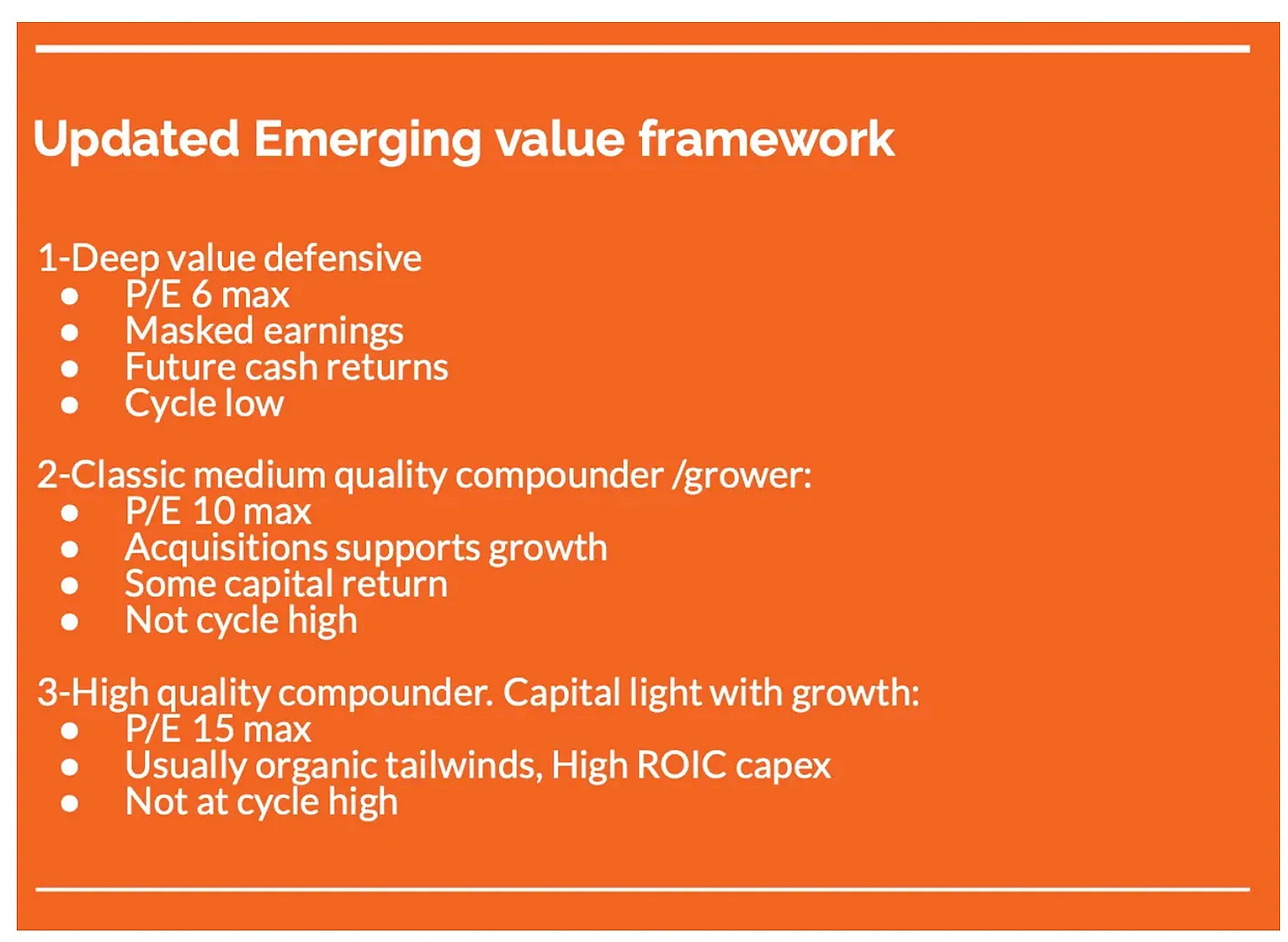

I would define a hidden champion as a mid-quality compounder.

It’s not Constellation Software type quality, it’s not Microsoft type quality. So why buy them?

It is hard to find Microsoft and CSUs at 10 times earnings. There are a few approaching this quality in frontier/emerging markets (I own them) but you cannot have a defensive portfolio consisting only of frontier markets.

A Hidden champion is still a good company that will be much bigger in 10 years.

This is the medium quality compounder. Here, there are no turnarounds again, only companies executing well. Some are higher than the P/E 10 max, but not when I bought them.

