Summary.

Newsletter update

Company updates

Beximco

SDI

PayPal

Liberty Latin America

Write ups/ideas

Links

Clarivate

IPSOS

Movements + Surprise

Company updates, Members exclusive:

French small caps

Japanese small cap start Buybacks

German small cap

Newlat

Other quick earnings reports

Spanish analysis link

Welcome to Emerging Value News and Updates.

Welcome to the new subscribers! We are nearing 4700 subs and the 5000 target is still far but visible.

This report is fun to write but takes a lot of time, so please share it as much as you can so that I can reach 5000. 5000, because I would start looking for sponsors with that number, and that would provide some extra support that is not related subscriptions, And I don’t feel like playing the promotional subscription game for now. No discounts!

I have added a performance section:

I struggled with that because my broker does not have a clear performance tab. I need to add dividends manually especially if I had partial sales on the name.

Then also, having performance related to write up dates is not my thing. I am not an event based investor, there is nothing wrong with that, I am more a long term slow investor. Tracking -20% and +20% movements also does not interest me and should not interest you.

II could buy something and it takes me 2 years to write it up sometimes, or not write it up if it has been done already by others! I do share the movements with my premium subscribers on a regular basis instead.

Therefore I will track only large winners (+80%) and losers (-40%) disclosed in the newsletters.

Significant performers

(since Newsletter started, as of early Nov 2024)

TerraVest Industries Inc +280% since 2023

Newlat Food +135% since 2021

First Pacific Co +117% since 2019 - Write up in 2021.

Kaspi - Over 150% since 2022 - stock moved from LSE to NYSE making performance calculation would be complex with dividends and currency - purchase price 43$

IMS SA +81% since 2023

A closed idea was Associated British foods in 2022 that did 59% in a short time, or Tim SA that did 77% in a short time too, but my real portfolio missed the upside here hahaha.

However, I don’t do closed ideas and trades anymore as I switched to long term investing. I had some other big out-performers and a -100% in China during covid. Hopefully I learned from that!

Significant bad performers

Intrum AB -55% since 2023 despite adding

Beximco Pharma -48% since 2021 despite adding

Bastide le Confort -42% since 2021 despite adding

For example, Beximco is about flat since my write up, but my performance is more like -40%-45% on it. What happened is that I bought the stock, it went down 50%, then I did a write up. It is more fair to track my own performance, related to the buys that I share in my updates, rather that some silly write up return.

On the contrary, Bastide performance is worse if you look at the write up, than my actual performance, because I added and lowered my cost basis.

Overall, there are not enough stocks with 100% performance yet, and many value valuations make no sense, therefore I am expecting the list of performers to increase in the future.

Also, don’t expect the performance part of the about tab to be updated monthly.. This is too much of a manual process and I prefer spending time on companies.

There are many many many earnings reports these days. I will not even be able to write about all of them. Most did well except some that are a bit cyclical like Pentamaster. What I think is that a growth company is measured in 5-10 years. Write up .

I will cover all companies it in the future eventually, one day..

Indofoods.

Is this finally the break out? The company has been growing profits and sales all the time but the stock stayed flat, leading to multiple compression. The magic of value investing is that at some multiple, stocks refuse to become cheaper and cheaper, so price goes up. It’s generally around 6 times PE from my experience. The PE on the screenshot is accurate. Target is a PE of 15 or a double from there. I wanted to add in 2024 but my broker deemed it too risky. Too risky to make money.

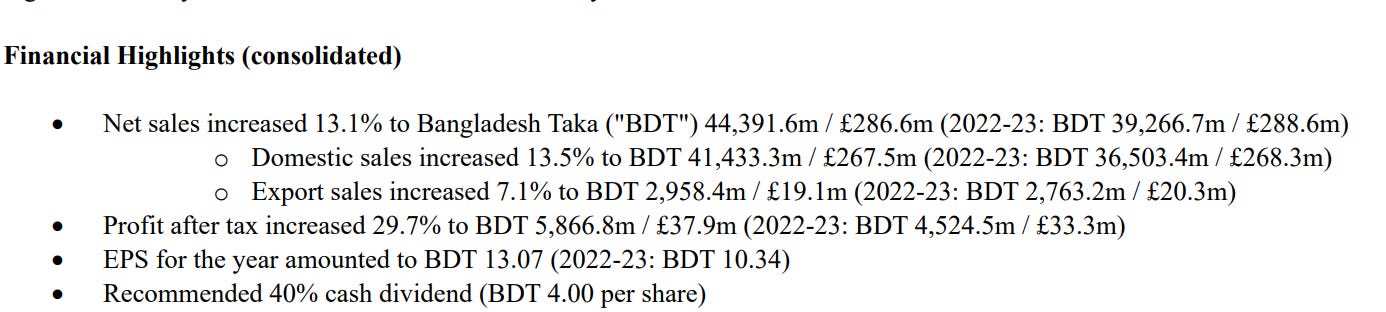

Beximco Pharma - Link:

The company is cleared of needing a receiver due to phony claims against the company, published great results, and business can go on as usual. Pfew. I is a bit of a political which hunt in Bangladesh.

SDI PLC - Link

The company made an good value acquisition that continues the serial acquirer journey. Contrary to popular belief that the new CEO does not understand anything about earnings growth, they didn’t issue 3 billion shares or paid 30 times Ebitda. It also published stable results.

PayPal, Visa.

PayPal posted only revenues up 6% and Payment volume up 9%. Margins increased due to efficiency and cost cutting. They also cut back on low/no margin Braintree volume.

They are early in the transformation to new products and value added services, but either the online economy is really bad, or PayPal is losing a lot to competition. Probably a bit of both. At 80$, it is not as cheap as before. 6% revenue growth is not acceptable long term for PayPal.

