TIM SA - Ecommerce leader or cyclical construction bet?

That is the question we will will try to answer

TIM SA is a b2b ecommerce company from Poland selling electrical components, for the construction and renovation and energy sectors.

I introduced it in my Tech world tour - Poland

Long story short, TIM is growing very fast, it has a high dividend yield and a very low spot valuation (Especially in July 22 with a drop in price) due to concerns about Poland and the economy. I’m not going into details about the sales growth or the valuation, because by every metrics it is very cheap.

I will do a qualitative analysis. It’s not your typical stock analysis, because it has been done already for TIM.

Some of the products on Tim.pl with google translate.

Tim’s management and background.

The president of the board, Krzysztof Folta, is at Tim since 1988, that he co-founded and built from a small location selling milk and beer, then building a network of electrical component suppliers.

https://en.timsa.pl/about-us/history/

The most noticeable moment is in 2013 when it launched the online b2b ecommerce service and the rest was a great success, because it is now the market leader.

“In 2013 TIM SA transformed from a 25-year-old network of electrical wholesalers into a modern distributor of electrical engineering articles whose nearly 70% of revenues come from the sales online”.

This shows how ambitious the management is, not hesitating to transform radically when facing an opportunity and executing the transition with success.

In 2016, they started a logistic company using TIM’s logistic assets, and selling to third parties.

I like the management and the company is very innovative. On top of that, they reward shareholders with dividends regularly.

Company strategic targets:

My big question is the following:

We can see that TIM went from zero profitability in 2017 to 10% ebitda margin in 2021. Was it good execution or market cycle?

First, in 2017, the ecommerce segment was only four years old and we can assume that this business with fast growth was not mature.

TIM had a target 2021 Revenue of 1B PLN and a 3.6% Ebitda margin—->TIM realised 1.25B PLN at 8.7% Ebitda margin.

This big overshoot on the margin suggests some impact of the market cycle and tailwinds.

The 2026 target is Revenue of 3B PLN and Ebitda of 250 million PLN, or a Margin of 8.3%.

Strategically, they want to focus on the core competency of TIM, electrical supplies, and provide knowledge and a community on the website to support small businesses. The margin contraction with higher sales in the 2026 target suggests that the company is over earning at the moment.

1. The Risk #1: economic downturn

Tim sells electrical supplies used in construction and renovation of buildings. Therefore, it is in a cyclical industry.

In an interview, the president (Krzysztof Folta), the economic downturn was addressed:

It can be expected that companies will suspend projects and participation in public tenders. The question that usually arises in such situations is how to navigate through this market turbulence.

I expect you to say that this is an opportunity for TIM.

– Of course. This will not be the first economic downturn in TIM’s history, and so far we have come out of each one stronger. The same will happen this time. We are able to find the way for effective growth during a crisis. The only strategy I have for such moments is to adapt quickly to the situation. We always keep up

Now it is clear that a downturn is coming due to inflation and the war on Ukraine, but it does not have to be a depression like in 2009. A peaceful resolution could produce desinflation and growth with cheaper commoditites. Increased drilling as well.

If energy becomes more affordable, I expect the Polish economy to continue to grow and catchup with the west of Europe due to favorable wage and costs difference and good workforce qualifications.

2.1 Opportunity #1:Renewables

The annual report shows that TIM developed its competences in photovoltaics.

-In 2021, Renewables made up 6.3% of total sales.

-In Q1 2022, benefiting from government grants, Renewable made up 9.4% of Total sales.

Renewables are not cyclical at the moment and depend more on government subidised transition in order to meet carbon neutrality for the economy and energy independence from Oil and Gas imports, as Poland is a big energy importer. As Poland is trying to be independent from Russian gas, it will need dozens of times more renewables than currently installed, and this is therefore a growth segment.

2.2 Opportunity #2:Heat Pumps

They are also a beneficiary of grands for customers and will be sold more and more in the future years. For more background on Heat pumps sales in Poland and the macro background, see this great article here of Grodno, a company a bit similar to TIM: https://alexeliasson.substack.com/p/grodno

Well well, who is just now entering the heat pumps race? TIM.

