Delko, European Small cap distributor and acquirer.

Opportunities and some problems

Nano Cap in Poland

Small margins but good ROE

Defensive normally but not in todays environment

Serial acquirer and consolidator.

P/E normalised under 10

Exchange: Warsaw

Price: 9 pln

Market cap: 15 million USD.

This nano cap is in a growth and defensive industry but with low margins, the distribution industry.

It has been able to grow earnings at nearly 10% CAGR over 15 years...until the recent decreases.

Covid gave the company a boost and the recent reduction of inflation is giving the company a harder time.

This company is quite known in Spanish small caps circles and the idea originated from two small cap investors, Marc and Rodri. It is Delko in Poland.

History.

Business Overview

Market

Recent Results

Capital Returns

Strategy

Management

Valuation

Conclusion

Like Marc said in his article from a few years ago, studying Delko is like exploring a jungle. It was tough. I hated it at first and towards the end I got excited to unwrap the mysteries.

A Jungle of non translatable XHTML documents, of non detailed reports and brief commentaries. A Jungle of non updated websites and Actual reports.

You have the worst document format XHTML of the whole world, which does not work in translators, and you have 10 links for one annual report, and 10 untranslatable format links. The Polish stock exchange is working very badly to promote it’s stock market.

Look at this. And not one PDF link.

Anyway, let’s start.

It is interesting to review Delko and to look at the perspectives now.

History (from introduction document)

DELKO is a nationwide distributor of household chemicals and cosmetics. The company was established in December 1994 in Śrem. The founders were 28 people, including 14 wholesalers' representatives and 10 other people associated with the chemical and cosmetics industry.

The motive for establishing the company was the idea of creating a nationwide distribution system for the chemical and cosmetics industry, which, using its purchasing potential and the resulting elements of competitive advantage, could become a significant entity on the domestic market.

For thirteen years of business activity, DELKO has systematically gained greater importance on the traditional market of distribution of household chemicals, personal hygiene and cosmetics. The company ended each financial year with positive financial results. With each year of operation, it increased its turnover.

Today, DELKO is the only network operator in its industry, providing suppliers with distribution of products throughout Poland.

2002-2015 - purchase of wholesalers in: Ostrowiec Świętokrzyski, Mrągowo, Białystok, Kielce, Olsztyn, Warsaw, Łomża, Kraków, Wrocław, Stargard and Łódź;

2011 – establishment of its own company Blue STOP Sp. z oo developing a network of franchise drugstores in Poland;

2017 – purchase of 100% shares in RHS Sp. z oo Wieluń – a chain of Sedal grocery stores and a food wholesaler;

2019 – purchase of 100% shares – AVITA grocery store chain in Kraków;

2019 – purchase of 100% shares in Słoneczko SA – a chain of grocery stores in Zielona Góra;

2019 – purchase of 50% shares in A&K HURT – MARKET Sp. z oo – a chain of grocery supermarkets in Mielec;

01.2020 – merger of Nasze Sklepy AVITA Sp. z oo and Blue STOP Sp. z oo – the company Polskie Sklepy Franczyzowe Sp. z oo was established, which became the operator for retail chains;

06.2020 – Delko acquires the Delta food wholesaler based in Zielona Góra;

07.2020 – Delko acquires 100% of the capital of PH Waldi based in Komorniki near Poznań (household chemicals wholesaler).

Since 2020, the acquisitions have been paused. There was covid so a lot of efforts to provide volume operationally, as well as the inflation wave which increased cost of debt (polish interest rates) and the debt was high. They have reduced the debt to a low level, with 0.5 times EBITDA or less depending if you take annualised EBITDA or the last quarterly EBITDA as a reference.

Business overview

Wholesale of chemical products and household and personal goods (cosmetics and toilet articles),

Retail sale of cosmetics, hygiene products and household chemicals,

Retail sale of food products,

Wholesale of food products,

Retail sale of pet supplies,

Wholesale of pet supplies,

Industrial products accounted for 77.8% and food and other products for 22.2% of sales.

Wholesale is 75% of the business and direct retail is therefore 25%, but this fluctuates a lot (we will cover this later).

The group is decentralised, allowing the subsidiaries to be more agile and entrepreneurial. However, this comes with less efficiency opportunities.

The company has a constant high ROE in the 20s, but this is down in 2024 due to the lower net margin.

