Jardine Matheson

J36.SI Singapore

Price 40.5$

Jardine Matheson is an enormous Hong Kong based Asian Conglomerate that represents value investing to it’s core. A slow grower, a defensive dividend payer and a nearly 200 years history.

This is the Part 2. Part one was published two weeks ago (free). It showed that Astra and United tractors are already interesting and cheap listed companies, if you can and want to buy stocks in Indonesia.

Now let’s go to the rest.

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a discount with my affiliate link here. It’s a product with real value for me. The free version is great too!Business overview (reminder)

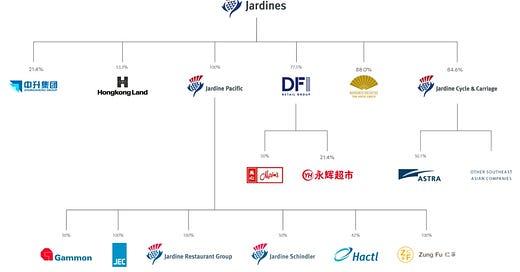

Here is the structure of the group:

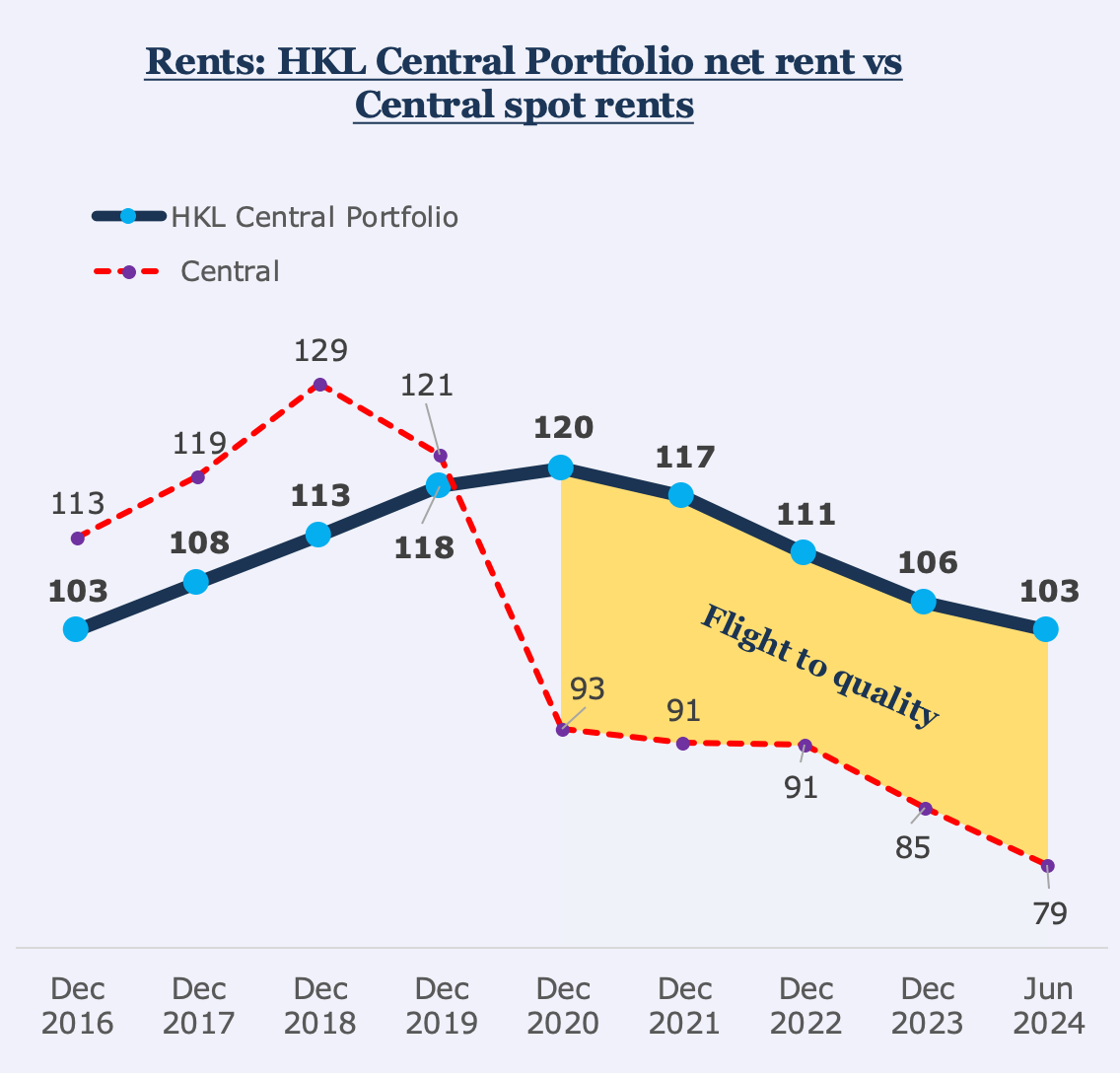

To do this, I will first show the underlying contribution by business for H1 2024

So we can see that Astra is the vast majority of profits, followed by Hong Kong Land and then a group of various businesses.

Astra: Indonesian automotive, finance and material resources company. (already covered).

Hong Kong land: High quality Asian real estate (mostly) leased.

Zhongsheng: Chinese automotive retailer.

Jardine Pacific: Mix of various small businesses.

JC&C: Automotive and Vietnam interests.

DFI: Retail: Asian defensive retail interests.

MOHG: Mandarin Oriental group.

Let’s go to Hong Kong Land. Now each business is very large and could be a 30 pages article. Even some subsidiaries of a subsidiary could be a full article, like Thaco or Ree in Vietnam. Therefore we have to summarize the reviews.

2.Hong Kong Land - approx 20% of profits. (potentially 27-30% ex impairment)

Hongkong Land is a major listed property investment, management and development group. Founded in 1889, it is a market leader in the development of experience-led city centres that unlock value for generations by combining innovation, placemaking, exceptional hospitality and sustainability.

The Group focuses on developing, owning and managing ultra-premium mixed-use real estate in Asian gateway cities, featuring Grade A office, luxury retail, residential and hospitality products.

Here we have.

Leasing of real estate: Rental income is about 50% composed of HK offices, some HK retail, then SG offices, China retail and rest of Asia. This is highly dependent on HK offices.

Selling real estate developments (China and rest of Asia)

All are of luxury standing. The leasing locations are really prime real estate, and the developments too, which makes them more resilient to downturns.

The company started from Hong Kong but is actively developing the same business model across emerging South East Asia

Lets start with Property investment (leasing) at Hong Kong land.

“Hongkong Land's Central Portfolio consists of 12 interconnected prime commercial buildings forming the heart of the financial district in Central (Hong Kong), providing over 450,000 sq. m. of Grade A office and luxury retail space.”

These are super prime buildings in the centre of Hong Kong. It includes Jardine house, the Jardine Matheson headquarters.

