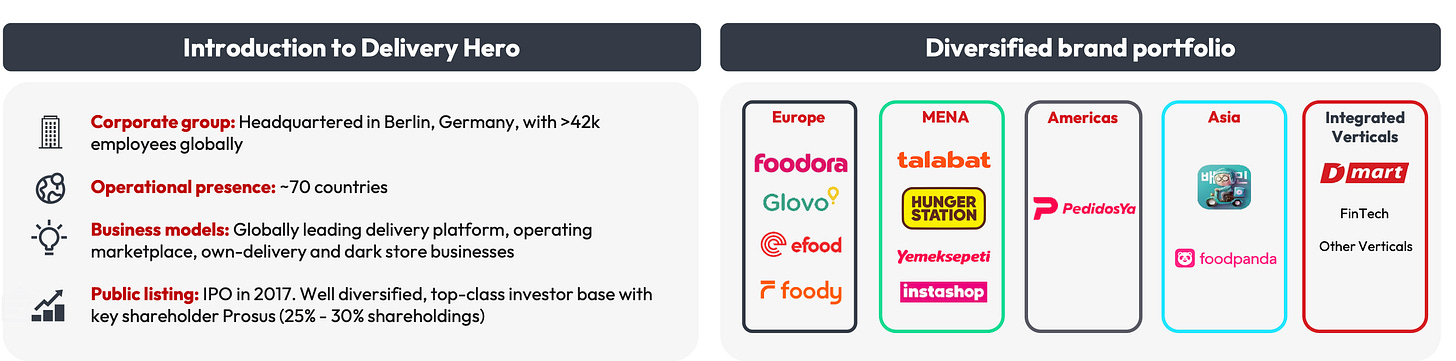

Delivery Hero is a food delivery company listed in Germany with the vast majority of earnings coming from Emerging markets of Asia. It trades under 1 times price to sales, compared to 3-6 for competitors like Grab or Uber.

Here I will present a quick article about the potential opportunity.

Share Price: 23.30 EUR

ETR: DHER (Germany)

Market Capitalisation: 6.8 Billion Euros.

I came across this opportunity as I interviewed for the company. They did not take me because I failed some Advance SQL test. Now, I am taking on another opportunity where I use AI to complete my SQL queries haha! They are a bit outdated. Also, an excellent substack investor Szew mentioned it.