Delko has a growing dividend. But for 2024, the dividend is lower at 0,57 pln compared to .80 in good times of 2021. (2023 was corresponding to a year and half because the company changed calendar dates and ran a transitory reporting calendar year of 1.5 years.. It’s a bit crazy)

Wholesale

The wholesale business covers independent small shops and is done by many subsidiaries bought over the years.

Delko distributes brands from companies like L’Oreal, P&G, Unilever, as well as food brands. The clients are mostly small independent stores.

Delko also offers branded items. See the Branded items

Overall, No customer has a concentration of over 10% of revenues.

This is a simple business.

Retail

retail is a collection of mixed bag formats, some formed by grouping independent stores into a locally based new brand to resist national or international competition.

Delko owns a set of supermarkets directly, and franchises.

But the business of retail is mostly focused on the Franchises, which are growing very fast in numbers:

Supporting the publication gives access to:

An archive of 30+ unique write ups. 10+ write ups a year.

Portfolio updates and movements

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks

The franchises are growing: here we can follow the number of franchises, and the news related to promoting the franchise network to store owners.

https://www.polskie-sklepy-franczyzowe.pl/

And they are growing aggressively.

However I see nothing in the financial statements as to where this franchise revenues are going. In theory it should not be very visible in the revenue increase, but should increase margins, or should be disclosed as franchise fees. It helps growing the wholesale business.

Market.

Supermarkets and Household items sales depend heavily on the population numbers.

The population of Poland has stopped growing and is going down due to a very low fertility rate. This is not going to change anytime soon unless the disapearing people are replaced by immigration. Let’s not bank on a population growth scenario. So the market is not growing and is contracting. There could be an upsale to more expensive items in a good economy (From non branded Items), that could lift consumption in value but not in volume.

Poland has seen like most of the world a wave of inflation in 2021-2023, followed by reduced inflation and possibly deflation in supermarket prices. Officially there was no deflation month of month, but it could have happened in supermarket only prices.

Therefore this impacts Delko a lot, since it buys items at Day 1 and sells them at Day 40-45. If the prices drop, and with a small gross margin, Delko can lose money. On the opposite, if the prices rises, it can win extra money. Of course there are also negotiations with clients and suppliers, and contracts, it is not a fully liquid price like the stock market.

The price war:

There has been a price war in the sector in Poland, and headlines suggest that this is not sustainable: Abusive practices, lower profits, hurt retail sector.

The competitive landscape is very challenging with Lidl, Biedronka, Auchan, Aldi, basically all the best chains of the continent except Mercadona are there. It’s madness.

This represents a serious issue.

Recent Events

The first quarter of 2024-2025 is bad.

Sales are down, and profit is down even more.

This is a low margin business that is impacted by salary inflation (similar to Ambra), but I think that there are several factors at play.

Constant inflation in the past years led to wholesalers and possibly consumers to stock up.

Now that inflation is slowing down in Poland, consumers and wholesalers are pausing the purchases and going through their stocks.

At the same time there is salary lag with salaries still rising fast, causing costs to increase.

It could be that they or their customers are losing market share, as I read in the forum that the hard discounter price wars is leading some people to ditch their local stores to go to the hard discounters. (And that the trend is not sustainable due to the lack of convenience).

Some of the Ukrainian refugees wave that entered Poland in 2022 went to other countries and Poland reverted it’s refugee population boom. (As explained by Rodri in one video in Spanish)

