TYO: 4689

Share price: 388 JPY

Market cap 2.96T JPY.

LY Corp is a Japanese tech conglomerate of a certain size (19 Bn USD Market Cap) with interesting business segments:

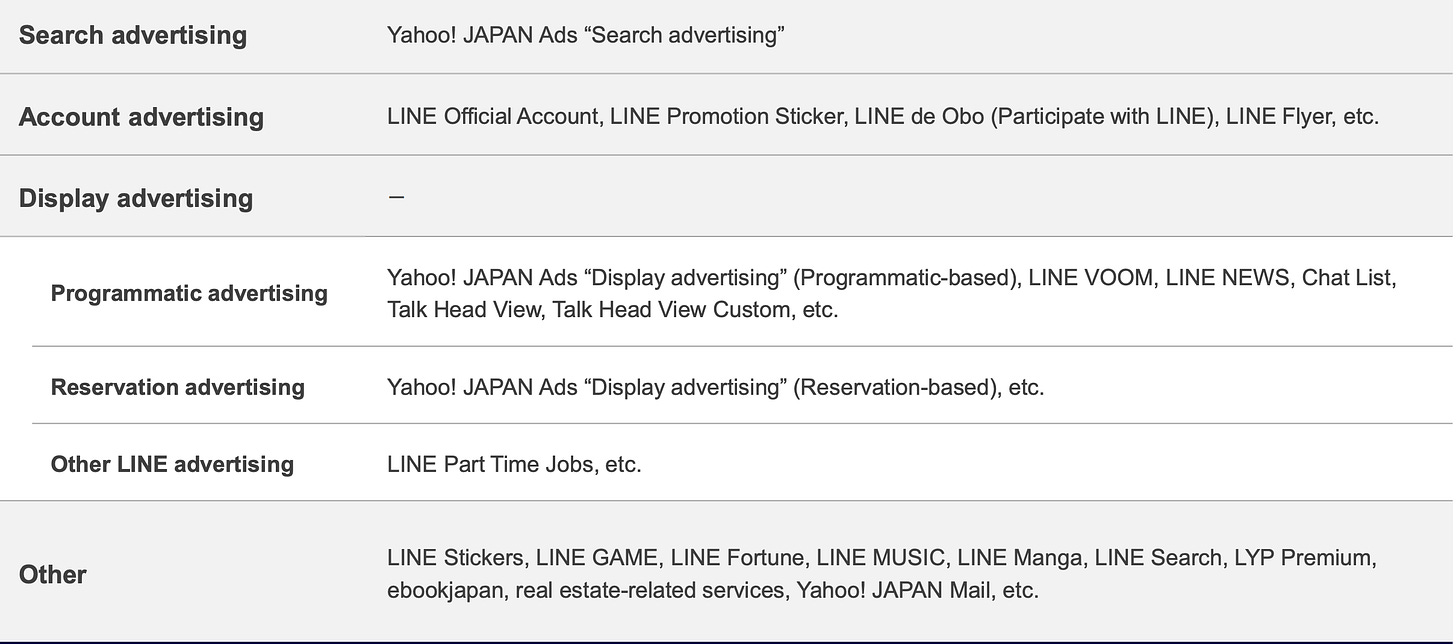

Online advertising (Yahoo Japan and Line chat service)

E-Commerce

Online Payments: PayPay.

Unfortunately since the write up, the stock price has not moved much and the yen went down.

Update:

LY has published the Q1 results with some changes: Link

Business is doing well:

