Jardine Matheson

J36.SI Singapore

Price 40.13$

Astra International

ASII.JK Jakarta

Price 4780 IDR

Today we will introduce a defensive holding. Some holdings are here for the offense, this one is here for the defense. It will not grow 40% a year..

Jardine Matheson is a boring Hong Kong based Asian Conglomerate that represents value investing to it’s core. A slow grower, a defensive dividend payer and a nearly 200 years history.

It illustrates my strategy of long term investing.

But? what is the two years objective? what is the catalyst? How do you get a double?

These are all short term questions. My view is more like “This is a dominant group in South East Asia that will grow by continuously expanding and will reward shareholders with capital returns”.

However, speaking of catalysts, I waited patiently to buy it until I saw some changes in terms of actions and valuation, that we will cover in the last part.

The long term stock chart showed good return until 2013, followed by a stagnation.

In terms of book value per share, we however do not have the same stagnation but good value creation. Note that this excludes good regular dividends. We see a relative stagnation from 2013 between 40 to 60. But the stagnation is only relative, as actually it’s still some growth, and it is now at 97 dollars of book value per share.

Price to book is almost at an all time low. Book value grew, but there was a massive derating. Looking a the stock chart, you may think “it was a value trap”, when in reality, a stock going from 2 times book value to 0.5 times book value is not a value trap but a overpaying trap.

These three charts alone should tell you it’s time to invest. But let’s look under the hood.

History

The company was founded by Scottish businessmen/adventurers in 1832. It expanded in the China and Asian region over the years, establishing businesses in every type of sectors as a conglomerate.

But the company was also trading opium, and It’s carefully omitted from their website. Wikipedia is a bit more explicit.

“the firm, by then named Jardine, Matheson & Company, set up its headquarters on the island and grew rapidly, smuggling illegal opium from British-controlled India into China. Jardine Matheson has been called the "most successful opium smuggling company in the world".[15]”

As China went full communist under Mao, they focused more on Hong Kong, where they had been based, and the rest of Asia.

They consolidated real estate assets under Hong Kong land, hotels under Mandarin Oriental, and Retail under Dairy Farm.

The company built an important insurance broker business that was established in 1972 and divested in 2018, Jardine Loyd Thompson. It was a certain success, judging by the share price, but was not very material to the group.

In the 2000s, the group started buying new assets in South East Asia, Cycle and Carriage, and Astra.

A key point for me was the Astra purchase. Astra is a conglomerate in automotive.

They had great success in Indonesia, with Astra being a homerun, and in 2008 the company entered Vietnam, also in Automotive.

In 2014, they concluded the Acquisition with 731 millions$ for Zonghsheng group holdings, a Chinese auto retailer.

A big catalyst for me was the group simplification in 2021. Prior to that, there was Jardine Matheson and Jardine Strategic who both held each other in a cross holding situation and prevented take over offers. The simplification created a lot of value for Jardine Matheson, because it was like a huge buyback, but the Jardine Strategic holders felt that they did not get paid the full value of their holding.

This is why it is generally recommended to buy the parent company in these cases, which can often buy out subsidiaries at a premium, but below fair value.

