Hello everyone !

Here comes another update with company reviews.

Summary.

Newsletter update

Write ups

Company updates

Today I want to write quickly about Liberation day. The day that Trump and the USA puts in place tariffs to everyone. Things are going crazy in the economy and on the stock market. Investing in this environment is tough. The best thing is to sit tight and hold the positions, because things are changing fast and are unpredictable. What is true today will be untrue tomorrow.

Remember that investing is about the long term, and that companies with decent cash flow will provide economic value by growing their balance sheet and then sending some of that value back to you.

Some companies that are exporting to the USA or to Europe may go suffer a lot due to this insane trade war. I do have a few in my portfolio. But inflation and freight rates could go down. I really invest like I invest in private companies, and I hope that they develop their products and sales. I invest like a farmer planting trees.

Performance:

Another funny thing is that on March 25 I had updated the performance section of the website where I updated the companies that did +80% in my portfolio and -40%. I was surely influenced by the relatively good developments in a few names.

So needless to say that the return page, which was not updated in 6 months prior to that, is completely outdated after one week, as my portfolio lost ground quickly. I was planning to list the winners and losers here but I think that I will redo it next time.

So far, I am only up 2% this year or break even after a good small run in Q1. However, I still believe stubbornly that small and emerging value did not get it’s run yet, and that the potential for a big shift to value will be mind blowing and it will happen.

Sponsorship.I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too!

I started providing updates to old write ups;

External:

An article about Jardine Matheson in FT that pretty much agree with what I wrote earlier. Maybe they read me?

The big news is that Grupo Catalana Occidente submited a take private offer. It’s a bad news for me as the company is sort of a mini Berkshire and one of the best hidden champions on the Spanish Market. I am up 72% ex dividends in two years, which is good. Most investors are happy with short returns like this, but I am not happy with parting with a good company at a low valuation multiple. I will definitely hold as long as I can. Various fund managers are publicly saying that the offer undervalues the company.

It’s a trend recently that I get good companies taken out cheaply. For this reason, I even kept one of these companies as an delisted holding (in Hungary). Needless to say that this company greatly outperformed this week! I am not against holding Catalana Occidente as a private holding, but the current take private offer conditions are not satisfying to me.

Catalana Occidente - The Spanish dynasty insurer

Grupo Catalana Occidente is a Spain based insurance company.

If I need to sell, I will have plenty of holdings to reinforce, or even new holdings to buy, so it is not a problem, but I want a premium, not just a 18% premium that only pays my capital gain tax!

To know about more hidden champions like Catalana Occidente, subscribe below:

