Grupo Catalana Occidente is a Spain based insurance company.

Catalonia is an “area” in the north of Spain, on the French border, and the Catalans have a reputation to be like the Scotts, very conservative with money. This company holds true to the reputation.

This insurance company has a P/E of 6 and a P/B of 0.8.

History

The company traces back to 1864 as “the Catalana Fixed Premium Fire Insurance Company”. In 1878 it was already listed to a stock exchange.

In 1948 comes an important date. Jesús Serra and a group of industrialists acquire the company Occidente. To this date, the Catalana Occidente is still controlled by the Serra family.

His son, José M.ª Serra, took over as CEO in 1991 and with him will begin the acquisition strategy, with the companies acquired listed below;

1999: MNA

2001: Lepanto

2004:

Seguros Bilbao (Insurance Bilbao)

Atradius shares start to be acquired

Cosalud ownership grows from 55% to 100%

2007: Ownership in Atradius rises to 55%, then to 83% in 2010

2012: Groupama Spain

2015: Plus extra seguros

2016: Grupo Previsora Bilbaína

2019: Antares

2023: Memora Funeral business

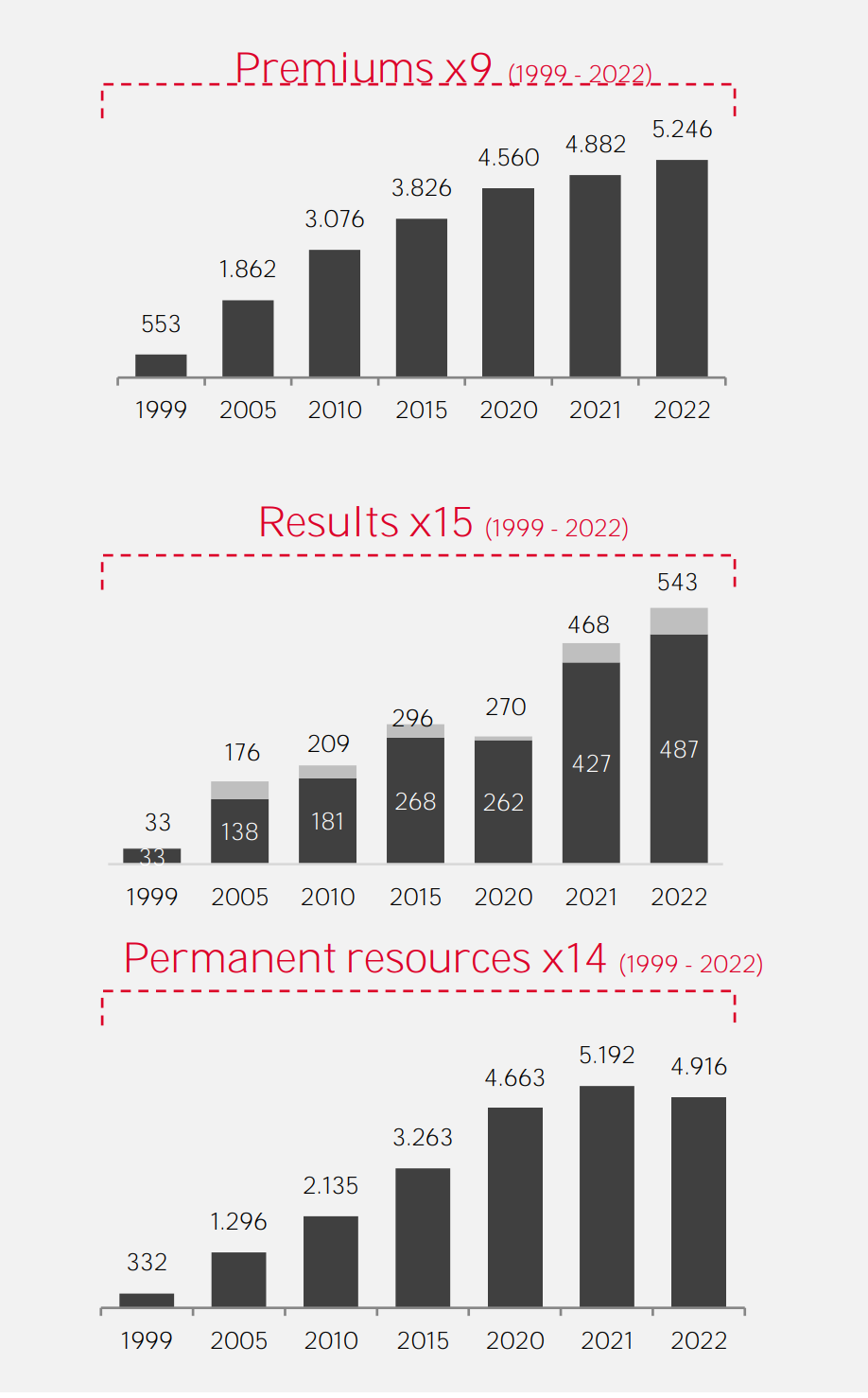

These are the results, very good long term development: I think that maybe 1999 is cherry picked by the company, so let’s look at 2005 and 2010. This result was achieved with a quarterly dividend with a 20-30% payout ratio.

