I reviewed dozens of ideas, write ups and tweets in the past years. I have learned so much.

Quality companies and compounders are great investments.

You just have to be aware of the cycle.

For example, they are most popular at the top.

See the tweet below with over 1.2k likes:

The stock compounded at 21% annually over the decade leading to November 26, 2023.

How did it perform since? Terrible. -44%. close to minus 21% annually by the looks of it.

To be fair, the author is only talking about a good business. It’s the enthusiasm of crowds for the past annual returns that is the problem.

90% of the crowd is very positive on quality companies when earnings are growing, even worse, when multiple expansion is making the stock price explode. Many times the fundamentals are not even that great or accelerating.

Unfortunately, this also creates disappointment.

I have seen many of these quality companies fall out of favour.

LVMH is a great quality company, and worth holding in portfolios. The valuation was a bit expensive, but not crazy.

It was simply over earning post covid, and hit a temporary depression when customer habits changed.

I saw that with many companies, and it also affected some of my holdings and returns.

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too! The chart above was made with the free version. I use long term views to see book value evolution and share buybacks, as well as revenue and net income.

Focus on the cycle:

ROIC, ROE and compounder past returns are overrated, unless you use average 10 years metrics. These are backward looking metrics. They just tell you that a company had a glorious past, and they also translate into a maximum valuation.

This is why many of these ideas and quality-only investors constantly get hit with huge drawdowns and low performance.

some examples:

LVHM: “great compounder”.

