Hello, Merry Christmas to all and welcome to the new subscribers.

Here is a summary with updated thoughts on the companies in 2024

As a remember, I hide the nano cap names that I buy only.

2024 Write ups

This is a nano cap household chemicals and food distributor in Poland, with very cheap valuations but a tough environment (deflationary on what they sell but inflationary on salary) is hurting them. I check the valuations and the prospects of the company. In the end, I view it as interesting but maybe not worth the language and competition hassle, in view of other opportunities on the market.

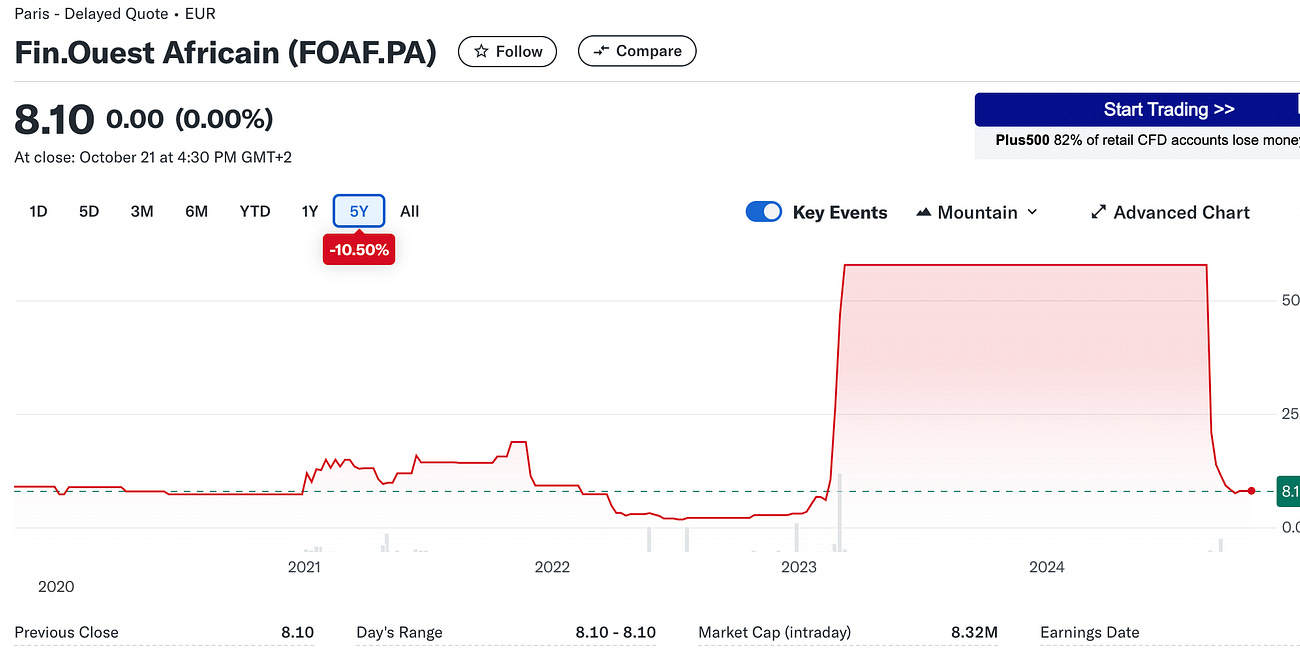

11-24-Financiere de l’ouest Africain

The curious case of Financiere de l'Ouest Africain at 1 or 2 times earnings.

Today we will cover an potentially incredibly cheap stock. Very cheap, but very obscure. Do not view it as an investment idea that is actionable, but as a fun Sunday email. And if you buy shares in the stock, you get a free emerging value subscription if you send a proof, because you are just too dam crazy.

This company is an UFO, with no statements available and no website, and of course no dividend. What I did is more like an investigator’s job than an analyst. Luckily, some members of the Boursorama forum know the company and I could piece the jigsaw together. It is an option to buy a growing insurance company in Senegal and Cote d’Ivoire at incredibly cheap prices. But the value may never be realized. It’s an interesting story.

Kaspi, the Super App company

I bought Kaspi in 2022 after the Ukraine Invasion and shared my movement in the newsletter.

