I have been looking hard at quality investing. Although I noted that there is a quality bubble currently bursting;

Nike, Fair Isaac, LVMH, Copart, Lotus Bakeries, the list goes on. Overvalued quality stocks crash regularly because the bubble was extreme.

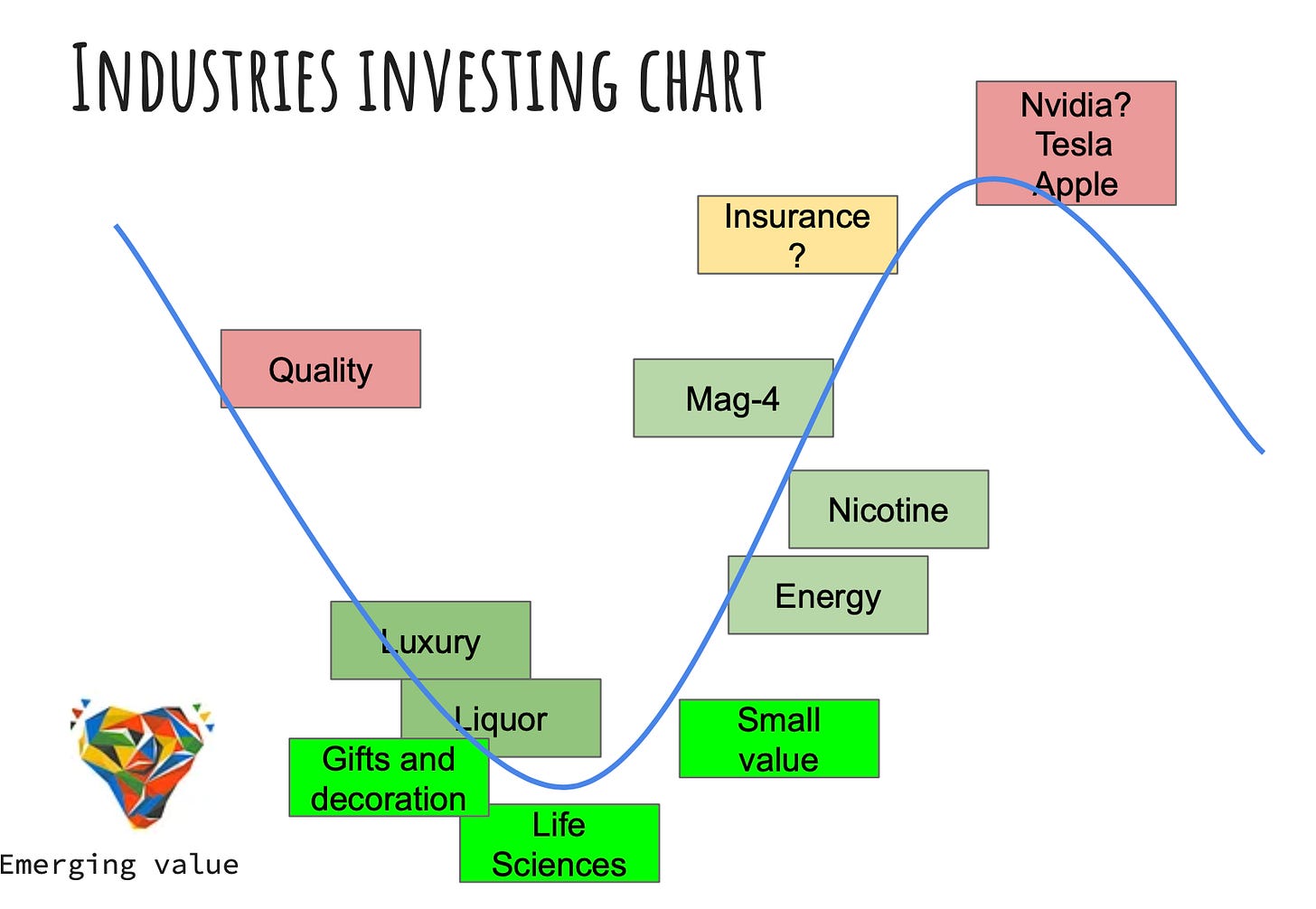

It started going down on my chart.