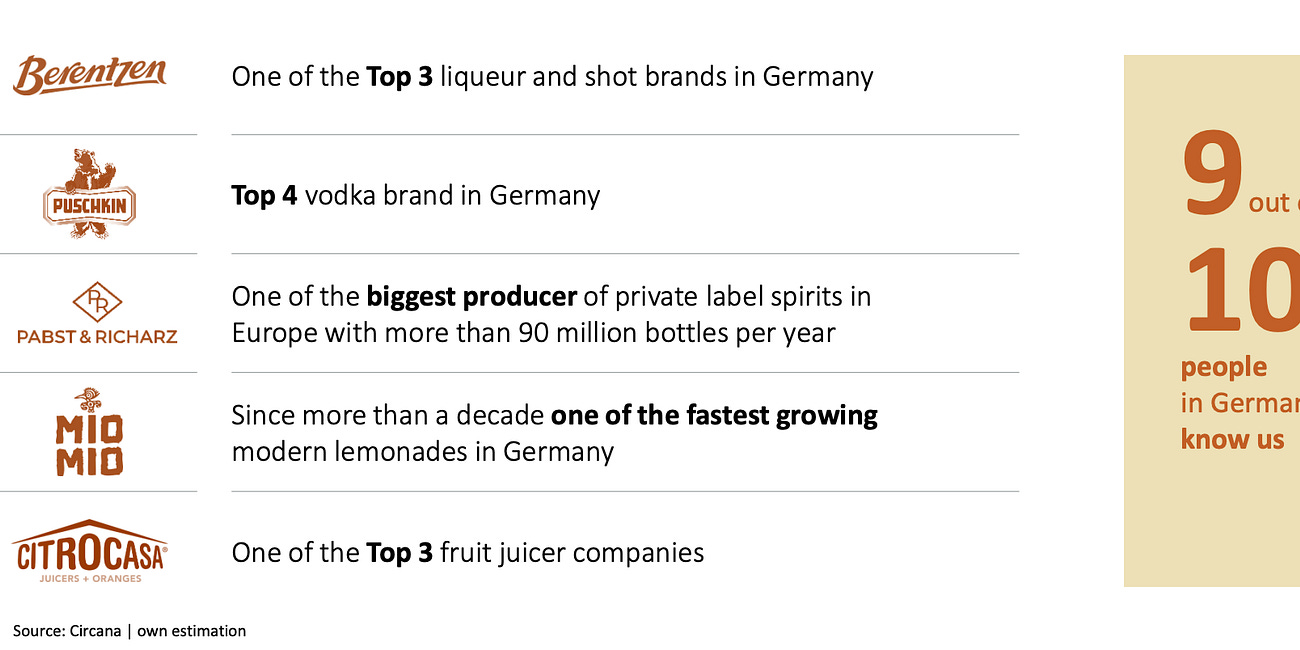

Berentzen earnings were released with EBIT up 37% to 10.6 million Euro, everything good, but a small dividend increase from 0.9 Euros to 0.11 Euros which leaves us with a small yield of 2.5%. Expected improvement in the inventory, capex and especially working capital were not explicitly mentioned in the conference call.

The company still has a bit of net debt from the working capital and inflation inventory build up, and I expect that to reduce and lead to much larger dividend returns in the next years. The interest costs and working capital have been taking away the free cash flow from the shareholders but that cannot be permanent. Forecasts are for EBIT to be flat between 10-12 million Euros. The most important will be the I in EBIT, with debt reduction in the future. Berentzen is also investing in marketing. At less than 10 times FCF, I like the set up, despite lower quality in FCF conversion.

Berentzen Update + Summer links

After being very busy lately, let’s look at some company links and write ups from substack.