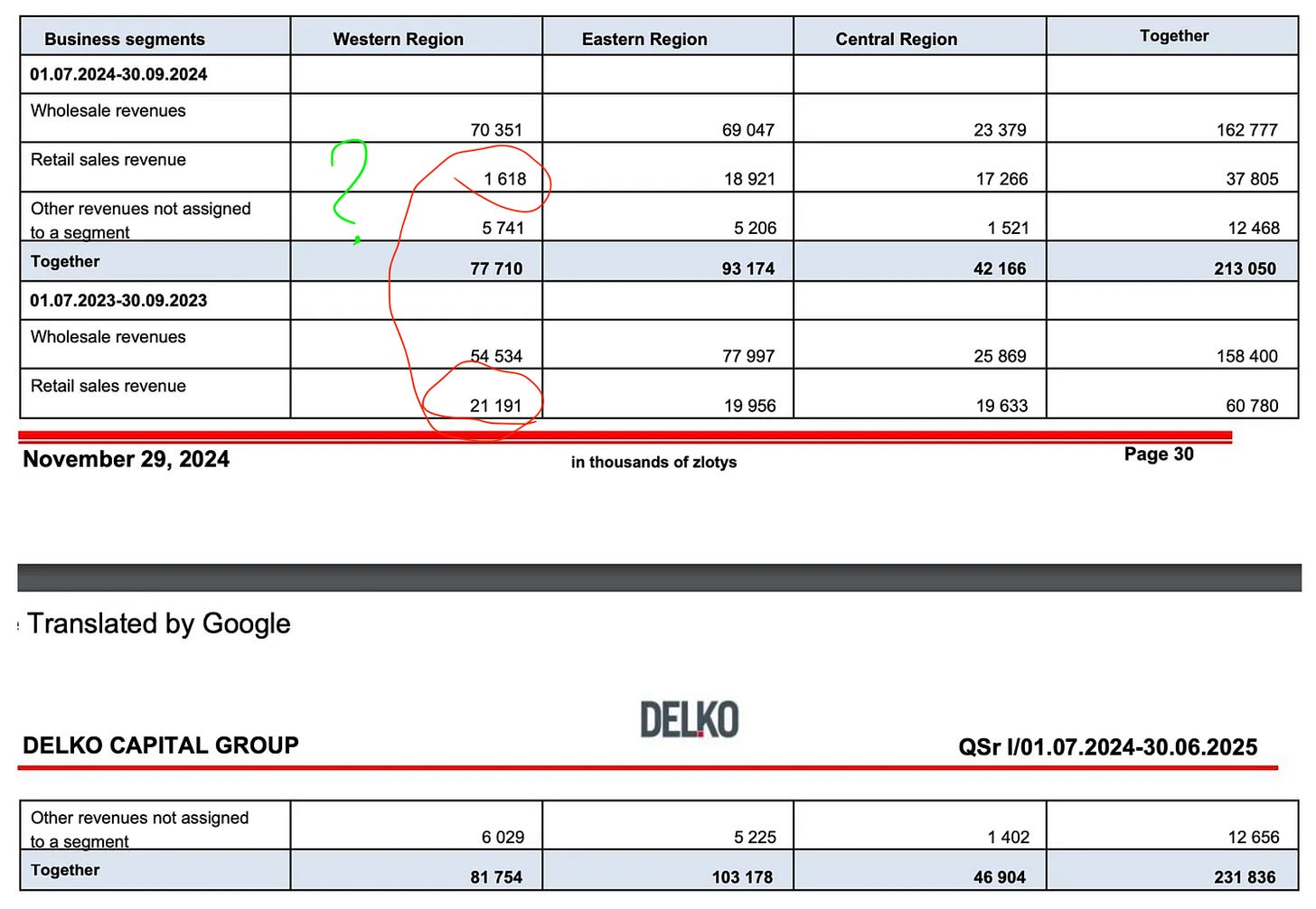

Here is the latest quarter financial statement.

(Net Profit is Zysk Netto), and is decreasing.

The debt is manageable.

They have been focused on reducing the debt lately, but higher rates meant no reduction in finance costs.

The results for Q1 2025 show a small loss in the central region, and profit in the other two regions. The company will cut costs as a results of these challenges and Q1 should be the lowest quarter in theory.

More strangely:

Something super weird happened in the Western Region, Retail sale revenue went from 21191 to 1618!

It could be like a sold company but there is no trace of sold company. However the wholesale went up from 54 434 to 70 351, which is unusual compared to the other regions that recorded a decrease. Therefore I conclude that it’s a reclassification or an error.

After all, the company has plenty of incorrect links on the websites, including initially the Q1 2024 report link was opening the Q1 2023 report! Not very serious.

The Western Region retail would be Sloneczko. There is no news about Sloneczko closing down, nothing on facebook that is unusual, no earthquake or floods, so I think the report is simply wrong there.

In the last annual report (well one of the annual reports from the 10 links), the company notes the following:

Delko Group's sales are affected by: - a demanding market environment characterized by intense price competition and low consumer sentiment indicators (no significant rebound in consumer purchases). The price war between discounters has greatly affected Grypa stores, - in terms of wholesale, the lack of sales growth was affected by closing stores - a smaller number of stores selling fast-moving consumer goods, such as food and cleaning products - a 2 percent decrease in 2023. This means that 2,300 outlets disappeared from the trade map during the year

Losing Share?