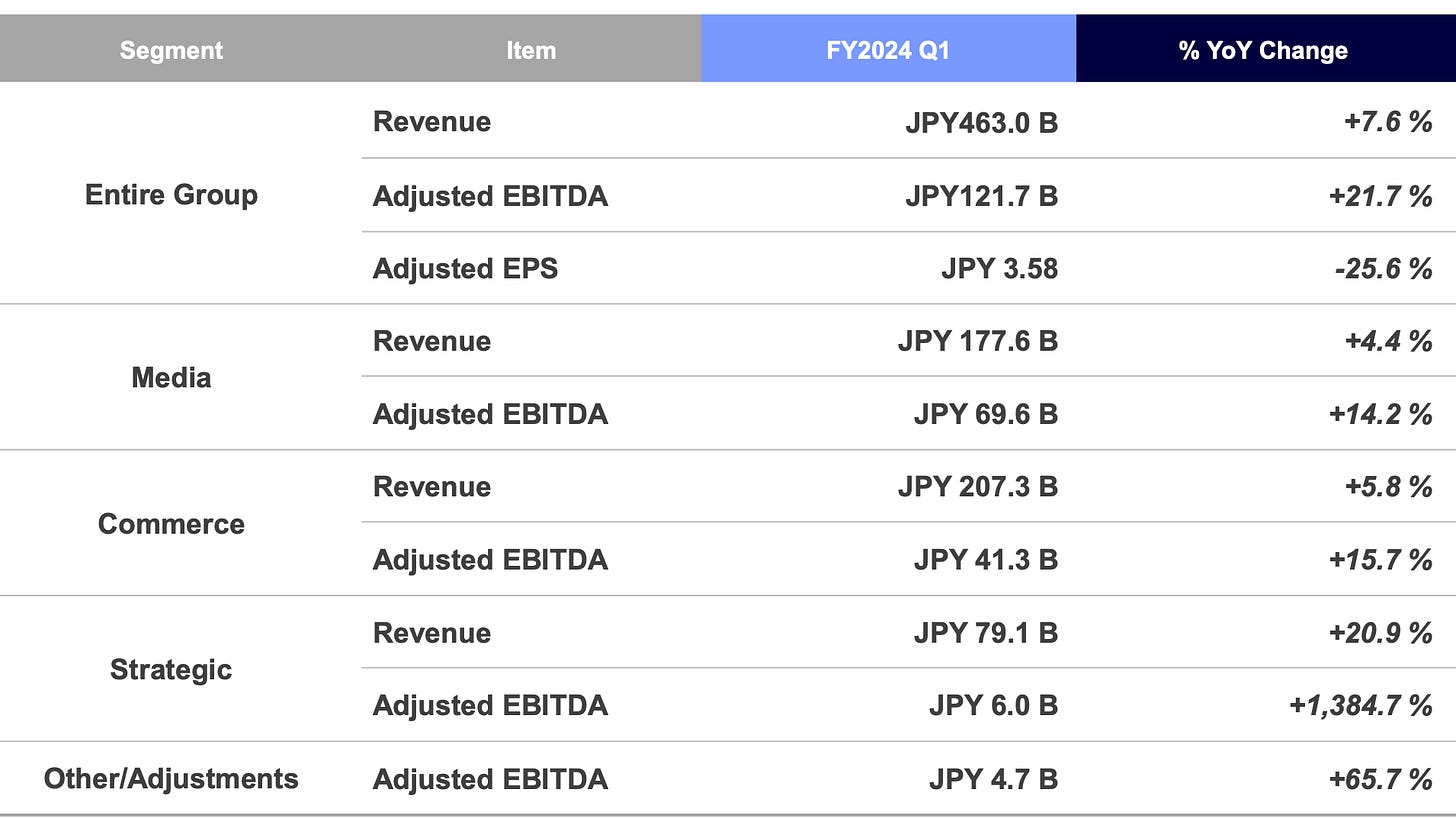

Group revenue grew YoY+7.6%; consolidated adjusted EBITDA YoY+21.7%

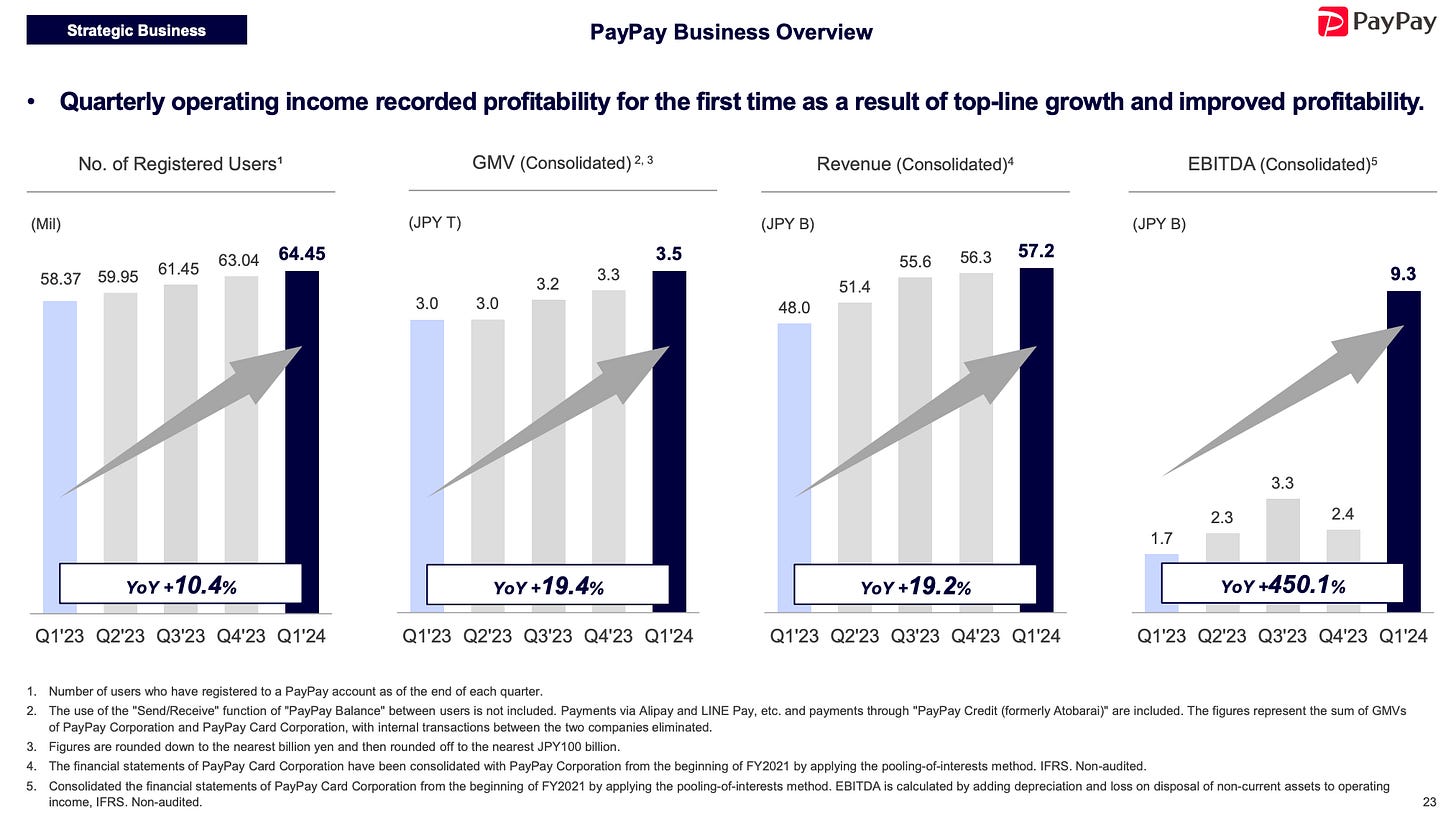

It is getting better across the board with Strategic (PayPay) finally turning the corner and becoming a profitable venture.

The media business is very diversified and shows 39% EBITDA margins.