My idea is to let them compound (or not). The winners will keep making the performance and the losers don’t lose much. This is the magic of investing!

Others that could be on that list are SDI plc or Terravest, but I talked enough about these.

(SDI up 63% since everybody was skeptical of SDI. I remember all the arguments against the stock on social media)

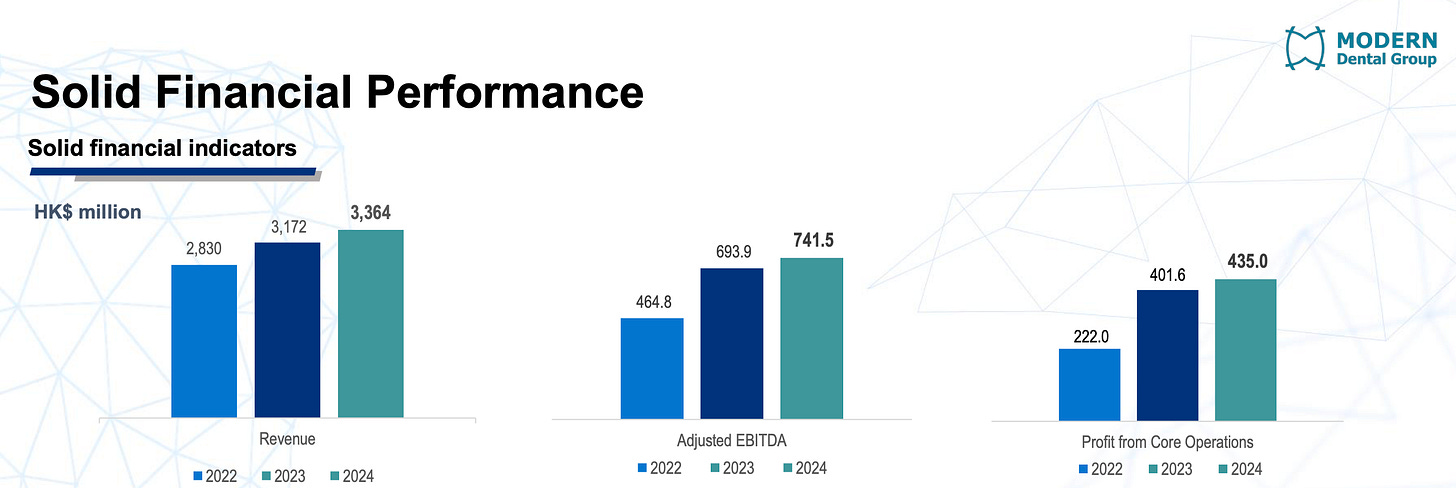

6-Modern Dental (HK 3600).

This is a dental company out of Hong Kong that sells prosthetics to a global sales network.

