Round 1 (4680) Quick Pitch: Undervalued Amusement Provider with Many Avenues for Growth

Tapping into one of my favorite childhood pastimes

Hi all, This is a guest post by Continuous Compounding. On a personal note I have another premium supporters write up almost ready. Thanks Alan!

Continuous Compounding Intro:

Hi readers of Emerging Value, I would like to thank Olivier for graciously featuring my Substack. Several months ago, Olivier reached out to me and shared my work. I was extremely grateful and was not expecting a much larger Substack/Fintwit account to assist a small fry like me. He even helped connect me with Michael Fritzell from Asian Century Stocks, where my write-up on Haier (690D) was featured on Monday Morning Links. I just wanted to take a second to give Olivier his flowers.

Back to the intro: my name is Alan, and I was born and raised in Vancouver, BC, Canada. For sake of anonymity, I will be broad in my description of myself. Even though my background is in equity research, I learned most of my investing knowledge away from school or work. I’d say Warren Buffett has had the biggest impact on my investment philosophy. Often at work, when I am forced to make these highly aesthetic Calvin Klein-esque financial models, I often think to myself how ridiculous this practice is. I always thought if I had to go to this level of granularity to attain a valuation and this level of granularity made or broke my investment thesis, then likely this stock is fairly valued or doesn’t have enough margin of safety. Hence, I hope you will forgive me for taking certain shortcuts in my modeling process, as I am using these models to simply get a rough estimation of value. I follow the adage of being roughly right rather than accurately wrong.

As weird or normal as this may sound to you, when I uncover an undervalued stock, using the words of cleaning guru Marie Kondo, it sparks joy in me. The process of finding an undervalued stock, learning about the business model, and relating it to my own personal experience is extremely fun and engaging for me. I sincerely hope my write-ups provide you with immense value, either through expanding your circle of competence or hopefully generating alpha.

Subscribe for free to my Substack to receive the following:

This is a quick-pitch. I will be posting a follow-up post(s) with more in-depth analysis.

Financial model updates on R1 whenever earnings comes out

YouTube video explaining the investment thesis of R1

Continuous update posts on R1

Other stock pitches, deep dives and special situations

Intro:

Round One Corporation (4680) is a Japanese amusement operator. They mainly have two store-format offerings. Their regular store offers bowling, amusement (arcade machines, crane games, photo booths), food and beverage, and karaoke. At their larger format “Stadium” stores, they also offer Spo-Cha (short for sports challenge). Spo-Cha is a sports center that allows people to play various sports (basketball, baseball, badminton, table tennis, pool, etc) and physical activities (go-karts). Recently, they are experimenting with smaller format stores that focus on crane game offerings (more on this later). They currently have 100 stores in Japan, 48 stores in the US, and 4 stores in China.

Valuation Overview:

