There is also the possibility that digital services explode higher.

6.Cosan (Brazil).

Cosan is the Berkshire Hathaway of Brazil. Or the Brookfield Asset Management. Or maybe it’s better to describe them as the Rockefeller of Brazil.

Started from an ethanol sugar cane milling business, it expanded in the same industry before branching out to gas distribution, land, lubricants, railways, downstream, terminals, and now mining with a Vale stake.

The results have been good (please remember that the BRL currency lost maybe half it’s value over he period, so this is more like 2X than 4X. But this remains impressive in a recessionary Brazil.

The company constantly invests in acquisitions, or large capex projects that give it important cash returns and scale benefits.

Recently, it acquired a large stake in Vale, using a complex leverage system. Vale is cyclical as an Iron Ore producer.

Overall, an excellent company but operating in cyclical industries except for the Railway operation and lubricants.

In terms of valuation, the company is expensive on a P/E basis (25 times) probably due to an increase in interest cost on its debt in 2024. If Finance costs can go back down, it will become cheaper due to this leverage. This might be a good opportunity but remember that it is cyclical, so finally, it’s not that defensive in this high interest environment. Forward PE estimates are all over the place due to interest costs. Price to book is 1.2, so not yet a bargain.

7.Embotelladora Andina (Chile)

This is another Coca Cola Bottler.

Although based in Chile, it sells beverages in various countries in South America with roughly 37% of profit in Chile, 24% in Brazil, 26% in Argentina and 13% in Paraguay.

These regions have suffered immensely over the past five years, with recessions in Argentina and Brazil.

The company also distributes various alcohol products in Chile (For AB Inbev and Diageo). It is solid and a slow grower.

The biggest projects are a new plant to make beer (Therezopolis and others) in Brazil for 2025, more fridges and displays for retailers, and recycling plants.

It trades at an EV/EBITDA of 6 and Forward PE of 11, with a dividend yield that varies at around 4.5% (note that Chile has a dividend withholding tax of 35%). In 2022 the company paid a 15% special dividend.

I presented this company in 2021 on substack.

