What a funky name and a nice article title - I could not add anything more to it.

Congrats on opening an email just called Papoutsanis. This means you are curious. Or Greek. Yes I like Greece as a tourist and as a potential investor, because they have excellent business people in the consumer goods space and are liked by consumers.

It is a company that gave me a few headaches trying to understand it!

Greek Soap company with a mix of B2C and B2B

Focus on growth and efficiency of production

P/E of 13 with earnings impacted by inflation

Large Capital expenditures

Let me share my research notes:

This company is a small cap selling cosmetics, soap, contract manufacturing and soap bases. It focuses on soap made with natural ingredients, around olive oil, as opposed to traditional chemical soap.

The company has a long tradition:

Recent History:

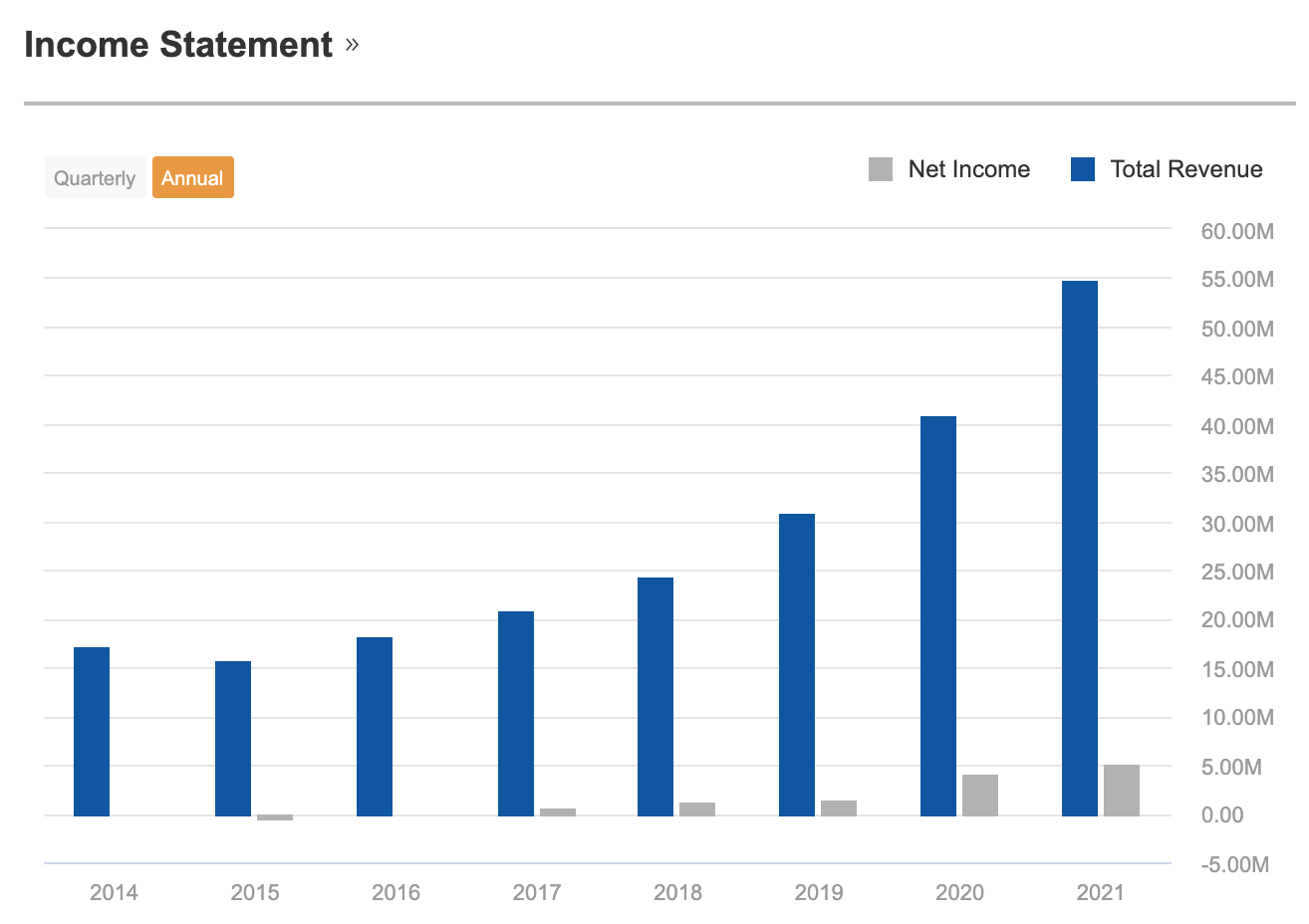

The company had a new management buy-out in 2010 and this was transformational - The first thing they did is invest a lot. There were no dividends paid before 2018 ( Capex).

The Factory advantage

“The Papoutsanis factory is today one of the largest vertically integrated soap and hotel cosmetics manufacturing plants in Europe with a very high level of automation and, therefore, competitive costs.”

That is a Moat in my opinion.

It is Probably the most automated saponification production facility in Europe - Sole producer in Greece.

Huge capex expanses eating all the EBITDA: (New plant investment: 50 mil Euros (2000- 2019) - Capex 2020 – 21: ca. 10 million Euros (doubling bar soap capacity) Earnings were 5 million euros last year.

Business lines

Four business lines for which we can see revenue:

In 2015- It developed a new business segments: Bar/base soap market, that we can see growing here.

Branded products

The brands are definitely upscale (natural ingredients, olive oil). It had a covid boost with liquid soap and this is now normalising.

