Liberty Latin America

Is the Caribbean Cable and Telecom company a good bet?

Liberty Latin America is a company I have been investigating. This is a company following the John Malone model. They utilise debt to consolidate the cable industry, have complex accounting with acquisition costs and depreciation causing low profits, and repurchase shares while paying no dividends.

Overview:

The Malone model of acquiring cable companies with debt, raising prices and doing buybacks, it really worked in the 90s, but it is getting disrupted by fiber, 5g and video streaming in the past few years. Video cable subs are cutting the cord. Cable subs are also cutting the cord and using fiber and for some people only mobile 5G.

As a result, the Liberty cable companies, which were seen as the ultimate “quality companies with great management” a decade ago, have traded downwards in recent years. So be weary of the quality narrative, because they can to rotate between sectors based on newly discovered technologies. (To be fair, value companies can also become traps and blow up).

The Malone cable complex got:

Liberty Broadband in the US

Liberty Global in Europe:

Liberty Latin America (A spin off of global).

Valuations have come from hyped up to depressed. I did own these stocks at some time and each time sold, some with a loss, some with a gain. I remember that Liberty Latin America was with a loss, since I got the stocks at the spin off.

Libery Latin America (LILAK), is a fixed and mobile telecoms company with a footprint around the Caribbean, operating like a holding company with subsidiaries. It has a large b2b segment at 32% of revenue which is interesting.

This company was a spin off from Liberty Global, the European focused cable company.

On a side note, Liberty Global (LBTYA) is itself interesting as an equality cheap European telecom company in a slow liquidation mode, for event driven value investors. The European markets have more access to competition and the industry has been a destroyer of value with large capex needs and prices that do not really rise. However today might be the time, and it could be the same for Liberty Latin America (LILAK). Here is an interesting write up on Liberty Global on X by Raging Capital Ventures, with some pushback on FIBER being a too strong competitor for Liberty Global cable assets, that could lead to subscriber losses on speed.

https://twitter.com/RagingVentures/status/1758568671528591790

1. A history of not so great moves

Coming back to LILAK, After the spin off, LILAK the company did not generate free cash flow and was indebted, so the value was not clear to the market.

Over time, LILAK did a really expensive acquisition of CWC, a mobile and fixed telecom operator in the Caribbean, which was owned by John Malone. It was a conflict of interest and did not serve shareholders well.

in 2020 during the covid crisis, the company did a capital raise at 7.15$ which I think was a move not in the shareholders best interest due to the discounted price. https://lla.com/blog/liberty-latin-america-ltd-announces-final-results-rights-offering

With this they financed an acquisition, so it can be said that it was strategic, but it shows in my mind a lack of long term thinking. If you know that you are going to make acquisitions, do not lever up too much.

2.Nice small acquisitions post covid

Below are extracts of the annual reports where some better moves were done recently with small acquisitions that consolidate the markets and bring cost saving synergies.

Puerto Rico and USVI Spectrum Acquisition. On November 6, 2023, we entered into an agreement with Dish Network to acquire Dish Network spectrum assets in Puerto Rico and USVI and prepaid mobile subscribers in those markets in exchange for cash and international roaming credits. The aggregate purchase price of $256 million will be paid in four annual installments commencing on the closing date, subject to post-closing adjustments. The transaction is subject to certain customary closing conditions, including regulatory approvals, and is expected to close during 2024

Claro Panama Acquisition. On September 14, 2021, we entered into a definitive agreement to acquire América Móvil’s operations in Panama in an all-cash transaction based upon an enterprise value of $200 million on a cash- and debt-free basis. On July 1, 2022, we completed the acquisition of Claro Panama, which was financed through a combination of debt and existing cash

BBVI Acquisition. Effective December 31, 2021, we acquired 96% of the outstanding shares of Broadband VI, LLC for $33 million, the payment of which occurred in January 2022. Broadband VI, LLC provides fixed services to residential and business customers in USVI and is included in our Liberty Puerto Rico reportable segment

Liberty Telecomunicaciones Acquisition. On July 30, 2020, we entered into the Telefónica Acquisition Agreement to acquire Telefónica S.A.’s operations in Costa Rica in an all-cash transaction based upon an enterprise value of $500 million on a cash- and debt-free basis. On August 9, 2021, we completed the acquisition of all of the outstanding shares of Liberty Telecomunicaciones. The Liberty Telecomunicaciones Acquisition was financed through a combination of debt, existing cash and a $47 million equity contribution from the noncontrolling interest owner of our Liberty Servicios entity, as further described in note 12.

