In this article I will do a summary of a thesis that explains why small international value further returns are looking very positive.

This came from a conference by Alejandro Estebaranz that I took screengrabs from. I did not plan to do this article before, but since I saw the video I was thinking that I had to do it.

Once upon a time in Spain there was a self made fund manager who became famous for investment theses, Youtube content and a small cap fund. He started as a mechanical engineer but became passionate about investing.

He became popular with his educational videos. I had a sort of love hate relationship with him, mainly because he has used atrocious clickbait youtube thumbnails, that I dislike (although I recognize a great artistic ability and a sense of humor).

“To adapt or die. “

“It will be worse than 2008.”

But after you click on the bait, you usually get a decent video with conservative explanations about the stock market and companies, and he said that he used the technique for the google algorithm.

As you have noticed it is in Spanish.

He also has interesting educational content where he mentions companies cycles, financial statements, moats, valuations. This is where I love his content, and I recognize a great knowledge of industries and investing.

What interests me even more is his other channel where he details the portfolio and market environment.

After a very solid start, our fund manager struggled in 2022 and 2023.

According to my excel skills, that is a CAGR of 6.85% in 11 years. Enough for people to call him bad, useless and the like. It is not great. But we could be at a low point of the cycle.

In his latest video, he explained why small value with have great returns going forward, much more than large cap growth or tech. Ok he could be selling his book to keep his investors, but this is demonstrated with data so it becomes interesting.

So let’s see the arguments (all are screenshots from https://www.youtube.com/watch?v=1JG23BhFjj8 )

1-Large caps expected returns are 3% per annum from there.