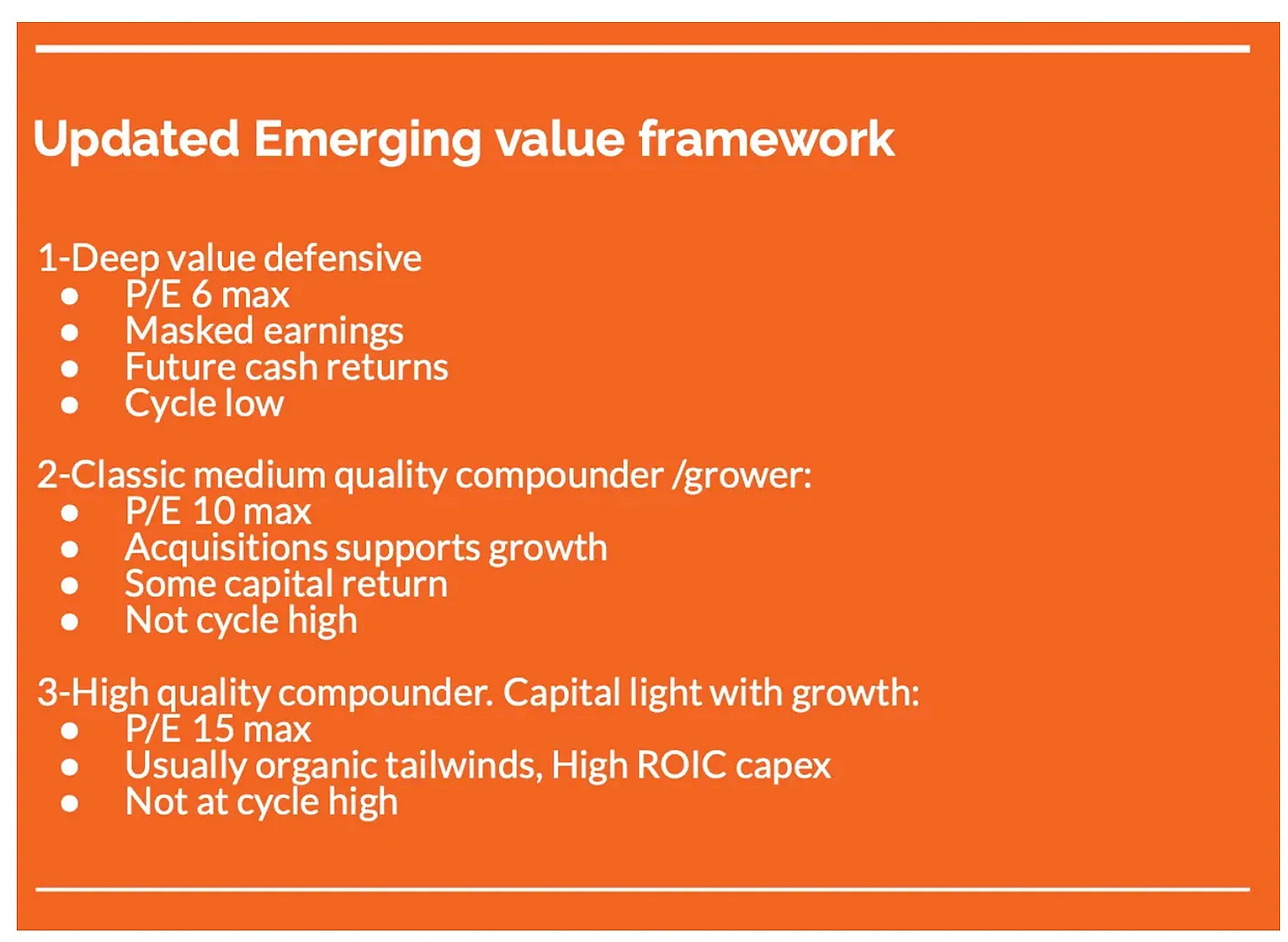

If you held these as long term investments, I think it’s still a fair strategy to hold and go through the drawdowns, although at 60 times earnings, it is probably time to sell, take a tax hit, and buy a cheaper quality company at 10-15 times earnings.

Overall, these companies crashes are opportunities. Quality investors overate the quality companies regularly then underrate them as they experience a 1-2 year slowdown. Then they say that they are “not really quality”.

I have learned so much from quality investors online. I also learned from my reviews of François Rochon letters. He is an awesome investor beating the market over a long time period. When I read his letters corresponding to his best years, I saw more than quality. I saw value investing mentioned everywhere.

I would say that Buffett and Rochon combine quality and value perfectly.