Business overview

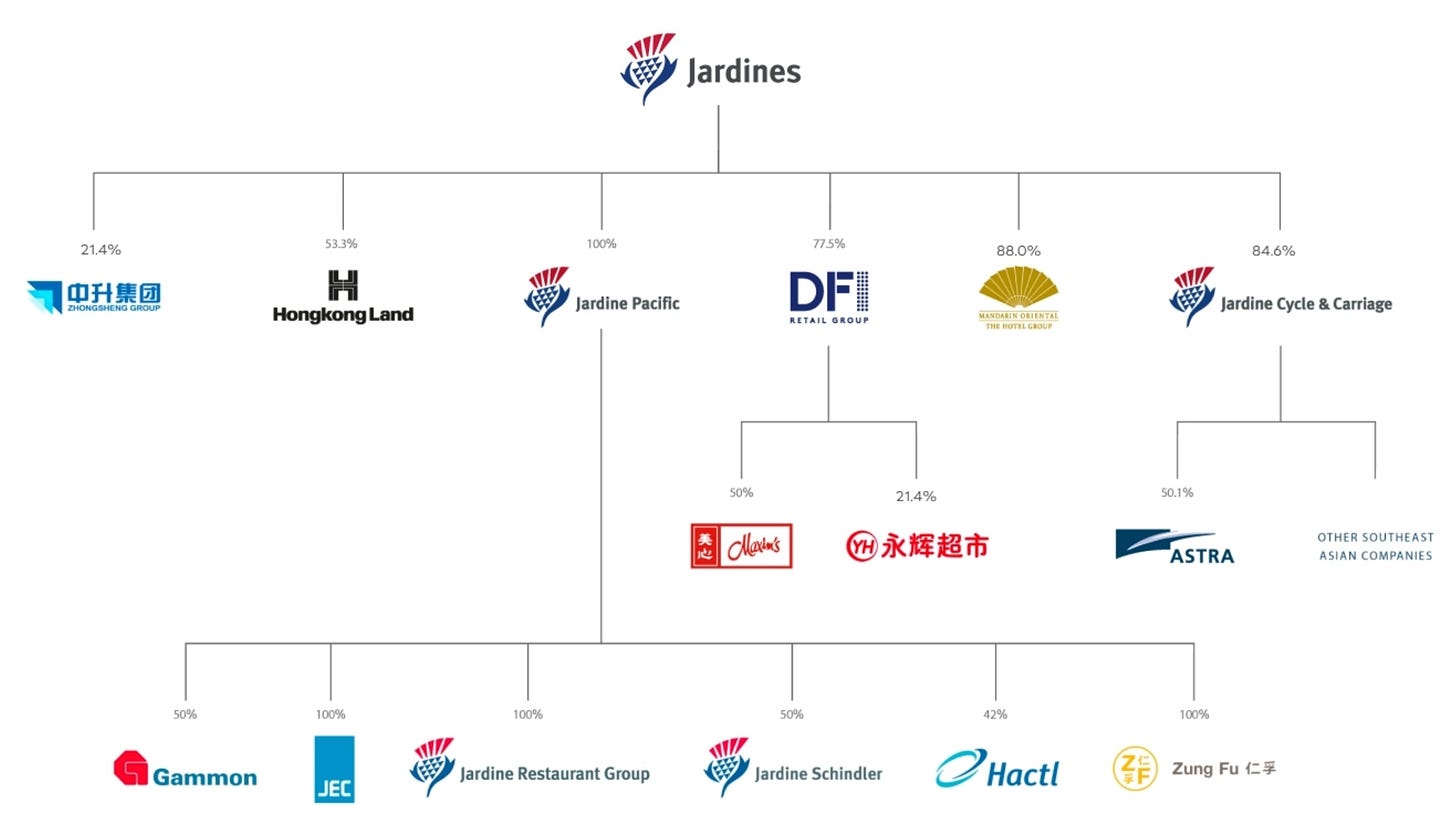

Here is the structure of the group:

To do this, I will first show the underlying contribution by business for H1 2024

So we can see that Astra is the vast majority of profits, followed by Hong Kong Land and then a group of various businesses.

Astra: Indonesian automotive, finance and material resources company.

Hong Kong land: High quality Asian real estate (mostly) leased.

Zhongsheng: Chinese automotive retailer.

Jardine Pacific: Mix of various small businesses.

JC&C: Automotive and Vietnam interests.

DFI: Retail: Asian defensive retail interests.

MOHG: Mandarin Oriental group.

We can see the Importance of automotive and real estate leasing.

These businesses are however quite defensive, despite the automotive portion. But they are not high quality businesses. We will review that in detail.

We will go to each major subsidiary. Many are listed, and that gives us a lot of public data on their performance, and it allows Jardine Matheson to increase their stakes through public or block purchases, acting like an on going buyback.

