Hi all,

This set of letters from Leandro got me excited.

I wanted to really know about how a quality investor consistently makes money with sometimes high valuations, if 20 years of experience could give me an answer, so I devoured parts of it, all the way to the 2007 financial crisis at least. I read it and took notes. I stopped at 10 years, late into the night.

This type of quality investing is now popular with many people on Twitter who do not look at cheap valuations but quality first, and Giverny Capital is well liked by these people, and rightly so.

So lets go.

Raw, quickly written article below:

I did not listen to any of his recent podcasts, to get an objective and cold view of his returns. I will after this article is published.

First what transpires from his letter is great intelligence. Not only because he picks great stocks. He does, but well, there is more.

It is because he sets up processes in which he does a post mortem on his decisions 5 years before and uses this to constantly improve his knowledge and process. He is also flexible in investment themes, based on opportunities.

So how I define value investing? When price paid is a major component of the investment decision. When it’s quality before price, it’s quality/growth investing. That does not mean you cannot buy a quality business, but you will look at the price as a major factor. François mentions prices a lot in these early letters, then it’s value. Sometimes he mentions paying up for quality, then it’s quality.

2001 letter: 15% vs 0% Benchmark

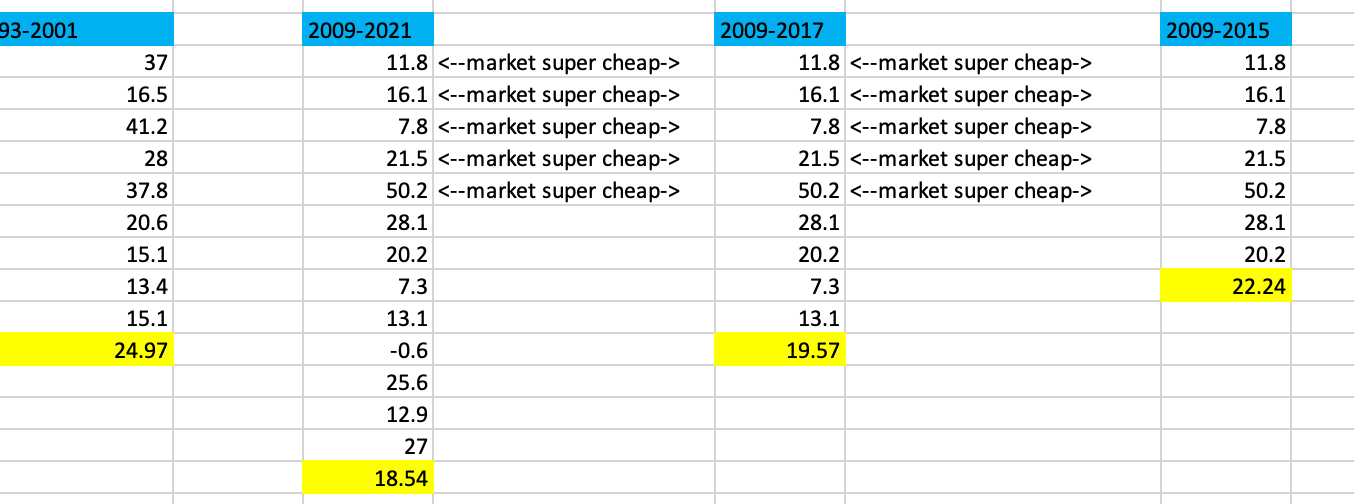

He starts by going over the returns since the start of the fund.

Returns super strong from 93-98.

why? VALUATIONS - he says it, not me. but for great companies as well. And some $CAD depreciation help.

Own defensive businesses. (Speaking about recession) “It’s during these periods that we can distinguish winning companies from the other kind.”

He Mentions a bunch of tech stocks: Interesting to see that they are now either mature or has been value traps. Tech isn’t easy. will it be different now? I think that partially yes for Software because software is mostly a service, harder to disrupt.

2002 - he beats the market: -3% versus -18%.