If you want more detail, please read this quickly / badly written raw review I did on François Rochon letters.

So I think that the problem, is that quality influencers have a bias to transform the best investors into “quality only” investors. Some even quote Buffett while preaching against his valuation principles or dismissing his early days deep value strategy.

These are inherent biases as they struggle with a valuation mindset. Some people just want the best shiny company at any price. A form of fear of missing out. Some people just want the cheapest stuff (I am like this): fear of paying up. Each group needs to fight off their biases.

Quality with a good entry price remains an excellent strategy. This provides some anchor to a portfolio where we don’t need to trade in and out.

Here we go with 5 quality stocks.

5-PayPal

Value score: 4/5

Defensive score: 5/5

Growth score: 3/5

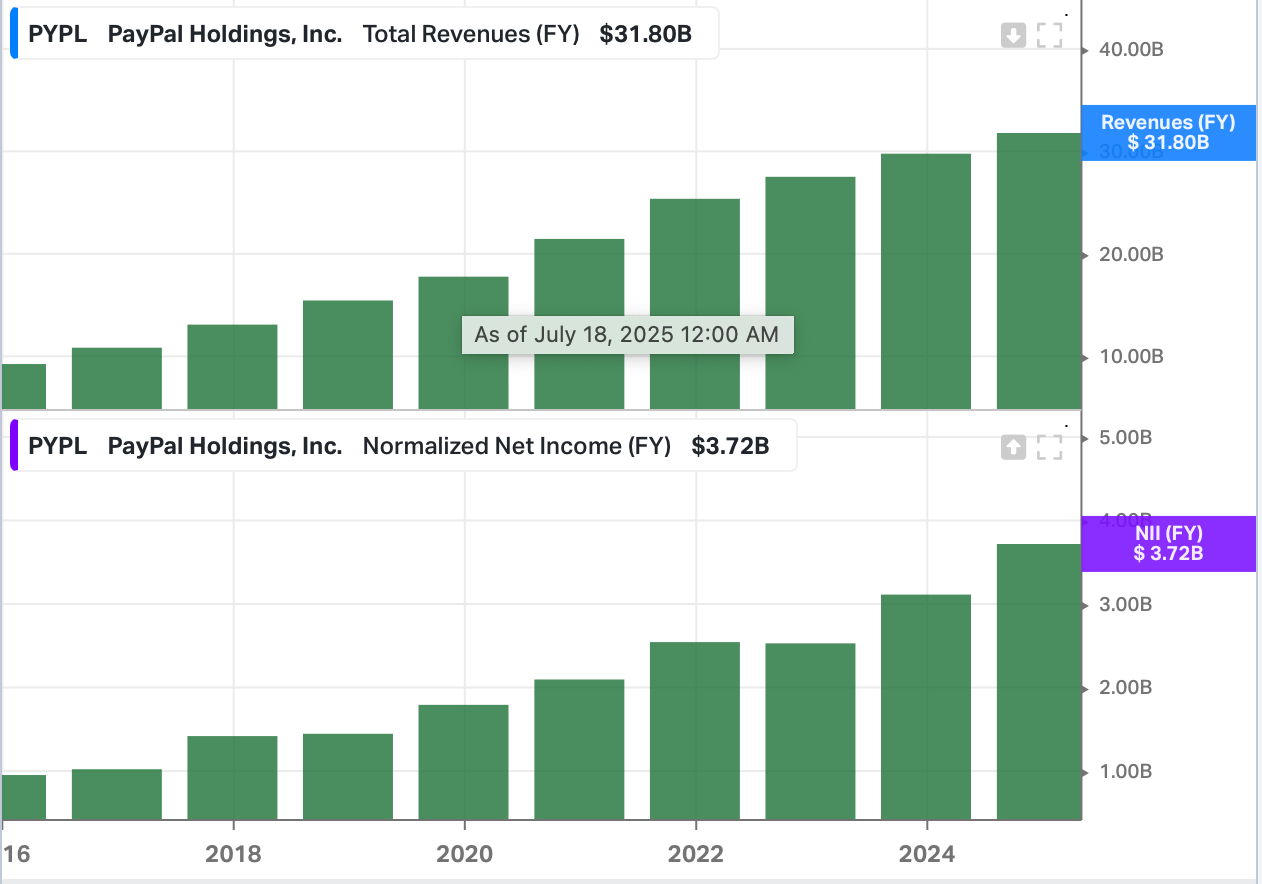

PayPal, the payments and commerce company, has revenue and net income growing in a straight line over many years, but with a slowdown in revenue since 2 years.

