Name: Indofood Sukses Makmur Tbk

Ticker: IDX: INDF (Indonesia)

Price 7,075.00 IDR

Also trades in Germany, OTC

Introduction; I will cover and update some of the longest posted thesis for which I still have an interest. Even if these are short updates, it will provide more follow up on companies.

Defensive paying company at a PE of 8

Quality business with good moat

Owner distrusted for outdated reasons in my opinion

Dividend payout disappointing in 2023

Indofoods is a company owned since 2021 and I covered at the start of the blog in 2021, and a 50.1% subsidiary of a Hong Kong conglomerate, First Pacific. For this reason, many potential investors avoid it, on the basis of corporate actions that displeased minority investors in the 90s.

I think that there are pros and cons, but also that recent actions are different from past actions when the owner of First Pacific, the Salim family, was in distress. This is not the 90s anymore, and all recent actions showed a conservatively ran business.

Also, many investors praised by the investing community for being “great capital allocator” then proceeded to screw minority shareholders (Vincent Bollore, John Malone). So I would take both positive and negative reputations with a grain of salt. As I explained in my quick note, the way to protect yourself in these cases is to own both the parent and the subsidiary. Don’t be afraid to have two positions instead of one.

The company was profiled when it traded at 10 times earnings.

The stock price has done nothing since, but some correct dividends were paid.

Contrary to popular belief on X and substack, the losing stocks or stocks that do nothing for a long period of time are often the best opportunities.

sponsor: I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too!

It is a defensive food company in Indonesia with a very illiquid listing in Germany and on the OTC market.

The main division is consumer branded products, which is also a listed company. “Indofoods CBP”. It mostly sells noodles under the Indomie brand and snacks.

It also operates internationally since buying Pinehill from the Salim family, an operation that was heavily criticized by investors, but stop the company from growing profits.

Then we have Bogasari, mostly flour and Pasta, and Agriculture (also listed), which is mostly Palm oil plantations. These divisions depends on wheat, palm oil and energy prices.

The last part of the business is the distribution group.

The Distribution Group continues to be pivotal to our vertically integrated operations and business model, ensuring the consistent availability and smooth distribution of Indofood products. By leveraging our extensive network of over 1,300 strategically sited stock points, we were able to keep a close watch on shifting market dynamics, leading to enhanced market intelligence and improved monitoring

As an integrated group with an agriculture subsidiary, it is a very stable company that can sometimes benefit from food inflation to compensates the rising costs of raw goods.

The best analysis of Indofood divisions is communicated in the First Pacific (holding company that owns 50.1% of Indofood) earnings presentations with the screenshots below.

Indofood earnings releases are very sparse in details.

Here we have the margins compared: Noodles being the highest margin business by far.

And here with have the sales compositions. Noodles being also the highest sales.

Therefore, as we consider the highest margins, Noodles is the majority profits contributor. But Food seasonings and Special foods are growing fast.