He Explains that it is because his picks were cheaper than the SP500 and that the valuation gap is now closed, resulting in the SP500 losing more value than his portfolio. » VALUE INVESTOR

.—

Goes back to past years to look at errors of omission or sales or buys. Constant learning and improving his process. He sold some Sun and Bombardier. who went up 1000% and 300% after his sale. But came tumbling down to earth a few years later. Selling saved his returns. Seldom do great business stay great for decades. (he writes). I think because these were not defensive enough.

2003 - 14% vs 14%

Avoiding commodities

He checks back on a 1400% return: it was furniture stores Brault & Martineau and Tanguay. It was clearly a value investment bought during the Quebec independence referendum crisis, and languished for years at 4x PE. I suppose that earnings were growing so it ended at 4x PE before shooting up.

“Our purchase of Fastenal was more rewarding. I knew Fastenal for a while when finally the stock traded in October 1998 at very attractive levels. I bought shares.”

Buying an Asian fund at a discount to NAV in 98: DEEP VALUE BEHAVIOR

“I knew about TDF because it is managed by Mark Moebius, a money manager I admire a lot. He doesn’t invest in the same way I do, but what he does, he does it very well. When I first started to buy TDF, the stock was at $6. The NAV was $9. So in addition to buy depressed stocks, I could buy them at a 33% discount to the market. But that was not all. In the $9 of NAV, there was $3 of cash. So in fact, I was paying $3 for $6 of value in stocks (which were already depressed I reminded myself). Wow ! I was like a kid in a candy store. Moreover, to reduce the market discount, the fund management decided to pay a dividend equal to 10% of the NAV. So at $6, I was receiving $0.90 in yearly dividend (a yield of 15%). For a RRSP account – where revenues are not taxed – it was an ideal vehicle. Today, TDF trades at $18. So an investor that bought at $6 in 1998 and has hold it for all that time, has made a total return of 250%, not bad for a period where the market has went nowhere. The best time to invest in China is not when it is popular (!).“

In October of 1998, we did lots of buying. The market had lost 30% because of the recession in Asia (who remembers that today?).” —> ……

2004 - 1.6% vs 2.8% SP500 (in $CAD)

Resources which they avoid went up in the Canadian Market (up 6%), he did not that much.

In the long run, investing in cyclical stocks can yield – at best – modest returns. In my early days, I invested in many cyclical companies (that looked “cheap”). Gives example of Nucor, a well managed steel company that had EPS down for 10 years before booming.

Post mortem 1999: Bought Progressive insurance after the stock was down 67% from highs after a few quarters of down EPS. The stock went down 35% from his buy price immediately. Is this “Buy quality no matter the price?”. He then had a 500% + return.

Bought a fast growing “compounder” Knight transportation at 20x earnings.

Review of portfolio.

Focus on “Best businesses in the world”

Several stocks with 15%-20 EPS growth in traditional industries and he mentions that the stock price will follow.

One of these stocks (Expeditors International of Washington) has a 30 PE ratio but has 26% EPS growth. They like the management and hold.

Owner earnings:

In fact, since 1996, our companies have grown their earnings at a rate of 8% better than the S&P 500. Our portfolio overperformed the index by a similar rate.

We aim at finding companies that grow their underlying value at around 12-14% per year, twice the market average.

So that is a contradiction with the previous examples of buying cheap. Unless he bought at Market P/E these companies, after they fell from expensive to normal price?

2005 - 11.5% vs 3.6% SP500 (in $CAD)

“In 1995-97, we had more than 40% of the portfolio in Canadian Stocks. In 1998, we invested in Asia”.

“Our own Canadian securities have done extraordinary well lately and we reduced the ones that we believed were too richly valued.” He finds the USA cheaper and more interesting.

Insists on ignoring the economy, fed, inflation, wars, oil and focus on good businesses:

“« If you are in the right companies, the potential rise can be so enormous that everything else is secondary ». Walgreen went up 18000%.

What comes next is pure value investing:

Portfolio review:

Many compounders with high growth in EPS. many companies with large runway.

ResMed is not cheap at 30x EPS. we will see how it goes.

Also buys solid companies when unloved and cheap: Berkshire, Walmart, Disney.