2.3 Opportunity #3: Ecommerce Logistics

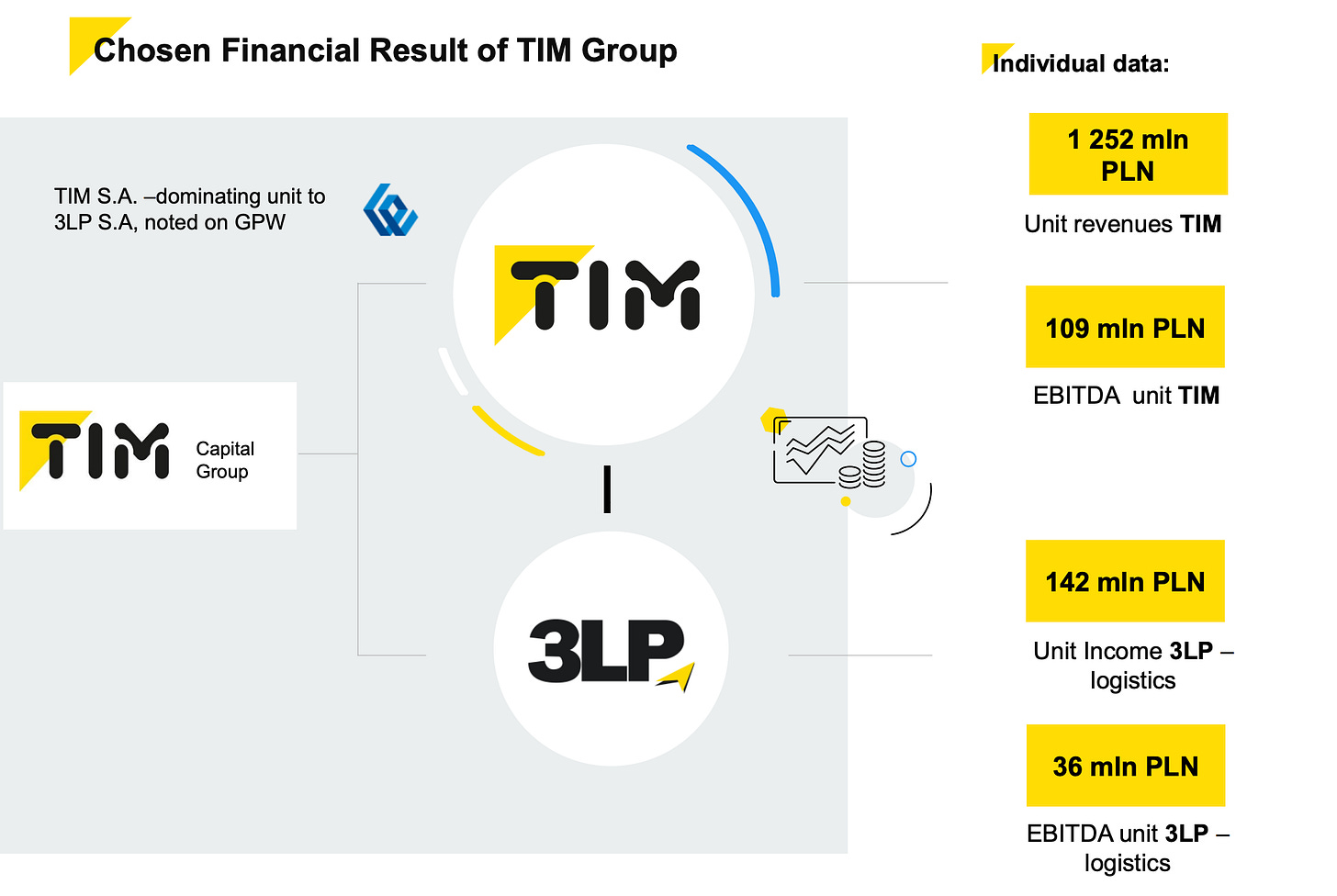

Tim owns a subsidiary called 3LP, doing Ecommerce logistics for third parties.

25% of EBITDA is 3LP, a separate subsidiary of TIM.

This ecommerce logistics segment is a secular grower. However a large part of revenues is for TIM sa. (ca 45%) so let’s assume 13% of EBITDA is non TIM ecommerce.

The expansion plans are ambitious and already contracted:

“Increase in the share of fulfillment revenues from outside the TIM Group to ~60% w 2023”

“In 2022 - 2-fold growth of the total managed area of the warehouse and 3-fold in 2023”

+Launch on the German market with warehouses situated in the west of Poland next to Germany.

We would have in 2023, pro rata, 108 mln EBITDA for the segment or which 64 mln is EX TIM ecommerce.

Of course, the development will be debt founded, or equity founded, which will reduce the bottom line for shareholders a bit.