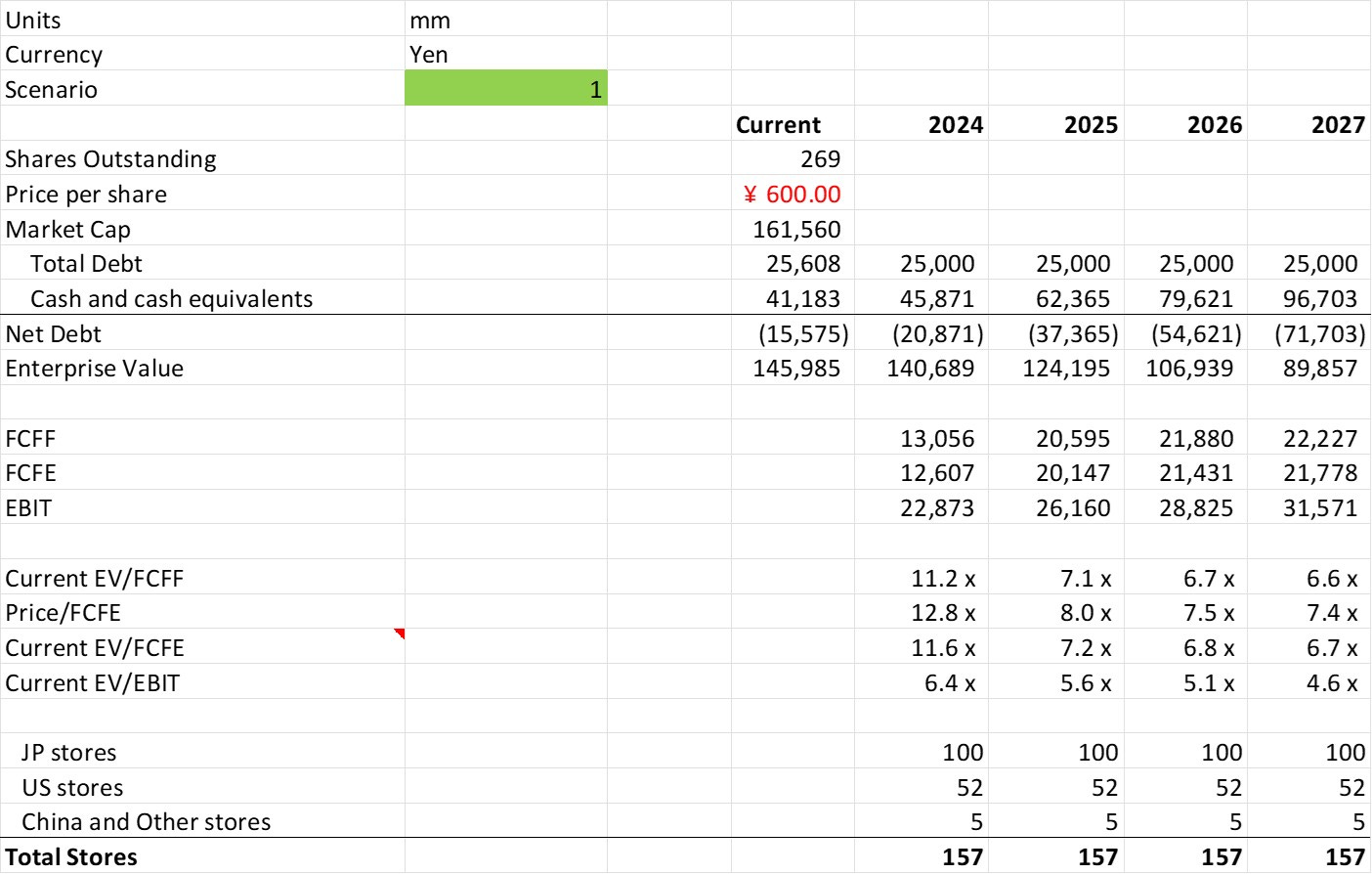

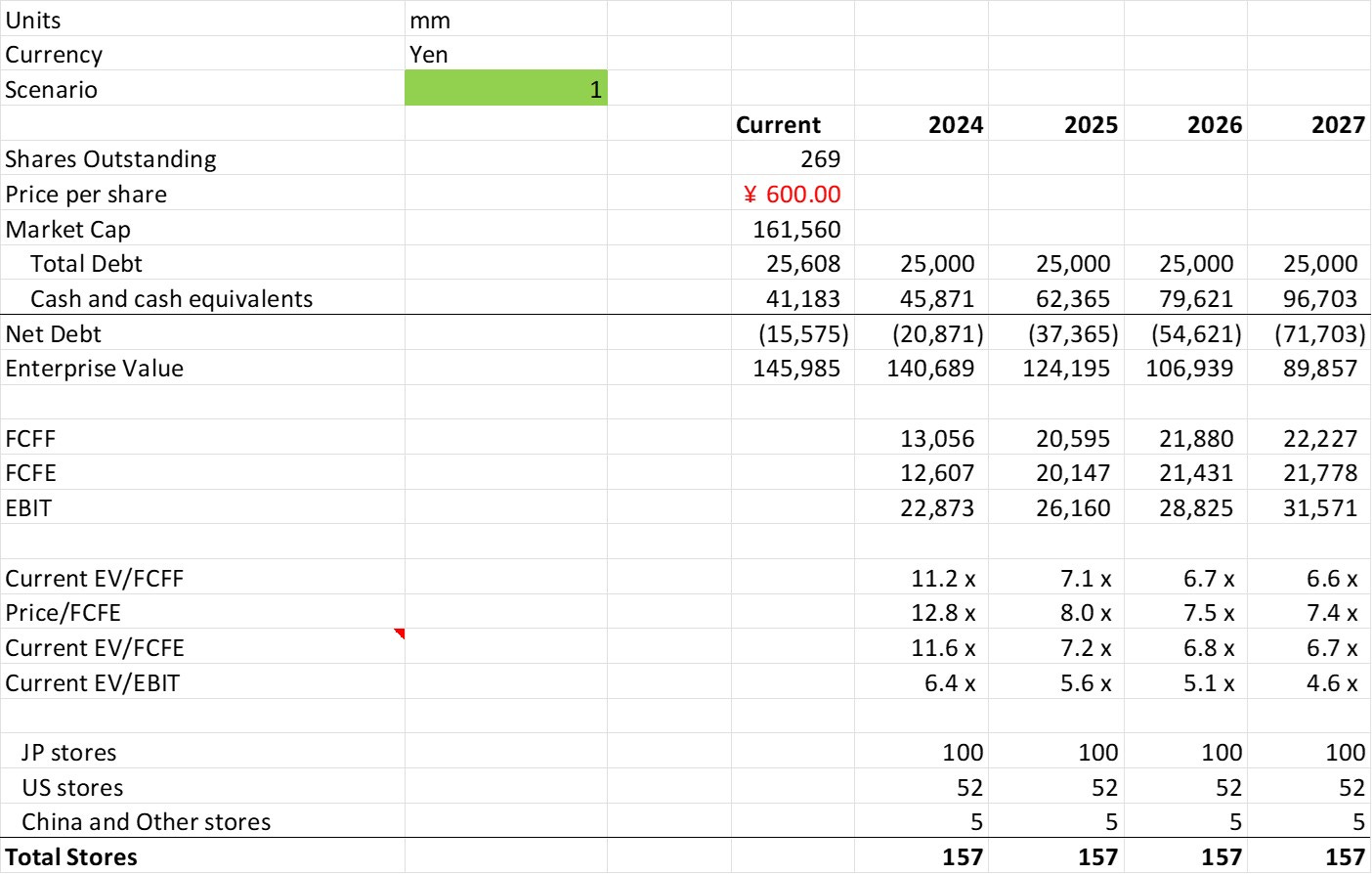

Scenario 1 Valuation:

*Share price of 600 yen per share is assumed for the entirety of this write-up. You may adjust this price in the attached full financial Excel model provided below.

**Above valuation is based on scenario 1 (S.1 Excel model), which assumes no additional stores will be open post FY2024 (this scenario is highly unlikely as the company is growing). Discussion of additional scenarios later in the write-up.

***mm = million, bn = billion

Key Highlights:

-Good (B) management and good (B) business economics at an attractive price (A-)

-Cash exceeds debt. Negative net debt of -16 billion (bn) yen.

-Becoming less dependent on Japanese operations through the success of US stores. Diversified across Japan (62% of Revs, 57% of operating profit), US (37% of Revs, 45% of operating profit), and China (1% of Revs, -2% of operating profit). *Based on FY2024 est.

-Stock is undervalued as the market is underestimating the company’s ability to grow

-Accounting cash flows are lower than real cash flows, given the depreciation schedule adopted.

-Stock is a double in 3-5 years. Roughly the time frame FCFF/FCFE reaches 30 bn yen after adjusting for the effects of a depreciation schedule that is shorter than the useful life of fixed assets. At this point, it’s completely reasonable to assign a 10x+ EV multiple to FCFF/FCFE, resulting in double the company’s current EV.

