Hello, everyone! A quick but researched article on PayPal.

PayPal ($PYPL) Q1 earnings release is very complex and gave mixed feelings to many investors at first.

But first, the PayPal opportunity in one slide: Offline, and Ads+Credit.

I doubt that they can dominate or make significant money offline, but why not, if they try enough.

The main issue for Q1 2025 is that revenue grew only 1%. This is really disappointing for a company like PayPal.

Payment transactions decreased 7% to 6.0 billion.

But, Excluding payment service provider4 (“PSP”), payment transactions increased 6%.

Active accounts increased 2% to 436 million. We will see why it doesn’t matter.

GAAP operating income increased 31% to $1.5 billion

GAAP operating margin expanded 447 basis points to 19.6%

Here is an payment volume growth and proportion summary:

Here we can see that TPV or Total Payment Volume is up 6% for Branded checkout, which is the highest margin segment.

Venmo is up 10%.

Payment service provided is only up 2%, because PayPal has been cutting unprofitable and low profit margin undifferentiated processing on Braintree.

From Payments volumes we go to Transaction margin. This is up a good 7%. This is like Gross margin.

Value-added services revenue grew 17% to $775 million, driven primarily by healthy performance in consumer and merchant credits.

This would include Ads, but they are in infancy, but mostly Credit to buyers and sellers.

This flows down to Operating income and EPS, showing operating leverage with efficiency and EPS growth with buybacks.

For Q2, they expect “non-GAAP EPS in the range of $1.29 to $1.31, or 9% growth at the midpoint.”

This is much lower than the 23% for Q1.

For 2025, the guidance is conservative at 6 to 10% EPS growth, due to macro economic and tariffs uncertainty.

During the call, it is clear that they sandbagged the guidance. They made it very conservative and they could beat it.

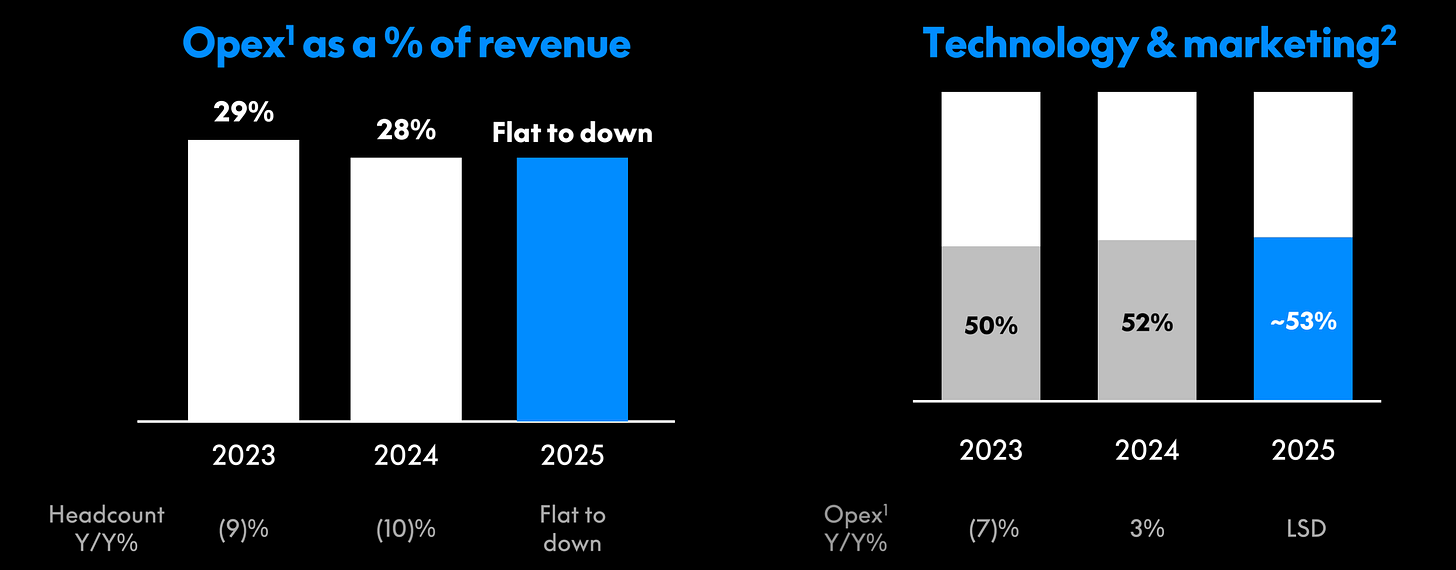

I have reviewed the Operating income details, and it appears to me that they have reduced overheads in Customer support and administrative. For the full year the short term improvement effect will be reduced.