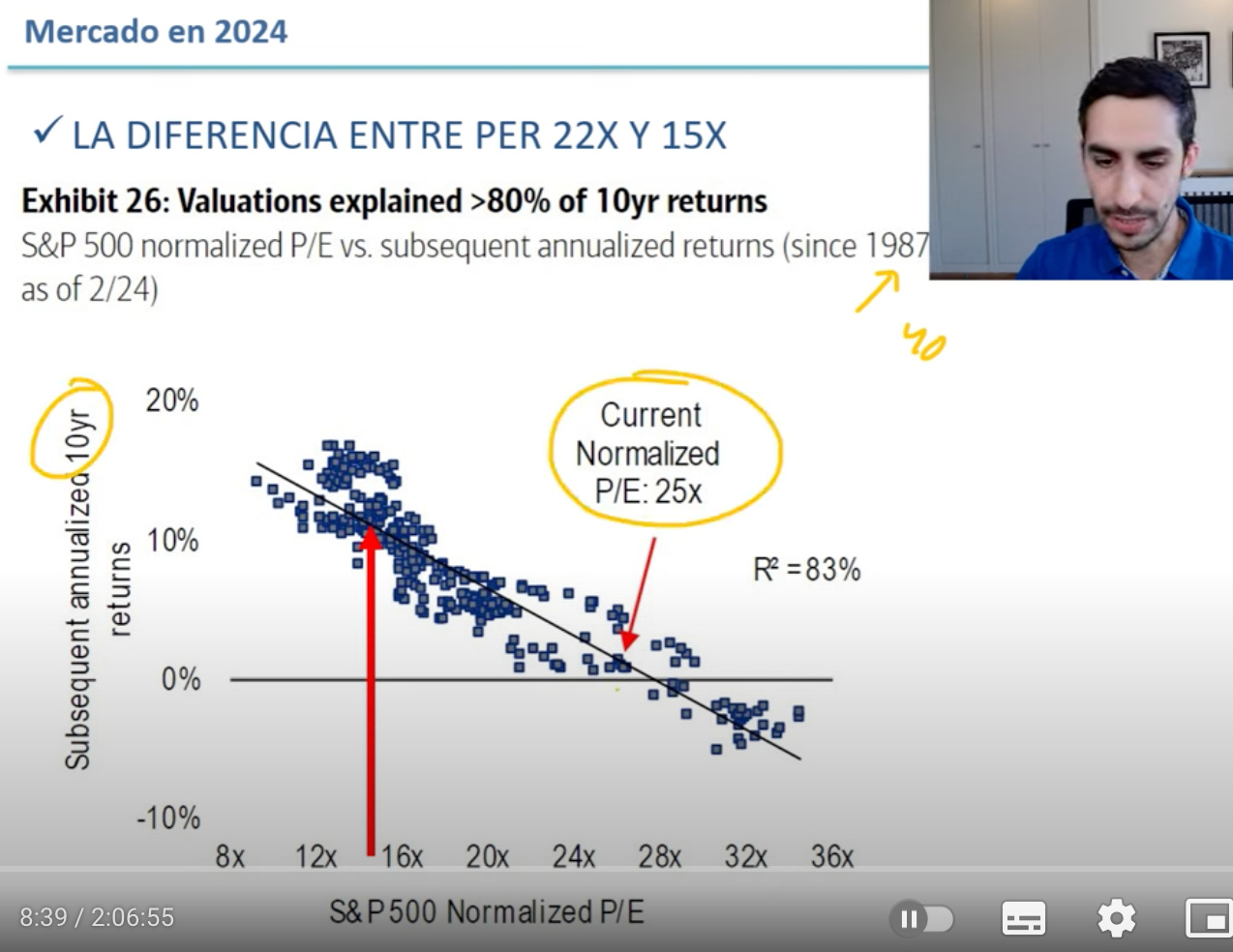

The following chart is telling. Very accurate predictive models predict 3% per annum in the future for the S&P500

This is confirmed in the following chart that shows that since 1987, valuations explain 80% of forward returns.

The best ever annual returns generated from our S&P500 starting valuations are 5% a year.

2.Small caps

Then he proceeds to shows charts that show that in 10 years, the sp600 profits grew 120% vs 100% for the large caps.

(S&P SmallCap 600 - To be included in the index, a stock must have a total market capitalization that ranges from $1 billion to $6.7 billion),

The reason for the less favor of the small caps is their bigger sensitivity to the inflation crisis and the interest rate impact, causing a drop of earnings in 2023.

In a few slides he showed that the four points necessary for a large rerating of small caps are present:

1-Low positioning of investors

2-Interest rates going down

3-Low valuations

4-Increased expected profits for 2024-2025

What about European companies profit per share?

3.High expectations in technology

For the above chart I have some doubt that IT sector is correctly mapping the Nasdaq 100, because most of the magnificent 7 had great LTM revenue growth and current growth like Nvidia, Microsoft, Amazon.

The next slide shows the five year expected growth rates of the semi sector and tech sector. We can see that there is no precedent and the prudent thing would be to think that this time is not different. GEN AI is cool but is it generating enough profits and cost savings to justify such investment and growth in profits for the sector? Hard to say.

Then he concluded with two slides showing that the US market is expecting a 15% long term EPS growth, when during 100 years it was 8%.

In Small caps in the US, the expected Long term EPS growth is 15%, when during the past 20 years it was… also 15%.

There are some signs. You see Tesla cannot growth this year, LVMH just released results where they don’t growth this trimester. Apple cannot grow.. Quality is not a guarantee.

Positioning.

Alejandro Estebaranz then continues to present his portfolio.

Here we see many B2B businesses, with a strong IT service sector weight, a sector that I shunned until recently due to cyclicality. We see packaging with Berry. Teleperformance the outsourcing company which fell a lot due to fears of IA replacement of agents by bots (your author has no position, no opinion, and prefers more defensive models, including some that the market sees as challenged by interest rates, but I don’t see challenged from a product point of view).

Then he proceeds to describe the contrarian thesis for Teleperformance, which was well explained and quite convincing. However I don’t think we need to fight every battle, but if you hold, I recommend watching it.