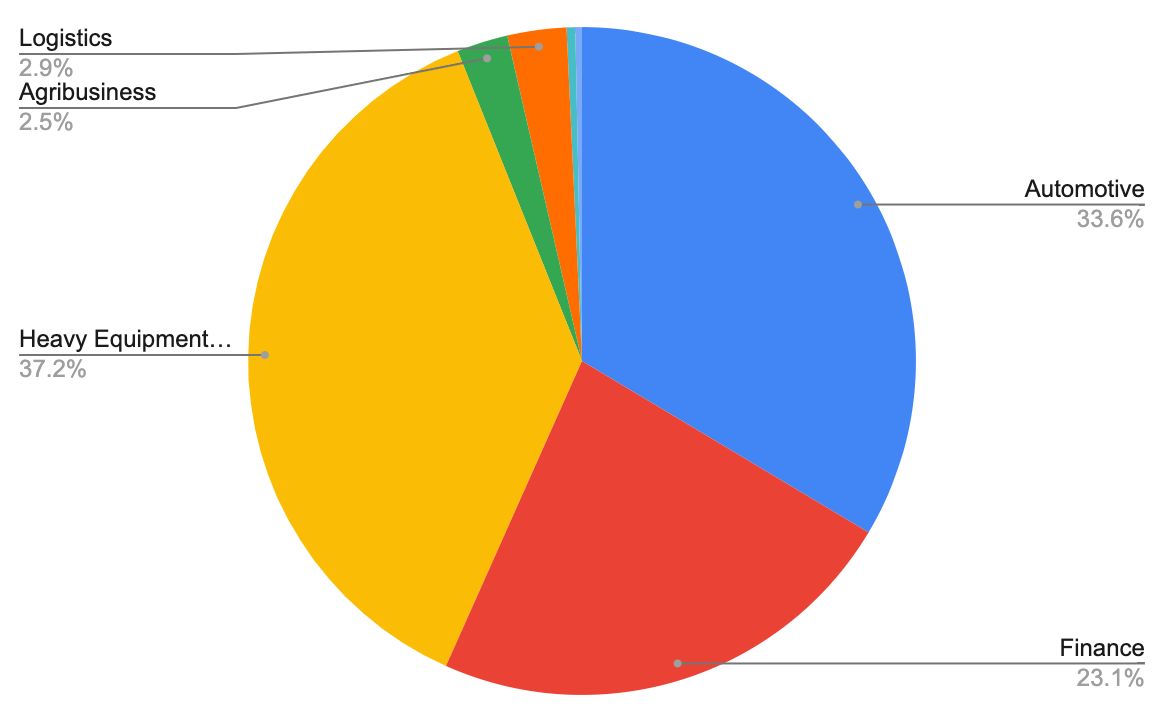

Astra - 42.4% owned.

Astra is a leading Indonesian conglomerate with 200 000 employees and 291 subsidiaries.

Astra underlying profit is around 33% automotive, 37% Heavy equipment, mining and construction equipment, 23% financial services (mostly financing for the two previous categories), and the rest is logistic, agriculture, and property.

1-Automotive:

Astra is one of the largest automotive groups in Indonesia. It participates in the full automotive supply chain, including manufacturing, distributing, retailing and aftersales of vehicles, the manufacturing and distributing of automotive components, as well as the developing and operating of automotive-related digital products.

Astra started in automotive as a trading company. This remains a very important segment.

It manufactures, assemble, distributes, and owns dealer networks for Toyota, Daihatsu, Isuzu, Peugeot, UD Trucks and Honda motorcycles. It is also the manufacturer and the retailer of BMW and Lexus automobiles. Being a local manufacturer is kind of better because you do not have all the R&D cost of a classic car company and can benefit from the development made by the parent company.

In 2023, the Automotive segment sold 561 000 cars and 4.9 million motorcycles. The company does not disclose the profit between cars and motorcycles, but I can see from their websites that the cars cost usually 10 times more Rupiahs than the motos.

Therefore, with the volume above also being ten times more motos, the division must be pretty balanced between the two types of vehicles.

The group sells mostly combustion engine cars but also EVs. “Currently, the Group markets 6 BEV car models and 13 HEV car models under the brands Toyota, Lexus and BMW; while AHM markets one BEV motorcycle model, EM1e.” (AR 2023)

The main business in cars is Toyota. Astra enjoys over 50% marketshare in Indonesia.

Then we have Daihatsu.

Isuzu

PT Astra Honda Motor (AHM) was established by Astra and Honda Motor Co. as a company that manages the production and marketing activities of Honda motorcycles in Indonesia. In South East Asia, people use motos and scooters much more than cars, and the lower price point, the need for transportation makes this business quite resilient and defensive.

There is also an automotive component division with a small contribution.

2-Finance:

The majority of the profits from that segments are related to automotive and motorbike sales financing, as well as heavy equipment financing. this segment will depend on these two businesses and the macro economy.

