Tech value quick world tour 1# Poland

The tech correction has been an interesting thing to watch.

I think some unprofitable 10 billion USD market cap and 1 Billion sales companies are terrible stocks to avoid. There is still too many crazy valuations.

However I see enough decrease in valuations to buy some tech stocks if you have spare capital (some GARP stocks). Such broad moves in the market are bound to bring some opportunities.

I am by no means a tech expert but contrary to many tech investors, I know tech from the inside as a worker.

It is funny that I do not invest much in tech.

I still made a killing on my company stock and stock options, that I knew to hold to a multibagger (despite some unfortunate trimming along the way).

I think, working in tech was a curse. Because I understood the company I worked in well, its product and runway, I felt that I did not understand the other ones, mainly Faangs, enough to participate. In that sense I was missing out. I felt also that I had my tech part of the portfolio covered with that company.

I have been focusing on finding value in tech (that would be GARP or growth at a reasonable price investing), to see if good opportunities are available with this correction.

So let’s see what value tech companies we can find around the world, starting with Poland!

These posts are quick and unpolished because in this market correction with prices moving quickly, we have to be quick to catch and review opportunities!

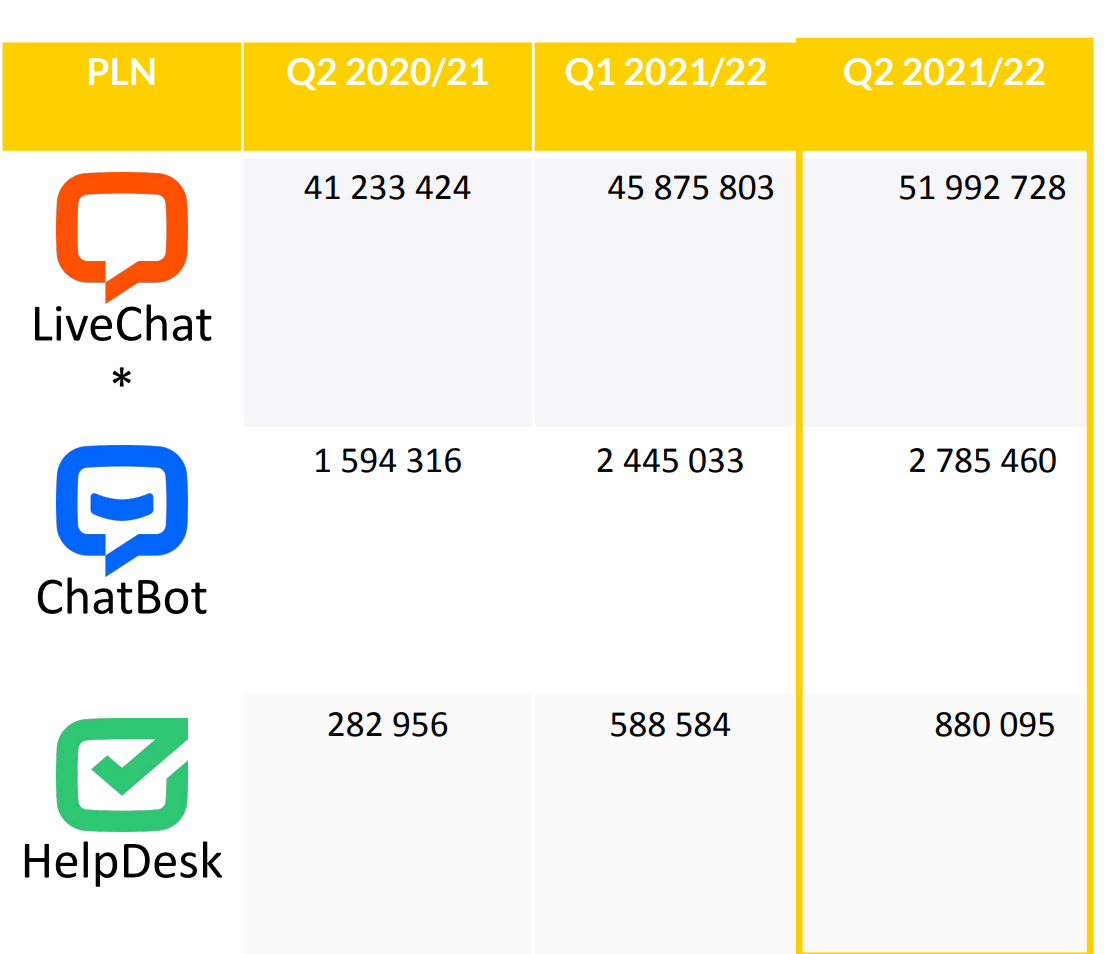

1-Livechat Software (Poland) (330m USD market cap).