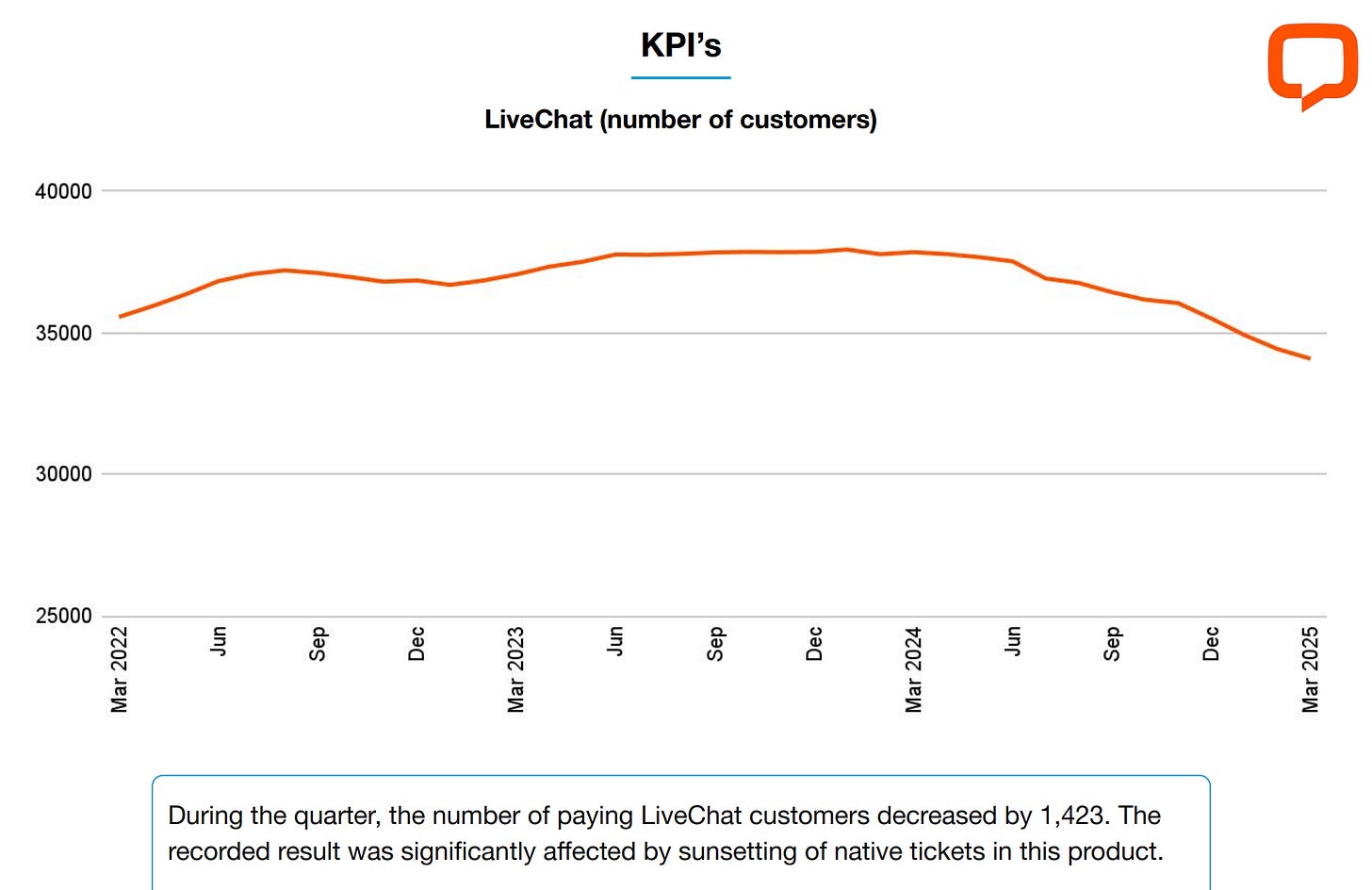

Text SA published KPIs, and the livechat product keeps losing customers, especially due to the discontinuing of the ticketing system, while the helpdesk product and chatbot products grew. In my write up, I went into details on the AI risk.

However, the “economy is bad” risk is also real and it’s the main reason for the customers closing their Livechat accounts. To sum up, Text SA is incredibly cheap, and has enormous potential, if you read my article and the updates I gave. But it may not work if the Livechat decline in customer numbers starts eroding the revenue (It has not happened so far). It’s a risk profile that you can have in your portfolio if you diversify.

SDI PLC, the company with a new CEO that fintwit called too stupid to understand that it should do acquisitions at cheap multiple just did another acquisition at a cheap multiple. Everything is going according to the plan and we are at less than 8 times earnings and EV/EBITDA of 5.4. A prime candidate for adding. I know that the name is not popular, but I only care about value.

Terravest, which was up to last week the best performing company that I still hold, announced one major acquisition for 85 million USD of EBITDA approx. Last year it made 189 million CAD of Adjusted EBITDA, but that was in Canadian Dollar, so it was instead 132 million USD, therefore the acquisition is really transformative. The acquisition is not very cheap at 7 times EBITDA and comes with an extended credit facility that will be costly, but this turbocharges the growth.

The company acquired is EnTrans International (“Entrans”) – a premier North American manufacturer of tank trailers and transportation solutions. Again, this shows that the process of not selling allows for some winners to grow tax free. Yes, potential value traps are needed for this process, but I buy them so cheaply that the downside is minimal.

Boustead Singapore has a very interesting development towards funds management in the real estate business.

Next up I will do something unusual, present an opportunity that I do not own (yet) as a quick value exclusively for premium subscribers.

No movements during the period as dividends received were low.