Let’s see if we can find value in Tech Africa

Africa is not a country, but for the number of listed companies accessible to non African investors, the opportunity set is the size of a small country.

Only some rare brokers provide access to South Africa, and for the rest of the countries you pretty much require a local broker.

1-Jumia - Market cap 850m USD

This company was started by two French people in 2012, and was backed and is partially owned by RocketInternet. RocketInternet is a German company that copies American internet startup concepts into European copycat startups, and had some good success in the past (Zalando).

The company is a typical e-commerce company.

They cover 11 countries and 600 million people.

They only have 6.8 million customers, it is a very weak 1%. After 10 years operating, it is for me a disappointment. The truth is they failed at scaling the platform, which is what they claim to be doing now:

I am pretty sure that in 2018-19 they were trying and claiming to scale the platform.

The growth has been very weak and profitability is terrible. This is especially terrible for a marketplace where the seller sells the goods.

Jumia Pay is $65m USD TPV last quarter, very low.

Total revenue is $42m USD a quarter. Very very very low for a “leader” in the continent.

Maybe 2022 is when the scaling starts to kick off, in that case we get a 10 bagger or more. It seems to me that the consumer is not mature enough to mostly shop online or is not convinced by Jumia value proposition, due to African specifics such as competition from offline markets.

The good thing is that the company has virtually no debt and cash from the IPO.

For the speculative investor it can make sense. For me it is too risky. I would need to see traction and positive EBITDA.

2-Airtel Africa (LSE- Market cap $8B USD)

The Lion has 118 million subscribers.

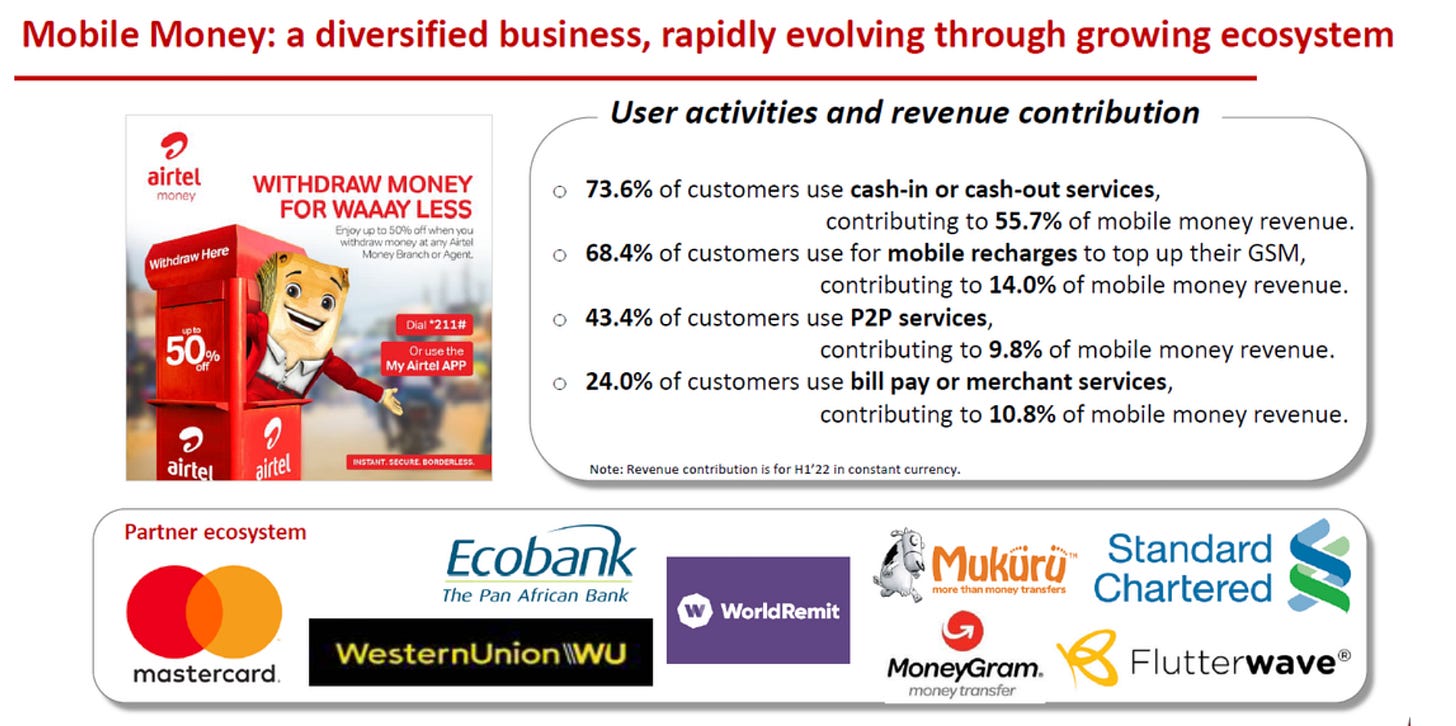

This is a telecom company. But mobile money is 10.3% of group revenue.