History

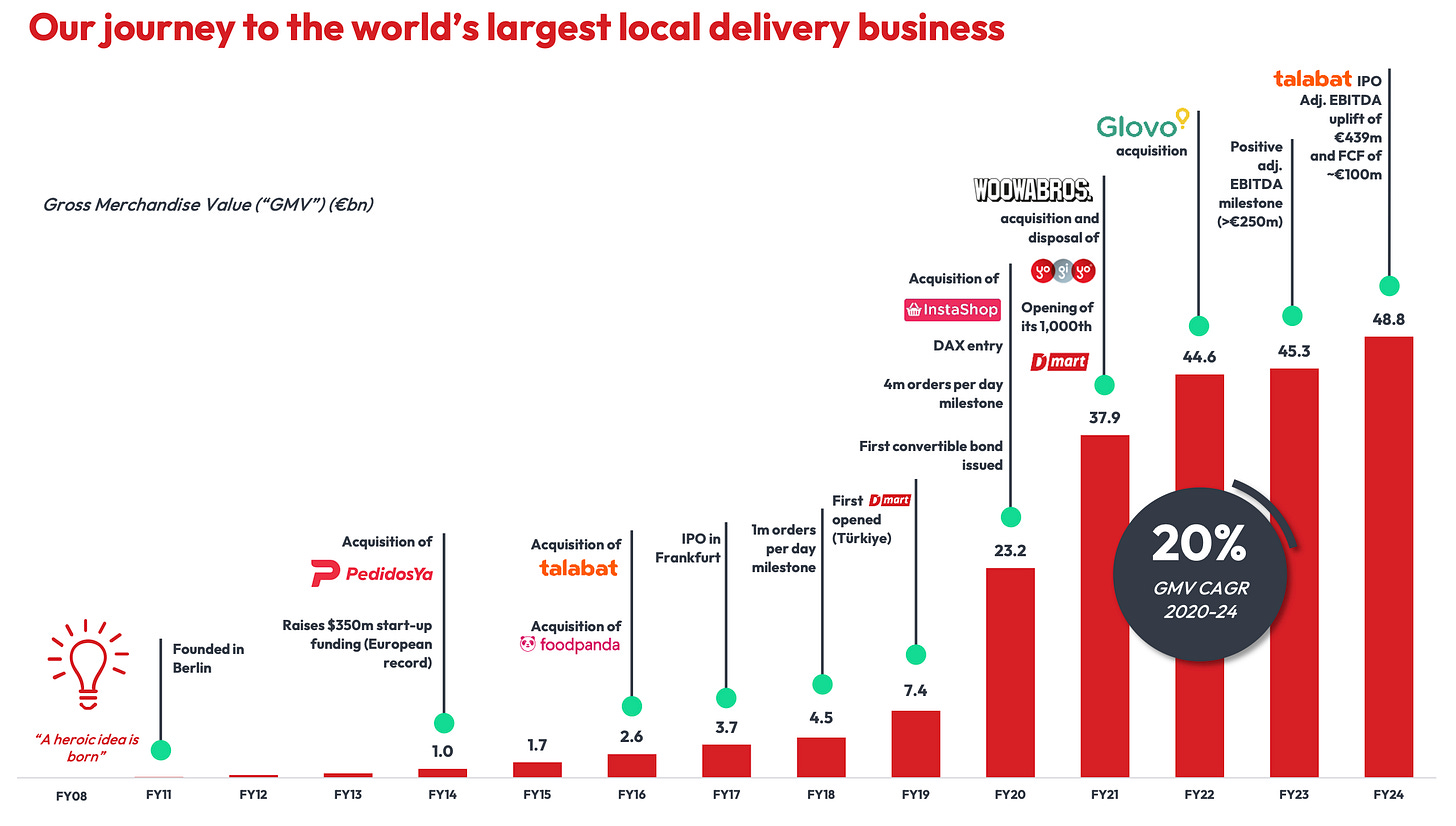

Delivery hero was founded in Berlin in May 2011. With investors money, they could expand internationally by doing acquisitions.

In March 2015, the important German startup investing company Rocket Internet bought 38.5% of shares outstanding.

Delivery Hero could then acquire a market leader in the Middle East and a Turkish leader - Talabat.

It acquired Foodpanda in Asia in December 2016.

Delivery hero was listed in Germany in 2017.

In 2022, they bought Glovo, that appears to be the leader in Spain, which I used a few times.

In 2024 there was the Talabat IPO, the Middle East leader.

Business overview

We have the typical food delivery business.

Do I need to explain how Uber eats or Doordash works? You order and a rider brings you some food. I think it’s clear.

In Spain where I live, they are leading with Glovo and I have used it a few times, but I just have a new favorite take away place (Mexican food - I love good tacos) close to my home, some good Italian places nearby so I have no need for that. For people living in areas with less restaurants, it is convenient. The experience is not differentiated in my opinion.