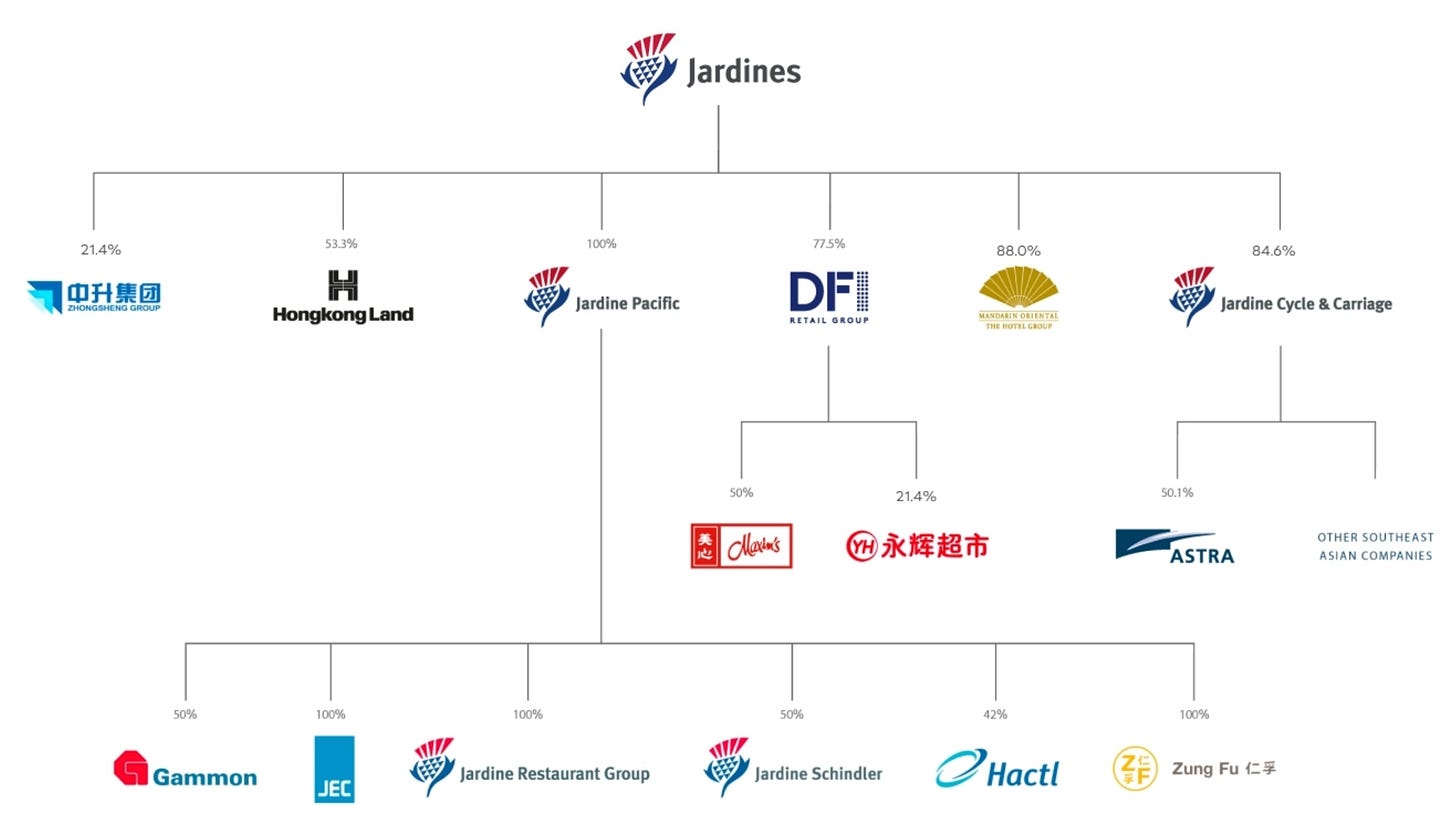

Unfortunately for Hong Kong Land, Office rents are going down in Hong Kong, and despite them outperforming the market, the rents are still down since 2020.

This is reflected on the company income, falling slowly in Hong Kong.

Hong Kong Land has a project to renew with growth in the Central portfolio. Landmark is the new “Central” project in Hong Kong where the retail bases of the interconnected buildings will become a ultra luxury destination, with “Maisons” or luxury houses all next to each other on the ground levels. This will be a 1 billion USD investment with 400 million put by Hong Kong Land and 600 million by the retail luxury tenants. I am bullish on this destination in the long term, because it will become an attraction in itself.

Here are the Investment properties in Singapore, again in a super prime location.

There is a large pipeline of luxury malls in China coming online that will keep growing the property investment income; There is also a large mixed use district in Shanghai that is being developed. This company is planning, developing and building the real estate that is then leased.

Property development:

The development properties contribution to the adjusted net profit in H1 2024 was small. This could improve in the following years but will slowly be phased out as part of the new strategy. Half is in Mainland China and the rest in other Asian countries, with many South East Asian countries like Indonesia, Malaysia or the Philippines.

Regarding the Chinese mainland developments, impacted by the real estate crisis, most are already constructed, with 2 million square meters under development or construction, and with the capital being extracted from this business by selling the real estate, and entering the leasing business.

To summarize for Hong Kong Land, the EPS is expected to grow 38% in 2025, recovering from some impairments in 2024. This is not really a growth company.

However, the company new strategy is to double earnings by 2035 by focusing more on leasing real estate and shutting down real estate development.