-During the holding period, the stock is offering 14 yen per share of dividends, or roughly a 2+% dividend yield. With an ever-growing cash reserve, the company is also likely to continue buybacks after deciding on a new buyback program for FY2025. The company maxed out its previous buyback program of 10 bn yen - a sizeable sum for a stock with a market cap of roughly 160 bn yen.

Quick Investment Thesis:

COVID had a negative impact on Round One (R1) because of shutdowns and decreased traffic. Post-COVID, the company's sales rebounded to surpass pre-COVID levels. With the resurgence of traffic and sales, the company has resumed its store openings.

The biggest investment the company has made recently is their conversion of stores into “Giga Crane Game” (GCG) stores in Japan and “Mega Crane Zone” stores in the US. In Japan, the average non-GCG store has 80 crane games, and those that get converted are upgraded to an average of 320 crane games.

The unit economics of crane games are extremely attractive. According to “Shared Research” (see appendix for data sources used), stores that converted to GCG stores in FY03/2023 experienced a 40% increase in sales compared to before their remodelling. There seems to be a trend that once a store changes their amusement equipment mix to include more crane games, they experience an increase in sales. The marginal profit margin of each crane game machine is 60% (more on crane game business economics later).

The company has converted 73 stores domestically, with an average of 240 crane game machines installed per converted store. From my research, the company mainly installs “SEGA UFO Catcher 9” machines, Sega’s newest crane game offering, which cost roughly 1,000,000 yen per machine (7K USD at 1 USD = 141 yen). I estimate the company has installed 17,520 crane game machines, a total increase in fixed assets of 17.5 billion yen. Conversions began at the beginning of FY03/2022 (April 1st, 2021).

**I assumed a slightly lower price given there must be some bargaining power from ordering so many machines.

The completion of finance leases related to crane game machines after 3 years is the main pillar of my investment thesis and one that is going unnoticed by the market. The company finances the acquisition of these crane games through finance leases. These finance leases last 3 years, and the crane games have a useful life of 10–15 years (avg. 12.5 years). Hence, current-year profitability is depressed due to the accelerated depreciation of finance leases that match the lease term. By 2027, a majority of the finance leases will be fully depreciated, and FCF and operating margins will increase significantly due to having, on average, 9.5 years of useful life remaining on crane games.

The next pillar is US “Mega Crane Zone” store upgrades. In the US, the average store has 50-60 crane games. The company aims to have a total of over 150 crane games per mega crane zone store. If we assume 100 crane games are installed per store, at 1mm yen per machine, it costs 100 mm yen per store to complete the conversion.

The company started US conversions at the beginning of FY2024 (April 1, 2023), and has completed 15 conversions as of Q2 2024 thus far. The company aims to complete 38 conversions by the end of the year. The company has 4 new store openings; if we assume these come standard with 150 crane game machines, there are only 10 more conversions available in FY2025. To convert 48 stores, it would cost 4.8bn yen, including the 4 new stores with 150 new machines would add on roughly 600 mm yen of fixed assets, for a total of 5.4 bn yen. In the US, R1 has directly purchased the crane games with cash on hand and will depreciate the machines over 7 years. Hence, by FY2031/FY2032, FCF will further increase, given that the crane games will have on average 5.5 more years of useful life.

Using simple math:

JP:

At 3 years of depreciation for a finance lease, the depreciation is roughly 5.8bn yen per year. While the useful life of 12.5 years means depreciation should be roughly 1.4bn yen per year. To keep it simple, we are overpaying 4.4bn yen a year in depreciation for our JP operations.

*Keep in mind that the company started converting stores in FY2022, hence some stores will fully depreciate in FY2026 and the rest in FY2027 and beyond. The above calculation is true in years where the depreciation persists for stores that are converted in both FY2022 and FY2023.