Adding to this, there are 6 billion USD of buybacks planned and PayPal has shown good share reduction.

It is disappointing to grow EPS only 8% when you are buying back about 7% of your market cap in a year. It means literally no growth. But I am expecting PayPal to earn more than the guidance as they are conservative. This is also caused by an increase in tax rates to 25%.

The company shows some core business growth initiatives below but I am skeptical that they can move the needle significantly as they represent small uplifts in revenue, at least in the short term.

Transition to a commerce platform

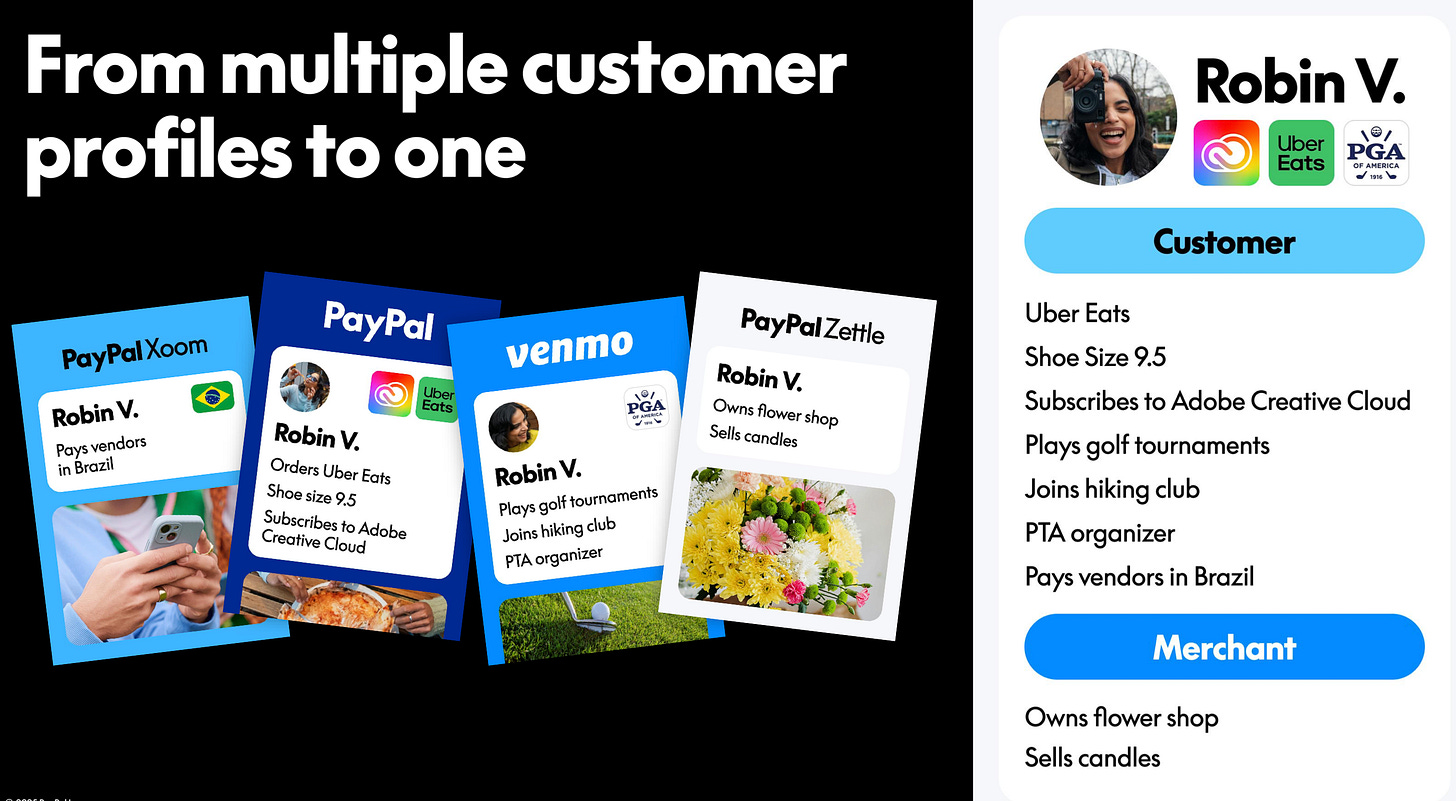

PayPal is transitioning from a pure payment platform to a commerce platform. Beyond the Jargon, it means that the payment is one form of monetisation, but extra services will monetise the users more, protected from the commoditisation of payments.

