Finally I had some more time at the airports and in the Caribbean now, where heavy rains pours at the moment, to complete my article.

This article is a summary of my findings on genomics. This has nothing to do with value investing but more with growth and hyper-growth investing.

While not a specialist at all, several sources online helped me and ChatGPT was very valuable to explain what the companies do, what the markets and technologies are. I don’t think I could have done it without ChatGPT.

It’s not an article where anyone should follow me and buy some companies profiled, but something to learn about interesting businesses and the future of healthcare.

What these people in companies are doing is incredible, and what the future holds for healthcare and humanity is amazing.

Ok so what did I do?

I opened some tiny starter positions in this that have no relevance to the portfolio as a whole.

The reason I did it, is to open the door for my curiosity. At the same time I see value and GARP opportunities at incredible prices around and I cannot ignore them, so I will keep focusing more on value.

I think that I will put more money into this very slowly, especially if I see less opportunities in value.

To invest in hyper growth, I used with my 10 plus years experience as an investor in order to favor some companies over the others.

I also used my observation of growth investors like Masa Son or Cathie Woods. What did my experience as an investor brought me?

A framework to identify what I would like to invest in.

This analysis was based on several factors:

The size of the end market: the bigger the better.

The size of the company: the bigger the better, because it will be more able to raise funds and acquire competitors or smaller technology companies.

Related to 2, preferably trading on the Nasdaq to facilitate fund raising and high equity prices for fund raising.

How much the results depend on the FDA approvals and patents: The less the better. Technology and services, consumable over patented medicines at favored.

Patented medicine have more competition, to be avoided or not favored.

Preferably a Price to sales not too high. There are almost no companies with earnings at the moment.

Preferably a company not losing too much money, or well capitalized. Some companies make like 5 million a quarter of revenue and lose 100 million a quarter. This is like pre-revenue and is very speculative.

So a company making decent sales (>100 million a year) and with a decent market cap.

Once you buy - you NEVER sell. You don’t try to understand the company earnings and news yourself, and don’t make decisions. and let humans working at these companies fail or succeed. What I learned from studying growth investors, is that most had giant multibaggers but sold them early. So they basically spent their whole life building a niche hedge and they found the right future leaders but sold them down the road to buy other early phase companies. A waste of talent. Never @@@@ sell.

Accepting that there will be losses. It is possible that the smallest players absolutely destroy the biggest players and that this basket goes to almost zero.

The genomics market is set to grow a lot in the past decade. To me, sky is the limit in this business because it’s literally understanding and controlling life. which means disease and aging, and this is priceless. It could beat the already positive predictions.

The companies.

To find companies, I looked at what the Softbank Vision fund had in healthcare, and what Arkk invest had in their portfolio (Yes thats two points of shame for a value investor I know), and also I read some publications like https://albertvilella.substack.com/ that google brought to me.

1-Guardant Health

Market cap: 4 Billion USD.

Sales: 800 million USD (40% CAGR so far).

P/S 5.

(I do not look at EV/Sales because these companies have net cash from raising funds, and they are going to burn all the cash anyway).

This company is all about early cancer detection. Cancer, when detected early, has good and better survival rates. The problem is that detecting cancer early when there are no symptoms is usually not done. Or it could require biopsies, tissue sampling and stool analysis, and few people do.

Guardant Health products and premises are to detect early cancers with simple blood tests.

That way, routine blood tests could save lives by detecting cancel before it’s well spread. And we could imagine a future where the tests are done monthly, or with a simple drop of blood, and cancer is treated super early like a routine disease.

It also helps with precision oncology treatment.

They have done only 550000 tests so far. We could imagine a future where they do hundreds of millions of tests per year.

We need to test more people and often. This will revolutionize survival rates. Obviously it will also have competition, but Guardant is well placed. A side effect is more demand for the current cancer treatments.

This is not the only company in the market, but others are more into other businesses (colon stool analysis for exact sciences, or prenatal screening for Natera), while developing cancer tests. Another company, Grail, has seemingly very promising multi cancer testing, but is much more Frail financially and in terms of revenues.

Grail, with a market cap of 600 million USD, is more early revenue with sales of 120 million for losses of 500 million USD last year, extremely far from reaching profitability with the projected sales (Koyfin) of 161 million in 2026. They do have promising technology in cancer screening, and Giant Illumina tried to buy them (back) recently, showing their potential.