Hong Kong Land is a company that I would classify as high quality slow growth. The net income dropped post covid due to the Chinese real estate crisis and the downturn in Hong Kong. A strong Dollar hurts Hong Kong atractivity because the Hong Kong Dollar is pegged to the US Dollar. Any city eventually recovers, as it is the law of markets and supply and demand.

3.Zhongsheng: approx 7% of profits.

This is a participation in a Chinese automotive retailer since 2014. It is focused on Luxury or semi luxury. The profits in 2023 and 2024 are down because of the softness in the Chinese luxury car market and competition from new EV companies.

It is a cyclical company, but analysists are expecting a doubling in earnings in the next two years.

The company is ongoing a new strategy on focusing on servicing luxury and premium car owners (regular servicing, or collision repair, or auto insurance renewal). The company is planning to double it’s collision centres.

In H1 2024, the company reported a loss in the new sales business and a profit in the after sale and preowned, business, and a profit overall.

That means that the new sales business cannot really go worse, and if it still, it could be shut down.

So I am quite positive at a new strategy not depending too much on new car sales.

In the long term, will people still use collision centres if there are no more collisions with AI? Will retailing of cars have a lot of future in China? I remain mostly negative on this segment.

4.Jardine Pacific: approx 7% of profits

This is a mix of various businesses operating in Hong Kong, that will provide profits, but I do not expect any growth from there. Here we have construction (Gammon), engineering (JEC), restaurants in Hong Kong, Elevators (Schindler), etc.

Despite making only 52 million USD of underlying profit in H1, this is a huge business with 6 billion USD of sales. There is maybe potential for improvements in restaurant and engineering.

Earnings have been flat over 5 years. So I rate this business as stable, and there is nothing exciting here.

6.DFI Retail - 7% - potentially 12% of profits

Asian retail interests. Formerly known as Dairy Farm, it was founded in 1886 and acquired in the 1970s by Jardine.

It used to be a good compounder but then profits almost evaporated, before starting to recover in 2024.

It has 7eleven Hong Kong, Macau and South China.

Some food business supermarkets and stores under different brands, mostly in Singapore and Hong Kong.

Ikea Indonesia, Hong Kong and Taiwan. Actually, it is not such a great business based on recent earnings. But it could improve.

Health and Beauty with Mannings in Hong Kong, Macau and Southern China.

Restaurants with Maxims in Hong Kong.

Associates in China and the Philippines.

The underlying profit attributable to shareholders has recovered substantially and is expected around 200 million for 2024. The group was hurt by weak macro in Hong Kong, and intense competition in Asia.

Recently, DFI retail has been selling associates in Malaysia, China, and Indonesia and focused more on the core business. The Chinese associate was loss making.

Analysis are expecting a further recovery in profit in 2025.

It would take a whole analysis just for this business consisting of between 5-10% of underlying profit only, and it would take a retail specialist in these countries. Which I am not.

Here is what DBS had to say about it.

I would rank this business as stable and low quality.

5.JC&C: (3%)

Automotive and Vietnam interests.

We have a leading automotive dealer group in Indonesia. It owns a network of 91 motorcycle and 70 passenger car facilities across Indonesia.

We have Vietnam interests.

The Vietnam interests are high quality in my mind. THACO in Automotive is a growth conglomerate with real estate and agriculture interests, and a lot of hidden value as businesses have start up costs. They are trying to follow the Astra success.

As this is a small contributor, there is not much need to go further in details, but it is interesting to note that the company is increasing investments here.

7.Mandarin Oriental group (2% of profits):

Mandarin Oriental group is a very luxurious hotel company. They have expansion projects, and a new capital light business model with Franchising. At 2% of profits, it warrants little attention for the Jardine Matheson investor. But if you are still interested, go here:

I rank it as a good business.

Going back to Jardine Matheson

I think by now you have a fairly good overview of Jardine Matheson. The P/E is 7.5 and you can make your own first opinion. We are already in value investing land, with this valuation. I dug a bit deeper on the company and I will now review the following points.

Business quality ranking

Strategy

Capital allocation

Investment thesis

Subscribe for a full hidden champion and EM value portfolio, free trial available for the rest of February.

Keep reading with a 7-day free trial

Subscribe to Emerging Value to keep reading this post and get 7 days of free access to the full post archives.