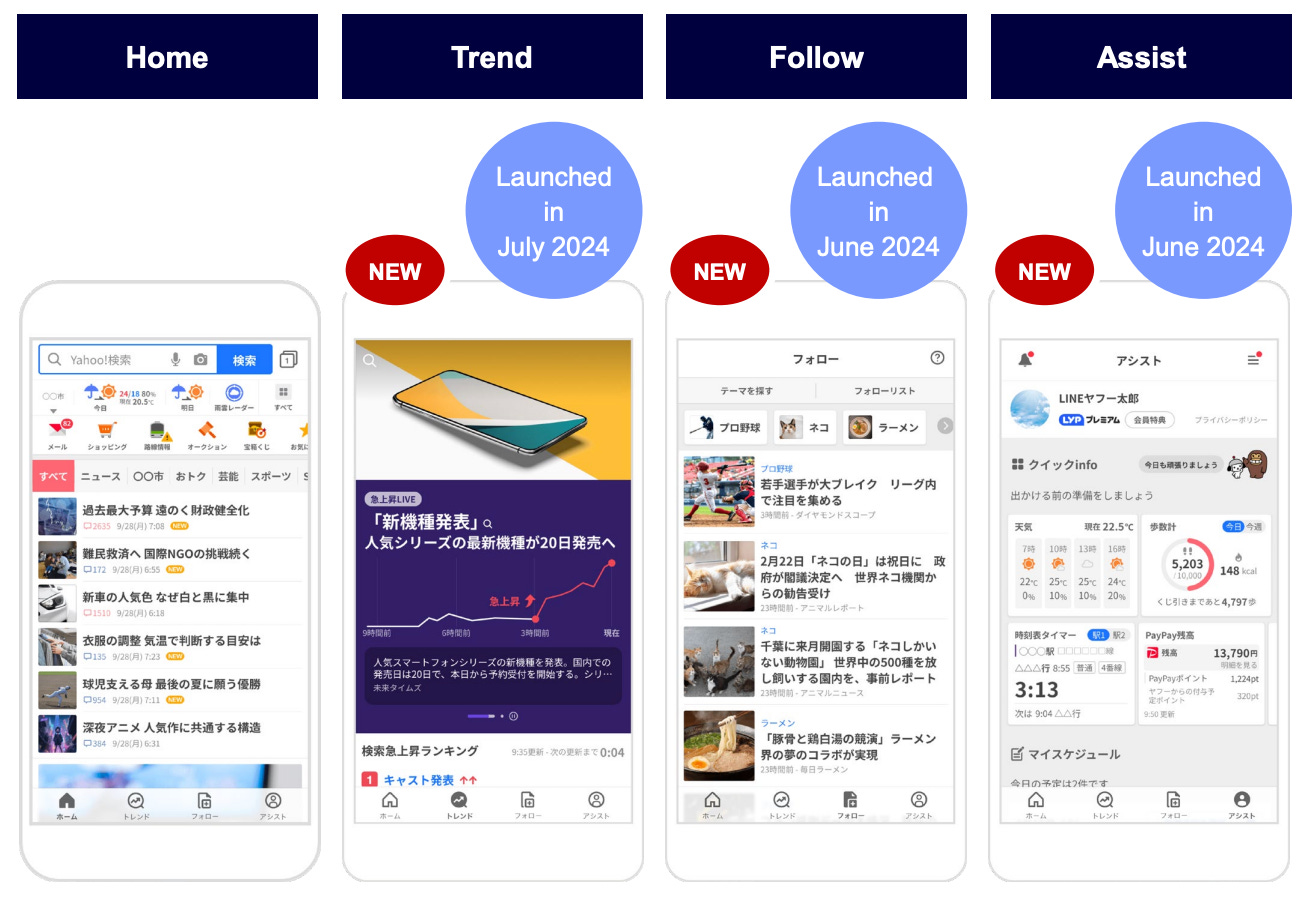

Here new initiatives are visible in the IR presentation, revamping the Yahoo Japan app with more trends and suggestions, and the line app.

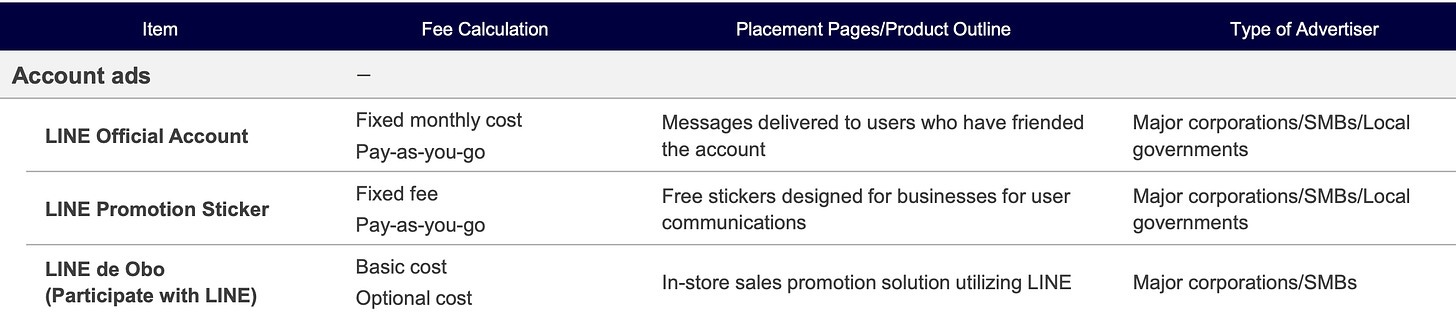

What is growing 20% is the accounts ads on Line part of the business, which is a messaging platform.