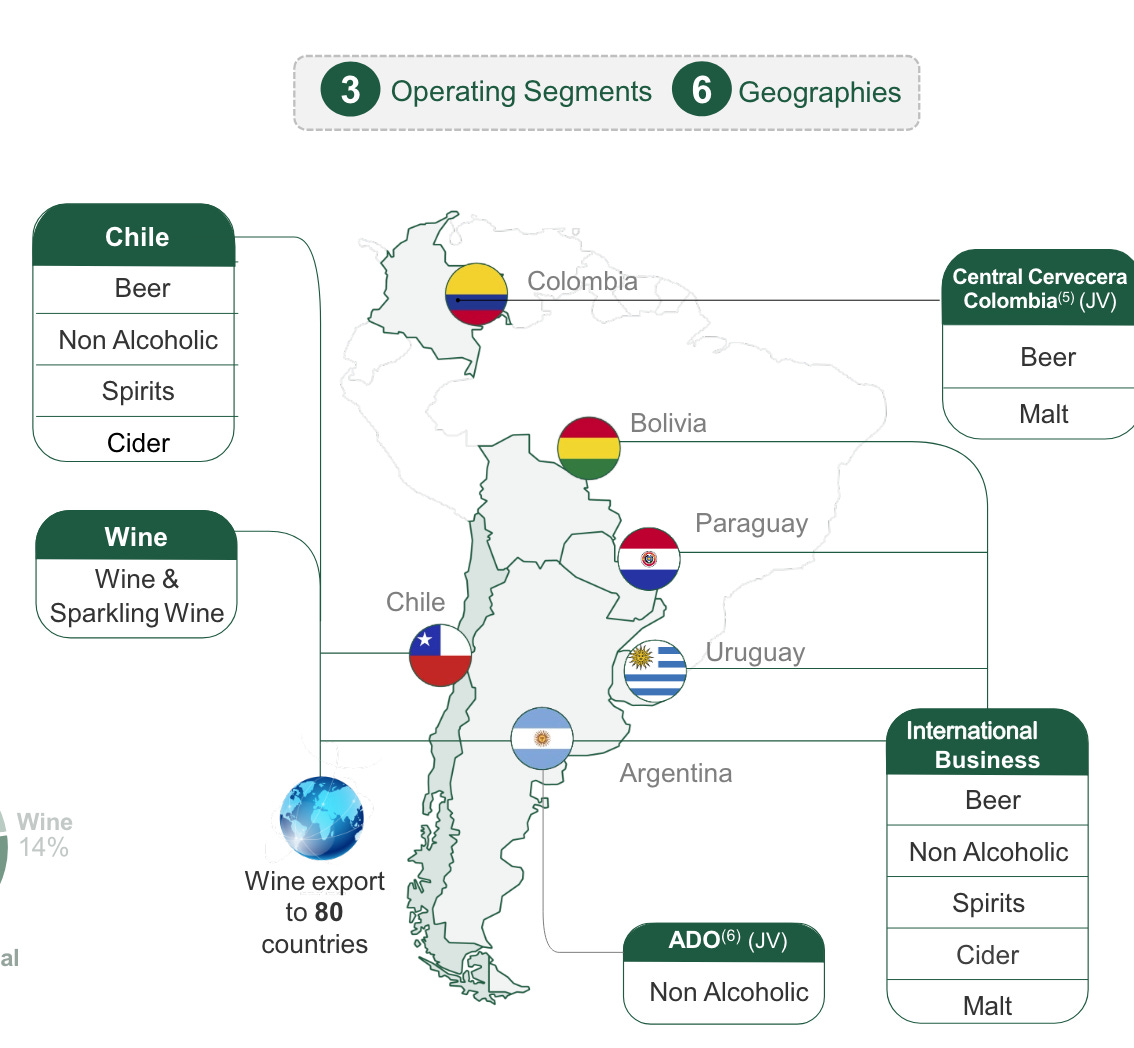

8.Compania Cervecerias Unidas CCU (Chile)

This one is related to Embotelladora Andina, but it makes beer and distributes Pepsi products in Chile. Embotelladora Andina makes Coca Cola and distributes AB Inbev products in Chile! They fully compete in a duopoly.

CCU is partly owned by Heineken, so it explains that Heineken brands are sold by the company.

CCU, which means united breweries, sells beer in Chile, Argentina, Bolivia, Paraguay, Uruguay, plus a JV in Colombia that is a growth initiative to take marketshare from the incumbent AB inbev.

In addition to that, they have a wine business that exports all across the world.

The results fluctuate, but approx. 60% of the Ebitda is Chile, 25% international business and 15% wine.

There is some volume growth when the economy does well.

They have done small acquisitions and distribution deals each year.

The forward P/E is 14 and the EV/EBITDA is 7, and the 2025 estimated PE is 10, suggesting a cyclical recovery. The dividend is correct at 3%, but was higher in previous years. In the last year, earnings were hurt by the currency devaluation and inflation of various materials.

Recently, for the two Chilean beverage companies, the Argentina segment has been suffering from austerity measures that caused sales to go down. However if you believe in capitalism under the new Milei president, the exposure to Argentina offers upside as sound management creates growth again.

Viva la Libertad!

9.Mercado Libre

This is an Ecommerce Giant with a 80 billion dollar market cap. It has achieved a solid competitive position that constitutes a moat, with a complete ecosystem that includes fintech and logistics

This quality is not cheap, at 4 times forward sales and 45 times forward earnings. It could work well if the company grows beyond a 200 or 300 billion market cap.

I have no strong opinion on Mercado Libre, but it appears that the Chinese or Japanese e-commerce companies offer bigger value with lower market caps related to population or GDP. For comparison, it has a bigger market cap than PayPal, JD, Baidu, Ly Corp or Rakuten who also have enormous Total addressable markets. Therefore, I prefer to look for value among these ones.

Others: You can access global food companies Bimbo and Gruma if you have access to the Mexican exchange, or through secondary illiquid listings in Germany.

Conclusion

In my opinion, except for Mercado Libre, Femsa and Coca Cola Femsa which are bigger and more stable and can be analysed as regular companies, an investment in such ADRs must be seen as a way to get a commodity hedge or as a sort of cyclical recovery bet. Latin America does very well in a commodity bull market, which can be a boost to investment, currencies, valuations and margins at the same time.

For Chile, Colombia and Argentina especially, the macro and currencies have wild swings. The dollar earnings can move a lot from year to year. Be careful with direct Argentina exposure.

If you have a more long term approach, a dividend perspective can be good for the high payers and will contribute to higher yields than American companies.

What do you think?

Which ones do you like?

Comment below!

If you want to learn more, please consider the paid tier.

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

Discover my latest deep value UK buy Here

And my deep value Portuguese buy Here

Thanks!

Tx Olivier.

On $ABEV, I believe the company is acting rational with its capital allocation policy. A strong balance sheet was indeed desired, both 1) to help the parent AB Inbev (who was over-levered), and 2) to optimise taxes.

On the latter, In Brasil companies with a strong balance sheet can enjoy tax advantages by distributing Interest On Capital (IOC) aka Interest on Net Equity (IoNE) to shareholders. This tax advantage is to be gradually reduced. I understand that the there is still quite some uncertainty on tax reforms in the country. My best guess, is that once there’s more clarity, ABEV will optimize its corporate structure for the new tax policies…and we may start to see even higher returns to shareholders.

With the IOC policy there was a tax incentive against doing large return to shareholders. That incentive is waning for ABEV.

I think Cosan actually does trade below 1 P/NAV. They have a nav calculator on their website.