2-10X Genomics

Market Cap: 1.7B USD

Sales: 600 m USD.

P/S: 2.8

This is another Softbank vision fund backed company. Which could be a red flag if I was sarcastic, especially with a name like “10x”.

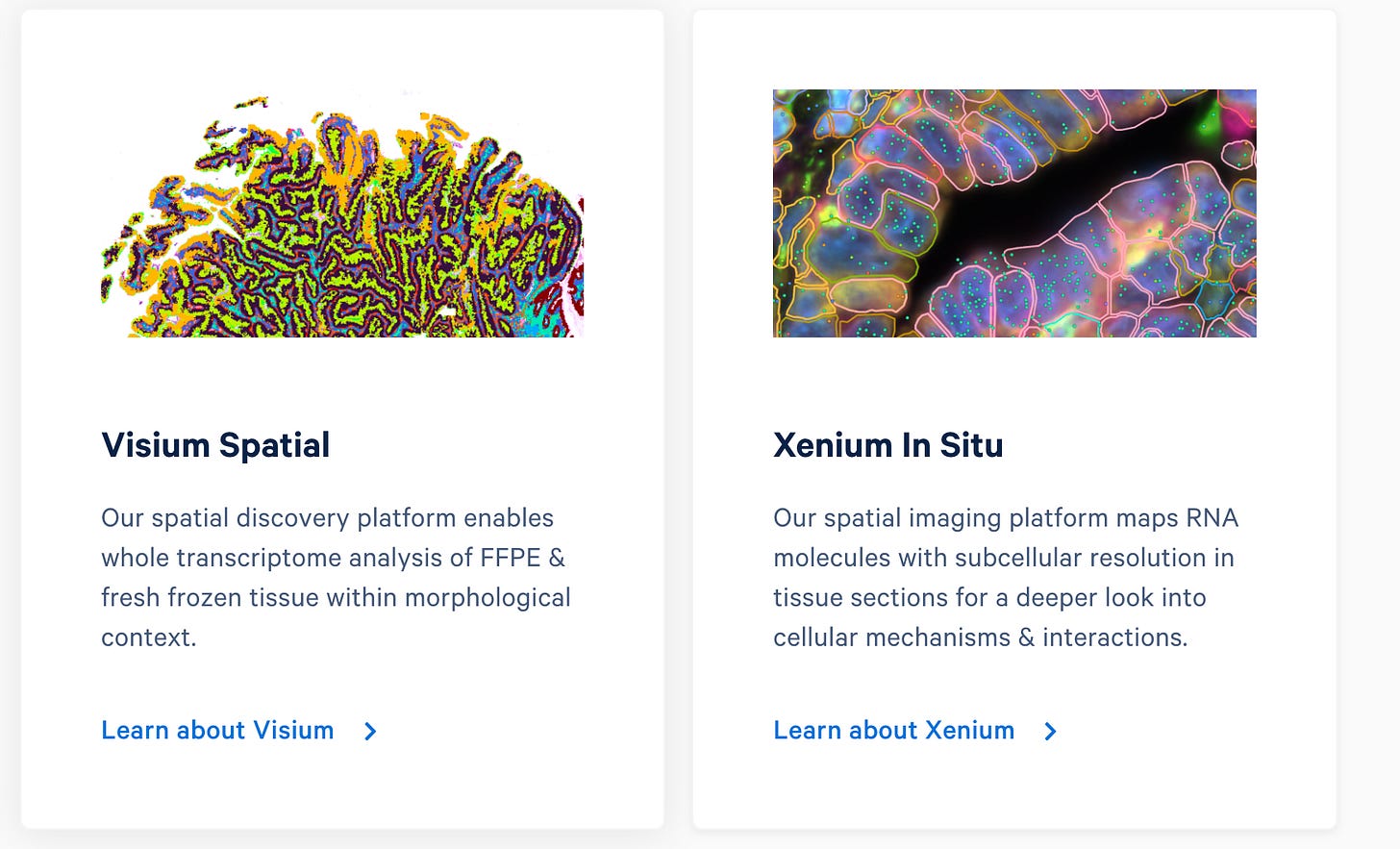

So what they do is complex. They do hardware to sequence single cells.

This is very scientific, and I don’t understand what they exactly do, so ChatGPT helps here to provide some answers.