It was found by

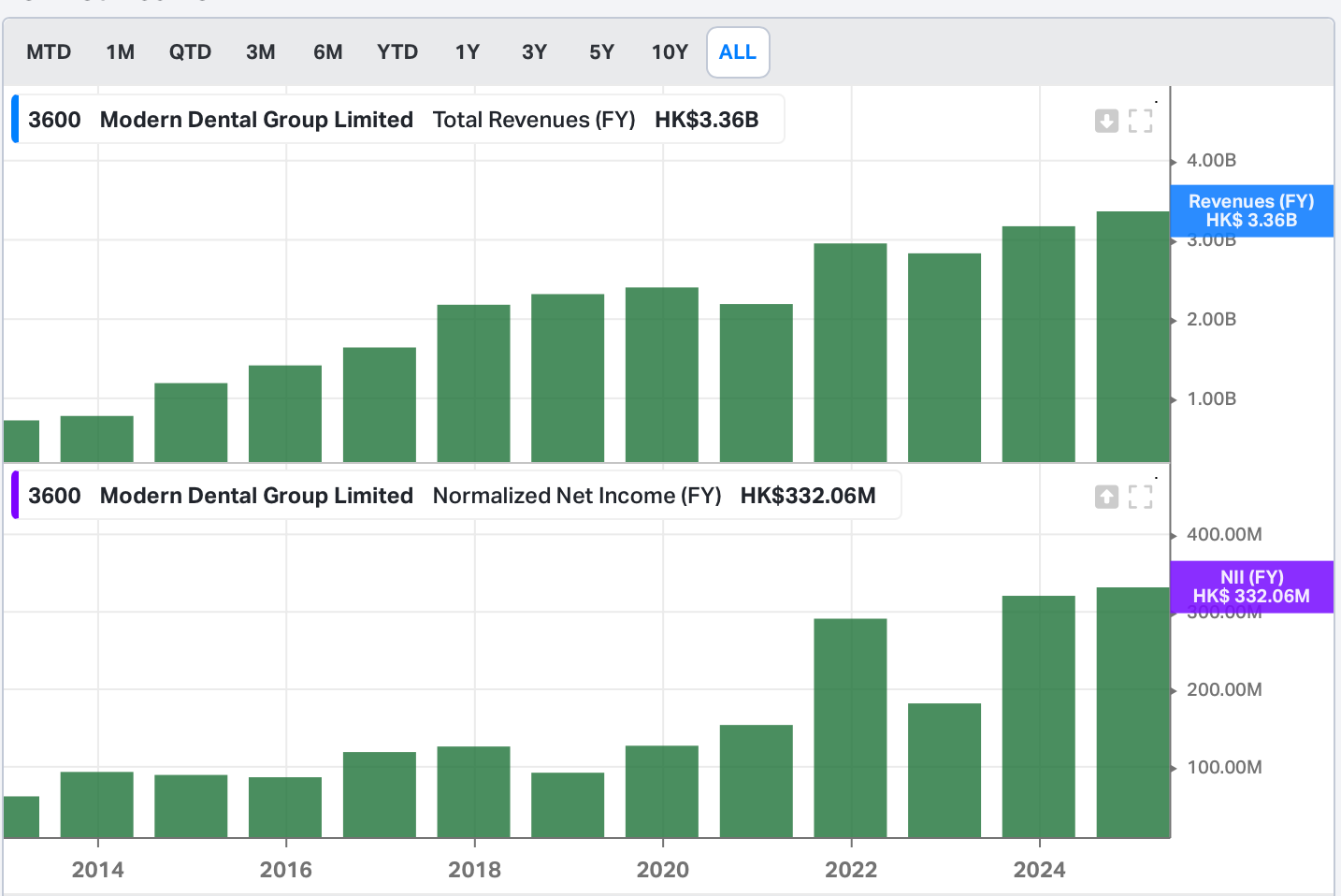

Over the past decade they grew revenue and profits at a good pace, mixing organic growth and acquisitions, with the tailwind of digitalization.

The revenue growth was not great but digitalization doubled the profit margin.

About 1.5% of sales are made by a new aligner “TrioClear”.

in 2025, they bought a company in Thailand. It has a solid growth profile.

Modern Dental is currently in a downturn. A downturn that translates into flat sales growth except for the acquisition.

Reasons are:

Procurement pricing in the China region

Dental prosthetics are cyclical and the US region is in a recession.

At the moment, Modern Dental trades at 9.2 P/E, 4% dividend and carries daily but modest buybacks.

I had some crazy trades on Modern Dental because the stock shot up post covid amid some speculation.

I had a multibagger in a few months and sold. I rebought and resold two times at a later stage. Now I am only up 24%. It was mostly luck, but luck happens when you search for it.

I stopped trading as market conditions post covid returned to normal.

I like Modern Dental because it is a company of builders, building services, products and solutions for the long term. It is only 6th because it has a Hong Kong discount which should stay for a while.

5-UNIVERSAL ENGEISHA Co (6061.JP)