Astra Credit Companies (ACC) Group comprises three multi-finance companies: PT Astra Sedaya Finance, PT Swadharma Bhakti Sedaya Finance and PT Astra Auto Finance. It is focusing on automotive and well as heavy equipment financing. In 2023, it financed 200000 units from 76 branches.

Toyota Astra Financial Services (TAF), has 40 branches and financed 157000 units in 2023.

Federal International Finance (FIFGROUP) is the same but for Honda Motorcycles from 288 branches and many more outlets. This group does not only finance motorcycles but also general loans for other purposes. It had 3.4 million contracts in 2023. It is focusing on expanding to micro financing and business credit.

Surya Artha Nusantara Finance (SANF) SANF’s business portfolios currently comprises heavy equipment financing, truck financing and productive financing for small and medium enterprises, and is a Joint company with Marubeni Corportation (Japan). It financed 3000 units in 2023.

Komatsu Astra Finance (KAF) is a Joint Venture with Komatsu Indonesia. KAF is a captive financing company, which supports Komatsu heavy equipment sales in Indonesia. It financed 800 units in 2023.

Apart from that, there is an insurance and banking operation. The Indonesian market has low penetration rates for insurance and banking, so I would consider these businesses good quality.

Moving to Insurance;

PT Asuransi Astra Buana (Asuransi Astra) is a general insurance company established as the Main Entity in the Astra Financial Conglomerate, which oversees all Astra Group’s financial services companies. It has Motor, Commercial and Life insurance in quite even proportions, from 29 branches, and had 18.4 Trillion Rupiah in assets, or about 1.1 Billion USD.

PT Asuransi Jiwa Astra (Astra Life) is a life insurance company delivering the mission of “providing peace of mind and prosperity to the people of Indonesia.” It has 7.5 Trillion in Assets or 460 million USD. The products are distributed online or through a partnership with Permata Bank.

PT Bank Jasa Jakarta (BJJ) has been operating for about 40 years and serving as partners to customers in providing banking solutions. In 2022, BJJ was acquired by Astra Group. Following the acquisition, the strategic focus in 2023 was directed towards accelerating the digital transformation

The Bank has 13 branches.

in 2023, Astra launched a digital bank, Bank Saku out of PT Bank Jasa Jakarta, attracting 100 000 customers.

BJJ had 11 trillion Rupiah in assets, and was loss making in 2023 due to the digital bank launch costs.

3-Heavy Equipment, Mining, Construction & Energy:

Here, equipment sales and rental is a good business selling to the natural resources industry. The mining segment consists of some coal, thermal power, nickel, gold mining as well as mining contracting services.