Faster earnings growth, Lower valuation compression (good price)

“our portfolio did better than the S&P 500 because our companies did better. Since 1996, our companies increased their earnings by 14% a year, twice the level of S&P 500 companies. And in the 2001-05 period, we did way better than the S&P 500 because not only did our companies continue do perform outstandingly but the general P/E compression was not as severe for our stocks. The “value” dimension of our approach played a vital role.”

Two mistakes of omission: Missing Starbucks Coffee and Panera Bread on high valuation grounds due to high P/Es. It was a mistake of being too value investors.

2006 - 2.5% vs 17% SP500 (in $CAD)

Since 2003, the Canadian Dollar rose a lot against the USD, yes it can happen! That eroded their results.

Contraction of their P/E ratios.

Our portfolio valuation is at a 10 year low.

Finally, on a relative basis, the sectors which did best in the last 3 years are those related to the natural resources, industries which we tend to avoid in general.

Fastenal: The high valuation of the stock, which seems to us justified, makes the stock volatile.

Pure value behaviour:

“Flavour of the day. We are often asked what is the most dangerous thing on the stock market (the “Flavour of the day”). A few years ago in Canada, Nortel and the other techno superstars were highly popular. Whereas today, nothing seems to us more popular than the Canadian banks. Ironically, at the time where Nortel was king of the Canadian market, we bought shares of two banks: the Scotia Bank and the Bank of Montreal, two stocks that were unpopular at the time.”

Conclusion

His first years, he was a pretty deep value contrarian

He never chased the popular or the highly valued stock, but the disliked stock

Always had a focus on quality.

This looks exactly like our time

Its pretty clear to me that the scenario now 2001 - 2006 is what is more likely to affect “Quality investors” from 2021 onwards, drooling over past results led by multiple expansion and good earnings (1993-2000), and achieving just ok results in a multiple contraction environment.

Reading these letters feel like reading the future. Ironically, we just had a tech bubble in 2020, just like in 2000, so it even matches numerically wise.

The Natural resources are said by many to enter a high price, high capex phase for many years due to underinvestment and to the need to build the energy transition. And the energy all together. And this is what he mentions with the CAD being strong and natural resources and cyclicals being popular in the 2000s.

Quality first and price second does ok in the very long term but will not provide these kind of annual returns starting from 2021 prices.

Starting from mid 2022, it already looks a bit better, but the multiple contraction can go on.

Quality first and price second is a complete misunderstanding of Rochon’s and similar investors returns.

Rochon bought great companies at cheap prices when he killed he market.

When it was average prices and “best business in the world focus”, he had just ok returns

Earnings growth provided support for long term returns, yes.

Defensive businesses protected the investments during recessions, yes.

The Quality first and price second scene is misguided. This will do well in the very-very long term only and but risk spending 5-10 years crossing the desert (2022 being the first year).

What it does not say is How do cheap companies with low growth investors do in the long term. This is for another day.

It seems that he had excellent returns being small, value and agressive at first, then managed to maintain good returns by focusing on the quality factor, but I never see a focus on quality before price, there is always a plan to get price and quality. Lately with the QE and multiple expansions he did very well.

2010-2020

I have not analysed the 2010’s returns, but it’s pretty clear that he started the decade at low valuations and I assume he did good value + quality stock picking and had exceptional returns.

His returns were better when the multiples expanded.

His stock picking and process was great, I cannot disagree. But this does not always work well. I love compounding machines, but I am not paying a high price for them as long as I can find cheap stocks in the small cap/international space (under 15 P/E or under 10). This set of returns is all the proof I need.

Buying quality at a high price is not the best way to go (unless your stock picking is MORE EXCEPTIONAL than Giverny capital), and we can expect future returns to be lower for this fund on valuation basis alone (Already started in 2022)

Valuation matters.

Annex:

This reminds that quality was value and that once cyclical industries were expensive. It all goes in circles.

Check this masterclass by LT3000

https://lt3000.blogspot.com/2020/11/unravelling-values-decade-long.html

And this just and one from Guy.

Both articles from 2020.

Hi, I would also recommend Santa Monica Partners Letters to Partners 1982-2021: 40 Years of "Pink Sheet" Investing.

Yes available on Amazon:)