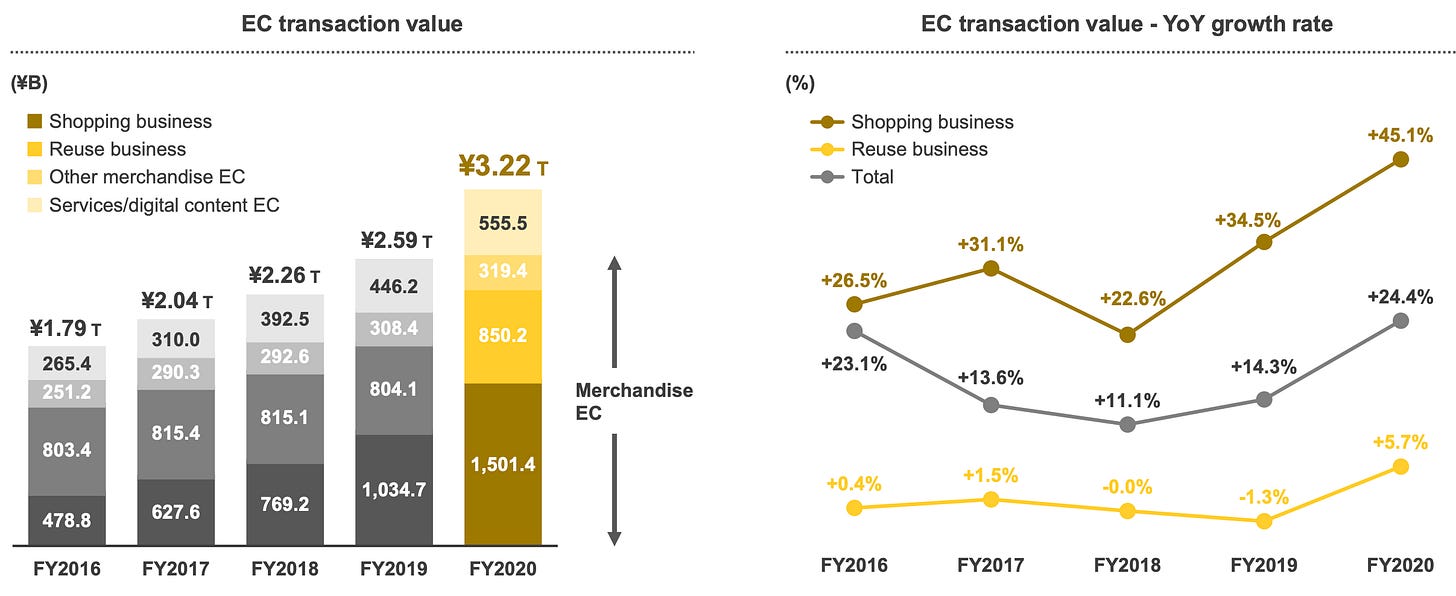

Ecommerce is a slow growth business with about 16-20% Ebitda** margins and only recorded a 4% increase in adjusted EBITDA excluding some special gain.

Prior to covid, it grew very fast and accelerated during covid. Now it has decreased to single digit revenue growth. It is possible that it reaccelerates again in 2025-2026 as covid brought forward demand, but until then, it is a slow growth business.

PayPay is hitting maturation but still growing moderately in terms of users and has potential to continue in terms of engagement (number of transactions per user).

Here is a comment from the Q&A explaining the profit increase.

“Q: What were the reasons for PayPay's profit exceeding expectations? Also, are there any new initiatives related to PayPay that you are looking forward to? A: Q1 had a very smooth start. We managed to grow the transaction volume by nearly 20% while controlling costs, thanks to improvements in product usability and initiatives to increase the number of uses per person”

Line Pay has also been discontinued to make place for PayPay and this will contribute to earnings in 2025.

Finally a larger share repurchase;

The Q1 results announced the plant to repurchase 6.4% of total number of outstanding shares by tender offer with an agreement from the Parent (to maintain the prime listing, as well as to improve financial resuts of Ly Corp).

Future plans involve more M&A for growth, some dividends and more share repurchase. Note that the company cannot repurchase shares without reducing the free float dangerously, because the free float is low at 34%.

Buybacks made without buying from A holdings would decrease the free float ratio, when the minimum required for the Tokyo exchange prime listing is 35%.

Conclusion

Last year adjusted EPS was 18.93, or 20 times PE.

The company plan is 20 yen in adjusted EPS. Which would make the company trading at 19 times PE. We are at 5.4 times in adjusted EPS in q1.

While it is not cheap, it is a quality company with interesting growth prospects, and some loss making affiliates.

I think that when I had my first write up I underestimated the cost of minority earnings and leases when I used the Ebitda and Operating cash flow. For 2023, there are about 18% of minority income that needs to be removed from Free cash flow. It is true that the company generates a lot of cash, but there are investments and leases.

What I saw well was the power of the Fintech business to reach scale and profitability.

The company remains undervalued with interesting growth prospects due to a big user base, but not hyper growth. The consensus Net result growth for 2025, 2026 and 2027 are 15%, 11% and 13%, while for EBIT it is 22%, 8% and 11%.

The Yen is also undervalued.

The company also has a set of interesting assets that currently do not generate profits but one day will, like Line Man, a Thai food delivery app, but these are not going to be very big compared to a $19B USD market cap.

I think that Japan has some lower valuation companies in Small caps that are more attractive, (with more risk operationally), but in terms of blue chips, LY corp is interesting. It is true that Baidu in China is cheaper for example, and I have a small exposition to China tech, but it comes with political risk and needs to be weighted accordingly.

Supporting the publication gives access to:

An archive of 20+ unique write ups. 10+ write ups a year.

Portfolio updates and movements

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

2024 Write ups

03-24 Liberty Latin America (Neutral)

03-24 Pentamaster International

2024 Updates

03-24 Bastide Le Confort update