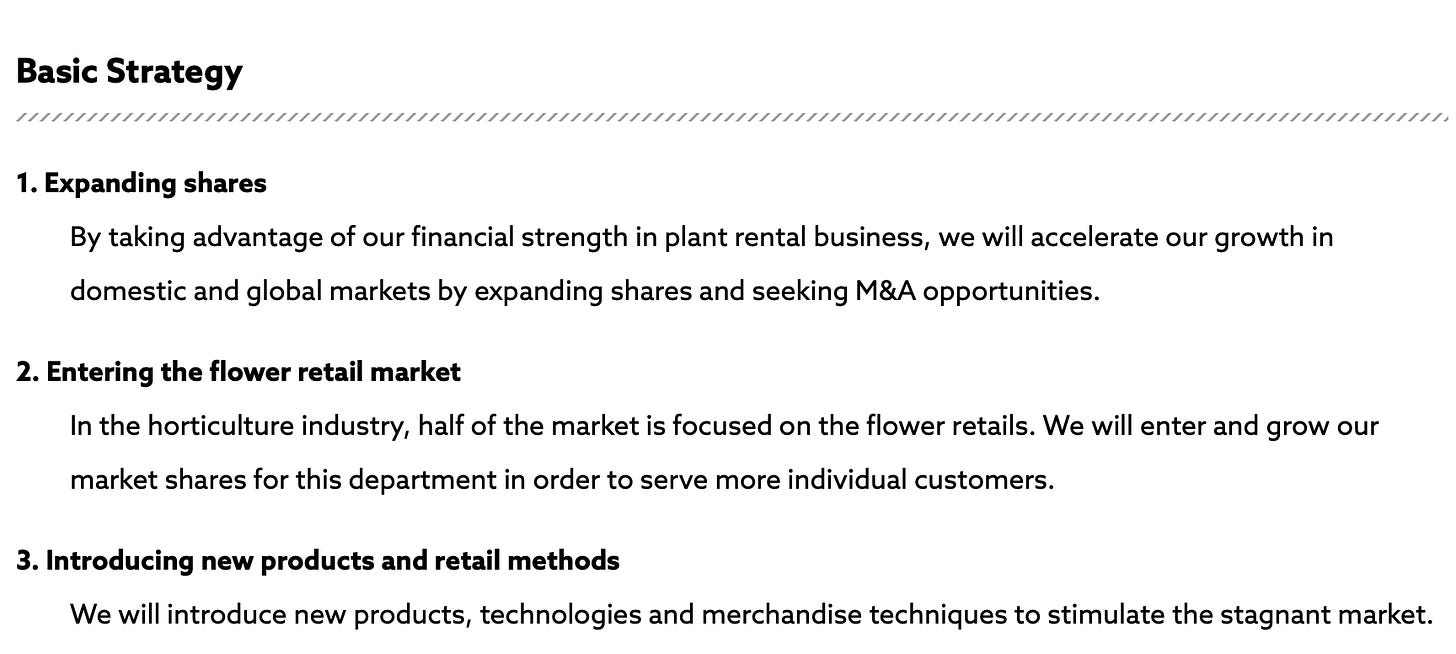

It is a weird company from Japan. It is a serial acquirer in decorating plant renting services.

Revenue and profit history is very good. We are now trading at 14.4 expected P/E for 2025. It is not that cheap, but my position is up 49%, so it was much cheaper when I bought it and shared it with my subscribers. It is a company I found on X (Thanks to the community). Sometimes it’s not only about finding but also timing the buys at a low valuation.

Plant rentals is 65% of the business. But in terms of profit, it’s more like 95%. They have only an estimated 8% market share in this business, leaving room for ample expansion

The whole sale business brings almost no profit and the retail business is loss making.

“In the wholesale business, demand for plants and other products subsided, sales fell short of plan, and the increase in labor costs could not be absorbed, resulting in increased revenue and decreased profits”

“In the retail business, revenue increased due to M&A, etc., but the operating loss only decreased due to M&A-related acquisition costs and increased labor costs”

Developments: Opening a new branch in the green business, launch new products.

The retail business is cyclically depressed, so there is potential to make extra 20% of profits here by my estimate when earnings are normalised and business rebounds.

Target: 3 Billion in net income (Doubling) by 2028. It is a company that has managed solid growth. With 18% of the market cap in net cash, there is firepower. To achieve this, the company relies on its high ROIC of 13-15%.

4-Supreme PLC (LSE)