How does this Chromium work?

They sell tools and consumables for the tools.

And they have an analysis business platform.

Lastly, they have a dominant position in the field.

Who knows if it will last long, it is still speculative after all. But with a price to sale under 3, it is quite cheap (in terms of early growth companies).

3-Illumina

Market Cap: 22.8 B USD.

Sales: 4.5B USD

P/S=5

The difference between Illumina and the rest, is that it is a profitable company, with a larger revenue and the largest market cap.

While the previous company, 10x Genomics, is leading in market share for single cell analysis, Illumina is leading in market share for whole genome analysis and sequencing. They sell machines, consumables and software.

Here is what ChatGPT has to say about it:

Illumina has had two years of stagnant revenues, and is making a whole new business plan to reach high single digit revenue growth by 2027. While I am interested in the name due to it’s size and market share, It is not really exciting. Therefore we will maybe get a better entry point if the growth until 2027 is planned to be tepid.

Illumina just got kicked from the Nasdaq, probably to make space for some ponzi or bubble stock.

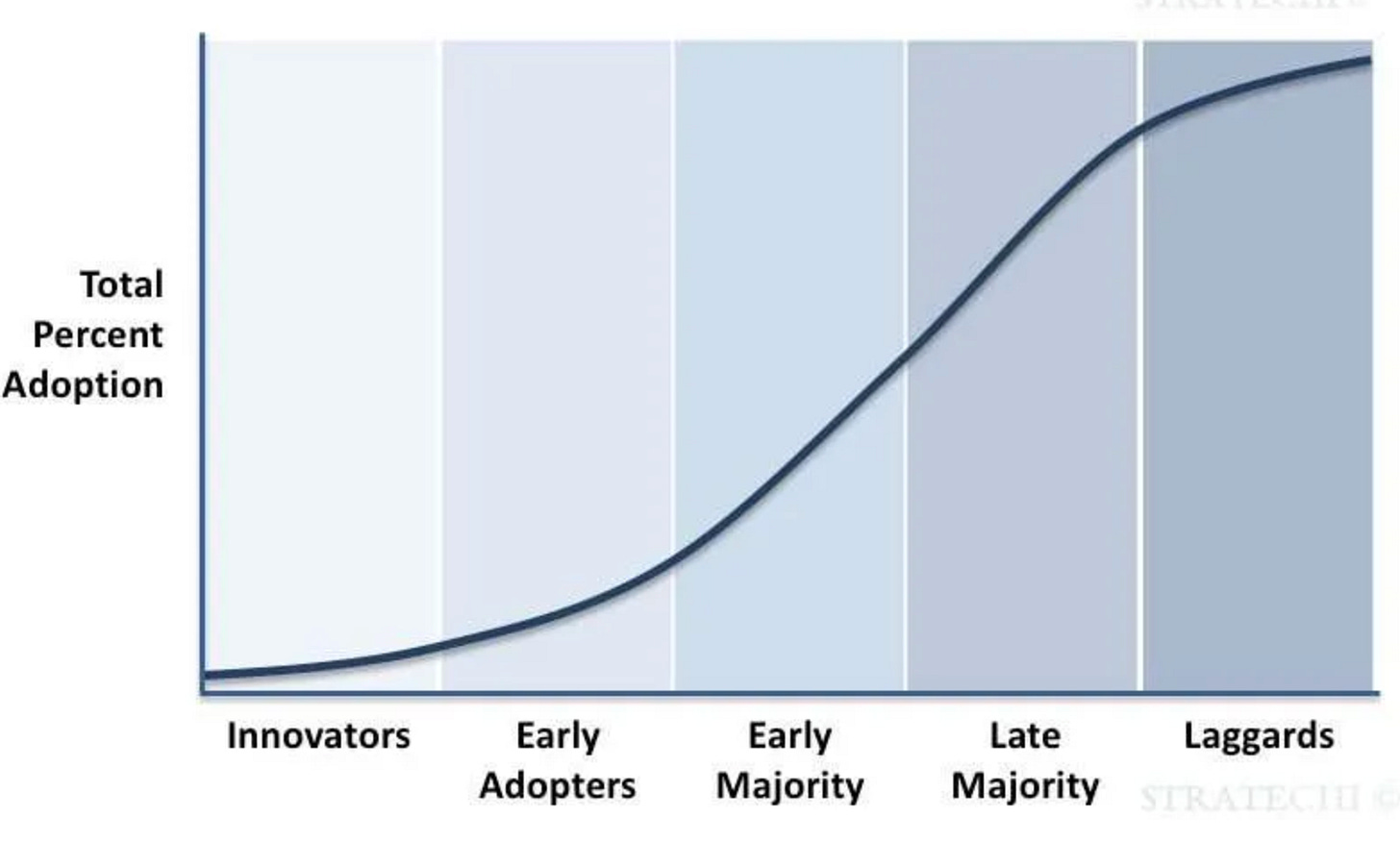

We are still probably at the innovator part of the adoption curve, or early adopters, because Genome sequencing will allow for personalised cure and preventive disease treatments, research, as well as modifying genes for longevity.

I would wait for a better entry point, or better growth.

4-Schrödinger

Market cap: 1.5 B USD

Sales: 216 m USD.

P/S: 7 (We are really high here).

Here we have more of a black box.

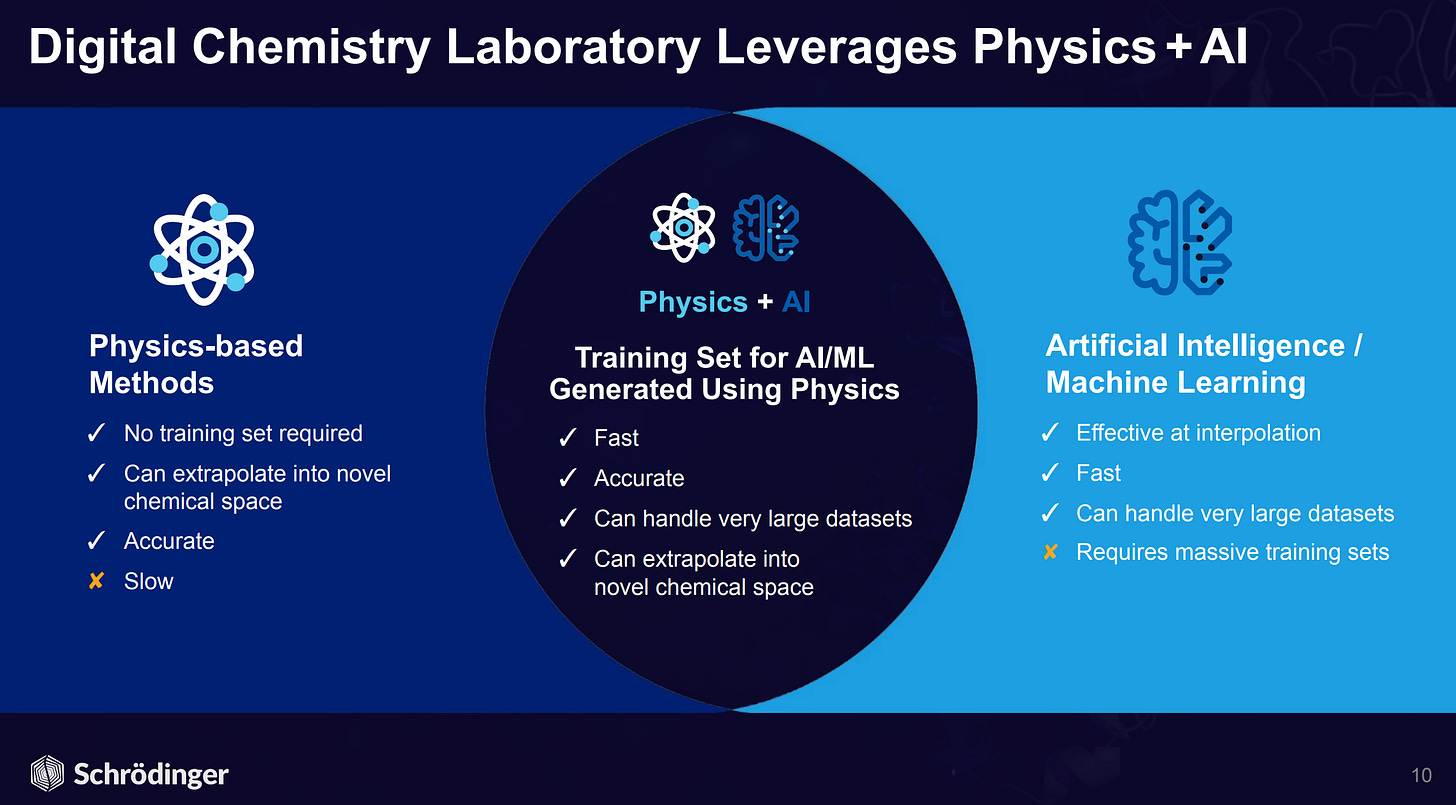

Schrödinger, as far as I understand, has software and data to calculate how the molecules interact between each other.