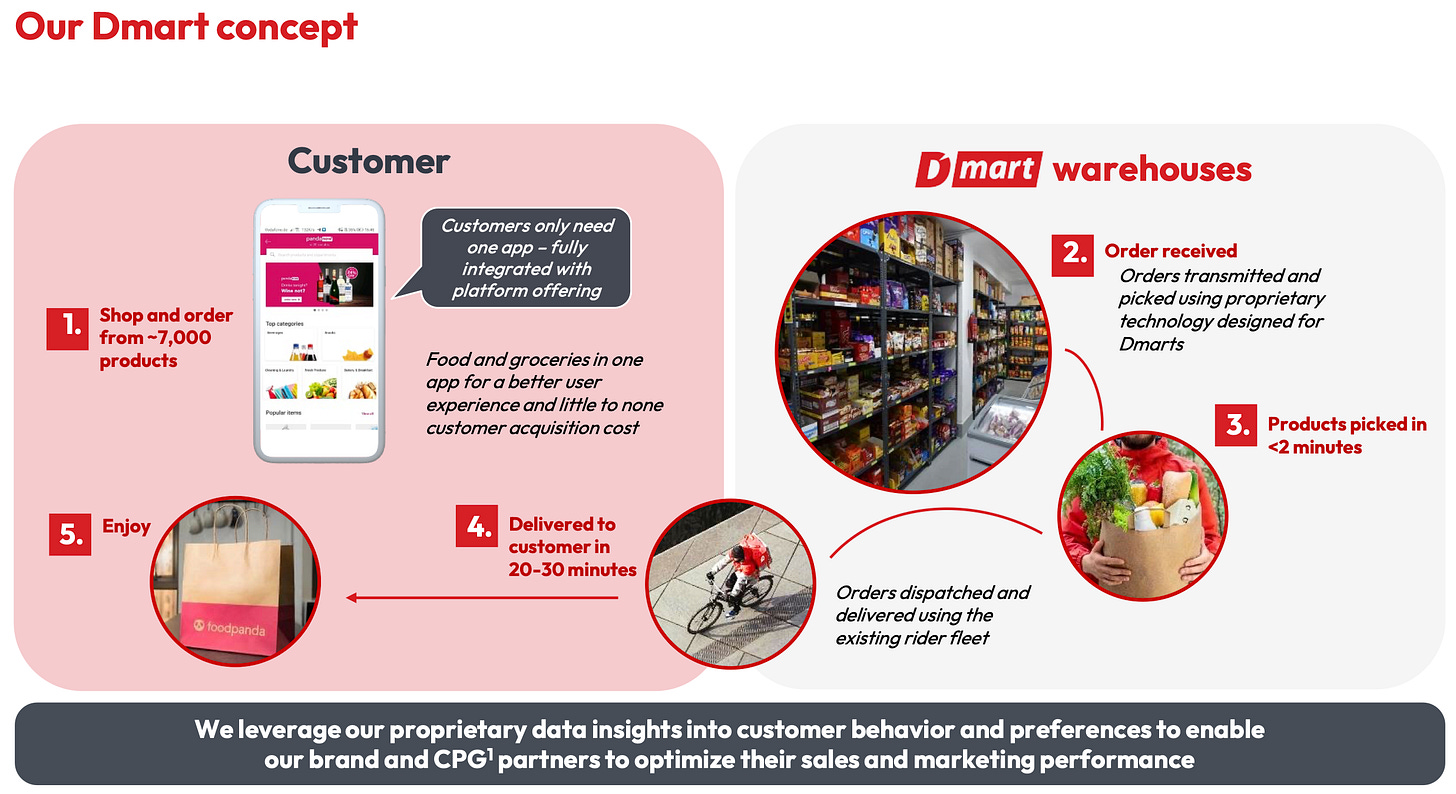

The item delivery business is where you order some items from a supermarket. Here, there is something unique and innovative that you can order items from a “Dmart”, a supermarket owned by delivery hero and designed and stocked only for delivery.

The Dmart concept is really something interesting as it can convert existing customer into grocery shoppers and increase sales and profitability.

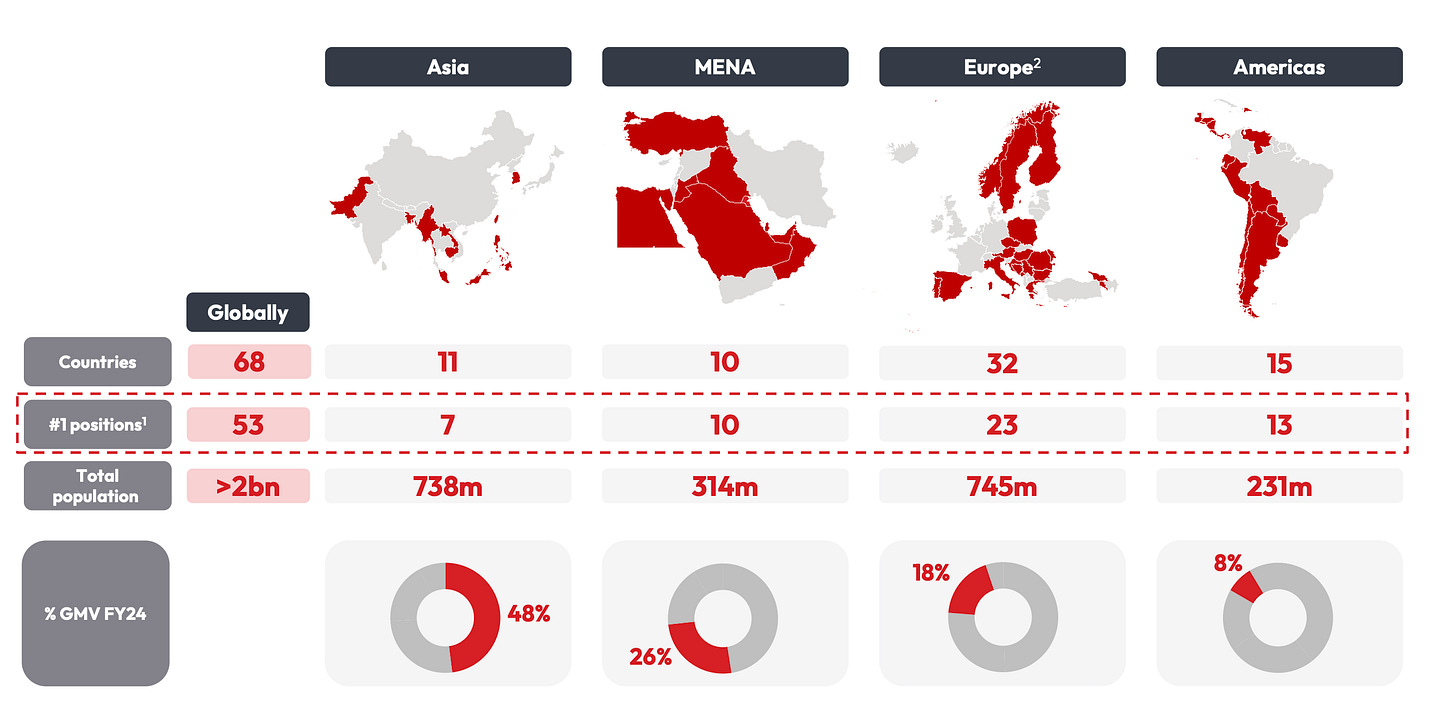

This world map of locations where they are number one is strange, they are number one in mostly second rate countries except MENA (no offense) and they are either absent or not the first Western Europe, Brazil, Mexico, China, USA and South East Asia.

Only 18% of the GMV comes from Europe, this is really an Asian play.