Lower take rates are caused by competition in payments. And only processing payments is a business of volume little differentiation - at least to the user.

PayPal can monetise the users by offering them more services. And it’s not just making them pay for things they don’t need. Currently, they use their Data to provide short term credit to buyers and merchants (PayPal working capital).

Visa and Mastercard don’t have this optionality.

As I noted in the past, PayPal needs to grow a Marketplace and omni commerce App. This is now underway for the omni commerce, but the Marketplace has not yet been established, probably because the company is afraid to compete with their own partners, or because they prefer to go with in app AI recommendations. But they should let people search within the apps at least.

The more product they upsell to merchants, the more transaction margin or gross margin PayPal makes.

Increasing monetisation of the user base is #1 key to PayPal, rather than having a few more million users who just do a payment here and there. The goal is to get users to start using PayPal for savings, for ads, for credit and for new future services.

However, I see the results coming in 2026 more than in 2025.

Review of the Growth initiatives:

On Ads, PayPal knows the users very well and can promote ads within their apps and emails as well as outside on third party websites. They can really help a merchant target a specific set of customers.

Then it can push an ad after checkout, in the payment receipt, in the app or even on third party websites.

AI and Agentic commerce

Agentic commerce is also in its infancy, where an AI helps you make payments. The partnership with perplexity AI is an important sign that PayPal helps to automate payments. For this, a waller is better than a simple card. Apple Pay and Amazon Pay will also have this capacity in the future. However, it could also be negative for PayPal if competition does it equally well.

This is the closest thing from a marketplace. PayPal could automate your recurring payments that are not really recurring, and giving you suggestions, by acting as a shopping assistant.