The company compounded at a 11.72% return in the past 20 years. And there was an incredible economic crisis in Spain in 2009.

Business overview

This is an insurance company still controlled by the founding family.

The traditional insurance is in Spain, and the credit insurance is global. There are two major segments, and the earnings are roughly 50-50 between the two. With a worsening economy, it will be a bit more weighted towards traditional insurance (60-40 maybe). We also have a large investment income stream that is growing and is a third pillar for the company.

Traditional business.

This business is centered on Spain. As you can see in the chart above, it is widely diversified. Post covid, the sinistrality is growing back to normal as subsidies decrease and car accidents increase.

The combined ratio is stable with time, but increasing (worsening) in 2022 with inflation and costs, at 90%.

The technical result is also table or growing slowly with time (last line).

In the life insurance business, they also manage 6.6 Billion euros of funds for customers, for pensions or savings, and this is slowly growing due to the pension funds business (where you get a tax deduction if you invest in your pension). I had a look at the funds they offer, and they underperform the markets with high management fees, like 2% a year.

They have a Spanish fund full of blue chips, a global fund of funds, and a “patrimonio” fund, which roughly translate to “net worth”, that is half fixed income and half stocks. That got killed with the bad bonds returns lately. Investing in bonds was not safe.

About the funds underperforming, I do not think that it is a big problem. For the average prospect of the group, do they know any better? Do they trust any fund manager like an aggressive growth or compounder investor? No. But they trust Catalana Occidente not to blow up and do crazy investments.

The traditional insurance business, as we will see in the market section, is not a big organic growth business. But it is a conservative business, with several brands, getting unified now under the brand “Occident”, and there are cost savings done as part of the synergies.

Credit insurance business.

The business overall is non Spanish (only about 15% Spanish) and is a bit of a Jewel. Credit Insurance is an oligopoly with Atradius (Catalana Occidente), Coface and Euler Hermes as big players.

It consists mostly in insuring non payment risk in trade between two companies. They also have some smaller business line where they sell information (credit ratings, market analysis) and do collections.

It is planned to grow at a 10% CAGR over the next ten years, or 8%, according to the various top sources that google is giving me.

Here is the evolution of the Combined ratio:

The combined ratio before the crisis was at 78.7%, which is excellent, and shows pricing power in the industry, as well as conservatism. It is now below averages at 71.4% so it should go higher, reducing profits. However the market growth long term bodes well for the companies in this sector.

Coface, the listed pure play French peer, also trades at a very low PE ratio of 6.6 and 12% dividend yield. But maybe it does not have the management quality of Catalana Occidente. The market was expecting a terrible 2023 for Coface but it maintained earnings stable, just a bit lower than 2022 H1. This show that pricing is strong and compensates for higher losses.

The market is skeptical of these companies, thinking that in the current recession they will face troubles. It’s certain that non-payments will rise, but insurance prices will also adjust accordingly to new risks. Another thing that is under appreciated, is the provision and skills of these companies. They know that automotive, or oil and gas are higher risk than consumer defensive or healthcare. These companies know their credit risk well and give shorter duration loans than a bank with mortgages.

Here is the exposure in 2022. Apart from Metals and Construction it is kind of safe.

Consumer durables 91,125

Metals 94,888

Electronics 107,892

Construction 62,382

Chemical products 123,206

Transportation 75,650

Machines 55,280

Food 82,021

Construction Materials 41,563

Services 30,309

Textiles 19,997

Finance 19,961

Agriculture 39,751

Paper 19,227

Also, the company is covering some premiums to reinsurance companies, about 37% in 2022, to protect itself in case of bad cycles and non recovered funds.

The credit insurance business is also a cash machine for the group, but with a bit more organic growth than the traditional insurance business.

After this introduction, we will go to the Investment portfolio review, the funeral group acquisition, the management, strategy and market, valuation, opportunity and risk, before concluding.