**To see a more detailed depreciation schedule, check out the attached Excel model.

US:

At 7 years of depreciation for tax purposes, the depreciation is roughly 770mm yen per year. While the useful life of 12.5 years means depreciation should be roughly 430mm yen per year. To keep it simple, we are overpaying 340mm yen a year in depreciation for our US operations.

Based on my calculations, the company is currently valued by the market at 12x P/FCFE FY2024 (year end March 31, 2024), and by 2027, when a majority of their current Japanese fleet of crane games is fully depreciated, forward FY2027 P/FCFE is roughly 7x.

*This valuation does not even factor in the US mismatch between the depreciation and useful life of crane games.

Given the company has more cash than debt, the EV(excl. lease obligations)/FCFF multiple is even more attractive. The company is trading at roughly 11x FY2024 EV/FCFF, and 6x FY2027 EV/FCFF.

*The reason we exclude lease obligations in our calculation of EV is because we are already subtracting “repayment of lease obligations” from our calculation of FCFF.

Based on scenario 1 (no new store openings), the company is trading at 7.4x FY2027 P/FCFE, 6.6x FY2027 EV/FCFF, and 4.6x FY2027 EV/EBIT while having many avenues for continued growth:

Continued US regular and “stadium” store openings.

New US small-format amusement-focused stores. According to Shared Research, the company revised the former guidance of 80-100 stores to 150-200 store openings

Small-factor crane game store expansion domestically in Japan

Continued China store openings and experimenting with small-factor stores in high-traffic malls

Round1 Delicious

Openings stores in Euro region and other countries

Hidden Catalyst:

Opportunity to expand north of the US border into Canada

I would categorize R1 as a GARRP investment. Growth at a really reasonable price. Or a stock that is trading at a discount to its GARP multiple.

Upside Potential:

I have attached 4 financial models in the link below that represent 4 different scenarios for the company:

Round 1 Full Financial Models and Scenario Analysis:

No-growth scenario (S.1):

-This scenario is only used to showcase the cash-flow potential of the company’s current fleet of stores

-The opening of new stores is halted post-FY2024 to clearly show the earning potential of existing stores after the 3-year finance-lease period for giga crane game stores is over.

