Hello everyone !

Here comes another update.

Summary.

Newsletter update

Write ups

Company updates

Movements

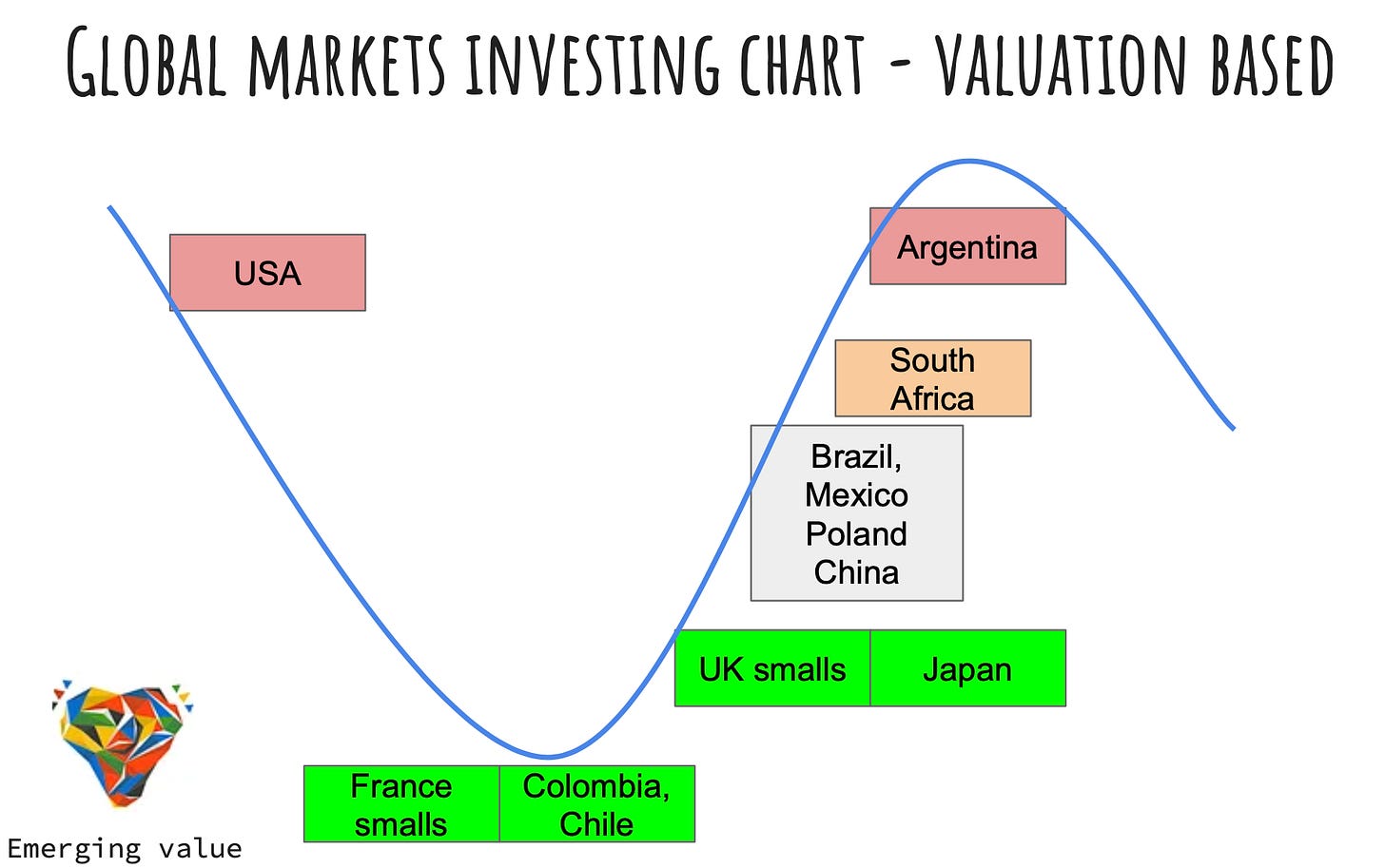

I am preparing quick thematic updates to help subscribers to understand better the opportunity landscapes. While I invest in Emerging Markets, there are moments to do so and moments to wait or focus elsewhere. I believe this will be clearer. In 2024 I flagged China, towards the end of 2024 Brazil, and this worked well.

One example is where I currently see the opportunity set. This does not mean that there are no opportunities in the USA in certain names or industries.

Updates about opportunities will come more frequently after my H1 2025 review.