Compared to Jumia with 65 million USD TPV - Total Payment Volume in the last quarter, Airtel Money is at 15 BILLIONS USD TPV a quarter. This shows the advance this service has. Jumia Pay could still do some catch up if the market place booms, but at some point they will have to accept Airtel Money and Momo (see MTN entry) to support conversion rate and traffic in their marketplace.

Airtel money makes 60+ million USD Ebitda a quarter.

In the write up linked above, @Researchglobalstocks makes a comparison of taking just Airtel Money and ignoring all the rest of the business valued at 0, and it could almost be a buy with valuations similar to peers.

According to this write up, the company is now trading at a 13 times FCF multiple, for a telecom company that includes Airtel Money. And the telecom company side is also growing fast (See his write up). It represents a decent value proposition.

3-MTN Group (JSE and FRA - Market cap 23B USD)

The elephant has 277 million subscribers.

I wrote it up in April and the stock doubled since. It is not cheap anymore at a 20 P/E. I am still long after reducing the position a bit. I probably would not buy too much at this price because I am a value person, but it is growing fast. Contrary to pure tech stocks, it did not derate lately.

Things have changed since with deleveraging of the hold co.

MTN is very similar to Airtel with the Mobile Money segment.

It is called “Momo”, has millions customers and is 9% of group revenue, and does 110 million USD Ebitda a quarter.

Let’s see the scale of that business.

TPV is $57.6 B USD a quarter, PayPal does $310B USD.

It is 18.5% of PayPal. Africa is transforming right in front of our eyes. Of course, many of these transactions are just mobile top ups, or sending money to your family members, or managing a virtual wallet for convenience or safety.

For purely payments, it is lower at $6.2B USD a quarter. But the growth there its +354% Year on year!

They have an insurtech business. It is not some weak product without expertise.

MTN is Partnering with Sanlam in an “exclusive strategic alliance (the Alliance)” to make digital insurance businesses with a focus on distributing Sanlam product. They plan to grow the policies to 30 millions by 2025.

Sanlam is the biggest African insurance company.

MTN is also building a super app with 10 million active users:

https://www.mtn.com/african-super-app-ayoba-reaches-10-million-monthly-active-users/

So overall, while not cheap, it is probably the continental tech leader with large runway.

I did not have the time to analyse all the companies in this newsletter fully, especially the last two.

4-Karoo - JSE and Nasdaq - Market cap 1.12b USD

This is a vehicle fleet management software solution from South Africa.

The PE ratio is high at 33.

5-mix telematics - JSE and NYSE - Market cap 300m USD

This is another vehicle fleet management software solution.

Half of the revenue is coming from South Africa, and the rest from a worldwide mix.

It provides Fuel savings, less accidents, vehicle recovery and safety.

The growth has been less stellar than Karoo, but is satisfactory.

Still, at a P/E 18, it is interesting.

Conclusion:

Jumia is the most famous African tech stock because it is listed on the Nasdaq and it is a pure ecommerce company. It is either a trap or a multibagger. People who like bets would find the odds interesting here. I personally want to invest in a proven company.

However, the western investor is misled by the Jumia story.

The leading African tech company are MoMo by MTN, Airtel Money and Mpesa (Mobile money by Safaricom). Their opportunity set is immense. The risk they face is government pressure to make the withdrawals and p2p payments cheaper or free, because they are really printing e-money. Unfortunately for stock buyers, the tech correction did not affect these telecom companies.

The vehicle tracking companies Karoo and Mix Telematics are very good niche leaders to keep on watch.

In conclusion, I don’t think that there are good tech buys in Africa right now, and I would favor the telecom companies who have a strong mobile money business instead.

Media 24 and takealot are african.

The biggest asset is tencent but they are also very active in África in my opinuon.

Besides naspers safari.com and fawry might also be interesting

Regards

Naspers not included in this list?