This Pharma distributor is growing and very cheap

Transforming healthcare in China

Hello!

Today I will present an opportunity I own.

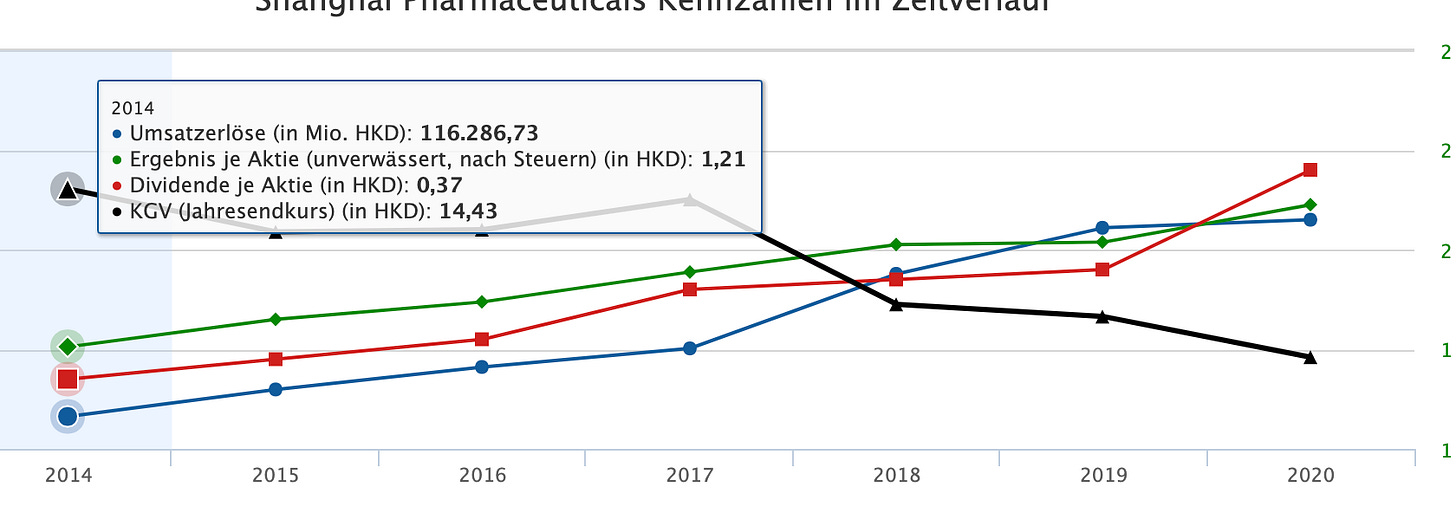

Here is an overview of the company performance: this is the type of chart that I like.

The P/E is at 6 and it pays a steadily dividend of about 4.5%. The business is very defensive.

It is looks like a steal ! But of course there are several catches.

1-Dual listed HK-SH Chinese stock. It is interesting to see that the Shanghai listed shares trade at a much higher PE of 10! I do not know the reason for such a discount on the H share (Hong Kong share).

2-Dilution

3-Not sure if management is in fully for the shareholders.

4-Price regulation

What is the opportunity?

It is called Shanghai Pharmaceuticals. It has an interesting business model:

About 1/3 of profits are developing generics and patented drugs.

The 2/3 rest is Pharma distribution (Think Cardinal Health in the USA).

Add a bit of Pharmacies and some promising tech investments.

History and ownership:

It originated from a state owned pharmaceutical company.

2010, relisted(?) in Shanghai.

2011, co listed in Hong Kong.

2017, acquires Cardinal Health's China Distribution Business.

2018, Additional Issue Of H-shares.

The ownership is quite complex:

It is controlled 36% by SIIC, which is state owned.

The interests are aligned to the state, which is provide good and affordable healthcare, as well as innovative healthcare and distribution. I do not think that the first goal is shareholders returns, but I think we should get some.

Segment 1: pharmaceutical manufacturing

quote:

3rd among Top 100 Chinese Chemical Drug Companies in China. Its products mainly cover 7 major therapeutic fields, namely anti-tumor, heart and cerebral vessels, psychoneural, anti-infection, auto-immunity, digestive tract and metabolism, and respiratory system. (…) SPH has 25 innovative products in its pipeline, 15 of which are either at the clinical trial stage or have been marketed:

It has over 700 different drugs.

TCM (Traditional Chinese Medecine) sales revenue is about one-third of the total revenue of its industrial segment. I like that because its maybe more like a consumer goods segment.

They do a lot of JVs with local biotechs and pharma companies, invest in local pharma companies. The company, just like Tencent or Alibaba, is a strategic investor in many startups, but in biotechs.

They are launching in 2021 the construction of a $1.8B Biotech park (Link). this is a huge investment, and the company does not detail the economic returns of it, and gives the following details. It will put Shanghai Pharma in a leading position in these fields in China in my opinion. This will support their push into monoclonal antibodies and cell therapies.