The synergies from these acquisitions are not yet in place, and according to the conference call, customer migration in Puerto rico went in the way of sales activities and caused some organic subscriber losses.

3. A Risky environment:

3.1 Chile JV

VTR Cable in Chile has been a disaster. They have been losing subscribers and money due to heavy competition and lower network quality. To limit the losses, they opened a JV with Claro, owned by America Movil. The JV is still making losses, and agreed on a cash injection pro rata of the 50-50 ownership. But the JV did not receive investment from Liberty, only from America Movil, so it looks like the Chilean Operation will be written off or diluted (by not participating in the capital raises) to insignificance or given to America Movil.

It shows how quickly a market can become loss making if subscribers cancel and move to the competition.

3.2 Hurricane: a devastating Hurricane would create another need for high capex during years. This happened in Puerto Rico and the company took some years to recover.

3.3 ARPU: Although the region is low to middle income outside of Puerto Rico, the average revenue per user, especially fixed users, is near 50$ per month which is in line with what people can Pay in western Europe. This is a sign of low competition due to the small size of the geographies and their isolation. On the downside there is room for someone to cut prices, but this is limited due to geography and isolation.

3.4 STARLINK

Starlink is the direct from Satellite internet service. It could disrupt telecom companies by having customers connect directly to the internet.

To access the service, you need to buy a receiver, a special satellite dish, for €225 to €450 in Europe, then pay a monthly service from 29 €/mo.

You also need a receiver. And so far the technology to work indoors or on a mobile device is not there yet. So if you are in an apartment or if you want mobile service, not possible.

It also does not include telephone calls, which are still widely used by businesses and individuals. I think that it can disrupt parts of the fixed business that have low connection speed in rural areas, but not the mobile business and not most of the fixed business where people are in, and not the low cost business. There are also capacity issues to onboard many millions of customers. I do not see it as a negative for the business.

3.5. Is there a risk of another capital raise?

The company aims the delever to 3.5 turns with EBITDA (OIBDA) growth and produces a lot of FCF each year. Therefore we can hope that future capital sources in case of small acquisitions will be with internal free cash flow. A large acquisition funded by equity would be neutral at best to returns and carry some execution risk, and most likely neutral.

3.6 High Debt.

On the negative side we have debt:

-Fixed with no maturities before 2027, but high leverage ratio of 4.2 times Net debt / Ebitda. If the rates are high in 2027 this will hurt, but this is not the main scenario. Cost of debt is already quite high.

3.7 Telecoms have trouble raising prices.

The telecom and cable industry has not been able to raise prices much due to competition and offers, as well as lower price of data. This is a not ideal type of investment in general and relies on just static flow of cash coming in, with synergies and efficiency a way to increase profits. In some EM markets, a rise in adoption leads to organic growth, and this can happen here in Panama and Costa Rica to a certain level.

On the chart above we can see that LILAK does not really have stable profits, because of the D&A and impairments. It’s a company to be analyzed with Free cash flow.

4.Recent events:

-A tower asset monetization for $244 millions.

-Future synergies will be a bonus for the free cash flow generation.

-Repurchased $300 million of equity and convertible note in 2023, including 117 million of common equity.

Valuation

-Convertible note: 9.8 million potential share issuance or about 5%. The company has been buying it back in 2022 and 2023, and while prudent, it reduced the amount available for share buybacks.

There is some cash flow that goes to minority holders: 27% of FCF according to FY 2023 earnings, difficult to get a future estimate. But if we take the past three years average, it is lower at 15%.

FCF 273 millions, FCF to equity: 233 millions.

Share based compensation 90-100 million $ per year.

130 million is what is really left to shareholders.

But note that we have some integration Capex in 2023. We can add back 40 millions or 170 millions.

I get a price / real earnings power of 8.

The management has higher objectives, so we can estimate a future P/”E” of 6.

Growth: mid to high single digit Adjusted OIBDA rebased CAGR.

FCF 1 million in three years before minority interests. That is an average of 333 million per year before the deductions of minority interests compared.

Conclusion

The metrics in the powerpoint presentations do not really match with the earnings to shareholders, due to minorities and share based compensation. However the situation is improving.

LILAK is not crazy cheap, it is cheap. But is going to be crazy cheap with the synergies starting to take place.

It will buy back maybe 10% of the shares each year going forward. The Islands and isolated geographies limit competition.

It remains exposed to a hurricane and debt refinancing costs.