Hotel

This is special made products for hotel chains. They differ in portion sizes and branding.

Contract Manufactoring

Here, it seems that it is a good value proposition for soap brands and supermarket brands that want efficient and relatively cheap soap manufacturing with natural ingredients. This is growing a lot.

“Our partners come to Papoutsanis for not only our flexibility and ability to meet complex production demands, but also our proven in-house R&D capabilities, which allow for new recipes co-creation and agility in developing, prototyping & piloting new products. Our state-of-the-art, continuously expanding, vertically integrated plant, with PET/PE bottles and PP Closing cups production capabilities, offers a wide range of format, size and packaging options, with a clear focus on environmental responsibility and sustainability in every aspect. Our ever-expanding portfolio, many with natural, organic and sustainable certifications.”

Soap bases

What are soap bases? Some sort of soap preparation used to prepare the final product.

https://www.papoutsanis.gr/en/specialty-soap-bases/

“(…) then, they are sold to other companies which make the final product. This market supported by the growth of organic products (olive oil is the company’s expertise) is poised to provide the group with great revenue growth alongside high profitability margins. “

The company is growing very fast in this segment, 77% in 2022 to date.

“This segment saw a 74% increase in 2022, mainly due to exports. This growth is the result of the Company’s established position as one of the key suppliers of specialty soap bases on the international market, its expanded customer base and continued efforts to further enhance the product range offered. It is worth mentioning that a new soap base production facility became operational in H2 2021,”

Again, the company does not disclose the long term plans and size for this business.

Market:

The global Organic Bar Soap market was valued at USD 1.5 billion in 2021 which expected to reach USD 3.54 billion by 2027 at a CAGR 10.54 % from 2021-2027.

2018:Filing for bankruptcy of the No 1 bar soap producer in Europe opened many new opportunities

Further consolidation of position as main soap producer in Europe. This is a moat created by long term investment.

The European soap market is nearly 2 billion Euros of imports, with 1.5 intra Europe. I think that leaves a good space for Papoutsanis and its 40 million Euro business to grow.

Finance:

Deleveraging since 2016 due to increase in Ebitda, from 3.5 to 1.5 turns.

Growing constantly since 2012, and faster and faster, due to the ability to fund more capex.

The ROI for five years has been 8%. not very high due to the heavy investment. However this capacity ramp up was not optimized for each year earnings but always with extra capacity in mind. Therefore our steady state ROI should be more.

oct 2018: Factory with 50% spare capacity

oct 2020: Factory with 50% spare capacity

Conclusion

We have a growing company, very capital intense due to the growth plans at a depressed P/E of 13. The management seems excellent and long term oriented.

One downside is that the company is not clear and not disclosing the long term potential and market size. I would like to see in the annual report or presentation a long term plan laid out and a future size of the market. As well as FCF margin estimate once the business is stable and no longer growing fast. I did not find this, maybe I missed it?

My other concern is that a large part of the business is a middle position and not selling a finished product, giving less room to manage prices than an end consumer company.

This write up is pretty short but figuring the business out was not, as the management does not explains the case well and not in one place.

A company interesting to watch. Is it a buy? I would buy it starting at a depressed P/E of 10 or a 48 million Euro market Cap vs 63 now, due to the uncertainties of the rising energy and material costs and the inability to maintain margins recently, and due to the competition with other portfolio companies.

It’s a good hidden champion.

https://financeclub.unipi.gr/wp-content/uploads/2019/12/Papoutsanis-Financial-Analysis.pdf

https://www.cbi.eu/market-information/home-decoration-textiles/soap/market-potential

https://www.businessdaily.gr/english-edition/39117_papoutsanis-bust-boom

So what did I buy in my public thesis recently? In foods, more Newlat foods for example. In Health, more Bastide Le Confort (some risk, but incredibly cheap). I increased AB-Inbev again when it was below 50 Euros which made no sense, but its no longer one of my largest positions. I Increased Delfi (Asian Century stocks)

Also some hidden champion from Poland in food (subscriber only), and France in Soaps and cosmetics (subscriber only) if we stay in the same sector. Other than this, Uk small caps, Canada small caps, Chile ADRs.

I am preparing for December a big article that will aggregate all the external writeups from my first 6 months of subscribers only monthly recaps. These monthly recaps also mention my watchlist and movements but here it will be write ups focused. I will add my quick comments and If I own them. So stay tuned.

If you like unique ideas in value land, think about supporting with the full membership.

This publication is my side activity and fun project and I love the support I received so far. The premium membership is my whole deck with more ideas.

What you get is access to:

Exclusive write ups

A fully accessible watchlist and deck spreadsheet

Monthly recaps with other people write ups from various languages circles and interesting stocks.

Full portfolio reviews with more hidden gems.

Free trial.

I can also give free access to any student - contact me for that

Note: this is not financial advice, but my opinion on the companies presented. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

how do you invest in Greece? any broker you'd recommend?

I'm Greek and have owned papoutsanis in the past. Before the current management took over it was almost run to the ground. New management / owners did a remarkable turn around.

I may be biased because I sold too early but the best of this stock is behind it at this point. Sure it's a great company but now it's priced appropriately, there's not much room to grow, in my opinion.

Brands are good. Karavaki is the soap that all Greek households grew up with. There's some resilience in the portfolio. When tourism was down due to pandemic, "wash your hands" soaps boomed, now it's the opposite.

One of the owners comes from an investment banking background iirc. There's a fair possibility, in my opinion, that the company will get sold eventually.