According to https://www.worlddata.info/europe/poland/inflation-rates.php, Polish prices rose 41.68% since 2019.

Food inflation was higher and household equipment also had high inflation.

Delko revenues rose 19% in the same period according to Koyfin. There is a sign of losing relevance and a first red flag as its revenue did not follow inflation.

Capital returns

Also, the company recently announced a 12 million PLN Buyback (Market cap 106 million PLN) and a 0.52 PLN Dividend. (Price 9 PLN). So we are pretty good on that front.

Strategy

In line of these challenges, Delko pursues vertical integration acquisitions, restructuring to be more competitive.

However in Full year 2024 letter, they do not speak about acquisitions anymore. Too challenged by the day t day operations? We will see.

Here are the perspectives.

Looking to the future: on the one hand, the increase in operating costs (inflation of labor costs, services, energy), the stabilized level of prices of goods sold, further negative regulations introduced by the government and its agencies and the EU - may negatively affect the financial results achieved. On the other hand, this is always an opportunity for a development impulse for the organization, which we will want to use.

We saw in Ambra’s report how the labor cost is impacting Polish companies. This should be temporary. If workers make more money, they will end up consuming more.

And in Q1 2025 report, they do not provide a commentary anymore! They were like no, screw it, bad quarter, no comments.

Management

Here is the shareholding structure:

Dariusz Kawecki is the president since 2014. He owns 30% of the shares and has been treating minorities well. There is some long term history in the other write ups Darius in the 2000s and 2010s but it’s irrelevant and was. I am ruthless with irrelevant information. It did not help to know it.

He makes terrible financial communication I can confirm that.

But he has a very impressive CV/Presentation on the website.

Mr. Dariusz Kawecki holds a Ph.D. in technical sciences in the field of automation and measurement systems. He has worked professionally in management positions for 22 years. His many years of practice and deep knowledge of the industry are supported by work in both retail structures (Lewiatan Opole sp. z oo, Lider Sp. z oo, Drogerie Rossa sp. z oo and others) and wholesale structures (Delko SA, Delko Esta sp. z oo, Taco sp. z oo, Delko Otto sp. z oo, Doktor Leks SA and others).

Mr. President Kawecki has successfully participated in many restructuring projects and projects related to company acquisitions and mergers, as well as the implementation of IT and management systems. He has completed dozens of courses and trainings, including in the field of finance, management and sales.

Strongly committed to performing professional duties. Responsible. Honest. Consistent. Extensive non-professional interests in the fields of history, astronomy, geography and history of the Sudetes region, macroeconomics, sociology and ecology. Lives in Wrocław.

It’s our Tony Starks.

Valuation

With the latest quarter results normalised, Delko trades at a PE of 20 more or less. But this is an exceptional quarter prior to cost adjustment and possibly recovery in margins.

Covid provided extra margins for Delko with inflation, then the war in Ukraine with the refugee population and more inflation. We cannot really look at this period to understand the business.

Taking the last normal year 2019 and look at 2018, Delko also trades at a PE of 10. But in the mean time the number of franchises has increased a lot, so the normalised earnings should be higher.

Taking into account normalised earnings of maybe 12 million PLN, we have a P/E of 9

Historically and before covid, the good net margins were 2%. That would put us at a P/E of 6.5.

I don’t believe in further margin improvements, untill we see them.

The company is cheap but there are some challenges to overcome in order to recover that valuation and the margins.

Conclusion

The main positives are:

Buyback

Low debt and further acquisitions.

The negative are:

Potential restructuration costs

Customer behavioral change in favor of big discounters.

The best is to leave the conclusion for the management group:

In the opinion of the Management Board of Delko S.A., the main external factors significant for the development of the Delko Group are:

-Positive factors:

The group's share in the traditional trade sector does not exceed 20%, allowing for further growth despite the stable value of this market.

-Negative factors:

problems on the labor market,

increase in the cost of the minimum wage

slowdown in commercial consumption in Poland

I am positive about these negatives, because you cannot have rising wages and lower consumption. One of them has to give.

However, there is one last risk, competition risk:

risk related to the expansion of modern trade outlets The development of super- and hypermarket chains, and above all discount chains, is causing a decrease in the share of sales carried out in the traditional system. In particular, it can be predicted that after a period of intensive expansion in larger cities and their relative saturation with modern sales outlets, the expansion of these networks may also cover smaller towns, which are largely served by traditional trade. Such a situation may certainly significantly hinder the implementation of Delko's development plans.

