AB inbev - I don't know about next quarter but I feel good about the next decade

Oct 25. AB inbev is since the post earnings fall in Q2 2021, a position I built up to become almost the largest in my portfolio.

To be clear, it is not the cheapest, it is not the fastest growing position, and probably it isn't the best. To understand why I made it a big position, I would place it in the Anchors of my portfolio.

My porfolio is composed as it is:

1-"The legacy B&H" a portion of quite expensive dividend growth names that are my family portfolio that are strict Buy and hold (Maybe 15-20%).

2-"The EMs" a large portion of diversified EM deep value defensive stocks and EM Garp (Over 60%)

3-"The Anchors" some Developed market anchors to bring some economic stability to the portfolio. In this basket I still look for value, but not deep value necessarily.

Here we find

-3.1- 2 French small caps, from my experience and knowledge in this segment.

-3.2- 2 Polish Garp anchors : EM prices with DM stability

-3.3 - European stocks like Fresenius, Bank of Ireland and now AB-Inbev

Yes, AB-inbev has been volatile lately, however the volatility was not correlated to fundamentals (or future cash flows). It is fundamentally an anchor, with one of the safest business in the world after Coca Cola, Beer, and selling one of every three beers in the planet. AB-Inbev main brands are: Stella Artois, Budweiser, and Corona (ex US).

My thesis:

it has huge local brands in the USA (Michelob Ultra) Brazil (Skol, Brahma), Mexico (Modelo, Corona), South Africa (Castle, Black Label).

The Budweiser and Corona brands are especially popular outside their home markets where they sell at a premium, and can raise prices. It is a weird effect of marketing the American dream and the latino fiesta or the Belgian tradition, but here in Spain for example Budweiser is more expensive than local beers, and at the hip and expensive Shake Shack ... its Budweiser and Corona.

In Mexico they have 9,500 points of sale beer stores called Modelorama.

Ze delivery in brazil is an app to get AB Inbev products delivered at home

70% of volumes are in emerging markets with a long runway for premiumization and increased volumes.

the company innovates on non alcoholic beer and seltzers.

The management team are acting like owners. They want the company to succeed the deleverage, they do not want to adjust numbers to flip it.

Financials:

the Company was able to produce roughly 9 Billion USD of free cash flow in the past few years, 6.5 Billions last year. ($1B is non controlling).

Market Cap: 111 Billions USD.

We can see that it trades at 20 times terrible covid year free cash flow and 12 times normal year free cash flow.

The stock is undervalued because it has a lot of debt and therefore does not want to pay the 5% fcf yield or 8% good year fcf yield, but focuses on paying down debt.

For this we will need net debt of possibly go from $83B to $40B (if Ebitda is stable at $19B-$20B).

The company has growth Capex that is not included in the FCF, so we can expect EBITDA to increase from it. ("In China we are investing our brew footprint and capabilities with the new Smart Green Brewery in Wenzhou. In the U.K. we announced a GBP160 million investment in two major breweries to increase capacity and efficiency. In Mozambique, we recently opened a new 2.4 million hectoliter brewery representing the biggest investment ever in the brewing sector in that country." Q1 2021 transcript)

FCF will increase as coupons are redeemed due to lower finance costs. at 4% cost of debt, every 10 billions repaid is 400 millions higher FCF.

Of course the stock can rerate faster on EV/EBITDA at anytime with good results. (Currently about 10).

In the future, we can easily get a 7-8% yield for a buyer at the current price.

A consumer goods giant ex tobacco does not trades at a higher than 4% yield, Therefore, we will rerate to a 3-3.5% yield dividend or less when AB-Inbev will have reduced it net debt to Ebitda to maybe 2 and increased its dividend.

The net debt is 95% Fixed, very long duration, and mostly EUR/USD. Any weakness or currency crisis in the EUR or the USD would help Ab Inbev.

Maturities are far out, no need to refinance the debt.

Current risk

the commodity rises in some of Ab Inbev costs: It can affect in the short term. In the mid term, an abnormal situation driven by temporary issues will return to normality and it is not part of my thesis.

A China crisis hurting Brazil and Africa badly with commodity crashes. However, even if housing construction stops, I think that the whole world needs enormous resources of these regions for the energy transition.

There is something incorrect in these two conflicting statements. The truth is maybe in between. Higher commodity prices will rebound the economy in EMs and give more purchasing power for the customers. Therefore it will help AB inbev quite soon.

Competition risk with Heineken in Brazil and China could leat to reduced Ebitda in these key regions as Heineken is moving strategically there.