This company is not so hidden on Twitter and is popular in niche investing circles, but if you do not know it, now it is time to learn about.

With the recent drop I had to sell something to finally enter Livechat Software at PE 22 and forward PE probably 20 or less, and a dividend yield of 3.5%.

There are many write ups on the web.

https://eastvalueresearch.com/category/blog/ (CTRL+F) http://www.globalstockpicking.com/2019/07/31/livechat-software-company-with-a-strong-track-record/

.

I am not going to present it with a detailed write up for this reason. I could write it up if things change, If there are new products or acquisitions and I feel I have a unique insight. I also work on Zendesk accounts and I can see how growing uses and growing revenue increases sales for them. Here is what I like:

Large large growth runway: the company is very very small, and sells worldwide.

Competition is important but market is huge and growing, and competing requires a lot of development from scratch. It is not only about a chat window. It is about getting the window in all sorts of landing pages and devices and getting the other side of the window in all sorts of systems, plus reporting and integrations into actions saved.

Dividend paying and profitable. This is because wages in Poland are much lower than in the USA, and I believe because the Polish founders like to make profit while Zendesk and Silicon Valleys CEOs are more living in Lalaland.

The company grows with the clients: so if the client increases sales, they will get more chat desks, so more revenue for Livechat. It’s going to ride e-commerce and digitalisation sales growth trends.

Chatbots and Knowledge base and ticketing systems are still very small with room to expand and growing exponentially.

So that is a good opportunity. I am not going to project future sales, because nobody knows with this organic growth model, and those who say so are lying, but with a 5% earning yield we have a good entry point.

2-Tim SA: (Poland) (100m USD market cap).

(Chrome translate image)

Tim is a b2b ecommerce company. It sells electrical supplies, mostly online (70%) and in a offline network (30%). It is the Polish leader in electrical supplies b2b in Poland. The customers are professionals and not particulars.

Tim is a first party seller carrying its inventory.

Tim offers the ability for professionals to start selling on Tim.pl with a marketplace service.

25% of the revenue is a growing third party logistics (3PL), of which 52% is services to external customers, for general ecommerce goods unrelated to electrical supplies. This is growing fast, and is a bit like the JD logistics playbook. The 3PL company will have a partial IPO in 2022, to raise some funds for a warehouse expansion and highlight the value of TIM shares.

The business is linked to construction, which is cyclical, but also to energy efficiency and energy transition like photovoltaic installations, which is a secular growth story, and to e-commerce.

photovoltaic is only 3.6% of sales but it grew 766% in 2020!

The management is very astute and focused and transformed the company from a b2b offline distributor to a leading online distributor.

It pays a large dividend of over 5%.

I think its cheap (less than 10 PE), probably on a cyclical high but with secular tailwinds (that means the company will still grow but slower). It should be a good buy but I still have some reserves about this company, because it was not very profitable until 2021. Was it finally a long term change of scale or tailwinds? Hard to say. The management is upbeat about future prospects.

This is one I watch.

3-Allegro (Market cap $9B)

This is your classic Busted overvalued IPO that IPOd at over 60 times earnings. Allegro is your ecommerce leader in Poland, PE is 32 according to investing.com

The company is still growing fine:

The take rate is 10% and is very high, they could feel some competitive pressure there.

They just bought Central European MallGroup, which is at break even. This deal uses cash and stock, is not accretive to earnings in the short term, I do not really like it and it shows that the company’s growth runway is limited in Poland.

Allegro is a good company but all these points together plus a PE ratio over 30 is a pass for me. It is not surprising that the stock did not perform well after the IPO.

Verdict: Pass.

4-Asseco Poland:

The company is focused on the “development of proprietary software and services and increasing the scale of operations through acquisitions. “

The good thing is that the majority of the business is proprietary software and services (proprietary software + services(79%), hardware + infrastructure (14%) and third-party software + services (7%).)

So it deserves a premium because of that mix in my opinion and is attractively valued for its growth with a PE of 13.5.

My negative point is that revenue is growing fine but net profit not so much. I did not do a review of this company.

Please see the write up below:

http://value-investor.net/2021/10/11/asseco-attractive-valued-tech-company/

Other mention: Oponeo sells tires as ecommerce. PE 19.

Conclusion:

Livechat is the King,

TIM sa is very interesting,

Allegro got some weaknesses in terms of acquisition choice.

Asseco is very good if the margin trend improvement is confirmed but maybe a bit cyclical in project sales.

NEXT STOP: JAPAN!

Thanks for the great post! Could you please provide some additional info/write-ups/etc. on Tim, since they're reporting only in Polish (and the English materials on their page doesn't seem enough).