Pentamaster International Limited

Another way to be exposed to Semis and EVs

Stock: 1665 Hong Kong

This company is a Malaysian company listed in Hong Kong.

Summary:

Pentamaster makes test equipment for semis and opticals electronics that will have growing demand due to EV adoption. It sells the machines for manufacturers to test that their crucial electronic components perform correctly. It also has a factory automation segment where it sells machines and solutions for manufacturers to automate their production, mostly in healthcare. It has good growth prospects, a management that innovates constantly and trades at a P/E of 8 while paying a small dividend, but earnings could be a bit cyclical depending on customer cycles.

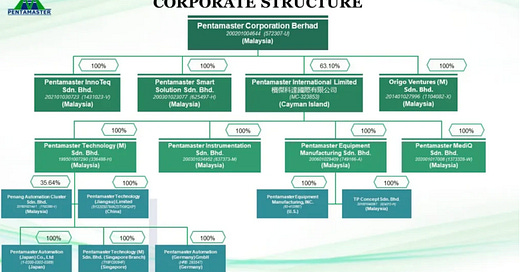

The mother company is listed in Malaysia, at a 32 forward P/E ratio, and the daughter company, with almost the same business, in Hong Kong with a 8 forward P/E ratio.

Malaysian investors surely know Pentamaster very well, and assign it a rich multiple, denoting a growth company with good prospects. Hong Kong investors on the other hand, don’t really care about Pentamaster.

Presentation:

Pentamaster was founded in 1991.

The company was into semiconductor vision inspection and contract manufacturing initially, but is now specializing in industries that are higher value added, automotive for EVs and Healthcare notably, which will be less cyclical than pure semiconductors.

Its sales were very related to the smartphone cycle and semi conductor cycles. The company suffered some setbacks due to cyclicality and costs.

For this reason, the company has become completely adverse to debt and operates at net cash.

In recent years it started an expansion to Japan and China.

The growth has been mostly organic, researching new product categories and expanding factories capacity.

The reason for the dual listing in Hong Kong in 2018 as a Malaysian company is one often found for companies aiming to develop Chinese customers, it provides transparency and a public exposure to secure more clients. The Hong Kong company is missing a few minor businesses from the parent Malaysian company because it is technically a subsidiary, but has almost the same earnings.

Business overview.

In this section and the market section there will be some extracts from the company reports and press releases, due to technical explanations that are better left as written originally instead of reworded.

The company has two segments:

Here is a more visual presentation:

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).