I recently wrote that I will stop digging in Japan due to no growth and low dividends, however in Tech it does not compare badly to the rest of the world. Healthcare is also good as aging is a growth industry. So I will leave Japan out except in the sectors that still have organic growth.

It is a country with low valuations for tech stocks, even if there aren’t many world leaders.

The most famous tech stock out of Japan is the old timer drunken samurai:

1-Softbank (Japan- $80B market cap)

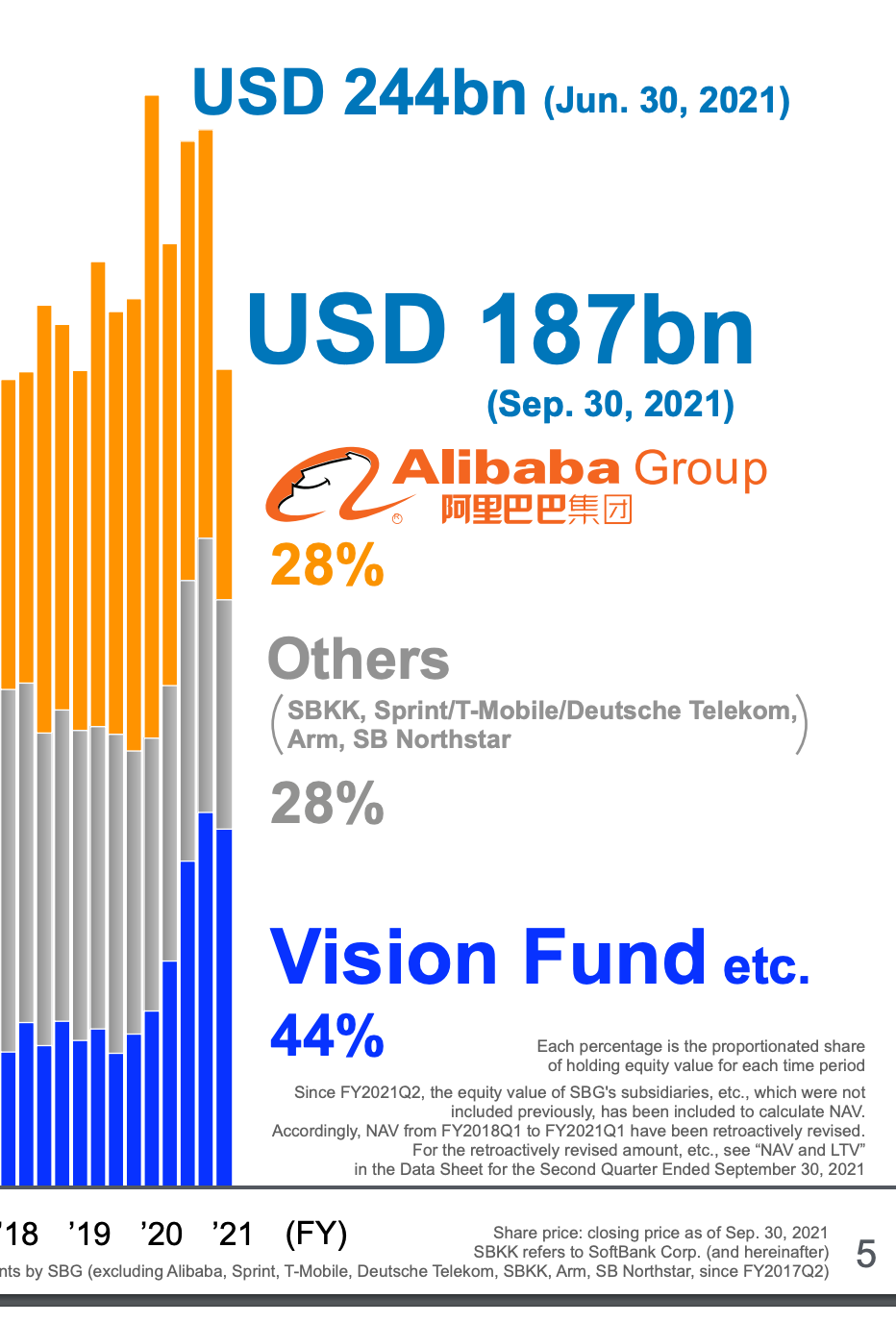

Softbank is a holding company whose NAV is mostly composed of Alibaba, Softbank visions funds 1&2, ARM, and Legacy telco companies.

I used to own Softbank and I made money on it, so I was smart to get out when I smelled the fishyness in Wework dealings and options trading by Masa Son.

