Hi everyone.

Here is my H1 2025 review. I am pretty pleased with the results.

The market:

The market is very expensive and speculative people are out again. There was a cycle of multiple expansion that started in 2022, especially in tech, that has reached the end of its possible course with the poster child Meta at 29 times forward Earnings. Now, only further fast earnings growth will allow good returns, making it more of a market of stock pickers, and making it more difficult to perform well.

EX US stocks have outperformed but remain the most interesting, except for some US niches. My portfolio is 93% Ex us.

Results

My results were satisfactory for a half year at 16.7% in Euros. As a fundamentals driven investor, I still see good upside to fair value, Much more than the s&p 500.

Unfortunately my European broker degiro does not provide performance charts.

Macro and positioning

I tend to agree with the thesis pushed by some authors and investors that says that some commodities will get a surge in the future, coupled with EM and resource country resurgence. This would completely reshape investing. At the same time, I am not an USA bear economically, thinking that it will collapse. I just think that there is no sufficient price at the moment to allow for the extraction of the resources needed for the energy transition, and that investment will increase in many countries of the world, pushing currencies up.

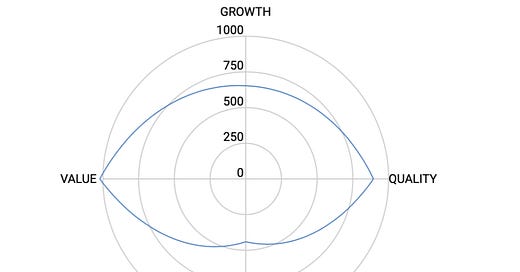

After a custom weighted scoring of my holdings that includes secondary commodity exposure through geography for example, I obtain the following positioning for my portfolio.

Good value, good quality, lower but decent growth, so that is fine. However low commodity exposure at 15% of the total points, which I should aim to increase potentially. I want to add to macro themes in my portfolio.

Good gains

I had some decent gains on pure deep value like;

British American Tobacco (on no catalyst)

Portuguese company Glintt +154% which I reviewed.

Grupo Catalana Occidente which I was forced to exit due to a buy out (+78%)

Brazilian name I bought last year when Brazil was left for dead did +92%

SDI Plc is up a lot in 2025: write up

Also one emerging market finance company nearly doubled

My portfolio has now 4 baggers and 4 multibaggers. Slow compounding at work.

The details of all the 80%+ performers are here https://emergingvalue.substack.com/about

Losses.

Interestingly, there were almost no losses in the half. Everything recovered at least partially (my big losers Intrum and Bastide recovered as predicted). I bought a tracking position in Close the loop in Australia, lost 30%, and sold, and it cost me 0.2pts. I will keep watching the company but I lost trust in management.

Some asian tech companies went down and now represent very compelling value.

My turnarounds Bastide and Intrum turned around and shot higher and leave the hall of shame, but are still not great investments.

Evolving as an investor

Having good results for a short period of time does not mean that I must stop there and relax. One good half, and a few years with a CAGR over 16% was good, in a really tough market for value, international, small and Ems. But I need to analyse what went well and what went wrong, and try to get better.

In this newsletter, what worked well were situations

1- A compounder is out of favor.

2- A country is hated (I told my subs that I was buying China at the bottom, and Brazil at the right time).

3-A company is cheap but capital light.

What has not worked well are some value traps:

1-A company is cheap but is not using capital for growth.

2-A company has a low profit margin and inflation comes in

3-A company is cheap but the business, while being solid, is hitting a cycle downturn.

Where is the company in the cycle killed many thesis, from me or from other investors. The Cycle will now be the main thing I will assess when buying a company. Not the past 5 years ROE, ROCE, ROIC or P/E which tells nothing about the real business prospects.

I have then decided to focus on a three different situations framework. From deep value, to hidden champion, to high quality.

For Deep value, I want a cycle low, or no cycle, and a normalised P/E of 6 maximum, usually masked by depreciation, and future cash returns, or future dividends. Then I want to receive the cash and the buybacks in high quantity.

For classic hidden champions, I want a PE 10 maximum or 11, acquisitions to make growth more solid, some capital returns, and not a cycle high. I just want here a regular small cap that does it’s thing year in year out.

For high quality compounders, I want capital light or great ROIC capital (think Costco), organic tailwinds, not at cycle high.

Recycling ideas and selling:

This is where I should start selling positions with lower forward returns. But I cannot just sell everything and start again each time due to taxes. This is a real portfolio, not a model portfolio where I can play around with my best ideas each quarter. I am more conservative and I try to avoid changes causing big tax costs. Therefore the performance is even more difficult to achieve versus a concentrated investor with a small portfolio. I am at a different life stage as a young investor.

This is also why I have a great part of the portfolio in long term compounders and hidden champions, so I don’t have to sell them even if my future rate of return can decrease over time.

Main movements, and portfolio analysis and composition below:

Subscribe for value ideas, hidden champions, quality at a value price.