Summary.

Newsletter update

Write ups

Euro Ideas

Portfolio Movements

I have been researching new companies, I have a desire to know the exchanges more. I found one in Portugal. I almost found a second one in Portugal that is incredibly cheap, but debt and erratic profits is an issue. Another writer mentioned that Ireland is very cheap (write up below).

I was writing an article about diversification. I will not post it, it is too long and confused, and boring, but the summary is below:

Quality investing → deep company knowledge → must concentrate → mistakes are more costly → can make big winners.

Quantitative value → medium company knowledge → can avoid concentration → mistakes are less costly → more medium winners

For my portfolio, I do a mix of the two, with quantitative value and minimum quality requirements. Opening 1% tracking positions as long as I find some that meet the criteria from a quality and value, and adding to existing companies once a full analysis was done. I know that it’s more than usually recommended (concentration), but it’s defensive for me. Always adding to losers is a risk so I limit this with a rotation and time spacing.

here are some write ups I enjoyed.

EL Financial ($) - very cheap, but the underlying investments are not necessarily.

Barry Callebaut (Chocolates) - good quality, good value , but I look for cheaper or faster growing.

Origin Enterprise (Ireland) - Lowish quality, not too cyclical, but cheap.

Biglari Holding - Bullish take - Interesting contrarian piece

There is a quality idea surfacing on French circles, it’s Equasens. It’s a software company selling to pharmacies, doctors. A historical compounder under 20 times earnings due to some slowdown in 2024. It does not grow very fast but it’s seems decent. If interested, I recommend looking for writeups.

Portfolio and movements. The portfolio is up by an insignificant amount 2.5% in 2023. It is not in fashion in terms of sectors and countries. I am very happy about high earnings yield and earnings improvement coming. But on the negative side, some stocks saw earnings yield come down due to inflation.

the geographies are a bit crazy.

(I count HK stocks not as China but based on where they operate and the ones I have do not operate in China much). I have little exposure to mainland China or the USA. I have maybe too much to Europe. I would like to add to Japan and compounders maybe, eventually to the USA, but honestly I don’t know this market. I do not want to add to China much.

In terms of companies, I would like to add to stuff that grows on top of being value. I avoid superfast growers you see all over Twitter because I think they are often not durable companies as much as medium speed growers (the competition has not showed up yet), but that is just my preference,I am more like a tortoise.

No big moves, but I mostly switched Chocolate and Biscuits for stronger Beverage sector, and said goodbye to Turkey. Chocolate is suffering with Cocoa Price and Beverage companies are coming out of commodity price suffering. Biscuits also have not much organic growth. The other main reason is the Turkish Holding again did not want to pay a dividend this year. If I have a value stock, at least that it pays a dividend please. It’s more of a swap of assets at similar or lower valuations than a big change.

All new beverage positions are EM quality companies under 10-12 times future PEs. If/when I write up the companies, the names will be public as these are mid caps.

There is also a Portuguese company that I entered and has very very cheap metrics. A Nano cap.

Full details below.

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

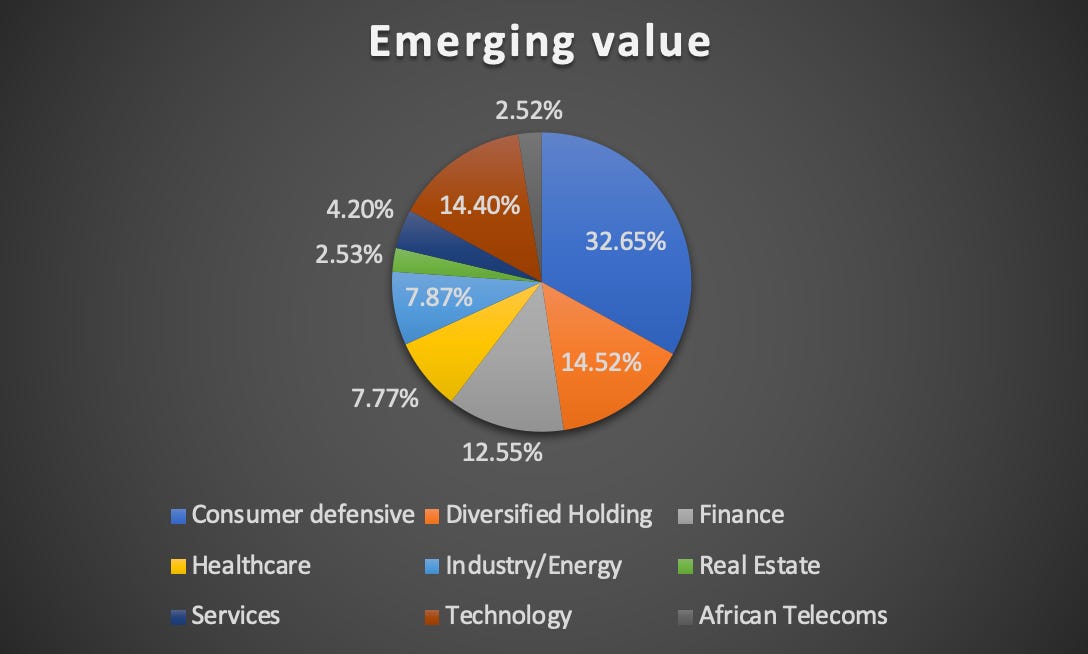

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

20% on Koyfin plans with the affiliate program