Today I will bring something different. I will present an interesting company that I ultimately sold.

Bollore is a well known company in global value investing circles. It is a French holding company with activities in Logistics, Medias and Batteries.

Brief History.

It was initially founded in Brittany, France in 1822 as a Paper manufacturing company, then working more with thin cigarette rolling papers (which had seen songs dedicated to its O.C.B brand), Tea sachets, the Bollore company was struggling in 1981.

The Quasi Founder and Chairman Vincent Bollore bought the then-in-difficulty company for 1 symbolic Franc in the 1981. He reoriented the company towards specialty industrial films, and started to invest in various industries to form a conglomerate group.

Contrary to Warren Buffett, he was not a traditional value investor, but a corporate raider, activist investor and special situation investor, with a value mindset. He also did not hesitate to sell assets.

He took control of a colonial legacy company Rivaud, built on assets from …colonization. There were many other takeovers in the history which are listed on the Bollore website:

https://www.bollore.com/en/le-groupe/history/

The most famous is the taking of control of Vivendi Group starting in 2011 with a passive stake. Vivendi group was a mismanaged and indebted collection of assets such as Brazilian telecoms, Videogame studios, Paid TV, and Universal Music Group. At the time the Vivendi share price (split adjusted) was in the 2s and it is now in the 10s, and on top of that, the Vivendi shareholders received Universal music group shares.

Little by little, Bollore took a higher stake in Vivendi. Vivendi had a market cap much bigger than Bollore so it was hard to take control. It was progressive and Vincent Bollore reputation as a value creator and activist investor allowed him to convince large shareholders to vote for his board members. Once in, they redistributed the cash as dividend and buybacks which increased Bollore’s control, and sold out some divisions. Vicent Bollore is also, like Masa Son, a ruthless operator, so he sent his team of ruthless managers to fix struggling Paid TV group Canal+, which worked at the price of some tensions.

He bought some stakes, notably Telecom Italia (didn’t work well).

He ultimately partially sold Universal Music Group (to Tencent) and distributed most of Universal Music Group to Vivendi shareholders with great success in value creation.

It was not luck, Vincent Bollore said very early publicly that record labels had a great future with digital sales, while UMG was still struggling due to piracy on the CD sales.

Vincent Bollore, now 70, passed the control to his son Yannick, who is a more consensual manager but still skilled and focused, so maybe the large raids are behind us with Vincent taking the backseat.

Bollore homemade valuation

Bollore Market Cap is €14 billions.

I could do a very lazy sum of the parts valuation, but it does not give me answers, and the recent market cataclysm in growth shows that using market values of subsidiaries to value a holding company is a no go for the value investor. With that logic, we could as well just take the market value of the holding company and accept it as efficient.

My favourite valuation method is Real earnings to owner of the shares. This can be found by looking at Cash flow and Net income statement and making my own soup and adjustments.

Bollore consolidates Vivendi in it’s accounts but is not a majority shareholder and it is already an issue because it owns 29.5% of Vivendi. I will attempt to deconsolidate Vivendi to get the real Bollore earnings. This is challenging and there could be some errors.

It is a bit of a nightmare to value Bollore post Universal Music Group spin off.

Vivendi retains a 10% stake in UMG, while Bolloré, after the distribution of UMG shares, holds a 17.7% stake.

So lets go with EBITA by activity;

Bollore Valuation

did 714 +71 in Logistics= 800m

did 748 in communications, but this is owned at 29.5% (Vivendi) so = 220m

A loss in Batteries, of 117m. (but very promising branch due to a proprietary technology).

This excludes 17.7% of UMG and 29.5% * 10% of UMG (2.95%) of UMG or 20.65% for Bollore.

UMG provides net profit to owner of the parent which is 886m in 2021 but that includes negative valuation adjustments, I don’t like their adjusted net profit fully due to SBC, but my adjusted net profit is 1201m. 20.65% of this is 250m.

TOTAL Bollore: 1.02 Billion in EBITA + a loss in Batteries + 250m in Universal Music profit.

the earnings in Universal Music Group are easily worth 20 times. This is capital light and growing.

Communication and Logistics can be ok at 8 times EBITA as we have not very cyclical businesses.

Battery is loss making but interesting and developing nicely: lets be nice and make it worth over 500 million euros due to the strategic knowledge.