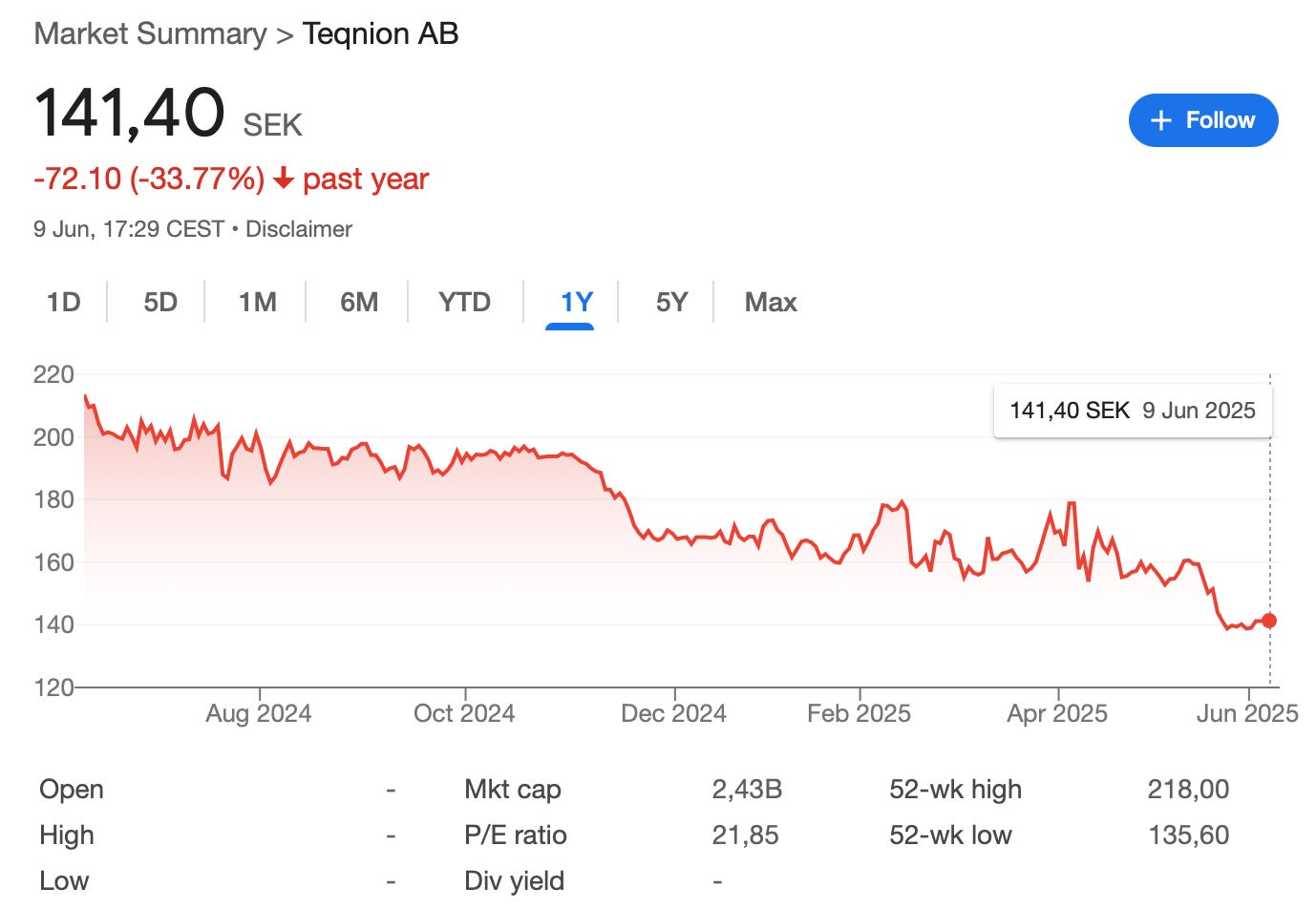

Teqnion: “great compounder”.

Teqnion is a mix of industrial and semi cyclical assets from Sweden. It is a good company with a good strategy, but if you buy construction linked assets before a recession at 30 times earnings, you get hurt.

SDI PLC: “great compounder”.

SDI plc is a scientific instrument company from the UK. Another serial acquirer and quality company. There were many positive write ups when the stock was between 150-200. I thought that the company was interesting but I did not buy. It was selling many instruments to detect covid, leading to a temporary boost in earnings, then covid stopped, and earnings dropped.

Then the write ups stopped coming when the share price decreased. It was no longer popular.

Then I bought.

Here is my analysis of the cycle on SDI:

Bastide le confort: “great compounder” This one was a mistake I have made. I did some mistakes like this in the past. The company was also a good compounder, but cheap debt turned against the company when interest rates went from 0% to 4%. I did not pay attention to the cycle risk of interest rate and the margins quality of the company. I learned.

Now, let’s be contrarian:

Terravest: “great compounder”. Not a single bear comment in sight.

Terravest has grown exceptionally well in my portfolio. It is part luck, part strategy. I do not really want to sell it, with such a large capital gain. If someone wanted to buy it know, he would need to really pay attention to the end markets of Terravest and if they are booming or depressed.

And indeed, the past three years saw good past organic growth for Terravest. So I would be cautious and look into this further. The future returns of Terravest are found in deep industry and cycle research, not in Returns on tangible capital. Sitting on a huge gain, and applying a coffee can approach (letting winners run) I have little interest in doing this research.

I naturally go towards depressed industries/countries and I found some. I am looking at the next things to add or buy at very low valuations too.

If you look for a great thing to buy, don’t look at a Terravest. Look at the new hidden ones. the hidden corners of the market, the quality companies who are experiencing temporary headwinds.

Buy with low expectations, and let it run.

What matters as much as valuation and quality is the company in the business cycle. I will pay attention to this first.

For full access to the portfolio, the write ups, and the opportunities of “quality investing 2.0”, upgrade below. More to come.

Spot on. You’re exactly right that articles and hype peak when a stock’s already flying high, then vanish when the cycle turns. That’s why the real edge comes from sneaking in when no one’s talking and easing out as the crowd piles in. I’m actually trimming the positions flirting with “extreme greed” and reallocating into names that’ve barely moved all year hoping they get their day in the sun soon 😊

Thanks for the reflective write-up, I really enjoyed it!