So at the end of the day, I think Delko has a sort of weak competitive position, but can still profit, and is likely to make good acquisitions in the coming year and years. It bought Avita for 2.8m pln and Slovenko for 3m pln.

With the stress in the sector, it could buy assets really cheap again.

In that case, a rosy scenario could see 900 or 1 billion pln sales with 2.5% net margins or 25 million of earnings, a P/E of 3, followed by a rerating (double or triple).

Therefore, with this and the buyback, I remain positive on the company as there is some valuation safety.

Better options

However, I believe that there are better distributors out there (more transparent) and better serial acquirers.

In line with the complexity of Delko, the obscure reporting and the competitive challenges, I swapped the position for Sendas Distribuidora in Brazil, in the same industry but with a good competitive position. How did I find it? A-Z of all ADRs. I must say that preparing the article helped me make my decision and to have a clearer view of Delko.

I still have a quality preference and Delko is really low quality, margin wise.

Psychological bias played a role here, because when doing the write up I realized the competitive challenges of Delko. And I thought for myself “Ok, your line is in the green and near break even, so why do you force yourself to stay invested if you find some risks and margin profile that you don’t love? ”

(Sendas is also low margin but a bit higher than Delko. Especially on an EBITDA Basis with 7% vs 3-4% for Delko and before leases). Hey, I had nothing in Brazil, so that was needed If I am an emerging market oriented investor? Brazil is the ultimate value play.

My conclusion is that Delko is a good valuation, but maybe not worth the translation, low margins, competition, bad reporting and liquidity trouble. I have written on better companies with similar valuations.

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

Allright, next up will be an annual letter, a full portfolio review, some guest free articles, one round of company updates with interesting notes.

Links

Rodri Recent Review of Delko - Spanish

Below is the translated letter:

Letter to the Shareholders of Delko SA

Dear Sir or Madam, The presented consolidated annual report covers the period from July 1, 2023 to June 30, 2024. During this period, our Group did not make any significant large investments, apart from the expansion of the logistics warehouse in Warsaw by our subsidiary. We focused our activities on preparing the Group for the upcoming and expected period of cooling down of the trade economy, reduction of price pressure from suppliers, as well as a significant increase in labor and service costs.

Summing up the presented results, I would like to emphasize that the last quarter of the balance sheet year turned out to be significantly better than the previous quarter. EBITDA (%) amounted to 4.15% in the current year and in previous years 2022/23 – 5.29%, in 2021 – 4.02%, 2020 – 4.34%, 2019 – 4.03%. This is important because we achieved this result while increasing work efficiency and maintaining good financial liquidity. The generated, consolidated net profit will allow us, as every year, to apply for the payment of a dividend to shareholders.

Results achieved for the 12 months of the balance sheet year 2023/24: Sales revenues: PLN 882,324 thousand Cash flow from operating activities PLN 39,679 thousand EBITDA PLN 36,632 thousand Net profit PLN 15,214 thousand.

Currently, the Delko Group is conducting activities to adapt to the economic situation in trade:

1. Implementing new technologies to achieve higher work efficiency. Its effect will be a slight reduction in employment.

2. Simplification of management structures, as well as a small replacement and reduction of senior staff, which results from generational change.

3. Closing the smallest, unprofitable stores and opening new, larger ones - adapted to market expectations.

4. Reconstruction of the supplier base and product range - in order to improve the % margin and improve logistics efficiency.

Since the Group has accumulated financial resources from previous years earmarked for investments, both in its own development and in other areas that can bring synergy effects - we will continue to conduct such activities, but cautiously and reasonably, due to the current economic situation.

Due to the fact that the current valuation of the Company's shares on the WSE seems to us to be significantly underestimated, not only in relation to the value of the results achieved and the real assets held, but also in relation to the valuations of industry competitors listed on the WSE - we are considering a share buyback.

Their current price seems very attractive to us. Looking to the future: on the one hand, the increase in operating costs (inflation of labor costs, services, energy), the stabilized level of prices of goods sold, further negative regulations introduced by the government and its agencies and the EU - may negatively affect the financial results achieved. On the other hand, this is always an opportunity for a development impulse for the organization, which we will want to use.

Dariusz Kawecki President of the Management Board