Masa Son, if you do not know him yet, which would surprise me, is the genius and crazy founder of Softbank. There are countless stories on the web on his antics, his genius investments in Alibaba and Vodafone and Yahoo Japan, how he almost lost it all in the 1999 tech Bubble, how he raised 45 billion dollars in 45 minutes.. the list goes on. I am a value investor because I am a coward in investing basically, I hate risk, so I have a lot of admiration for crazy growth investors/gamblers like him.

Softbank trades at a discount and is cheap, they are good operators…I understand that VC plays a role in capitalism and can be very profitable. I am not sure if they are excellent investors, not all the time, but this is the nature of venture capitalism to have a hit or miss approach.

The NAV is decreasing and will decrease further in the next earnings release as Tech and Alibaba valuations went down.

Segments:

Alibaba has weak corporate governance in my opinion, but has value and terrific assets and earnings which should provide growth in the long term. It is reasonably valued by the market.

Others: There is a large part of “not growing” defensive telcos giving some balance to the crazy softbank Vision funds holdings. ARM is a fantastic tech company producing IP for microprocessors for AI and IOT. Zholdings is a leading tech company in Japan (Analysed below) that is owned by SBKK. PayPay is also co-owned by Softbank.

The Softbank vision funds mostly comprise of unprofitable companies or close to profitable: Coupang, Doordash, Uber, Didi, Auto store are the biggest ones with a combined value of $50B as of last earnings release. These are dominant companies not going away, and I understand that they have some value. The rest are mostly unlisted or listed small tech and many are interesting.

On the VC, super expensive high growth companies:

As I am not an early stage growth investor it is tempting to say that they are all overvalued but with a dominant product, a growing company can quickly earn a billion USD and be worth $20B, and some may scale up further. This is growth/VC. It can also have huge value for a declining incumbent or a FAANG to acquire for synergies. So owning a company doing this sort of investments does not bother me. It has value even if I do not understand each investment.

Risks

Masa Son and capital allocation. Masa Son gets a lot of bad press when he goes wrong, but when things go well, like Coupang, ARM, or Sprint there is silence. He often overpays, but he really knows technology like no other and his selection is really good. He does buybacks whenever the discount to NAV is large. I rate him as a good one.

What I do not like is the leveraged nature of the vision funds with preferred coupons that Softbank must pay to investors year in year out. Because the investments do not generate dividends, Softbank must pay these yearly coupons with VC capital gains. If the music stops, they need to raise debt to pay the coupons. (7% on the funds value, about 2 billion USD per year If i am right). It is manageable.

I am monitoring Softbank again, and next earnings should be terrible.

Valuation: We have a page with the NAV here, there is no need to do any work, it is perfect!

https://group.softbank/en/ir/stock/sotp

We trade at 1/3rd or NAV, this is crazy. But the NAV decreased with the value of listed holdings going down, and Softbank will update it at the next earnings release. After that, we should see the new discount. I think that the upside will come from a future recovery in Alibaba and some Vision funds stocks if they correct enough.

Conclusion: Buying after the next earnings, with an explanation of the effect of the derivatives and Loan to asset management of Softbank, with maximum pessimism, seems interesting. After all, it is a nice collections of assets.

2-Zholdings (Japan) (37B USD market cap)

It is a large cap, but completely unknown in non Japanese circles. It ran up a bit since I started writing this article.

It is controlled by Softbank.

Softbank can overpay for things, but two things about Softbank and Masa Son:

He is a visionary. Alibaba, Yahoo Japan, Vodafone Japan, ARM, those are visionary moves. On AI, he is right.

He is an excellent operator, and he hires excellent operators. The way he managed Sprint, the way he turned Vodafone Japan andYahoo Japan were excellent. They will maybe even manage to Turn we-work around.

In Japan, Z holdings is the result of a merger between Yahoo Japan and Lime.

It has leading positions in Web portals, Commerce and Messaging and now Payments.

Now with PayPay, it is aiming to build the Alipay of Japan. And it looks like they are succeeding.

Zholdings owns only 33% of PayPay, the rest is owned by Softbank, Paytm and other shareholders. PayPay earnings are deducted as an equity method earnings from associates (it adds to losses). But Zholdings also has a fintech business benefiting from PayPay members and marketing: PayPay bank and PayPay card.

By merging commerce, web portals, advertising and messenging together and putting it with payments, Zholdings is trying to create a super app, a full social and commerce ecosystem together. And they have the assets to do so. And I strongly believe they will build a fantastic ecosystem. And the time to own it is now.

Since the merger was completed in 2021, the company is investing heavily towards this goal and explicitly states that it is front running investments and not trying to maximise short term returns.

Softbank did the same with ARM when they bought it. They immediately boosted R&D and headcount, depressed earnings for a few years before the revenue and profits exploded higher in 2021.