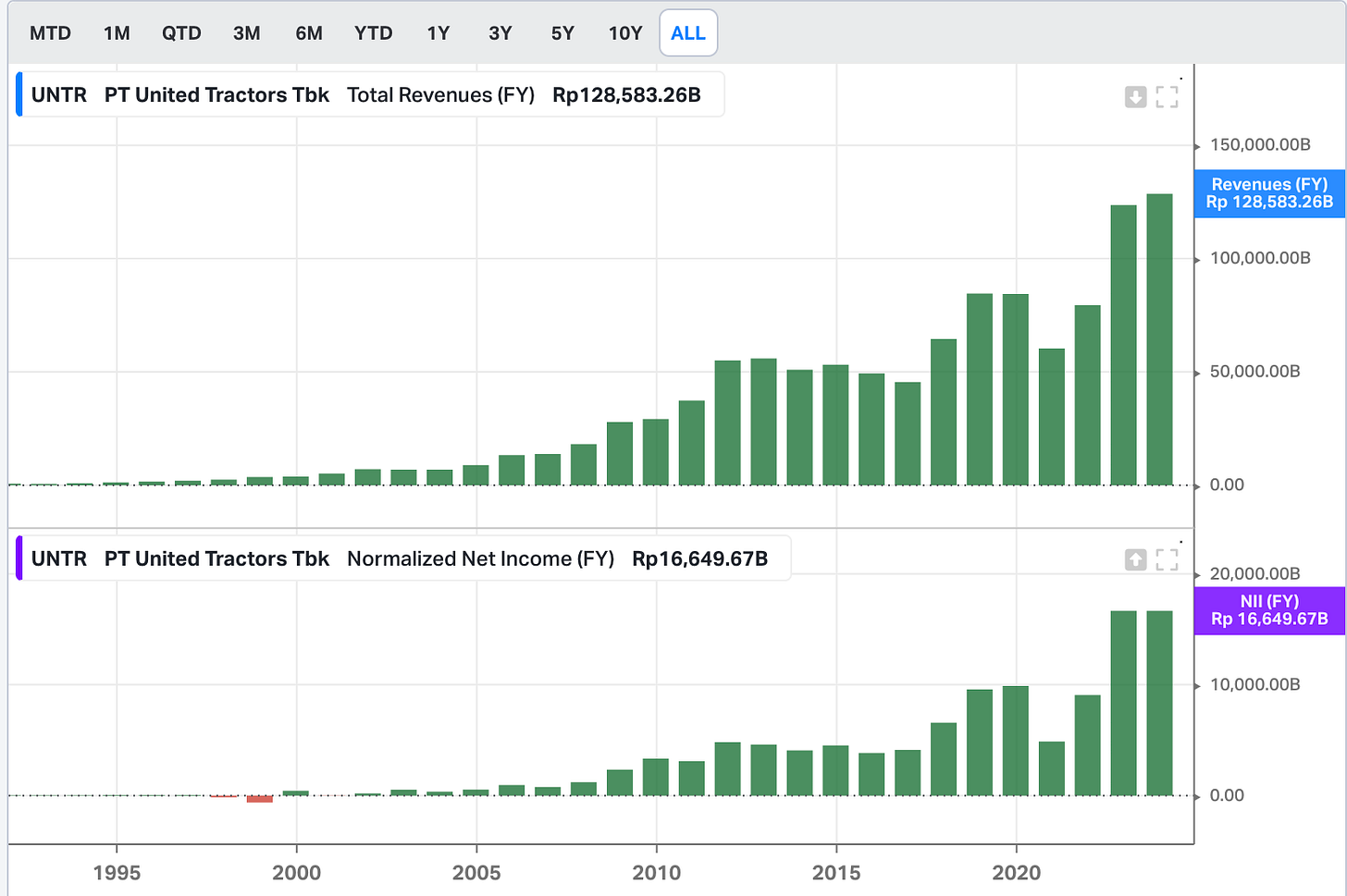

PT United Tractors Tbk (UT) is a subsidiary of Astra Group with 59.5% ownership. UT conducts five business segments, namely: Heavy Equipment, Mining Contracting, Mining (Coal, Gold and Other Minerals), Construction Industry and Energy. UT shares are listed on the Indonesia Stock Exchange. it has been a long term compounder.

UT has been the sole distributor of Komatsu heavy equipment in Indonesia since 1973. UT provides other products from Tadano (crane), Bomag (vibratory roller), Scania (bus and truck) and UD Trucks. Scania bus fleet currently contributes to the modernization of public transportation systems in various regions of Indonesia.

1/3rd of the heavy equipment segment revenue is composed of maintenance services. In total this made 36 Trillion IDR in revenues in 2023.

Mining Contracting segment is operated by PT Pamapersada Nusantara (PAMA) and its subsidiaries. In total this made 54 Trillion IDR in revenues in 2023.

Mining Segment - Coal mining segment is operated by Turangga Resources, whose shares are owned by PAMA and UT. In total this made 30 Trillion IDR in revenues in 2023, with 20 years of reserves.

Mining Segment - Gold Mining segment is managed by PT Agincourt Resources (PTAR) and PT Sumbawa Jutaraya (SJR). PTAR operates the Martabe Gold Mine in South Tapanuli, North Sumatra, with a valid contract until 2042. Meanwhile, SJR, operating on Sumbawa Island, West Nusa Tenggara, is currently in the stage of developing production facilities and infrastructure. SJR is scheduled to commence production in 2024. It made 5 Trillion IDR in revenues in 2023.

Construction Industry Segment. The revenue was small at 2.2 Trillion IDR in revenues in 2023.

Energy Segment. In 2017, UT ventured into Energy Segment as part of its expansion and diversification strategy. The initial step in UT’s energy business involved its participation in the consortium PT Bhumi Jati Power (BJP) to build Jawa-4 Power Plant (Tanjung Jati B Unit 5 and 6), a 2x1,000 MW facility in Jepara, Central Java. This power plant has been in commercial operations since late 2022. BJP consortium comprises Sumitomo Corporation (50%), PT United Tractors Tbk (25%) and The Kansai Electric Power Co. Inc. (25%). This is a new segment with challenging profitability. In 2023 it made 15 trillion IDR of revenues, down from 2022.