What I found interesting is that Visa posted Payment volume up 9% too. The key for PayPal is (like Visa) non payment revenue. You might be surprised that I say that about Visa, but all it does is hiking special fees (not the payment fees, because these are the ones the politicians look at - just call it anti fraud fee or something like this and you are good), and forcing services to customers. Check the latest Visa revenue growth chart.

If you don’t take the “optional service” from Visa, you can get your merchant account deactivated. PayPal could do the same with merchants and grow EPS fast but PayPal is more ethical than Visa. PayPal is also much better at fraud prevention for merchants. Things that outsiders don’t understand.

Liberty Latin America

They posted bad results, but as usual, they spin it positively in their Press release. These Liberty CEOs are just the worst salesmen.

What we need to figure out is why is the CAPEX as big as the cash flow generated, and how do they get to Adjusted FCF. All this Capex to show no growth is very negative. Well, they show growth in other markets but got negative growth in Chile (got killed there) and Puerto Rico. Each time this company has a negative surprise in one market. In order to invest in it you need to really find out how these Property & Equipment additions are going to trend going forward. It’s maybe a good turnaround, and I like their small acquisitions, but I prefer turnarounds where I don’t need a PHD to understand it. Pass. Maybe if someone does an updated write up I will revisit. Also, in potential value traps, I demand a dividend to wait.

JD, Alibaba.

Stock prices went up because they were too cheap in 2024, earnings are average, in a terrible Chinese economy. Price is what you pay, value is what you get. Not much to say here, they can compound value without much growth and do huge buybacks, I will review in a few years, I think it makes no sense to really look at their earnings in details when China is passing a 2009 type economic slowdown. It is not telling anything.

Financiere de l'Ouest Africain - Senegal

Two quick ideas from me - not recommendations, but sparks.

Clarivate stock dropped again in November and now trades at 6.3 Forward PE. This is a media and IP company that is very Free cash flow generative, with strong and established brands, acquired at much higher multiples and sometimes at more than the whole market cap. Obviously there is quite a high debt load and low organic growth.

Here is a thesis from June. https://valueinvestorsclub.com/idea/CLARIVATE_PLC/3683334279

Ipsos trades at 9 times Forward PE and is a French polls and survey company. It trades cheaply on a Forward PE basis. We can see on the chart below (Koyfin) that the net income development had long periods of stagnation, so some further analysis is needed.

edit: look, an Ipsos write up

Zero sales.

I know I am a value person but here comes the surprise:

I am a starting a mini VC emerging value subportfolio. Yes it’s crazy!!

I love Masa Son, he is a dreamer and he is funny. He is smart, and crazy. He loses and wins big. He believes in a better future. Let’s believe with him.

It started with listening to growth investors like Chris Camillo. I don’t know if he his legit with his claims of returns, to be honest, does not look like he is. I am working and bored and there are so many things that I listen to, including growth investors. I cannot listen to value investors only. I also listen to history, geography, humor, you get it.

He says interesting things about growth investing. Basically that valuation in terms of PE does not matter in a startup, it’s more about the size of the market vs the size of your company. He also says some really stupid stuff about value investing not working anymore, but let’s ignore that. It is interesting that he states that the AI revolution was obvious. Rest assured, I will not switch to a crazy growth investor. I will just open a tiny segment with this type of investment.

I often think about value vs growth, deep value vs quality. All the quick dismissal of other strategies is completely stupid. I criticize quality investors a lot because many are closed minded to non quality, but I respect the quality strategy and I apply it to some extend.

I was thinking about my experience as a Softbank value investor, and reading about Tom Gayner from Markel. He often never sells and was able to hold value stocks together with growth stocks. He also makes me feel good about being diversified.

His portfolio is called HOLD:

I will make a bit of Healthtech Venture capitalist type investments. Healthtech is depressed. Semi conductors are the craze. I have zero experience as a VC type investor and no one should follow me, and I will not write these names up. I am interested in Guardant Health, Illumina, 10xGenomics, Shrodinger for example. I learned about some of these names when I held Softbank as a value investor, before Masa Son had me tap out when he gambled too much on WeWork. I can also look at his vision fund and check the companies that are listed. Knowledge compounds. Why not just buy Softbank? First there is a big portion of ARM that is very expensive in terms of P/S, then Masa is playing with derivative financial instruments, and is trading in and out of stocks. I feel that Softbank is often more of a IPO flipper than an investor.

ChatGPT is very valuable to explain what these companies do. Their websites are a mess of jargon. If you want to understand a company or a sector, use ChatGPT.

Chat GPT clarifies:

ChatGPT is great for understanding complex sectors.

I look for the biggest players that will be able to be more capitalized and to invest more in R&D or acquisitions. I look for decent price to sales ratios. I don’t look at balance sheet or profits. I have no idea how they will finance themselves but they will.

I need maybe 5 companies and I WILL NEVER SELL, the number one error of growth investors. That is totally clear. It is the worst thing a growth investor can do. That’s why I can’t trust thematic ETFs, even Ark or Masa Son. They both rotate stocks in and out and sold Nvidia, when their job was just to hold. I need to hold the stocks myself, because any fund is busy trading in and out. I will not follow any earnings report. I am not too interested in Semis, trading at trillion dollar market caps. Healthcare and robotics, space, are the next revolutions, and I prefer Healthcare. I am scared of robots.

As a consequence, for a while I will not add to value and Garp stocks. I will keep writing about them and I will now start a new deep value write up. In my value and Garp portfolio, there will be no buys and no sells, sorry if it is boring, but it is investing.

My newsletter will not cover the healthcare VC type investments or change focus.

My last VALUE/Garp additions, and more companies updates below:

Supporting the publication gives access to:

An archive of 20+ unique write ups. 10+ write ups a year.

Portfolio updates and movements

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks