Bastide is a stock that I covered quite a few times, and it keeps plunging. When my companies do well, I quickly look at the results, but when they don’t, I try to understand if I should do something, and if all is lost. Then it, is better to write my thoughts, if some holders or non holders are interested.

To remind people, this is a French small cap consolidating the healthcare home assistance sector for the elderly.

In this sector, prices are fixed by the state (in France). 82% of sales are in France.

Demand is guaranteed to grow every year, there are no recessions in this business.

This serial acquirer was growing with debt and acquisitions.

It was good until refinancing started to cost 7%, and wages and material costs got up, but the prices fixed by the state were going down a bit.

It’s a communist nightmare from France, starting before Macron.

So the company feels the pinch. And the whole sector feels the pinch, with record bankruptcies.

Yet the operating result (ROC) is going up like clockwork.

The operating result is before interest.

What is going on?

So, the market cap is approx 120 million. The net profit is set to be 7 million for the year. Last year it was 17 millions. Also they sold some company and I think that it increased their taxes.

There is huge bank debt, the cost of debt is already 6.5%, and it is mostly variable.

I studied the Free cash flow statement of this company for years trying to understand it. I think that I now get it. The company records no free cash flow, but net profit. And we have to use net profit to analyse it.

See, the company records 6-7% organic growth a year, without price rises. This is due to equipment rental. (This is growth and maintenance Capex together).

Ok this is going to be a bit numberish below:

The Capex is about 10% of sales. 530 million sales, 53 of Capex, organic growth of sales and EBITDA of 6.5%.

EBITDA It is currently near 100, at 98. So we are adding 6.5 million of Ebitda on 53 of Capex, or 12%.

Because cost of debt is 6.5% and under 12%, we are deleveraging with the growth capex.

Net debt to EBITDA went from 3.88 a year ago to 3.41. Bank covenants were lowered to 3.50, so we are pretty close to problems, but the trend is surely down, while debt is still increasing in absolute numbers (for now). If acquisitions stops, earnouts and integration costs will also drop.

Obviously, this is not appreciated by the market.

Acquisitions could restart but I would prefer only a deep discounts and with the leverage maintained constant (maybe 2.5 times and fixed rate would be nice). The company wants to focus on EX France acquisitions, to operate in a better pricing environment, but at the moment is planning to pause all acquisitions and delever.

Future reasons for recovery.

-Interest expenses are high and it is a big problem as these are variable bank loans. But that should go down with the ECB rate cuts, Europe is an ex growth continent.