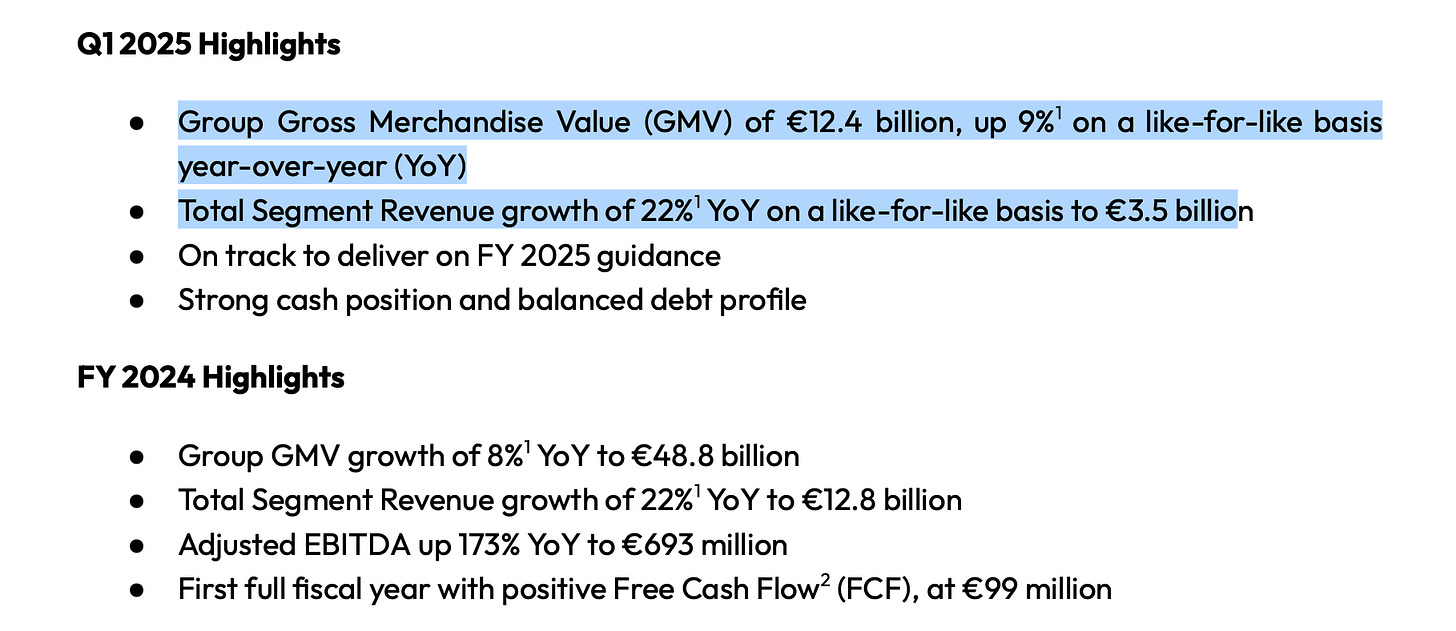

The latest results showed good GMV and revenue growth pushed by advertising.

Strategy

The strategy is to expand profitability with ads, order density, and dmart ordering.

-Advertising.

To improve profitability, ads are perfect:

The ads are paid to get top of the frontpage of the app, and also for notifications.

(PayPal could scale to similar ads revenue with some effort - see)

Advertising is now 2.5% of GMV, and the long term target is 4% of GMV, providing upside but somehow limited from there.

Too much advertising could also start hurting the customer experience.

-Dmart:

continue to roll out Dmarts and improve that business described above is an opportunity.