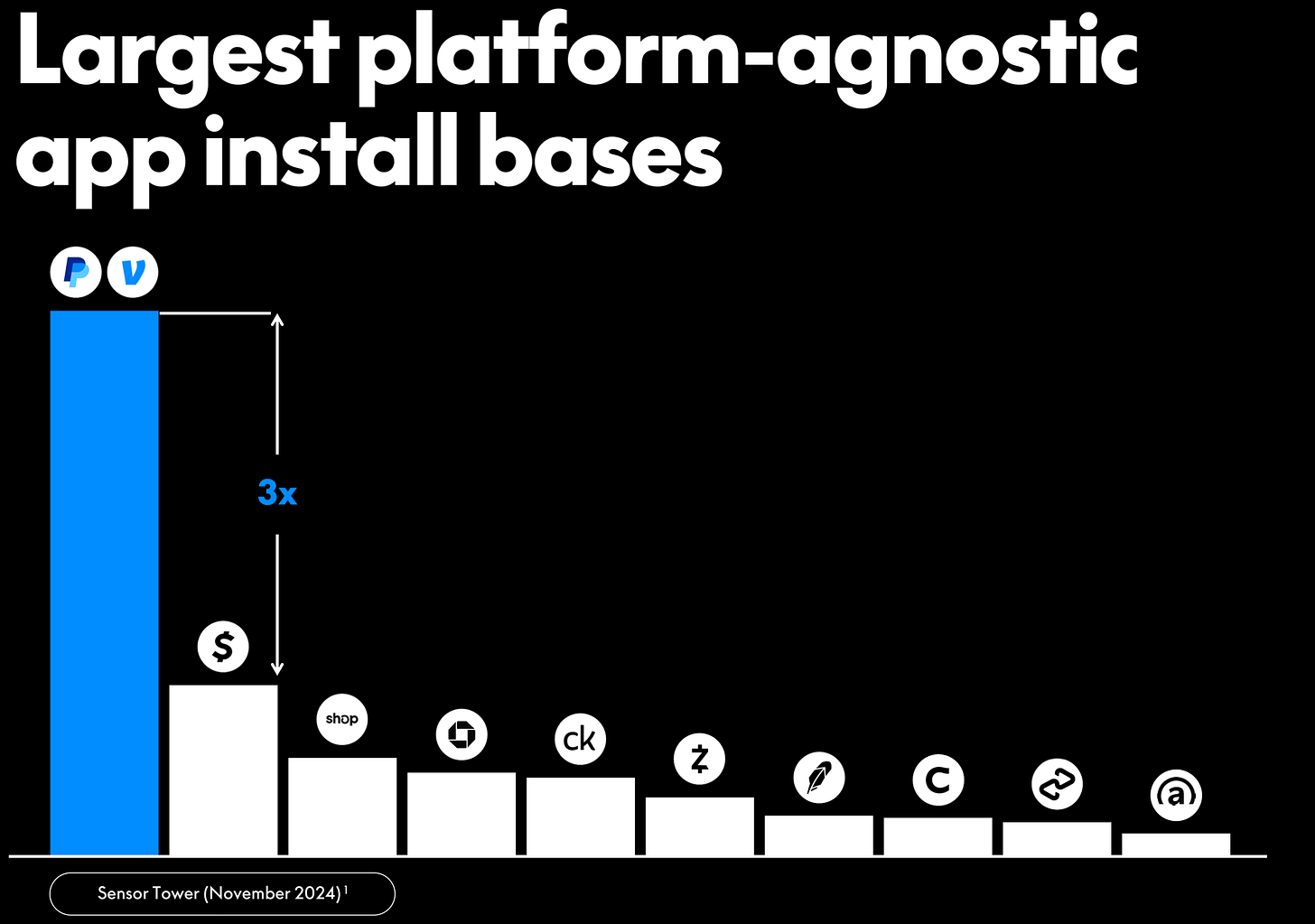

App installs.

A key for PayPal is to increase active users on the App as well.

They have many active users on the Venmo app: This is an incredible opportunity to monetize them more via local business marketing, and this has not started yet.

Fastlane

Fastlane is a faster easier guest checkout option. I expect this to increase growth by a 1 or 2 points maximum.

B2B Payments.

PayPal is experimenting with implementing B2B payments. They could also increase services for merchants, and why not a merchant service marketplace as the B2B payments provide data on what services and products they exchange.

Perspectives

The perspectives for the long term are aiming for increased EPS growth to the 20% range. I am not fully convinced. But operating leverage and single digit payment volume growth does a lot to the equation.

Let’s be cautious and assume only 12% range. At current price levels, this would rerate the company to a multiple at least 20, and also increase EPS (6.4$ earnings Estimates X 20 = 128$ versus 73$ today) for 2027.

This seems realistic to me.

But that is not all.

PayPal, like some other companies (Some hidden gems I have in portfolio that are developing digital assets on top of their physical businesses), as the optionality upside. The hidden data asset is enormous if they can become a to-go app for commerce, just like Amazon or Alibaba is. Or the traffic could come with AI like perplexity. Automation requires a e-wallet, and I am expecting to see Wallets take over simply inserting card numbers in the future. If they manage to get the customer to open the app and use the AI agent to shop, they could become one of the entry points for shopping online and offline.

It is possible and is the pie in the sky scenario. In that case the profits could go up many times.

More info into the ads opportunity - from User Kross Roads on X who is a good PayPal source of Info

DLOCAL: Why I would avoid Dlocal

I reviewed Dlocal. Dlocal is a company for international payments in EMs. It is controversial with short reports.

There are strange things like growing Other Latam a lot, and a take rate of 2.6%.

A take rate of 2.6% is too high. It could be legitimate, but it could be a sign of Fraud, like inflated sales reporting. It seems that the take rate is going down but its very high in some small countries.

A growing other Latam segment with a stagnating Mexico and Brazil is a concern.

My biggest concern with Dlocal is that they don’t own the customer relationship and cannot monetise the customer relationship just like PayPal does, so they are stuck in being a middle man squeezed on price.

Dlocal could still do well, it’s just my risk management, and PayPal could underperform Dlocal.

Edit Sept 2025: Dlocal earnings were more positive with growth in the main Latin American countries so my fears were probably overgrown.

Subscribing gets you

10+ more unique write ups per year

Full portfolio with diversified 50+ mostly EM/small value ideas.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin)

Great giant to have in the portfolio

This other Latam growth (perhaps Curaçao or Belize) reminds me of some high-risk payment processing activity (online gambling ?) like what we use to see at Paysafe or Wirecard. I don't see why take rate is so high otherwise.