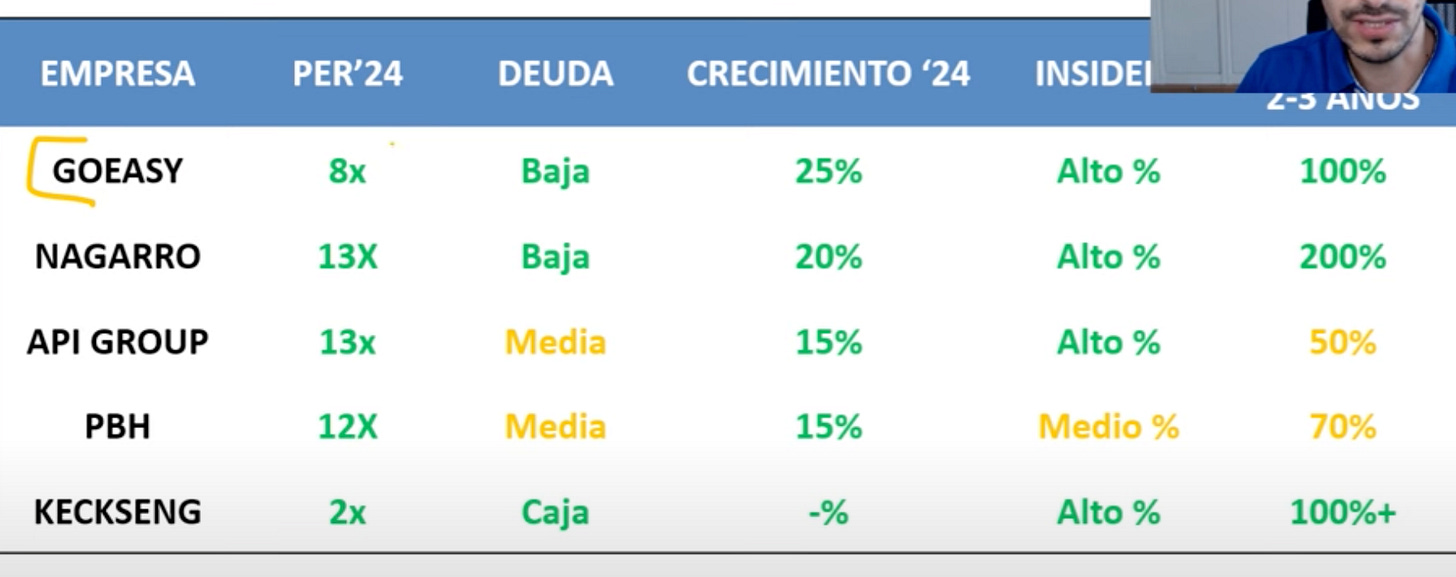

Here is his top 10

(Deuda means debt, green is low)

(Crecimiento 24 is growth in 2024)

And the last column is the expected return in 2-3 years. I find it very interesting especially. Because I also see many of my stocks with this expected return under normal multiples, and I was wondering if I am crazy or not. Seeing an experienced fund manager think the same from similar profile businesses is a validation.

My holdings are not the same, but they share similar characteristics, cheaper on the multiple, and some with more debt or lower growth. One shared holding is Newlat.

Conclusion

On the valuation demonstration, valuations for smalls, euro smalls or EM companies are extremely low and returns to shareholders are high. This is setting up very well for the future. I also think that currencies are not at fair value vs the dollar, but that is another story.

With one or two disappointing years, many commentators are “hitting” on him online. It tells more about the lack of knowledge of the commentator than the value of this fund manager. This is the problem when you are a novice and invest in a fund: you have no idea what your investment is doing. I have no doubts that he will do well overall, because at some stage fundamentals matter.

I have criticized him for his clickbait yes, but not his general ability.

The main thing I see in his style is that he stuck with the same positions years in years out. By doing so, you gain a level of knowledge and conviction that few participants have, and can observe some really weird reasons for selling that they have, or some very wrong statements about the company, and have the strength to hold or add. MemyselfandI at https://valueandopportunity.substack.com/ and Jeremie at https://frenchhiddenchampions.substack.com/ also keep some core positions very long. I do have this knowledge for some historic positions and I am building it for starting positions.

Oh and look at the latest comment from MemyselfandI:

Note that the google translate for the subtitles seems to work well as he speaks with a clear pronunciation.

https://www.youtube.com/watch?v=1JG23BhFjj8

That’s it!

I have started working on a new tech write up, for which I am focusing on the product analysis.

Share like subscribe thumbs up or down.

Supporting the publication gives access to:

All the stock thesis - minimum 10 a year.

Full portfolio with diversified 50+ mostly EM/small value ideas with short pitches.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin).

20% on Koyfin plans with the affiliate program