Management and Shareholding

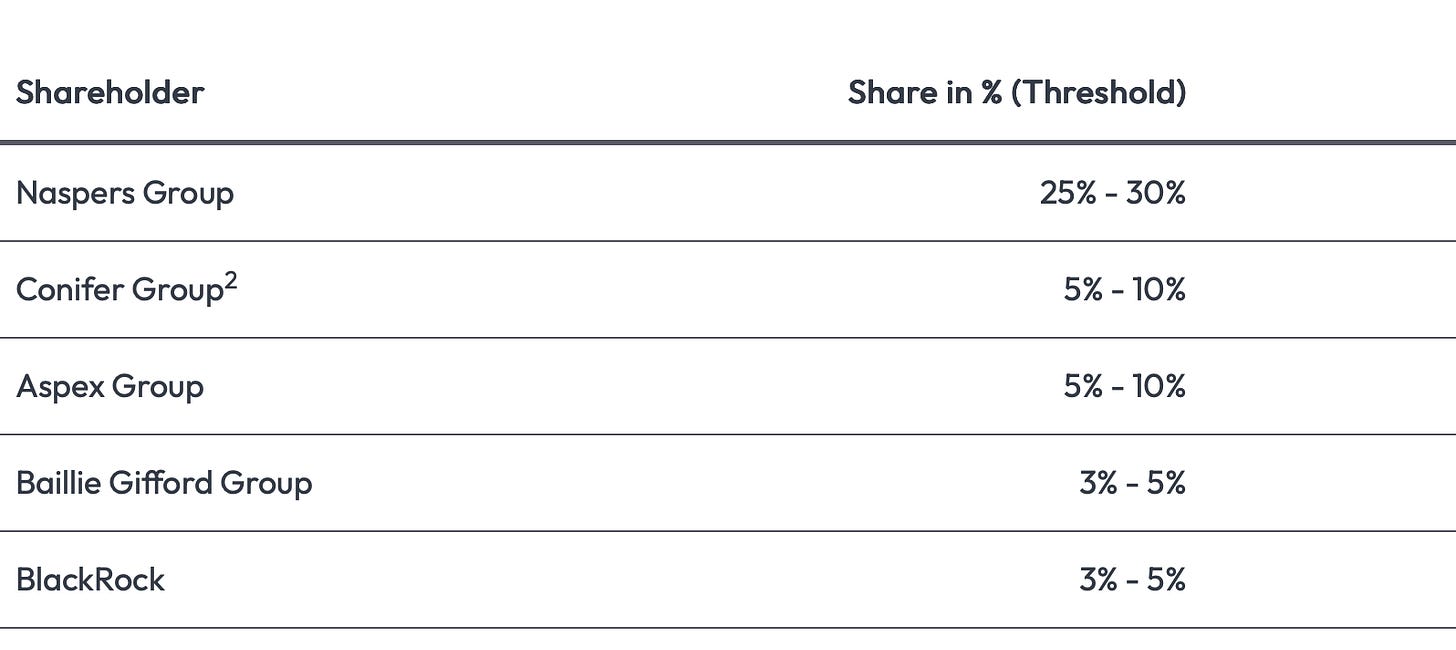

The shareholding is no longer controlled by the founders, with Naspers (Prosus) controlling 25-30% of the shares, as well as other groups.

Well, it’s interesting to find at least one subsidiary of Prosus that I like.

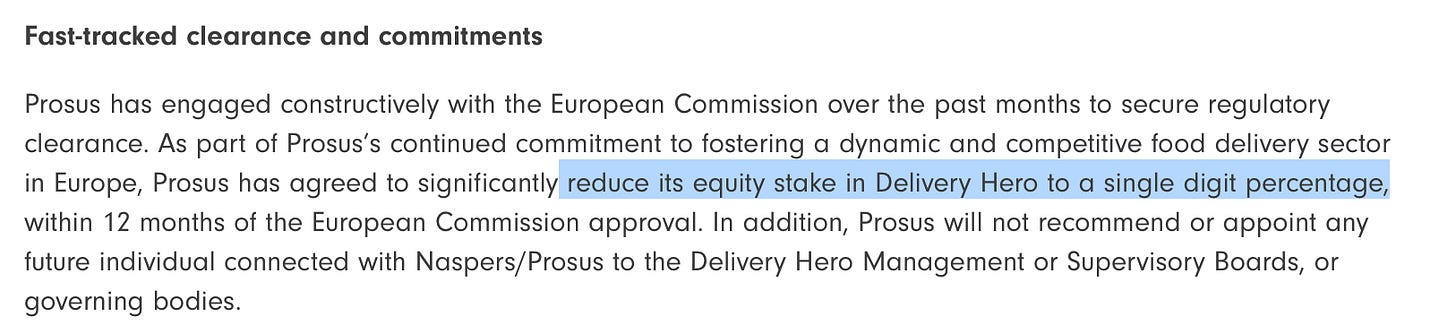

But wait.. Prosus just got cleared to acquire competitor Justeat, and will have to sell down their share in DeliveryHero!

My first question is what do they See in Justeat that is not in Delivery Hero?

Maybe it could be that they cannot buy all of Delivery Hero. Or Maybe they will try to keep some delivery hero and reduce competitive pressure, benefiting on both sides. Or maybe, they are not doing a great decision.

But this is a orange flag, and the selling pressure, if publicly sold, could weigh on Delivery Hero.

The CEO is Niklas Östberg, and it’s great to see the founder still in place after such ownership dilution.

The CFO, Marie-Anne Popp, has great experience in Emerging markets and corporate roles:

“She was SVP Corporate Finance at Adidas, following 19 years at General Electric, including as CFO Emerging Markets and Head of Project Finance for the MENA region.”