Valuation: The company explains that we must use EBITDA to value it as a proxy for operating income, because it does have a lot of non cash charges and D&A with the merger and other acquisitions.

It does an EBITDA of $341B TTM, it has an EV/EBITDA of 14.5 and some leverage at 2.55. The official target for 2021 EBITDA is still 310. We have some non controlling interest but not a lot.

Zholdings already did $187B of EBITDA in H1, so I am hopefull that they beat the target, especially that they also bought back some royalty rights for which they expect savings from September 2021.

Terminated royalty payments from September, as a result of buy-out of Yahoo!-related trademarks, technical licenses, etc., in Japan

But this values the Fintech business at less than 0, when it is the one with the highest potential. And it values 33% of PayPay at less than 0 too.

The company plans to reach $390B of EBITA in 2023, so we would have 12.8 EV/EBITDA. After that it should keep growing. Currently, the company is front loading R&D expenses to build the ecosystem.

We are not paying too much for a company set to be the wechat+wechatpay of Japan, in addition to its current excellent position in Ecommerce and web portals.

In addition to Zholdings, we have listed subsidiaries Zozo, Askul, but I prefer owning the ecosystem than parts of it.

3-Rakuten ($13B USD Market cap)

Rakuten is a leading ecommerce company in Japan that is starting a mobile network, currently unprofitable.

The idea to start a mobile network in my opinion is stupid when you have a great asset and no synergies, but there is great value in the ecommerce assets at a cheap valuation (PE 15).

Full write up by value punks here.

The value punks find a lot of synergies between the mobile network and customer acquisition for Rakuten, but I am not convinced. Here, the network seems to bring some consumers due to marketing, but is it worth the cost? I am not sure.

Nevertheless, this is definitively value due to the discount created by the telecom business start up losses. And the ecommerce assets are of great quality, so I think it is also a buy for the patient investor who can handle the telecom skepticism for a while.

4-Zigexn ($250m USD Market cap)

The company offers comparison, information or transactional websites in HR, Housing and repairs, Cars and general services.

It has an acquisitive model. PE 11. It seems lightly cyclical but not very cyclical.

It was written up by Tristan Wayne here:

https://drive.google.com/file/d/1RC6ev3j8AB_OY4dylPJ-b82tNl2ZK2go/view

and here more recently:

Here is the latest business briefing by the company:

I think it is a great find by @Tristanwaine

Management, business seems on point

There must be some cyclicality with HR and Real estate markets but they are soft real estate (renovation, rent) that are resilient and are not about new construction or sales.

Very cheap, seems like a great buy as well.

5-Medical Net ($39M usd Market cap).

I found this one by checking for tech companies and it caught my attention with the name.

All the info is in Japanese and the translated documents are not really clear.

They have websites to get information about doctors, treatments, clinics. They have medical journals and websites for profesionals.

They help doctors and clinics in web presence.

They also manage some clinics, although this segment is loss making. They also have a football academy apparently, or its google translate getting that wrong (?)

They grow organically and by acquisitions.

https://www.medical-net.com/service/dental/

https://www.medical-net.com/service/consumer/

https://www.medical-net.com/service/business/

The impact of corona was a bit negative according to their report.

PE is about 12. it is very interesting. If I have some Japanese speakers, it would be great if they could tell us more about the business.

DON’T PUMP UP THE SHARE PRICE PLEASE! No position (yet).

Sum up.

Here we have 5 businesses interesting in their own profiles and all providing good value and growth. Some with short term challenges like Rakuten and Softbank but good value.

Japan tech is very interesting.

This is a good area to fish more.

NEXT STOP in the tech value world tour: Africa

Just a comment about the Japanese translations.

Don't use Google translation, it isn't good. You should better check out www.deepl.com

I use it every day and the quality is quite good.

Best regards from Japan :-)

Thank you for your analysis

your writing is very insightful.

Z holidngs is a very interesting investment choice for sure, as it has been starting to expand its services fully utilizing PAYAY application. Here in Japan, everyday you see their services more and more. they are establishing its brand. And, the merger of YAHOO and LINE ends their competition and spending spree finally. Rakuten still stays here. but Rakuten's capital allocation history is terrible...

Medical net seems to be interesting too. I checked a little. This company's sales are mainly composed of 2 sectors. 27% sales come from managing website platform for dentists. Other 69% sales come from consulting and marketing for companies like medical institution.

One more note, they do not own a football academy. they provide website production and marketing services.

Generally speaking, growth stocks have been hit very hard recently in Japan so there are lots of companies undervalued. it is interesting situation now, though we don't have many companies which are globally competitive..