(biotech park):therapeutic antibodies, cell therapy, gene therapy, microecology and other biopharmaceutical innovation fields, and making every effort to build a leading national innovation incubator and CDMO platform and antibody industrialization platform. The production area of antibody industrialization will reach 100,000 square meters and bioreactor scale will reach 120,000 liters.

The vast majority of sales are in China but they are starting to export medication.

● The International Business Division is proactive in overseas markets. SPH's APIs have been exported to over 50 countries, and its preparations have now been marketed in more than 30 countries.

● SPH will be expanding its footprint to regions along the Belt and Road Initiative.

Segment 2: pharmaceutical distribution

quote:

SPH is the second largest Pharmaceutical distributor and the largest drug importer in China. It owns over 2,000 pharmacies and its distribution network covers 32,000 hospitals in 24 provinces, municipalities and autonomous regions.

SPH keeps innovating its business model, and is committed to becoming a service and technology-driven healthcare provider, offering integrated and creative solutions to our partners and people across China.

SPH (Cloud) Health Commerce, a leading Internet + Med-tech in China, is building its own Yiyao ecosystem:

● Separation between Dispensing and Prescription (SDP)

● The largest specialty drug network in China (22 Provinces covered)

● The largest public electronic prescription platform (10mm issued In 2019)

● A leading service provider in clinical trials, medical aid, physicians and patients' education, e-prescription management, remote and cloud hospitals.

In the pure distribution segment, the company continues with acquisitions and expansions:

2020 Annual report:

Completed the acquisition of the third-ranked pharmaceutical distribution company in Nanjing,

Laid out businesses in Nanjing and Taizhou, forming a business axis of Wuxi-Nanjing-Xuzhou from south to north, truly achieving effective coverage of the whole Jiangsu Province

completed the construction of provincial platforms and network extension layout in Hunan, Yunnan and Shandong provinces

2019 Annual report

Acquisition of Sichuan Guojia Pharmaceutical Technology Co

Built provincial platforms, extended and spread network to Jiangsu, Heilongjiang and Jilin

Acquired minority interest of companies in Hubei, Sichuan and Tianjin

2018 Report:

Acquisition of Cardinal Health China

Sub Segment: SPH Cloud Health + MediTrust Health

SPH Cloud Health is an “Internet +” pharmaceutical business technology platform incubated by Shanghai Pharmaceuticals. Yiyao·Electronic prescription platform is a big data platform that integrates electronic prescriptions, drug information, and patient health data. There is also CRM and fullfilment for pharmacies.

SPH Cloud Health is not profitable yet, it is a startup and concludes open financing rounds regularly. The last one was a series B financing of an aggregate of RMB1.033 billion on 18 January 2021.

The company was de-consolidated in 2021.

There is nothing about revenue or valuation online, at least in English. Here is an overview of funding: https://pitchbook.com/profiles/company/403987-06#overview

MediTrust Health: Established in 2017, MediTrust has grown to become China’s leading private healthcare payor through its proprietary integrated platforms for both healthcare and insurance companies (over 60 million served).

They are successful and interesting. However compared to the size of the company, they should not be really impactful for a while, but it is a good optionality in case of IPO or major growth.

Recent News

The company has increased the size of its pipeline and increased R&D investment a lot, up 31.38% Year-on-Year.

The number of innovative drugs in SPH's pipeline increased from 11 in 2018 to 25 at the end of 2020. The company is really pushing on this side.

Construction of high-end preparation platform is beginning to show results

Consolidation of the position as the leading service provider for imported drugs and innovative drugs in the PRC

The company establishes funds to invest in the bio tech industry

Analysing this company is crazy. They do everything! The company also has like one press release every few days, it is very active on all fronts. I never saw anything like that. They are not sleeping, but working hard. It’s obvious that my review is only partially covering the company.

Financial statements:

Lets use the 6m 2021 EPS:

EPS. 0.9 RMB per share or 2.20 HK annualised. Share price 13.74 HKD.

PE : 6 for the Hong Kong Share

.

On the profits, we can see that distribution is much bigger than Pharma production. Roughly 70-30. Retail is pharmacies and not worth mentioning at the moment.

For the 9 months of 2021, the net income adjusted increased by 8%. We notice a slowdown this year, but maybe it is due to increased R&D.

The company said: The net profit attributable to equity holders of the listed company after the reversal of R&D expenses increased by 26.04% YOY. Im not sure what does that mean here. maybe they mean that they are over investing at the moment.

Balance sheet:

No net debt, net current assets for 14% of the market cap. But if you buy the cheaper HK shares, you get more net current assets per share in proportion to your price.

Cash flow statement: No red flags here in terms of valuation (as it is a State owned entity I do not really fear scams here). The cash flow statements includes buying and selling investments and bonds under investing activities which is confusing. We can see that the company pays dividends, acquires companies, and invests in assets. They are again, not sleeping at the wheel and I like that.