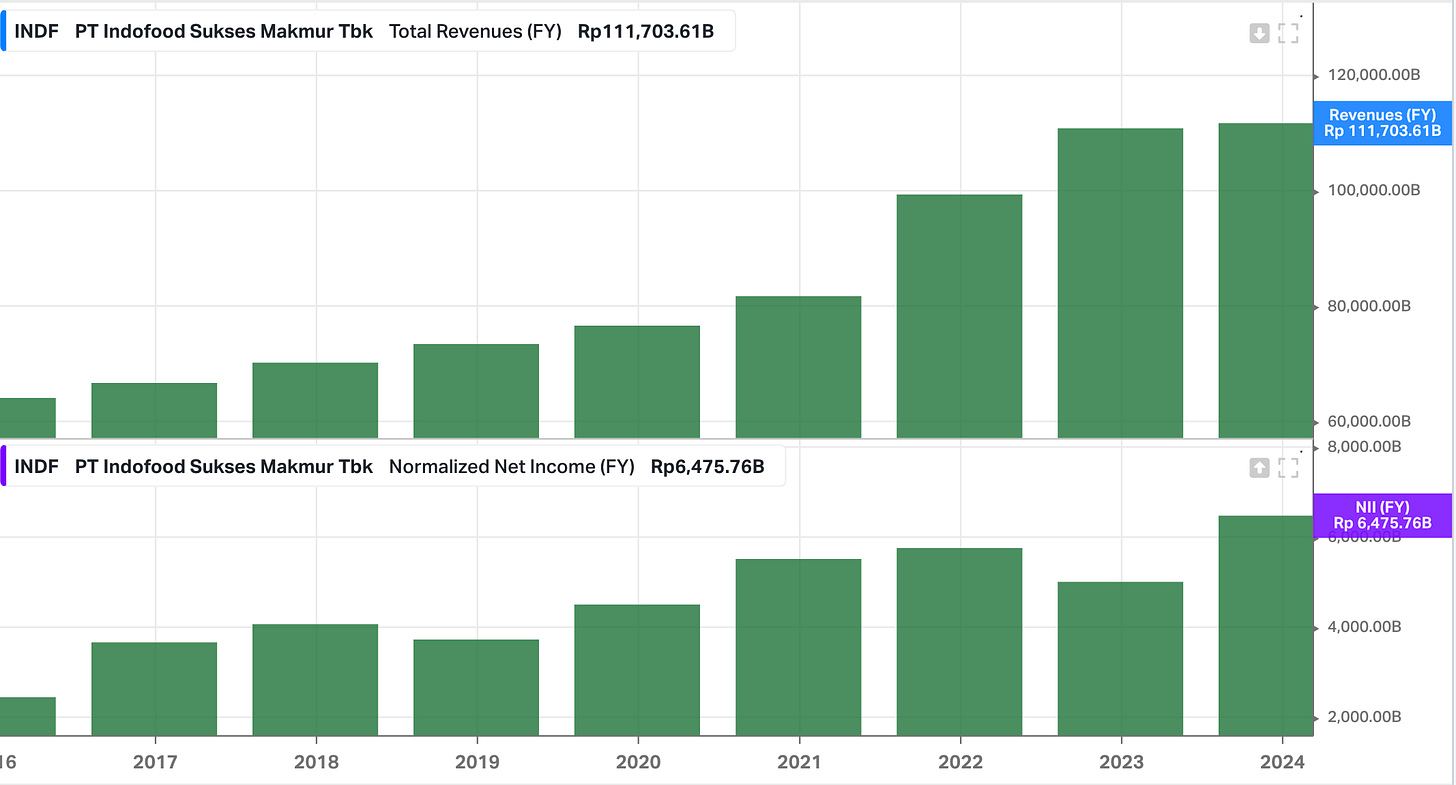

Since the article in 2021, the company experienced positive development as you can see below from the koyfin screener.

Note that 2024 results are not yet reported, but H1 results showed a 4% increase in sales and a 16% increase in core profit. Customer defensive companies are really about steady slow progress.

So what was the capital allocation?

Since the acquisition of Pinehill in 2020, net debt has not really gone down much, despite a low payout ratio in the 30-40% range.

We can see that the capital expenditure is in control, at 3,600 Bln IDR in 2023 and 3,741 Bln IDR in 2022.

So why do we have a net cash used in investing activities of 1,0766 Bln IDR in 2023 in the screenshot above? The company invested in short term cash funds, probably to take advantage of good interest rates while awaiting a good utilisation such as repaying bonds obligations.

Therefore, there has been a good deleveraging that is a bit invisible in the screeners, because these investments are not “Cash and Cash equivalent”.

Market:

The noodles market is a defensive growth market in Indonesia and growing in Africa.

Conclusion.

The overseas listings are very illiquid with a large spread. You have to be willing to hold as a semi private owner. The spread could be also used as a trading opportunity if you study the patterns.

The market is a voting machine. When it sells cheap stocks for no reasons, it is a good opportunity. Indonesia is a good opportunity, as the momentum investors turn towards China, based on hype on the country AI progress.

The valuation is attractive:

The dividend is a bit less attractive, with a low payout ratio in 2023, but it is also stable. I am hoping for higher dividends soon, which could be a good reason for a rerating.

So what do you think about Indofood?

Interesting read:

For all the reports and companies details, subscribe to the premium tier below:

This is my personal opinion and not a buy or sell recommendation. Please carry your own analysis before buying shares in any company.

Love the exposure. Have it via First Pac (I like the real assets also in there).