Risks

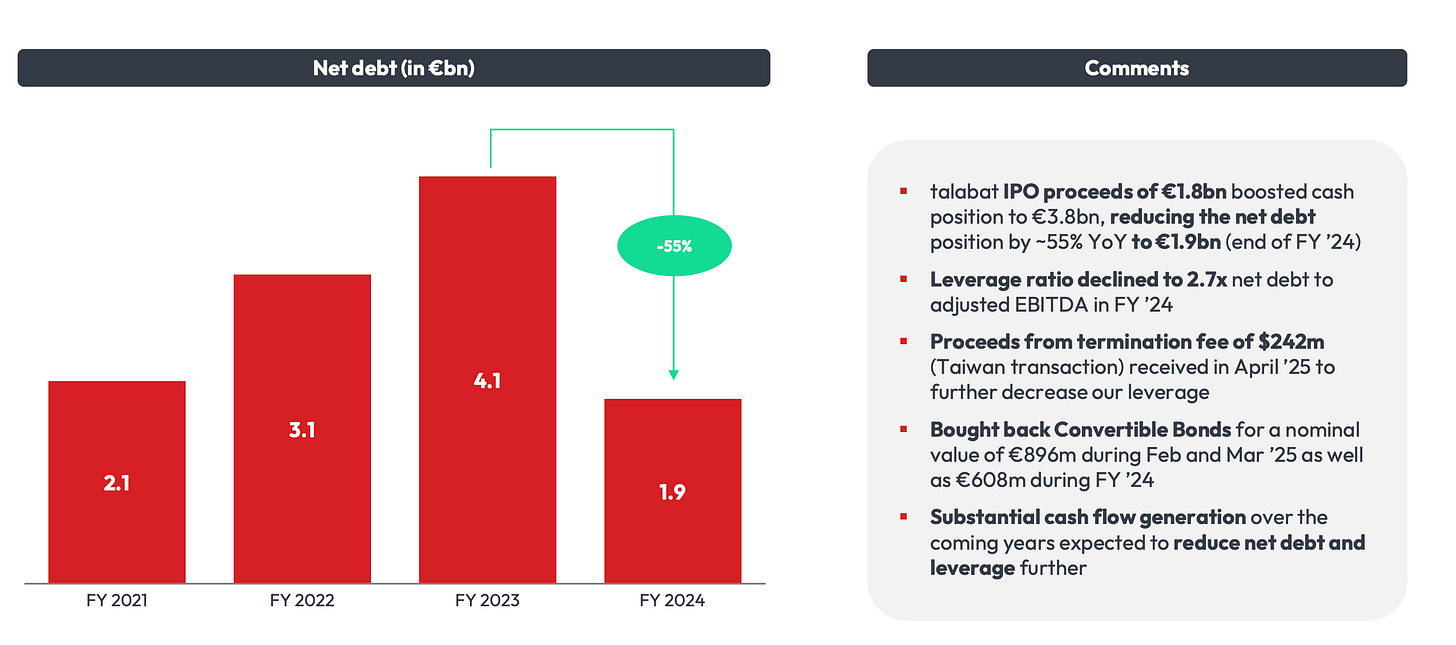

-A big downside risk was the net debt.

The IPO of Talabat allowed net debt to be reduced and consequently the leverage is under control.

-Price wars in Asia where there is historically strong competition.

-Playing against Grab and Uber who may have more developed apps.

Valuation

-This is where Delivery Hero is particularly interesting.

the EV/Sales is 0.7, with a potential for that to decrease as the company will pay down debt. Peers trade at 3-6 times price to sales.