So they sell software contracts to big pharma companies and biotech, their software cuts the costs to develop new drugs. Most big pharma companies are clients. One thing is also that it helps to find what combinations will fail faster than in vivo testing. And failing faster also helps the drug development to focus on the non failing combinations.

Now some note on machine learning and AI. These are good tools to predict future things that match based on past correlations. But to find new drugs, we cannot look at past correlations because potential the new drugs have no past data to analyse. So traditional AI does not work. It has to be precise calculations with algorithms. BUT if one day a ground breaking AI (I mean really intelligent, not like Chat GPT) arrives, Schrödinger will be best placed to use this tool.

Actually, they don’t claim “AI” too much in all their investor material. The CEO likes to tone down the AI talks because he likes to be precise about the methods used by the company.

The company, founded in 1990, started out by making software that used the basic laws of physics to laboriously and exactly predict how molecules will interact with each other in space. Those calculations, rooted in the field of computational physics, needed lots of expensive and time-consuming computing power to run, and many people abandoned those techniques in favor of easier techniques that took in tons of data and approximated the predicted results, which eventually became called “artificial intelligence.”

Source: statnews (paywall)

So the approximations are “AI”, and the exact calculations are Schrödinger.

They are however starting incorporating AI. I cannot say that I understand all of what they do, but, hey, it’s really cool and it’s the future.