Hated, doubted, however when you look at the metrics, say what you say, it is a quality company.

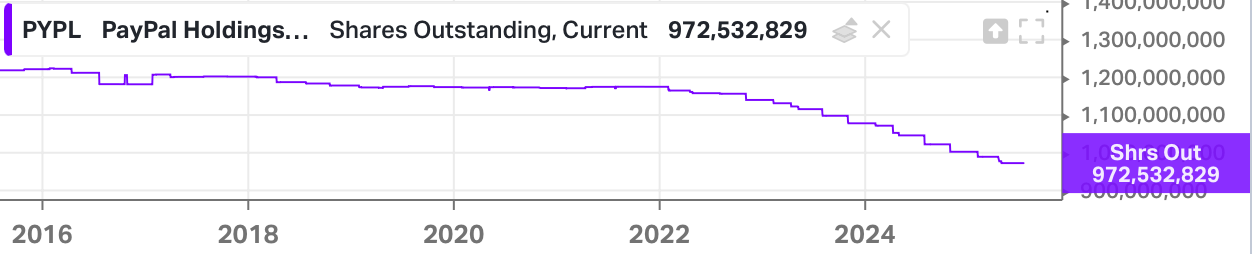

The buyback is cancelling shares like no tomorrow.

Forward P/E is 14.4. You might think that the business is dead due to competition. And it is true that they lagged behind on some segments, but the growth is on par with the market in payment volume. The main thesis is that it’s about to grow in profitability even more with ads and extra services, after they recruited the head of Uber. For more details, please see my report below.

The ROIC is now at 13.6%

EPS is expected to grow 9 to 13% a year in the next three years.