Agribusiness: Palm oil.

Infrastructure: Growing from a small base, with toll roads, logistic centres, including close to the new capital city being build in Indonesia. In this segment we also find pre owned car sales websites and branches, notably OLX with 9 million active users. Astra is focusing on growing this segment.

Technology is a tiny business.

Property is a very small segment with leasing and sales, inspired probably by Hong Kong Land.

For Astra, it is really about Automotive, Financial services and Heavy equipment.

Infrastructure and Logistic is the new promising growing segment with nearly 50% growth in 2023.

10% of the market cap is also covered by investments in GOTO and Halodoc, tech companies that are important in Indonesia, in transportation and telemedecine but probably not yet contributing to earnings.

Initiatives

Now, looking at the capital allocation of Astra. Firstly the company pays a large dividend to the parent company Jardine Cycle and Carriage. There are also constant new investments at Astra (2023 annual report).

There are also investments in mining and energy, which are harder to value for me.

There was also a new further investment in Halodoc, a telehealth company.

We can see that Astra keeps investing in further businesses, either good assets, technology startups, or energy. We do not have the details on the valuations bought but it should be reasonable over the years, and it is Indonesia. Astra has a digital focus for its strategy, and will invest in more startups and technology products over time.

Astra is very very long term focused, it is a tortoise slowly expanding and I like this.

Earnings overview

Astra is a decent company that generated 7-12% ROIC in the past three years.

It’s revenue and earnings are highly correlated to emerging markets and Indonesia GDP. Over the long term, Astra is a compounder, but goes though periods of stagnation.

In H1 2024, Astra’s earnings were down 8%, driven by heavy equipment, energy and construction, while Infrastructure kept growing at 24%.

Market.