What is negative for me is a lack of alignment of management with shareholders as noted in the 2020 capital increase, but since that it has been positive. I prefer dividends in stagnating industries, but it can be said that dividends and buybacks are the same in the end, if you decide to sell your shares pro rata when you need income.

Despite some risks, the return can be good in a buyback scenario well executed over 3+ years.

I kind of like the idea here, but I don’t own shares and I am observing. I am investigating some companies, notably in the Portuguese and Brazilian markets.

Further reading: lets-talk-about-lilak

This is my personal opinion and not a buy or sell recommendation. Please carry your own analysis before buying shares.

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

20% on Koyfin plans with the affiliate program

I have an article coming about diversification and adding to losers.

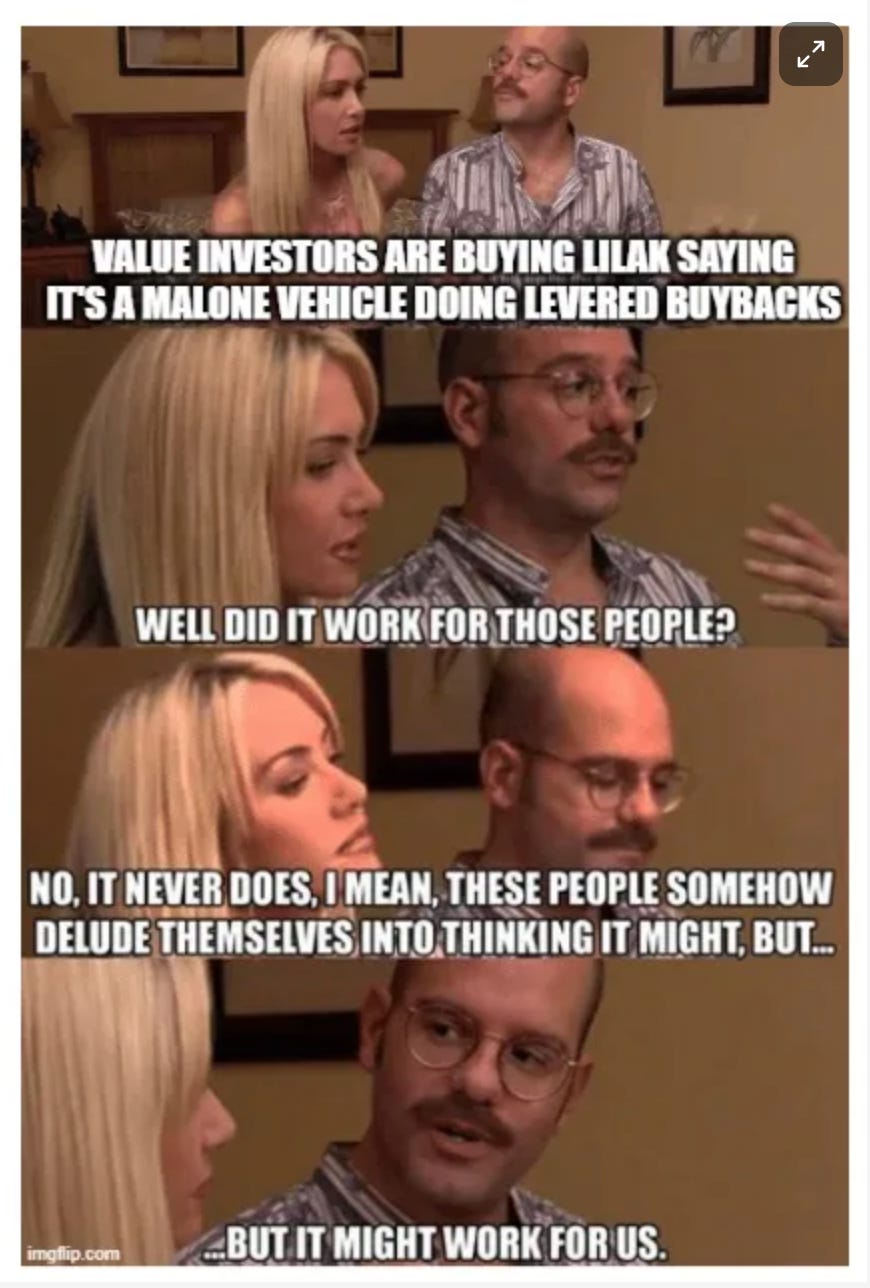

Let’s finish on a great meme by Guydavis (lets-talk-about-lilak)