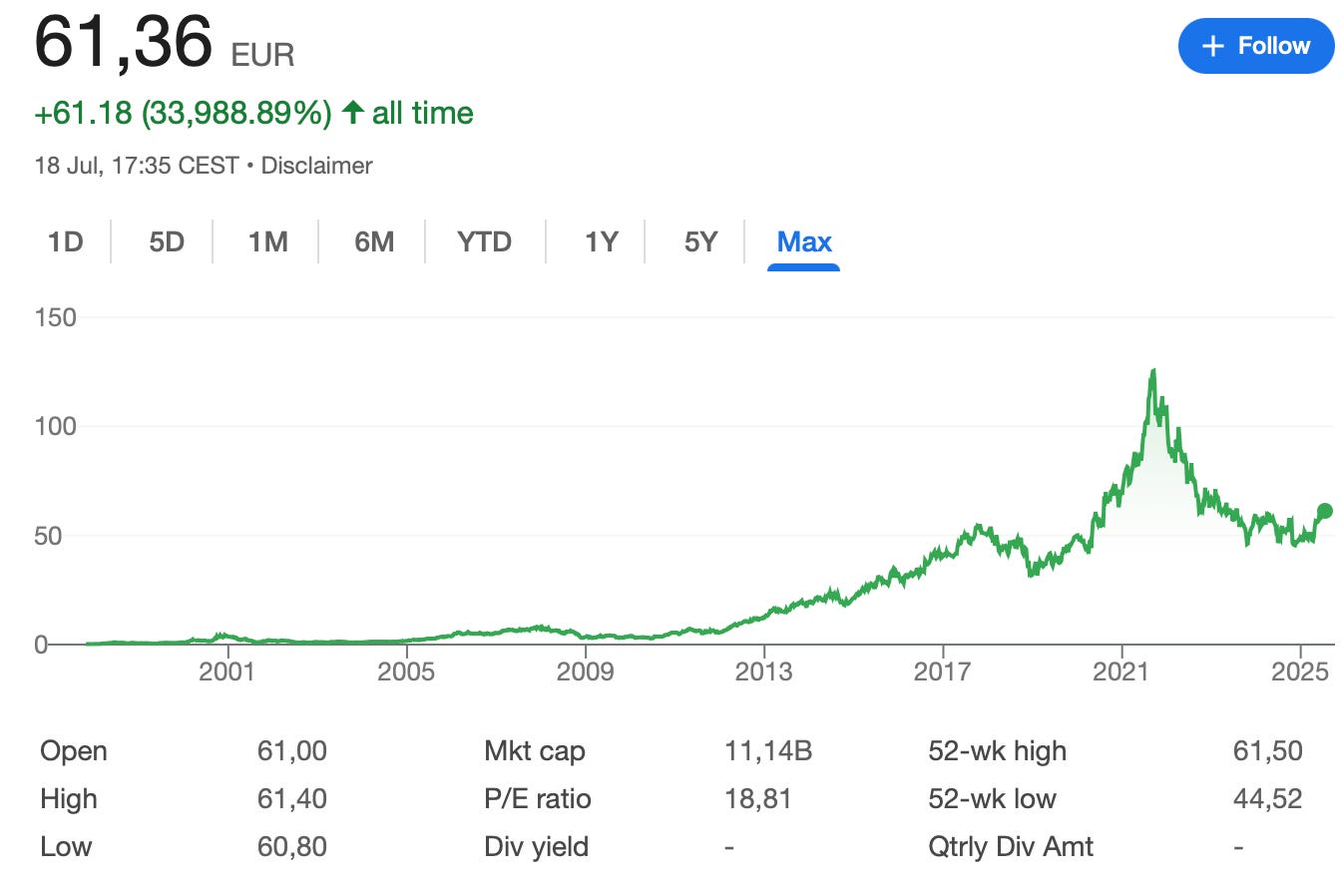

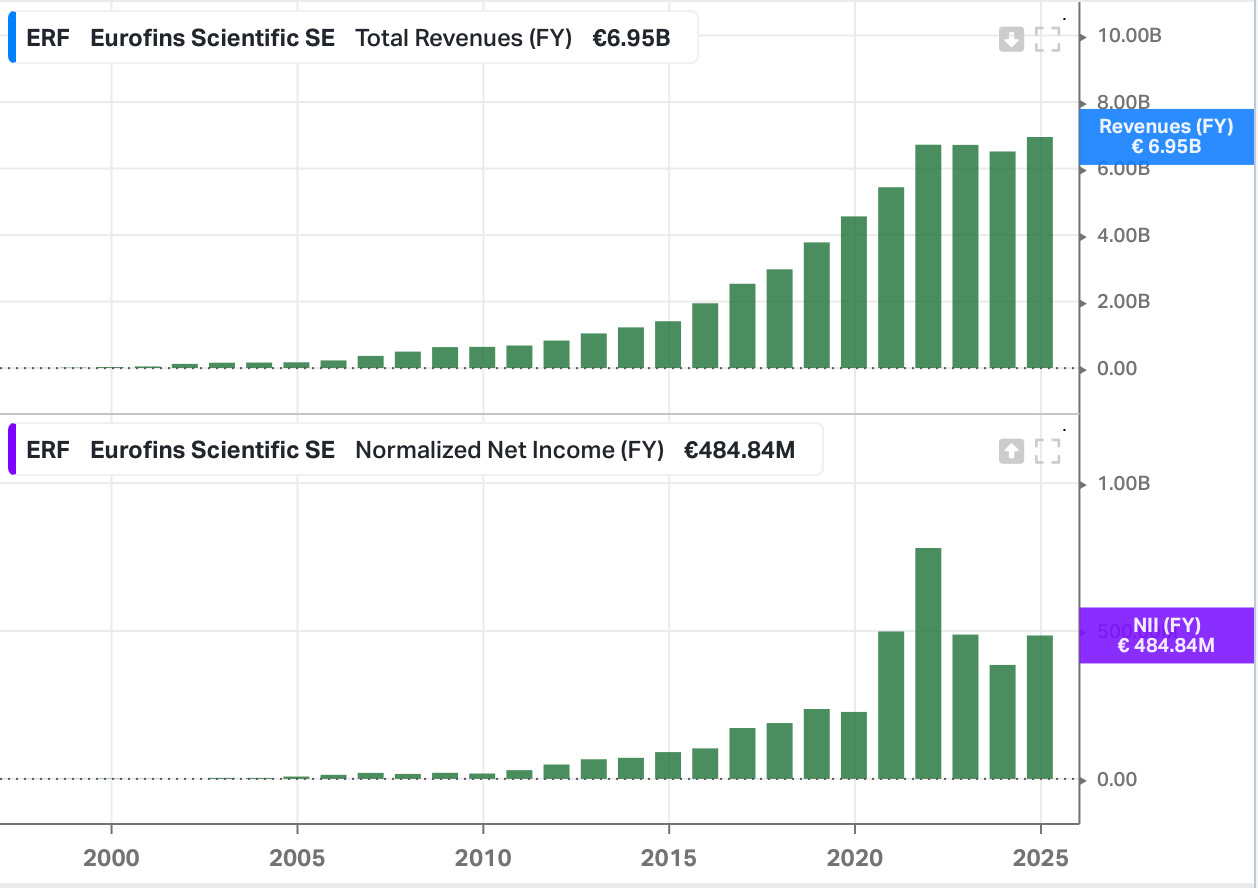

4-Eurofins Scientific (France)

The healthcare and food testing company is recovering from a covid cyclical high.