3LP does not own the warehouse but leases them. It does incur some capex to automate and modernise and organise them for the maximum efficiencies.

2.4 Opportunity #4: Ecommerce marketshare vs offline.

Tim’s president published a article on TIM IR website:

So where do you see the opportunity?

– In increasing our market share. I estimate that currently TIM has about 12 percent of the market of electrotechnical materials distribution in Poland. This gives us the first place. Thanks to constant development in the e-commerce channel, nominally our revenues are growing all the time and we are gaining new customers.

(…)

We are prepared to serve the growing number of young people who are entering the labour market, for whom the internet is a natural environment for working and shopping. Demography is clearly on our side.

Is TIM already feeling the downturn in construction due to increases in% interest rates?

- The sales structure has changed. Permanent increase in the number of clients should neutralize the situation in the construction market. For several years, the results achieved by TIM S.A. deter themselves from the situation in the construction market.

We can see in the number of new customers, that Tim is taking marketshare:

3. Market outlook

Solar energy is still very small in the Polish Energy mix despite a boom in the last few years. The large majority of electricity comes from Coal. Coal prices are at record high in July 2022, making a search for alternatives crucial. Due to this and the need for energy independence, Poland will subsidise solar and renewables more and more aggressively in the decade.

-Far too many Poles still use Coal at home to heat their home.

Poles burn as much as 87% of the coal burned by all EU households at their homes

47% of Polish households heat their homes with solid fuels

With high coal price and subsidies, maybe more will switch to electricity based solutions.

-EU Funding: the European will support Poland's €35.4 billion recovery and resilience plan, of which 42% is going to the energy transition.

-The war on Ukraine will support NATO and European investments to make Poland a very supported and well funded army. For example here, we can see that the US is establishing an army HQ in Poland us-to-establish-permanent-army-hq-in-poland-in-face-of-russia-threat. This should enable construction demand.

-Ecommerce and industrial construction demand is set to continue to increase in Poland. Due to lower costs of labour and land, as well as good qualifications, Poland is used by western Europe as a logistic and manufacturing base. This trend is uncorrelated from Polish housing cycle. It would be affected by a an economic slowdown in Germany, which is very dependent on Russian Gas.

Conclusion

Tim is a company exposed to Ecommerce and also the cyclical construction activity.

The construction industry is notably cyclical, and depends a lot on the price of energy and on the job market, as well as the mortgage rates. Short term, the economy of the continent is not doing well, especially in Germany.

As of 2021, we got 20% of the business that is a a massive secular growth sector (Photovoltaics and non Tim ecommerce). This will grow in proportion.

However, Tim stability in case of a downturn and long term growth seems assured because of the counter acting forces of ecommerce and renewable energy as growth engines.

Several factors stand in this conclusion:

Higher share of 3LP logistic services in 2023

Ability for Tim to gain marketshare due to superior service for clients.

Younger cohort of new clients replacing older clients who shop offline.

Push for electrification and solar energy.

Financial support from the EU and NATO

I acquired Shares of TIM a few months ago as a good long term holding. The position is currently down and represent in my opinion a bigger opportunity.

To discover multiple more hidden champions like TIM, you can upgrade to the premium membership. You will get access to my deck and ideas.

I wrote my full portfolio review full of hidden champions from many countries.

A thesis for a loved retail Juggernaut at a value price:

And a monthly recap with links to other people thesis and conversations in different languages, my review deck of potential gems, and my ranking of low valuation stocks. I am a crazy rock turner, looking at every forgotten market.

To end on with a public thesis, here is a thesis I published 8 months ago. This month unloved retail Juggernaut is similar to this unloved Beer monster with great footprint. It also beat the market despite not doing much and not delivering on its potential yet. Just by not being overvalued and being solid.

Further research on TIM:

https://augustusville.substack.com/p/portfolio-holdings-tim-sa

https://sanabriaequityresearch.substack.com/p/tesis-de-inversion-en-tim-wsetim

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

I exited TIM for what I believe is a bit of a Safer opportunity. I still like it.

Good article I have also been researching this after reading about it from Alluvial. One thing that concerns me and it's one negative in a sea of positive is the earnings were a bit inconsistent prior to 2017 going negative in 2013, 2014 and 2017 and all the annual reports seem to be in Polish from what I see, so can just look at the numbers with no commentary. Any tips on getting around this?

https://en.timsa.pl/consolidated-annual-report-7/