Main risk 1 - Price regulation

Risk: national volume-based procurement (VBP) policy. This is a policy aiming at cutting generic drug prices.

Although some products were affected by the national volume-based procurement (VBP) policy, the Company’s overall sales revenue in the first half of the year still achieved a rapid growth

We can see that the effective price reduction is very important.

How many products are affected and what is the impact? The company does not detail this, which is a bit of a problem.

Main risk 2 -Share sales

The company has a habit of making Capital increases.

1-in 2018, an offering for 5.70% of outstanding shares. Placing Price of HK$20.43. It was at a PE of 13.5 which is too low. The reason for the capital increase was generic:

The Directors consider that the Placing represents an opportunity to raise capital for the Company for its business development and to broaden the Shareholder base of the Company. Probably due to this, the EPS was flattish in 2019.

2-In 12 August 2021, a private placement of about 853 million A shares at the price of RMB16.87 per share to Yunnan Baiyao and Shanghai Tandong, to raise about RMB14.384 billion. The P/E is at 9.4 for the capital increase, too low.

I actually owned Shanghai Pharma, sold it when I saw that news at a ok profit. I don’t really like this move and a 18% dilution at cheap prices. And I went back recently because the price kept dropping and I had some funds to reinvest.

They say that “The introduction of Yunnan Baiyao as a strategic investor will further optimize the corporate governance structure through the diversification of equity structure and promote the further deepening of institutional and mechanism reform”.

What is Yunnan Baiyao? It is a traditional Chinese Medecine company. It is listed in Shanghai, has a stellar stock price history over the past 20 years and pays a growing dividend. Some background: https://www.forbesindia.com/article/cross-border/yunnan-baiyao-the-picture-of-health/48169/1

As part of the share placement, the companies will cooperate on drug distribution and establish a strategic alliance.

I suppose that with the 18% shareholding in the company and a 3 years lock up period, they will want a good return and will not vote for further dilution.. I hope.

Analysts price targets:

The company and environment are extremely complex.

I can fairly say that I do not know the future. So let’s look at third party analysis of Shanghai Pharma.

Price targets for overvalued companies (high PEs) are usually full of thin air. The analysts have the need to be consensual, and think, “ok because the market likes it at PE 50, I will just rank it as buy”. Analysts are good at analysing the businesses, it is their full time jobs, they specialise in the industry and geography. Then they place a PE multiple based on sentiment, consensus, pressure from their management.

However, for stocks that have a low PE, usually I found that analysts place a reasonable multiple ratio. They cannot really justify a PE of 6 unless the companies are really bad. And this is where it is a good indicator.

For Shanghai Pharma, trading at HK 13.42, we got the following targets:

-Morgan Stanley PT 20.8

-Credit Suisse PT 20

-Goldman sachs PT 16.6.

So they do not think it is going really that bad.

We can also look at the historical PEs versus now (KGW in black) and we see a derating since 2017, when it was normally around 12-14. For me it is worth 20 due to the growth and quality.

We can also see the Green (profit per share), Blue (revenue), and Red (dividend) shooting up while the multiple contracts. (Yes I got the habit of using a German website to look at historical metrics - Sorry)

Competition

The main competitor is Sinopharm, which is purely a distributor. It is a bit bigger than Shanghai Pharma. It trades at almost equal valuation and has a similar growth history and chart. I checked in the annual report 2020 if there was a financial explanation of the impact of volume-based procurement, but there is not.

The sector is just hated.

I bought Shanghai Pharma and not Sinopharm because it is more diversified with the Pharma and Tech segments. Buying Sinopharm in addition is also an option.

Conclusion

The business is growing and defensive

Very diversified

The management is not fully aligned with us. Further dilution would be annoying.

The analysts are positive on the stock. With their local knowledge they would have been negative if they saw some really bad future for the company.

The company is cheap not because of a price crash but because of the price moving sideways while the business grows. This is the best set up for a value stock because it means that the market did not see a giant risk, but just got bored of it.

The price regulation is a negative, but on a positive side we got new patented innovative drugs in trials, imported drugs, distribution services, Traditional Chinese Medecine, the Cloud/IT segment, and associates and JVs (14% of operating profit). I like what they are doing with antibodies and cell therapies, where they will probably become a Chinese leader after completion of the industrial park.

My goal is to detect and take action on opportunities based on risk reward, not to know everything, and I do not hesitate to place small bets. I own a very small position, from a quantitative basis, small enough that doing all this analysis was overkill, but I understand the company way better now and would be comfortable with increasing the position to 3-4% if funds are available.

Disclaimer: This is not a recommendation to buy the company but solely my own rationale. Conduct your own analysis before buying a stock.

Our flywheel has been on the same track with the times and has been rotating for several springs and autumns. The times will be our most powerful gas pedal.

Annual report 2020