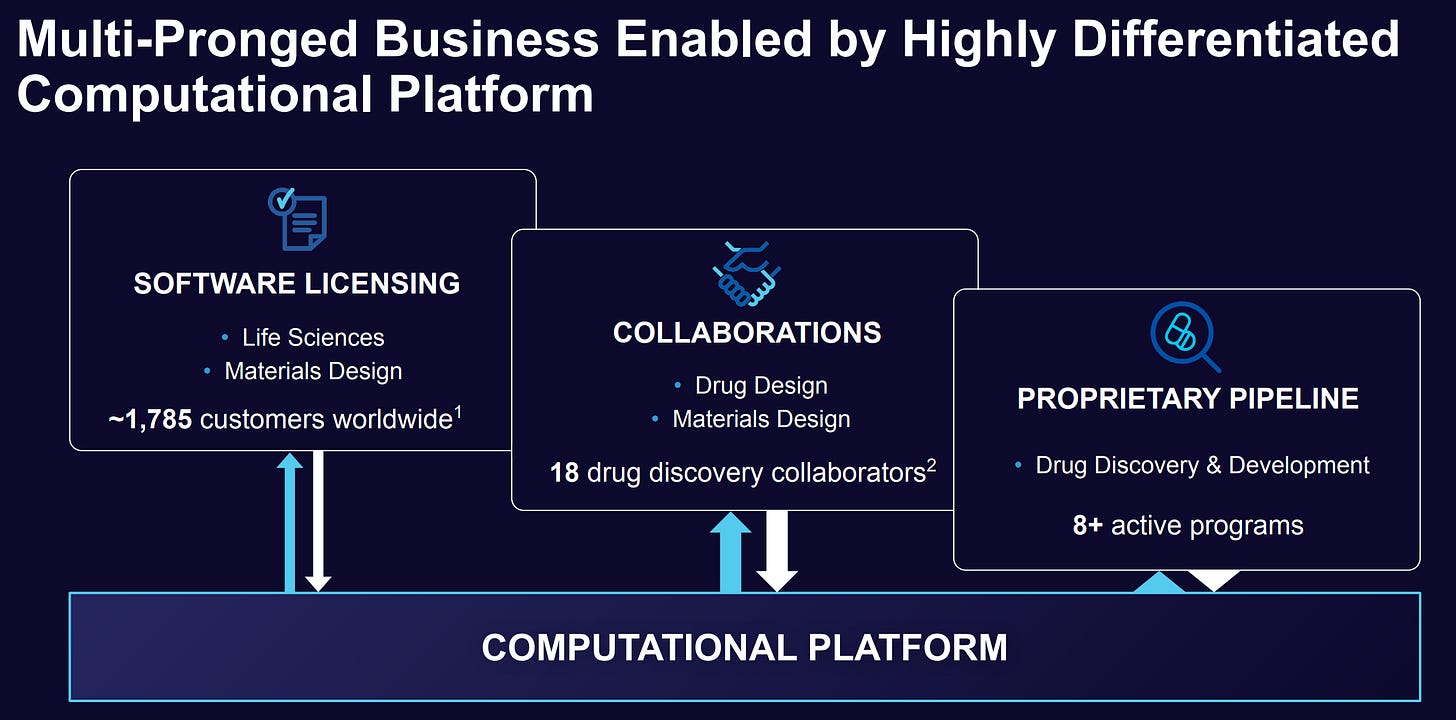

What is nice about Schrödinger, is that, while loss making in the growing software business, they also use their own platform to collaborate on drug discoveries and therefore collect royalties on drugs, like a recently announced potential 2.3 Billion USD deal with Novartis.

They have their own pipeline which will end up as collaboration with a pharma partner.

This pays the bills for now, but could be paying more than the bills in the future.

I find this company fascinating and entering science fiction.

The next company in this list is completely a science fiction company.

5-CRISPR Therapeuthics

Market cap 3.5 Billion USD

Sales: None

Crispr is a gene editing company.

Here is from Wikipedia.

CRISPR Therapeutics was founded in 2013 by Emmanuelle Charpentier, Shaun Foy and Rodger Novak.[6] Charpentier later shared the Nobel Prize in Chemistry in 2020 with Jennifer Doudna. As part of a working group, she provided the first scientific documentation on the development and use of CRISPR gene editing.

This is a company from Switzerland. They have top scientists and technologies, but are pre revenue.

They are more like a biotech.

They edit your genes or the genes of something that they insert into you and then you are cured. I am not going to pretend that I understand what they do.

This is what Arkk invest had to say about Crispr in 2018.

“The first application of CRISPR in a commercial therapeutic setting likely will occur in chimeric antigen receptor T-cell (CAR-T)7 therapy, a type of immunotherapy that harnesses an individual’s immune cells to target and kill cancerous cells while leaving healthy cells intact.”

Sounds good. They have several projects in the pipeline, and they have one approved drug now:

“-CASGEVY™ approved for the treatment of patients 12 years of age and older with sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT) in Switzerland and Canada-”

Therefore some revenue will start. This is a company that is pioneering incredible technologies to cure people. Putting a valuation on this is a bit impossible at the moment.

There are multiple possible backlashes from CRISPR. The first is it needs regulatory approvals for ground breaking diseases.

The second is that it potentially has the potential to build mutants by accident. Well we maybe already have done this with a recent disease that shall not be named haha. But the regulatory risk is high. Obviously, if its a terminal disease, the drugs will get approved easily.

Conclusion

In the end, I am more interested in Guardant, Schrödinger, 10xGenomics, with tracking positions.

I will follow Illumina for growing revenue or falling stock price.

As for Crispr, I have no idea, and biotechs are not my cup of tea, but a small punt once it grows real revenues from their first drugs would be interesting.

Other than this, Exact Sciences and Grail and Natera in the early cancer detection space are interesting with a basket approach.

Focusing on the pick and shovels type of companies would be my safest best.

I have no doubt that genomics will transform our lives and grow enormously in revenues too.

I hope you enjoyed this off topic as much as I did when searching. I would love to hear comments.

Please Share so that we can reach maybe the 5000 value bagholders before Xmas! An annual letter with investment thoughts gathered this year is coming, then a portfolio review.

2024 Write ups

11-24-Financiere de l’ouest Africain

03-24 Liberty Latin America (Neutral)

03-24 Pentamaster International

Yesterday, Pentamaster was just announced to be taken private, so not much upside was collected but at least it was quick! Cannot complain too much.

Subscribe below for deep value and deep growth investing porfolio updates!

PS: Look what I read this summer, susbtack auto generated. Yes and I still managed to go outside :)

Very nice, I discovered a whole new universe thanks to you, super interesting!