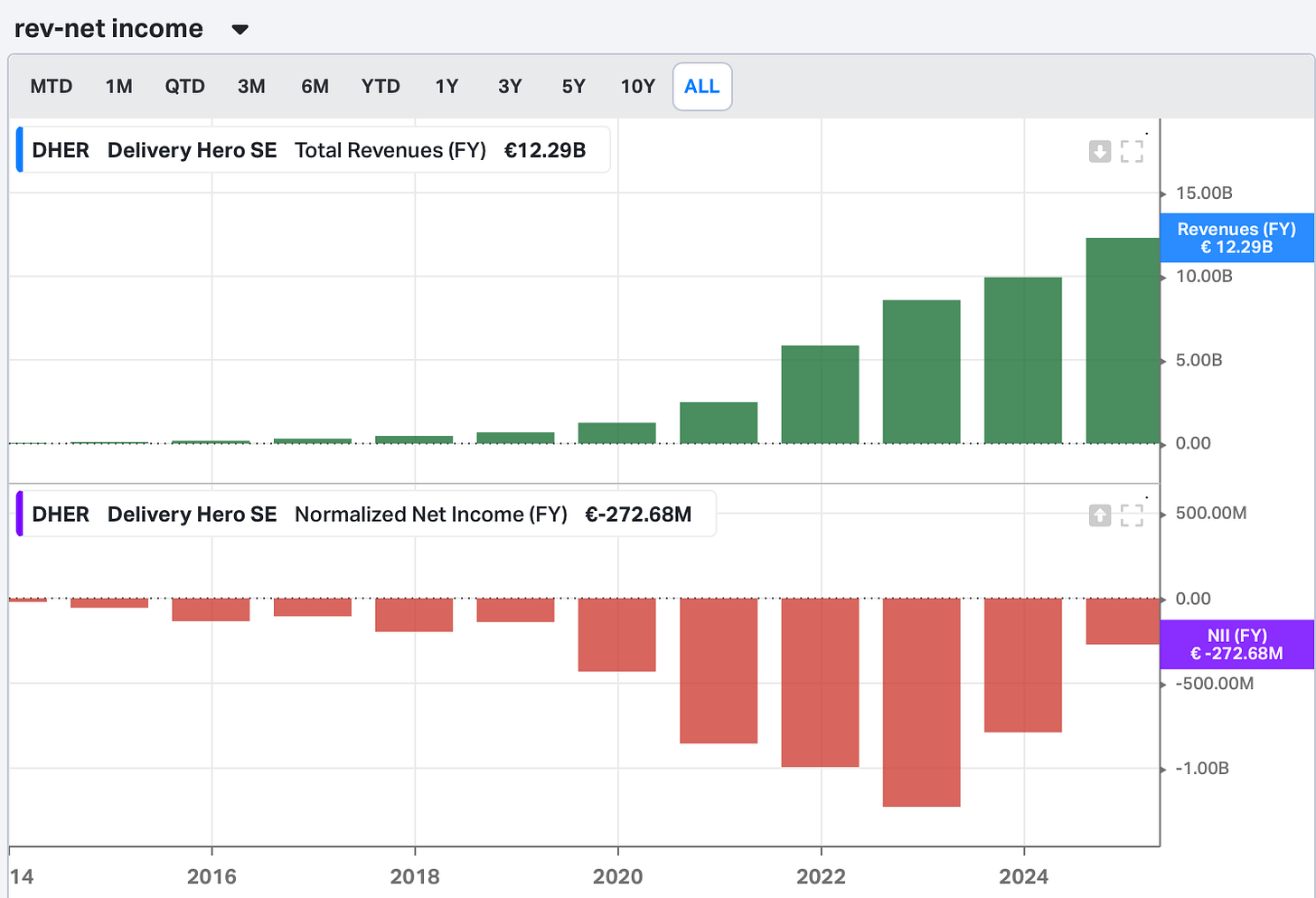

Operating leverage is kicking in with Sales growth reducing losses.

******

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too!

******

The company aims for FCF margins of 3-6% in 2030, with maybe €18B of revenue, that makes €0.5 Billion to €1 Billion of FCF by 2030. On a Market cap of €7.4 Billion Euros.

EDIT: commenter Jake Allen corrected in comments that DH aims for 3-6% FCF margin on GMV not Revenue. This is more bullish. Check the detailed comment below

Moreover, analysts estimate that the stock earnings are going to grow in 2025, 2026 and 2027, trading at 10 times 2027 earnings.

Not a basement bargain, but attractive if the business keeps proving a solid growth asset.

The negative catalyst of Naspers/Prosus selling Delivery Hero could give us more attractive prices.

What the stock price, if the selling pressure happens, we could go below 10 times 2027 earnings.

In the end, I did not make space for Delivery Hero in my portfolio, favouring more established or cheaper businesses, but it’s something to watch.

Delivery Hero is an idea outside the beaten path, but important if you cover Emerging Markets.

To find the full portfolio and list of other hidden gems ideas, potential future winners or past multibaggers, upgrade to the premium level below, which offers a large discount to other newsletters (for the moment).

***

Also, be sure to review my Payment newsletter! Part 2 of the Visa review is coming soon.

***

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

DHER trades at 6.9x 2025 EBITDA / 8x 2025 (EBITDA - SBC) / 8.5x 2027 (FCF - SBC)

DASH trades 41x 2025 EBITDA / 70x 2025 (EBITDA - SBC) / 31x 2027 (FCF-SBC)

Same revenue growth, and as they can invest more profits - and if they can turn around Korea they will have higher growth (growing revenue 29% outside of Asia). DHER has better ad-tech, grocery, quick-commerce penetration. Their margin improvement when they inflected from negative EBITDA was twice the delta and faster than Doordash, and I believe they have a much higher long-term growth potential. Their new customer acquisitions were up 16% in Q1, and I looked back, and this is the best leading-indicator for growth. And that 2027 FCF estimate for DHER assumes only Talabat is FCF positive and DHER only grows revenue 11% (ridiculous), I highly doubt that. DHER has beat estimates the past 3 years and will again in 2025.

Talabat (60% of their Middle Eastern GMV, estimated 17.5% of group GMV in 2025) just posted 190M FCF in Q2 (1.5M SBC), growing revenue 35%, likely at a 900M FCF run-rate by the end of year, SBC well-under 10M annually. They are already at a higher run-rate than DASH was in 2024 when you exclude SBC. DHER EV is only 28% higher than their 80% Talabat stake (6.6B vs 8.25B EV), and Talabat is undervalued, Morgan Stanley sees 90% upside, so do most analysts. Their margins are so good because of the percent of groceries, advertising, and there are more orders per capita as its a more mature market. DHER's tail markets average 0.1x orders per capita per month, if this reaches 0.5x (compared to their top 10 markets at 1.3x) that will add an incremental 150B in GMV, quadrupling the size of the business. And groceries is a 12T TAM worldwide, <1% online, and is rapidly growing across DHER's entire portfolio, where they're outgrowing the market growth rate by 2-3x.