-The company has an attractive valuation even in this scenario

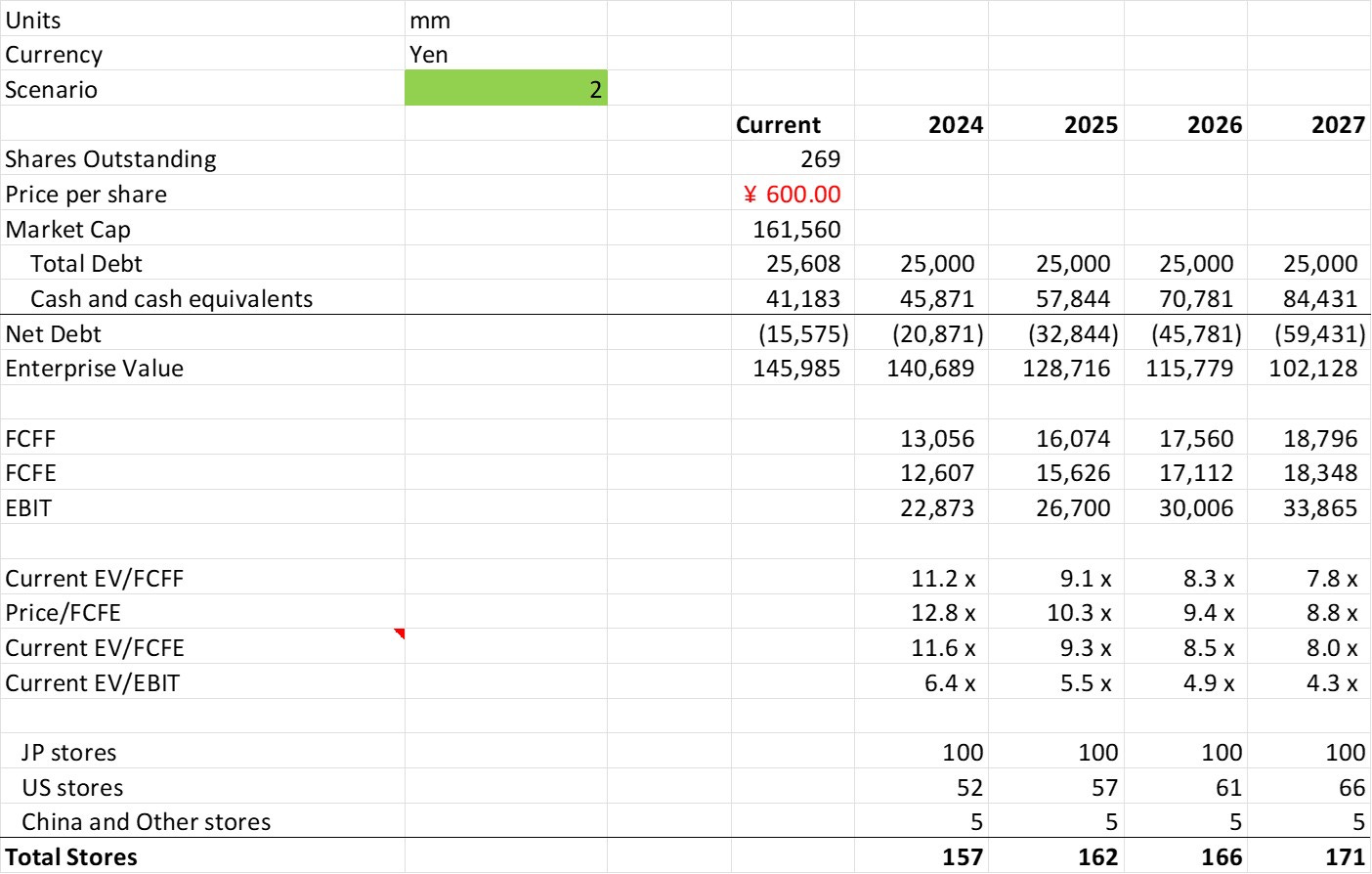

Base Case (S.2):