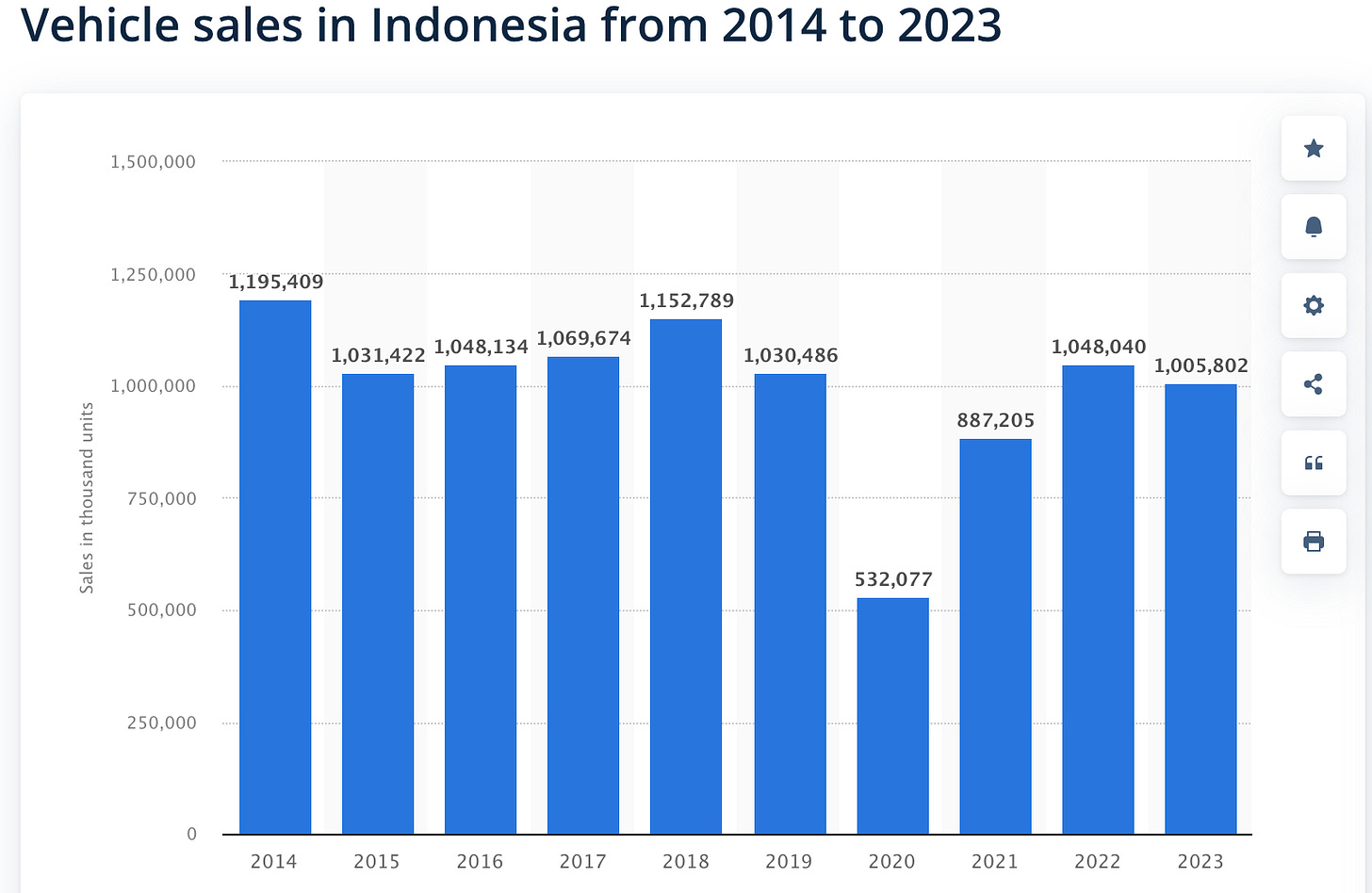

The main market to watch here is the Indonesian Automotive market. It has not grown in 10 years, but has potential to grow more, as Indonesia is way behind western countries in vehicle sales. It can also grow in value. Revenue is expected to show an annual growth rate (CAGR 2025-2029) of 1.83%.

Note that in South East Asia, there are more Motorbike sales than cars. This could be a potential higher value shift for Astra in the future as more people turn to cars when their income increases, or to higher value cars.

Despite the entry of BYD in Indonesia, so far Chinese EV makers did not make a huge dent in market share.

There is also a strong government push for supporting electric vehicle industry in the country.

Risk: BYD is busy building a large Factory in Indonesia, so I think that there is a risk to Astra and Jardine. It is good to see them continuing to invest in other businesses that are not automotive but higher quality.

The commodity sector is very important in Indonesia’s economy. It will reflect on the Heavy equipment and mining sector, but more broadly on the Finance and Automotive business.

United Tractors benefits from rising demand for minerals, as well as infrastructure projects in Indonesia.

Its business is closely linked to commodity cycles. Astra overall is linked to the commodity cycle, like the rest of Indonesia.

Despite issues with BYD coming to the country, the main picture remains positive over the long term. Other segments should be able to compensate any loss of value caused by BYD competition.

Conclusion for Astra

Astra is Listed in Indonesia and the OTC market.

This is about 50% of Jardine Matheson’s Profit, and represents a long term investment in Indonesia.

It has a forward P/E of 6 and a 10% dividend yield.

This is pretty compelling on it’s own, in my opinion.

United Tractors maybe even more, with a P/E of 5.

These companies are not very accessible in terms of stock exchanges.

Both companies are set to benefit in case of commodity prices rises, possibly linked to a rebound of China or growth in India.

Going back to Jardine Matheson

In the next article of this analysis, we will get an review the rest of the business.

In the mean time I will look at some companies updates and news and see what the portfolio companies are doing.

Subscribe to the premium tier of the publication for access to all the thesis and portfolio.

Thanks!

Supporting the publication gives access to:

An archive of 20+ unique write ups. 10+ write ups a year.

Portfolio updates and movements

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

I’m afraid this is rather wide of the mark, understandable given the desktop basis of the analysis.

One useful thing the author could do is simply to examine underlying profits over the last 15 years, or look at EPS while stripping out buybacks. That will tell you the story over whether there is any deep value in the company.

From Asian Godfathers, which if you haven't read, is excellent:

"If one seeks the worst record of corporate governance in the region over the past thirty years, a serious contender has to be Jardine, Matheson... The Keswick family ... have treated minority investors in a manner that would make many godfathers blush"

The take under of Jardine Strategic in recent years does little to assuage this concern. $58 NAV, buyout price of $33.