Uber offered 950M for Taiwan (and invested 300M into newly issued shares at a 40% premium, paid 250M break-up fee which is not yet reflected in DHER net cash balance!), Grab offered ~1B for 4 of their Foodpanda countries, leaving Pakistan, Hong Kong, and a few others. So the market is assigning a negative value to Glovo (7B GMV, profitable), PedidosYa (3-4B GMV in 2024, #1 in 13 Latam countries), Hungerstation (130M EBITDA), Baemin (500M+ EBITDA), Yemeksepeti (#1 in Turkey), Foodora (3B+ GMV), eFood/Foody (small but very dominant and profitable), remaining parts of Foodpanda (750M+ GMV). Absolutely ridiculous.

Doordash paid 8B (2.3x GMV) for Wolt, much smaller, now 5B GMV, grows slower, less dominant than Glovo. Glovo covers a huge market and is only #2 in Finland. Prosus paid 1.8x GMV for iFood, ended up being a steal, and iFood failed expanding anywhere outside of Brazil. Hungerstation is by far #1 in Saudi, one of the best markets for food delivery in the world, Morgan Stanley thinks worth €3B. Baemin would be worth 5B at 10x EBITDA and would be the lowest ever multiple for a scaled, profitable, 60% market share food delivery company - compared to lower-market share TKWY acquired by Prosus at 14x EBITDA with no-growth and ROO at 16x (zero #1 markets) by Doordash. Uber paid 0.35x GMV for unprofitable #2 Trendyol Go in Turkey, would put Yemek at 1B+. Foodora, eFood, Foody are in very attractive European markets, likely worth 1B+. Foodpanda ex-Malaysia, Singapore, Philippines, Taiwan likely worth 500M+, PedidosYa likely 3-6B.

This is too complicated for investors to understand, so they simply pass on it. The market totally has this wrong, viewing them as undisciplined, cobbled together collection of substandard assets, over-investing - and scared over a EU fine. This is a dominant platform of leading local champions, #1 in 95%+ of their markets, and has never lost revenue in a market where they are #1. Niklas knows exactly the returns they're earning. Uber failed in 25 countries against Delivery Hero, and succeeded organically in a few outside of North America (Japan, Taiwan). Doordash has been unable to as well, only (barely) succeeding Australia, New Zealand. Meituan has taken no share from them in Saudi and in Hong Kong DHER growth improved 20pps when Meituan slowed vouchers, and Meituan is still discounting hard in both markets. Coupang, with every advantage ever seen and burning billions, hasn't even dented Baemin's profitability or revenue (9% yoy, was up 24% in 2024), and when Coupang slows their burn they will gain most of the market share back - it's already stabilizing into a duopoly - UBS, Morgan Stanley, CEO see Korea returning to growth later this year, and DHER just took back some market share there, lots of initiatives to firm up their product. Delivery Hero is the best operator in the space, in the best markets- even despite that, you simply can't take on a #1 delivery businesses anymore unless their service is horrendous, it's no longer an emerging market. Look at Uber, Amazon in the US - Uber spends multiple times as a percent of GMV on Uber Eats marketing than Doordash does, and is struggling to take any. This trend of consolidation and slowing burn is not slowing down. Getir spend 1B in Turkey and Yemek's share got cut by more than half, and a few years later the business is 80% bigger than before Getir entered. This plays out over and over again in every market.

There's a very clear path to 5-8% EBITDA margins, and their target is quite reasonable, already exceeded by Talabat - adding ad-tech (1.5-2% GMV), order stacking (1-2%), basket size (0.5-1%), cost per order reduction (0.5-1%), pricing (0.5-1%), subscription service fees (0.5-1%), to gross margins, and a conservative -9% of GMV buffer for risk, marketing, and opex. Talabat provides a 5x ROAS in 2024 for advertisers, in the US, this is more like 2-2.5x, so as restaurants catch on, this will get competed down, doubling ad-tech revenue without requiring more penetration. Even if they can run the food delivery at break-even, they should be able to get to 4% of GMV EBITDA margins from advertising, and running it at break-even likely improves growth as it makes competitors unable to compete on the only edge they have ever had against DHER - pricing.

Coupang, Grab are threats, but manageable, and likely recover when discounting slows. The biggest issue for DHER the Prosus overhang, but I think that's also the biggest catalyst, and DHER is going to buy back shares. DHER quickly inflected to profitability, rushed the Talabat IPO, paid off 2026/2027 converts at <2% rates, leaving their 9% term loan, extended maturity on a 1B undrawn credit facility, tried to sell Taiwan & Foodpanda, and built a huge cash balance. CEO just bought 3M in early 2025, first purchase since 2022. Greg Alexander (Buffett's "favorite" investor), Sachem Head (greatest activist investor in the game) have both made this their biggest position (Sachem has one bigger, but it's grown into it).

Sorry for such a long comment, just so excited to see someone write this up!

That FCF margin you have is wrong, 3-6% is on GMV, not revenue. Guiding for ~52.5B GMV this year, likely 86B in 2030 (at only a 10% growth-rate, I'd take the over), that would equate to 2.6B-5.2B FCF in 2030. Street expects they do around 575M FCF in 2026, 950M in 2027