250*20 + 1020*8+500= 5000+8160+500=13660 million Euros or 14 Billion in conservative earnings power value to simplify.

After much digging, I found 4.5 Billion Euros of Bollore gross debt excluding Vivendi. Minus 0.5 Billion of equities. They are mostly backed by Vivendi equity and it is not clear what are the consequences to me. I should remove this from the valuation because the earnings cited above are prior financial costs.

now we got 14-4 Billions in Bollore value = 10 Billions Euros.

Market Cap is 14 Billion Euros.

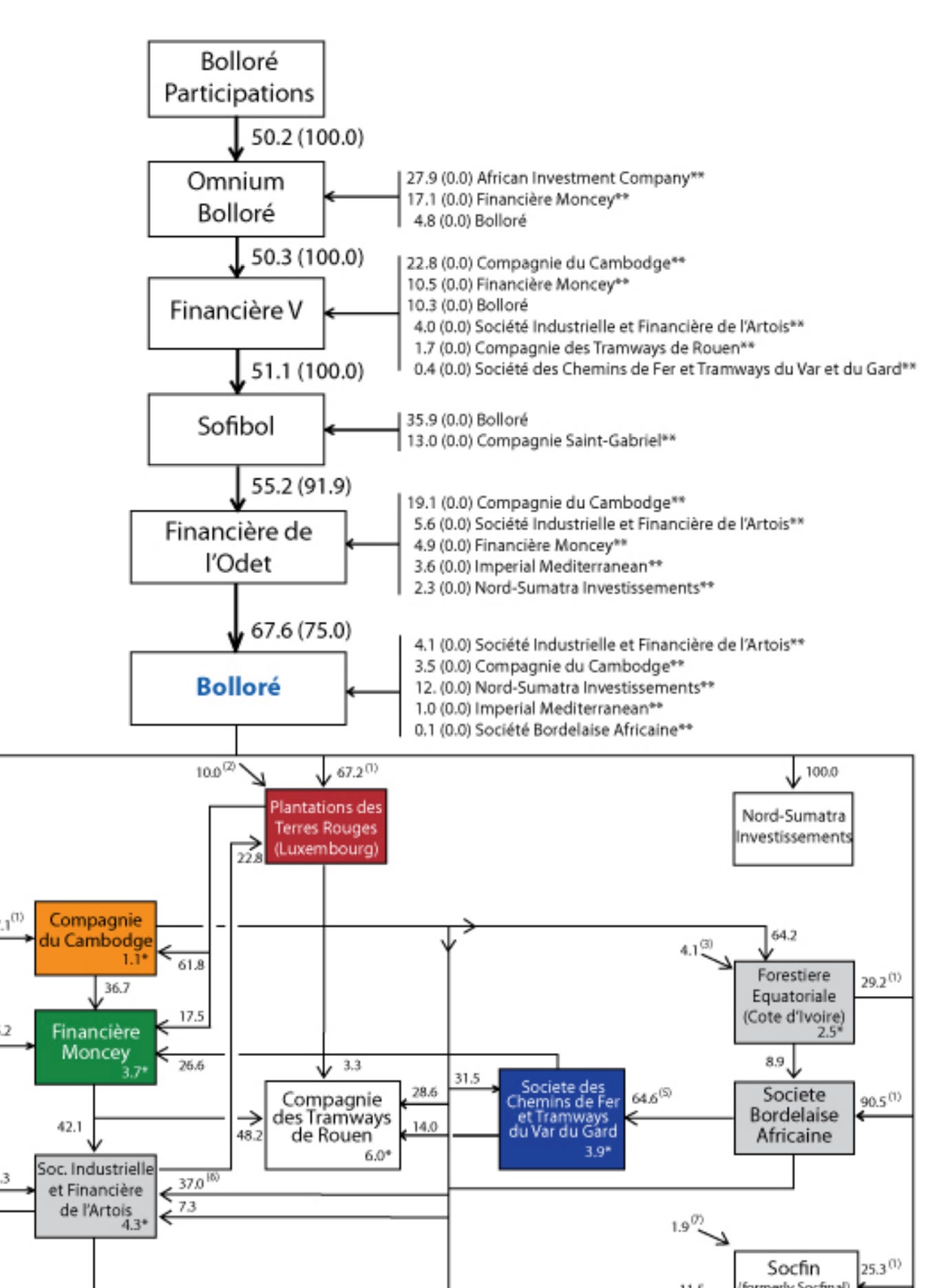

However, as documented multiple times on the internet (here, or here) due to a systems of cross holdings, Bollore owns a lot of Bollore, the real market cap is divided by around two and we have a market cap of 6 or 7 Billions versus a very conservative value of 10 Billions. Not a huge but decent bargain.