I have been cleaning my watchlist and removing bad quality names and names taken private, while adding regular quality or tech names, just to have them visible if they drop to a more attractive valuation.

I have been investigating Japanese value names further, as well as beaten down quality names to expand my universe. The goal is to get more familiar with good companies and know them more.

****Sponsorship****

One example of these beaten down quality names is Eurofins, that I wrote up recently in May. Here we can see the recent buyback as well as some valuation metrics.

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too! The chart above was made with the free version. I use long term views to see book value evolution and share buybacks, as well as revenue and net income.

****

1-I wrote about a Japanese M&A Active company in a sector that would benefit from a Yen normalisation. ($)

2-I wrote an update on what to do with Glintt after a great return on this value tech stock:

3-I wrote about PayPal the Data Goldmine that would allow them increase services to merchants rather than focusing only on commissions on payments.

4-I researched Japanese trading companies under book, and wrote about the ones buying back stock. I bought one actually. I also covered quality companies in one unloved sector at the moment. I was doing the hard research work ($)

5-I wrote about a French nano cap that did not work well as a thesis, but where the value price protected the downside. ($)

Continuous compounding did a A-Z on the Japanese company handbook. He is doing the hard work too, Buffett A-Z stuff.

Cairo Capital on Jardine Matheson new “better returns” strategy with a new CEO and trading at 8 times depressed earnings. I covered Jardine this year. I am now up a tiny 7% on this position. Usually, I would not buy average quality businesses anymore, but, in the most promising macro region of the world, I like it.

Free capital with a new substack on the middle east stocks. I know, it’s a bit Scary right now, but it’s about the geopolitically stable Arabian peninsula. Give it a chance.

For me, the best article was this deep dive into Illumina genome sequencing business model. Illumina is a leading tech company, profitable and not too expensive. A rarity. But this is because the company hit a growth wall. I am not an expert in the subject and I apply a probabilistic investment framework. But having a specialist teaching you about the business is great.

Eurofins, profiled in May, is up already 27% in six months at 60€. I constantly bought over the months and the portfolio moments are opportunistic, with always a tracking position, followed by additions when there is great value. By subscribing you will get more info on these opportunities in real time. The full write up is almost always a delayed information, but providing more details.

The Saga on the CK Hutchison port sales continues with Cosco China joining the consortium to buy them, which could ease China’s reluctance to let the deal go through.

French indebted healthcare company Bastide has been firing on all cylinders, with two disposals and winning the London region.

This led to a good stock recovery YTD and a forward P/E estimated at 9. I am a bit cautious about this forward P/E ratio and I think it is not really 9, but higher.

I was correct to reinforce cautiously between 16 and 21, but I was incorrect in my earlier buys. I am observing the transformation over the next semesters, and expecting good business development.

Another Acquisition for UK Serial acquirer SDI, performing well.

African Telecom company MTN group is a bit impacted by the war on Iran, after the war in Sudan. While I don’t expect a Giant conflict over Iran or a regime change, it is tiresome, and definitely anything can happen. And tragic for everyone involved. I would prefer a democratic regime in Iran and a better economic prospect for the country, as well as peace of course.

Singapore Holding company Boustead had a great share price run, up 35% since the 26th of May with increased dividend and good backlog. And now it has announced a strategic review for some industrial and logistics assets. It seems that the company is moving towards more unlocking value.

sales

1-I have made a tracking position that did not work and exited immediately at a loss. A potential great value but a recovery that is not working out, and a management that I don’t trust. I will watch the company for a possible turnaround in 6 months to a year. I lost 0.2% of the portfolio as a result. A good risk management process with tracking positions, but also a reminder and a lesson to invest in more solid companies. The company is called Close the loop (Australia).

2-The other position that I sold at a profit was also due to some red flags (change of structure, CFO leaving, niche businesses that seem in decline, CEO that threatens media with lawsuits) posted by several people: Platform group AG. It could do very well because there is no definite proof of falsification, but with so many ideas that will do well and have less risks, and with the positive performance of my portfolio so far in 2025, I turned more conservative.

I have entered two new tracking positions in more solid businesses.

Tracking positions are a cornerstone of my strategy to improve my knowledge and experience of different industries and countries, and to understand the cycle better. Sometimes it hurts a bit, but I get smarter and better with the experience.

Adding to: three companies under ten times earnings, including a net-net and a tech company.

Opening: Tracking positions In one Japanese trading company under book, and one US listed quality company at 15 times earnings.

details below