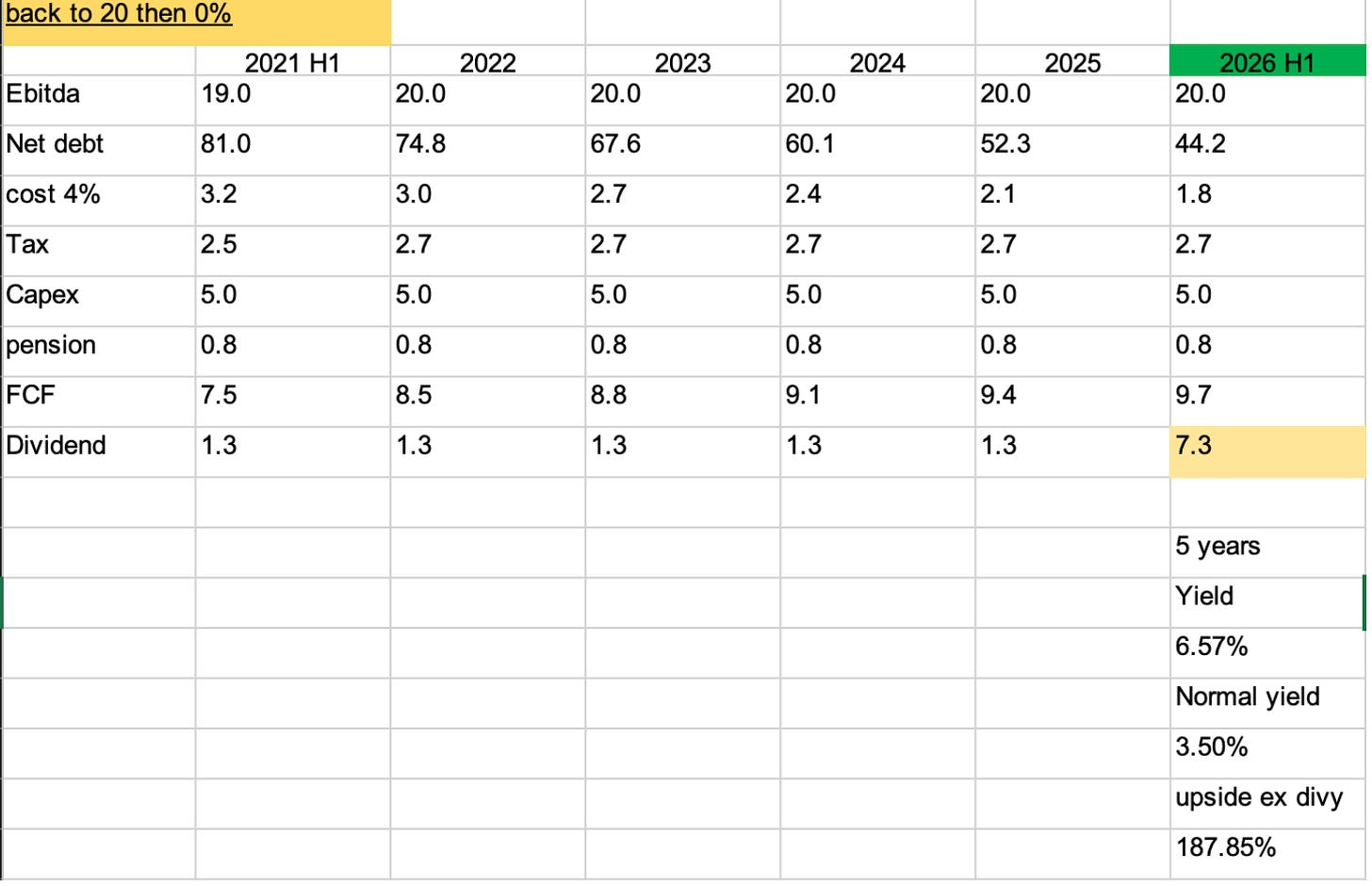

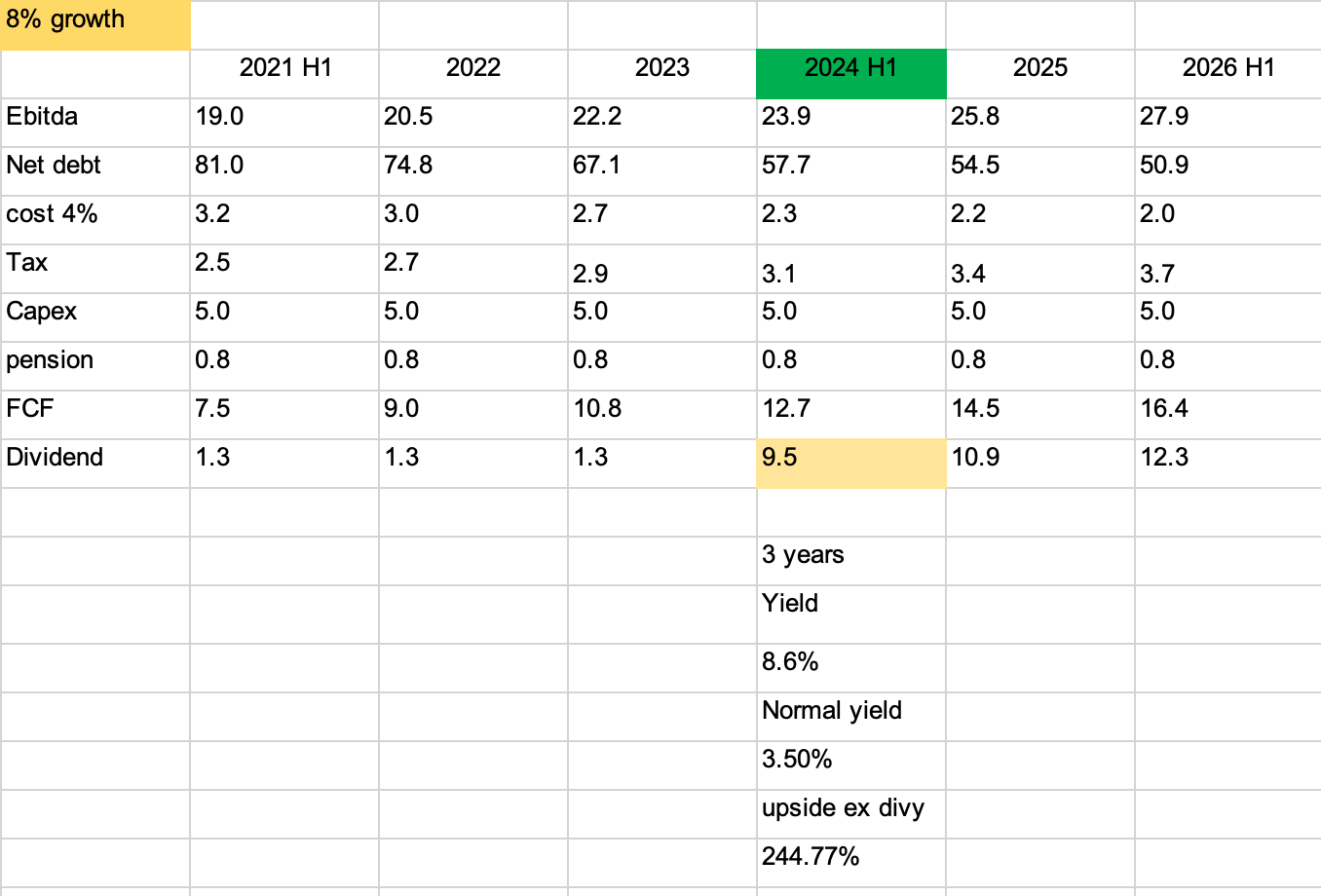

different deleveraging scenarios.

I previously stated that I dislike Excel models for valuing stocks, due to the fallacy of false precision, but I found that to evaluate deleveraging of this company, it was useful.

Therefore I put three models in excel,

0, 5% and 8% Ebitda growth, with the time where we reach or get really close to 2X net debt to Ebitda, assuming a stable dividend.

I put net debt at 81 not 83 due to H1 2021 working capital build up.

Personally I tend to believe that we can reach the medium deleveraging scenario, or even the optimistic one because of strong organic growth with economic growth in Latam and Africa, due to the commodity rebound and trade restarting. Any scenario is acceptable for me, even the lousy scenario, which is not so great but just ok.

Bonuses

-Potential upside that would make deleveraging faster is selling one subsidiary at an elevated multiple.

-Potential boom in the BRL currency would make the optimistic scenario possible.

-Passing inflation would be great to delever as debt is at fixed rates, especially if they manage to raise prices in USD in the USA. "Your Next Round of Drinks Might Be More Expensive

Booze makers are mostly absorbing the higher costs to make beer, wine and spirits instead of lifting prices—for now (WSJ)"

Conclusion

Of course next quarter, on October 28, may be terrible, we will have to hang tight for mid term returns.

long AB Inbev is a story of slow deleverage with each passing year. Time is on your side.

At the end of the 5 years maximum, we will get higher payouts to shareholders and a stable elevated valuation for the stock, because large consumer stables are always highly valued.

I am open for feedback on the thesis in case something is missing or incorrect with the models- I don't usually make these!

My next post will be about one of my French small caps.

Thanks for reading, cheers! Yec’hed mat !

$BUD

I wish they had a bit more of a starting yield. Waiting years for them to pay down debt and hopefully raise their dividend requires real conviction. Good company with great products (obviously;) but it does not tick all the boxes for me. Nice analysis though.