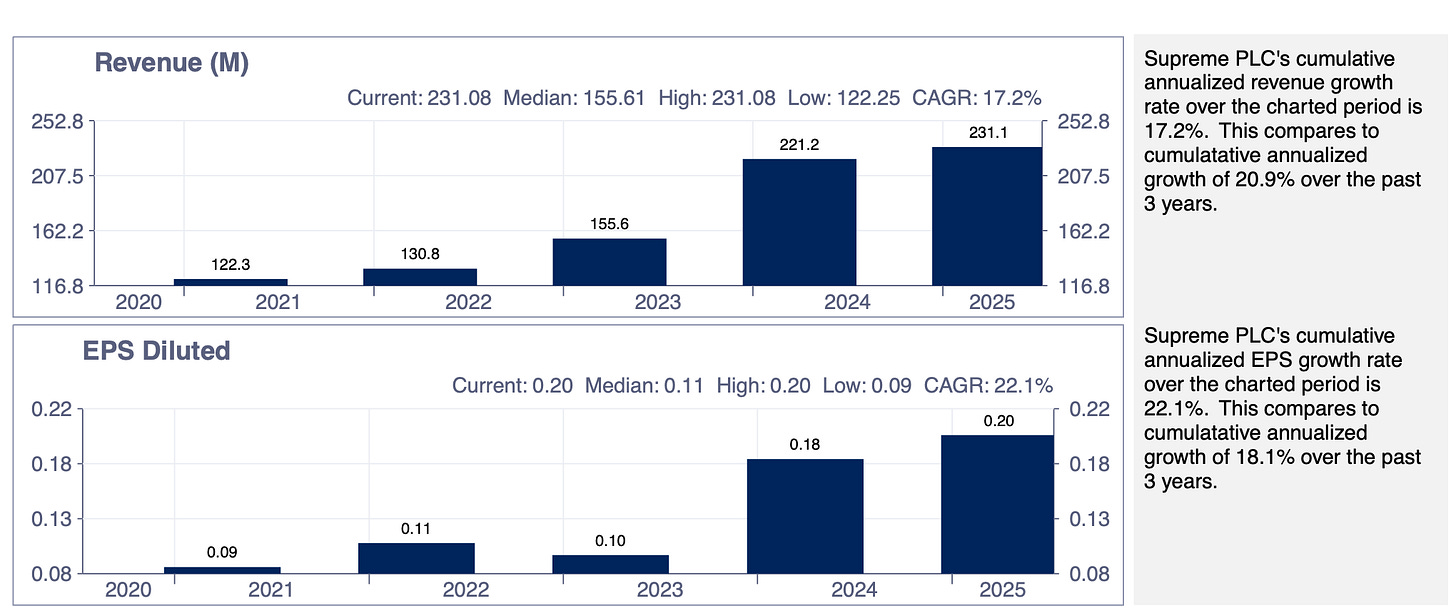

This is a company that is up 68% in my portfolio ex dividends.