Value score: 4/5

Defensive score: 5/5

Growth score: 4/5

Before that, it produced a 40000% return and more.

This was an incredible growth company with acquisitions and organic growth.

ROIC is a bit on the low side at 8% last year, but this is because of recent investment in Real estate and accounting treatments. Eurofins wants to own more and more laboratories real estate, which is an upfront investment, but is key to increase returns over the long terms as no rent will be due. The company prefers free cash flow before investment in real estate.

According to the 2024 Annual report, Return on capital employed also rebounded, improving year-on-year by 180bps to 12.2% vs 10.4% in 2023 and 9.1% in 2019.

Considering that this is in the first few sentences of the annual letter, it is a strong focus of the company.

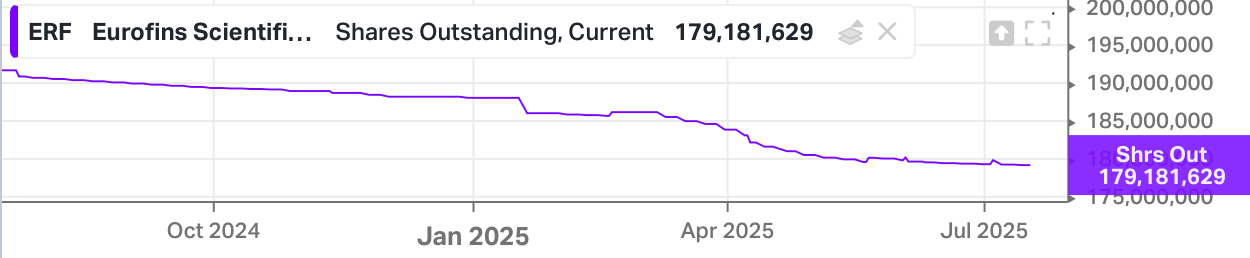

I caught the rebound on this company by buying at the low prices. Eurofins has been buying back shares heavily in the last 12 months, with shares outstanding down.

We are at a forward P/E of 15.7 and expected adjusted EPS growth of 13% a year for the future, it is a good opportunity in my opinion.

Eurofins targets 2.4 billion EUR in EBITDA and 1.5 billion EUR in free cash flow** by 2027. The current market capitalisation is 11 billion EUR. That would be a 7.3x Multiple of Free cash flow.

Adjusted before acquisitions and real estate purchases.

I fully expect PayPal and Eurofins to be relatively quick doubles and to continue to compound at a decent rate from there.

Note: this is not financial advice, but my opinion on the companies. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

The rest of the article is available only to paid subscribers (150$ a year).

This gives access to movements, best buys, full portfolio, hidden small caps, for a portfolio beating the SP500 this year. (+20% in EUR - all my returns are in EUR) with a much cheaper newsletter than average. The reason for this relative success is looking for quality+value no matter where it is.

I just sold this value company at 100%+ return on my cost basis. I don’t win all the time, but I get some wins. I reinvest in better opportunities.

And where is the quality + Value ? The next three are all in Emerging markets. And they are really promising. They already delivered good returns for me, except number 3. And EMs should continue to outperform.

I aim to provide the most complete cover of Emerging markets.

Number 3… The highest quality business you can find, similar to an investor favourite in North America. Except cheaper at 12 times earnings. Exposed to Latam secular shifts in financial markets, doing acquisitons. Very few talk about it. I am still cautious because I am learning more about it, but I entered the position.

Number 2… The second highest quality business you can find? In the USA, it trades for 50 times earnings. In EM, it trades for 15, and I bought it at 9 times earnings. In all honesty I believe in a multibagger here in the long term. (OTC market or local market). Since 2015 it multiplied revenues by 10 in USD, and still has large potential.

Number 1..

✅Incredible ROICs over 100%, ✅one free call option and a ✅P/E under 10.

This is why I now focus more and more on Emerging markets. I have added to number 1.