Another favorite is Financiere de l’Odet, which controls Bollore, is listed and trades at a bigger discount to NAV and fair value. The whole point of my article is not the valuation however, and I could have made some mistakes in this exercise. It is not my reason for selling Bollore.

(Capital structure extracts)

(Source Muddy Water 2015)

The capital structure of the Bollore empire is simply mad, with cross holdings and thinly traded, 19th century named empty shell companies.

Cambodge company.. it used to be a French Colony.

Tramways in Rouen. The last classic tramway ran in 1953 in Rouen, France.

Bordelaise Africaine - African from Bordeaux, linked to the old colonial legacy.

Nord Sumatra Investissements! Here is North Sumatra.

This has created a cult following in mostly French value investing circles where some people hold these very illiquid assets with a tiny dividend yield, hoping they are bought back by the Bollore or Odet companies with a premium, like some have been in the past.

Doing so, they spend their focus speculating on which will the next entity to be bought, or when will Vincent Bollore or Yannick Bollore buy all these companies at a premium and remove the discount. A main thesis online was based on the 200th anniversary of the group, or the retirement of Vincent in 2022, and I hope for all people invested that it happens, but if it does not, the speculators will find a new symbolic date based to cling on. There is sometimes not enough focus on the business but rather on guessing the Bollore family next moves.

Why I sold

I sold because recent developments made the company strategy not aligned with my requirements from my holdings. I want my holdings to develop their businesses in a boring and constant manner. I want them to be more like Berkshire.

However Bollore has recently made some moves that are either lacking long term direction or at best, valuation arbitrages.

1-They sold part of UMG to tencent music https://www.reuters.com link and IPOed it while retaining a large portion, using proceeds for general purposes, including buybacks, debt reduction.

2-They sold the African logistic segment, while it was an interesting long term growth area despite some controversies.

3-Recently, and for me the less comprehensive move, is the acquisition by Vivendi of a majority stake in Largardere.

So in the end, as Bollore shareholders, we reduced our exposition to Universal Music Group, which is some of the highest quality business out there and earning money from streaming royalties, sold African ports where they are bound to increase volumes and prices in the future, to get more exposure to ..French books and TV stations.

Half of these are obsolete or stagnating medias.

The Vivendi AR states: The offer for Lagardère’s share capital is consistent with Vivendi’s strategy of building a major player in European culture enjoying global reach in the creation, production and distribution of cultural content. The prospective combination aims to enable us to achieve compelling industrial goals and as such to contribute to better promotion of our editorial and cultural assets.

To this I want to reply… ok but selling parts of UMG, how does it fits with the strategy?

The reality is that there is no long term strategy. It is a value investing activist playbook, buy cheap, fix them, and spin or sell assets. This is not Amazon, this is not Berkshire, and this is more like Carl Icahn or Ben Graham. While it is a playbook that can work, it does not always (Telecom Italia), and is not a reason to enter industries at high risk of disruption.

For those remaining invested in Bollore or Odet, it is a bet that the past value creation which was created by opportunistic raids and well timed purchases will continue, as well that the structure will be simplified to remove a major discount to NAV.

It is too unpredictable for me. When I bought shares of Bollore it was for Vivendi, UMG and Africa, and now the company is moving into a different direction.

And another of my concerns is that the minority shareholder does not seem a large concern for Bollore:

They don’t really focus about the shareholder structure simplification

They refuse to publish a NAV or a NAV per share.

If you are still interested by this company want to learn more about Bollore you can follow https://twitter.com/FoxCastlehold

This is it, thanks for reading, and let me know your thoughts.

I encourage you to subscribe if you aren’t, there is some interesting content upcoming.

Too many times investors sell for some dumb made up reasons, this (at least in my opinion) is definitely not one of them. I think we all should be more open minded to selling and also sticking to our rules. Not easy but a must. Great article! Thank you for sharing

Right after I published my article, Bollore and Odet went more aggressive with buybacks. So the stock is a bit more interesting to me. I sold it in 2021. However I am still unsure with the long term strategy. is it just to grow Nav per share?