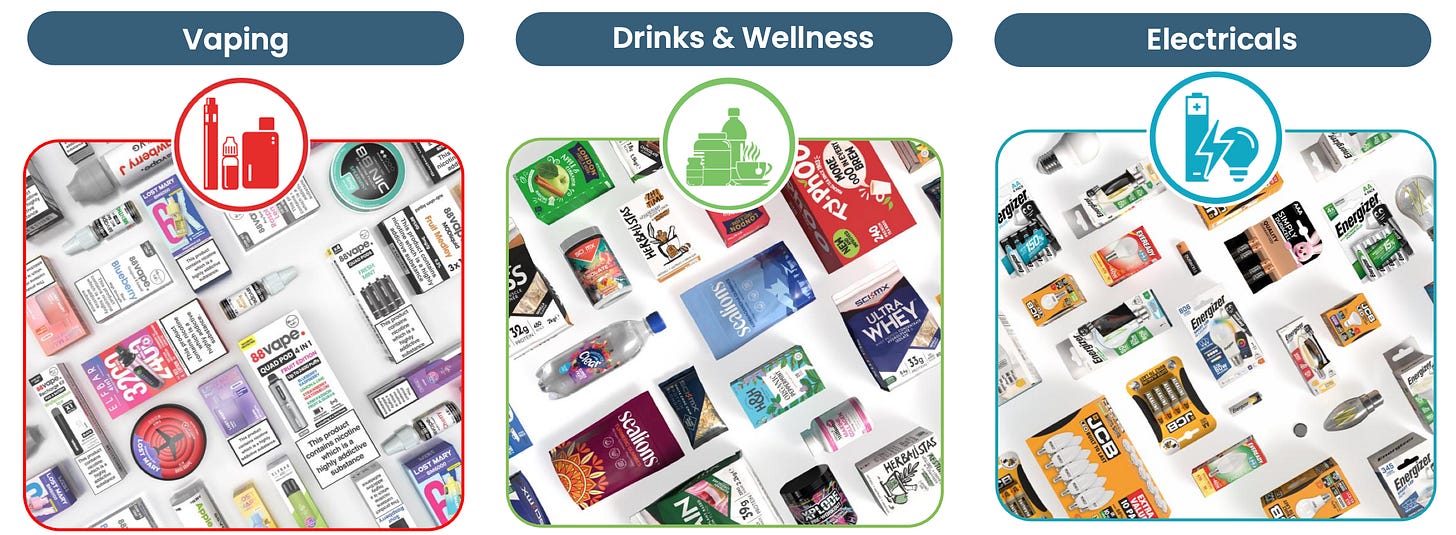

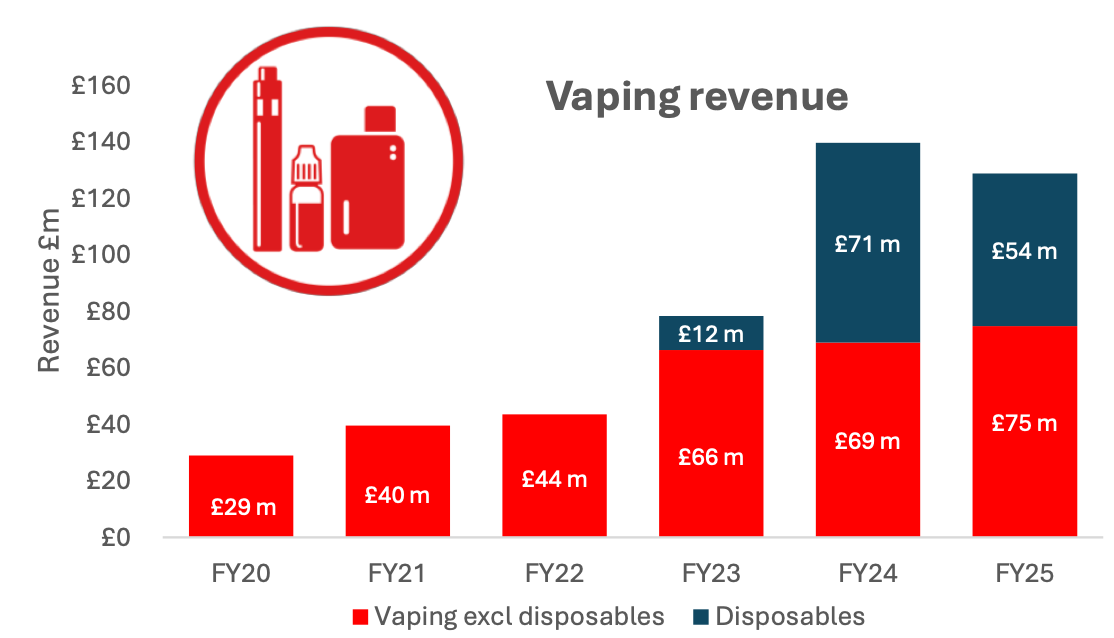

Supreme is a serial acquirer in the defensive consumer goods space: Mostly with vaping, batteries, soft drinks and lightning. These represent a good defensive business with strong growth.

They manufacture distribute the products in local shops across the UK and Ireland, and more and more in Europe.

That means that they can cut costs and expand distribution after making acquisitions. On top of that they make very very cheap acquisitions, sometimes out of bankruptcy.

At 9.9 times forward P/E and 3% dividend yield, it is a bargain. So why isn’t it number one on this list?

The problem is that Vaping is under scrutiny in the UK. Disposable vapes have just been banned and they are adapting to pods. They may be over earning since in their last release the earnings started slowing down hard, with Adjusted EPS up 3% only.

A strong levy on Vaping in October 2026 will also hurt vaping sales.

Still, it is expected that the growth moves to the rest of vaping products and that it will remain resilient.

With low debt, further M&A should compensate for potential declines in Vaping, and Supreme remains a stock to watch.

In my piece “understanding the compounder cycle”, I bring the idea that great ROIC and ROE, metrics loved by quality investors, are often a sign of a a good past rather than a good moment to invest. The key is focusing on the cycle, after confirming the business quality and plans.

Supreme finds itself coming out of a up cycle and entering a down cycle in demand, as vaping is under regulatory crackdown in the UK. However the low P/E ratio somewhat compensates for it, and I am expecting supreme to come out on top from this down cycle. Does it happen in 2025, 2026 or 2027, time will tell.

Article:

The rest of the list is below with three hidden champions from Europe:

#3 is a very small illiquid and almost unknown serial acquirer up 50% in the portfolio. It trades at a P/E ratio of 14 with net cash and is very early in the acquisition strategy. It will use the net cash to fund growth. The industry where it operates is counter cyclical.

#2 is a very small cap that is underperforming and is only up about 20% in 5 years. Not all ideas work well. Operationally, everything is fine and I have been adding a little bit each year, since it trades at 3 to 5 times Free cash flow when I deduct optional growth cash flow, and it is very defensive.

#1 is mid cap in a defensive sector. It is up over 200%, but through a series of acquisitions and perfect execution, it is as cheap as before, with a Free cash flow yield of 15%.

To get the full report on the hidden champions, and the past report on deep value, upgrade now and support the publication.

Thanks!!