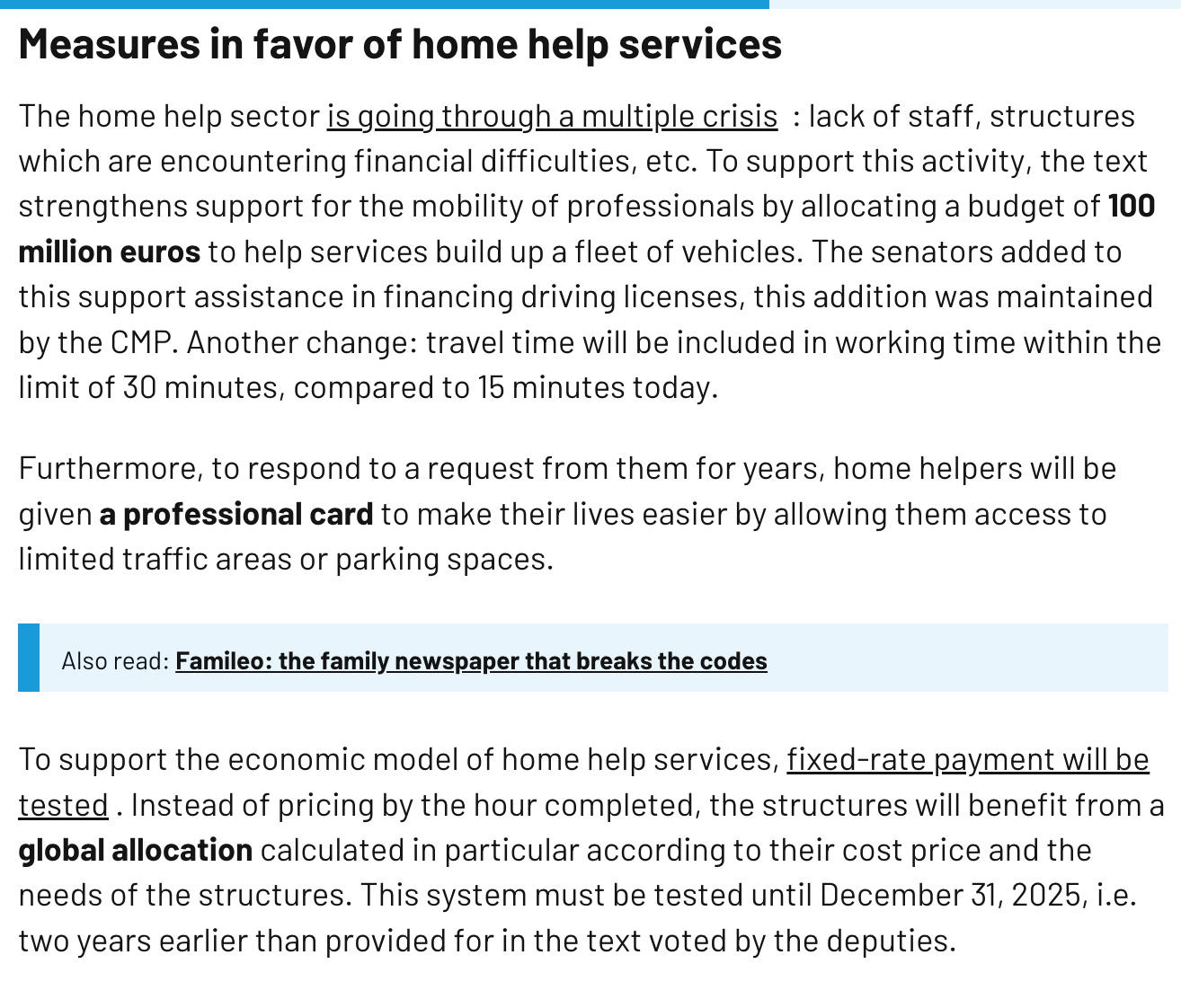

-After many bankruptcies, the French government is slowly preparing laws to change the pricing model in the sector. The industry is ravaged and produces a very important, crucial service for society. Sooner or later, it will receive appropriate pricing, because prices for these services are down in total in the past ten years. They need to rise and will rise in the mid term, as more and more patients go without service.

Usually, like for anything made by government, the government will accelerate reforms in support of the industry. This is like the FED: They do nothing for too long, then panic.

Future Risk

A risk is another big inflation wave, rates going to over 10%, and costs rising while revenues cannot go up. Then they are toast, au revoir, adios, unless the government frees the pricing. Note that not every thing they do is fixed prices, they also sell products like diapers and accessories. Maybe they should do more cross selling when they visit patients, if this is permitted.

Another risk is debt refinancing being even more costly.

Conclusion

There is a potential for an good recovery if you model just 5% net margins and 6.5% organic non cyclical growth. Market cap is 120 millions, 530 million of sales, 5% net margins is 26.5 million Euros. 1% net margin is 5.3 million Euros.

And if pricing is reformed to be more free, then it’s more.

There is also some risk with this business model.

I will keep holding but will need a recovery to do well.

Learning from this potential mistake due to the perfect storm of inflation and rates, I will now buy companies with higher margins if there is leverage. In general, I will focus on higher margins companies that can handle cost rising without problems. Investing is a constantly improving process.

Also, yesterday I published an update on the earnings of a near Net net Asian real estate company, who does not have exposure to property development and is more focus on rental. I kept the update private for supporters as it is a nano cap. No Catalysts included. https://emergingvalue.substack.com/p/asian-real-estate-small-cap-holdings

This is my personal opinion and not a buy or sell recommendation. Please carry your own analysis before buying shares.

Due you know the maturity of the debt facilities ? If they need to renew, the credit spread might be quite substantial.

What a crazy is Mr Market, Is this falling justified? 15,20 € per share is incredible.