Kaspi is a Kazakh fintech and super app, with commerce and payments. It is an amazing company that posted strong returns for my portfolio because I liked it during the panic post Ukraine war. Since then, the company announced the acquisition of a leading e-commerce company in Turkey that will provide growth for years to come and that makes me more optimistic than before.

SDI PLC is a former fintwit darling that had good write ups. Then when a cyclical slow down appeared, it stopped being popular. Many people who wrote the write ups sold. Today’s investors are so short term oriented, if your thesis is good, hold! I recognized the good value in the write ups, especially to whoever discovered it first, despite missing the cyclicality and focusing too much on side fluff. Since then, the company posted ok results and conducted an acquisition. The price showed resilience.

Boustead Singapore is a holding company ran by and excellent and patient management, and I felt a overly conservative average capital allocator. However, even this can lead to interesting investments at the right price and with a dividend and growth policy. The management is also shareholder friendly. Here I explore the four main segments, with a good emphasis on a hidden or hard to analyse real estate portfolio that is leased. Since then, the company posted good results, a low backlog, and seems open to sell for a lot of money a real estate building that does not even produce profits yet! This is interesting.

This extremely small cap proved defensive and resilient with good results. The management is ambitious and they have good products and services. I am waiting to see acquisitions, and more dividends. This is something I am happy to hold indefinitely, especially that I probably use the services as a Spanish resident.

Swatch group: luxury is cheap

In this article I will summarize two investor thesis published in video format in French and German, and will add my perspective.

I was Neutral on Swatch. I thought I had a super cheap luxury stock, and it is, but the fundamentals in the whole industry are worsening. Even LVMH suffers. At some stage the whole sector will recover. In the mean time, if I can find small caps at 1/3 the valuation… I know what to do.

Defensive Latin America ADRs

Hello, First of all thanks to the new subscribers and supporters of emerging value.

I covered various Defensive Latam ADRs. The sentiment for EMs is still very low. It would be a good idea to carpet bomb the region with ADRs buys. Actually, when I wrote the article, I missed one important ADR, completely by accident, that I since bought.

I wrote a UK nano cap with a defensive business. The company is and was very cheap, resilient, but 2024 remains a bad year with very low profitability. However it also did ok in the worst environment possible and it was almost priced in so the stock did not fall much. Funds are now adding.

I wrote Text SA up, and went deep into the business and the risks and opportunities with AI, using my knowledge of E-commerce and tech. The stock price has since since fallen on slowed growth, before recovering towards the end of the year. There remains to be seen if they will show more growth in customer accounts again. New unified billing should help with big corporations contracts and upsells.

03-24 Liberty Latin America (Neutral)

Liberty Latin America

Liberty Latin America is a company I have been investigating. This is a company following the John Malone model. They utilise debt to consolidate the cable industry, have complex accounting with acquisition costs and depreciation causing low profits, and repurchase shares while paying no dividends.

I continued with an analysis of LILAK, where I was Cautiously optimistic. This is due to the debt, no dividend and complexity. I just found the company investment case not clear enough. The price being lower, and acquisitions having continued, I am more willing to reconsider the name. However, the capex is a bit too much, and fixed services are being disrupted by mobile only in many EMs. FCF in 2024 is null so far and I need to see more of it especially in Q4. Wait and see.

03-24 Pentamaster International

I followed with an analysis of Pentamaster, a semi conductor and sensors inspector as well as factory automation company. The company posted mediocre results but boosts great potential and had great value. So much that it was acquired at a premium at the end of the year. I consequently replaced it with a new Japanese holding.

Melcor Development

Melcor development is a real estate company almost exclusively on western Canada. The special part of this company is the value creation flywheel.

I started the year with Melcor, a very undervalued property developer and operator based on the economy of Western Canada, family owned and with low price to book, with dividends and buybacks. Since then they have proposed to acquire Melcor Reit which would be accretive to earnings. They are a sort of bet on Natural resources wealth too.

The performance will be the subject of the year end review coming soon.

If you enjoyed it, please share, comment, and subscribe to support Emerging value.

Supporting the publication gives access to:

All the write ups - aiming for 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

20% on Koyfin plans with the affiliate program

Referral program: Get premium access for free!

If you share the newsletter and get people to subscribe, you can gain full access quite quickly!

https://emergingvalue.substack.com/leaderboard

Thanks!