-Continued US regular/spo-cha store expansion

-Halt expansion in China

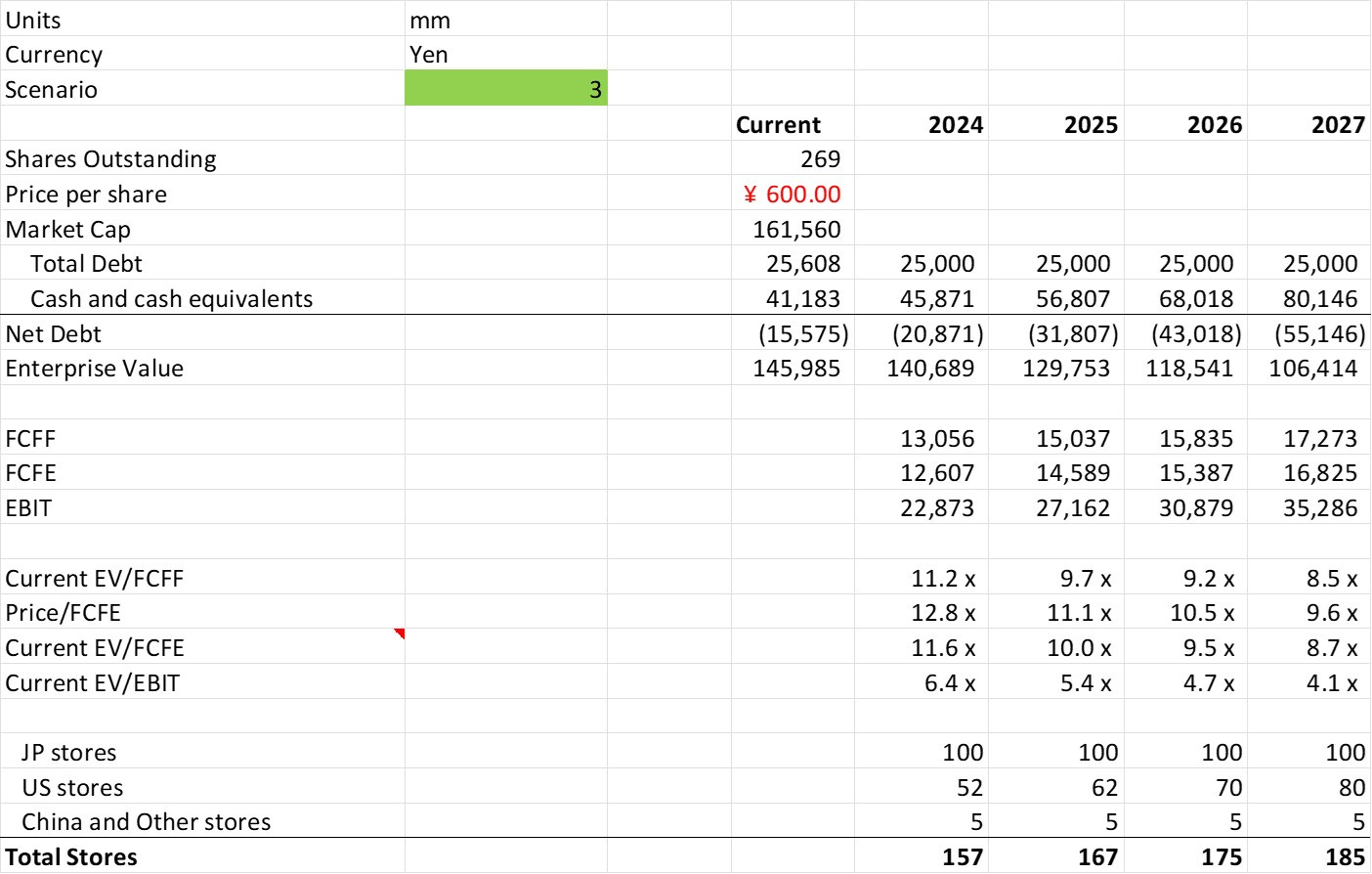

Better Case (S.3):

-Continued US regular/spo-cha store expansion

-Halt expansion in China

-Small amusement stores prove profitable in the US. The company targets opening 150-200 stores in the US

Best Case (S.4):

-Continued US regular/spo-cha store expansion

-Small amusement stores prove profitable in the US, JP and CN. The company targets opening 150-200 stores in the US. The company will be opening more amusement stores in JP and CN as well.

-Recovery in China’s retail sector. The company continues regular/spo-cha store expansion in China.

Best Best Case: (Free lottery ticket)

-All the above and Round1 Delicious (R1D) is well received and profitable in the US

*I will not be modeling this scenario as there are too many what-ifs with R1D. The point is that the company is undervalued enough that if R1D works out, we can make additional returns. In the words of Mohnish Pabrai, we get a free lottery ticket.

Scenario 1: Earnings potential of current stores

By 2027, the dust clears and the true FCF potential of the company’s current stores will be displayed to investors.

The above is the FCF earning potential of the company’s current stores that are already in operation in FY2024.

The opening of new stores is halted post-FY2024 to clearly show the earning potential of existing stores after the 3-year finance-lease period for giga crane game stores is over and capex is only maintenance capex.

Scenario 2: Base Case (Continued US expansion)

-Continued US regular/spo-cha store expansion

-Halt expansion in China

The reason I wanted to illustrate scenario 1 first is because FCFF/FCFE decline once we start opening new stores. This is due to increased “growth” capex due to opening more stores. As amusement stores are capital-intensive businesses, higher upfront costs result in a major impact on FCF in the year the stores are opened. This is coupled with depreciation schedules being shorter than the actual useful life of arcade machines, crane games, bowling assets, karaoke assets, and sports equipment (basketball and badminton courts).

This further demonstrates why the market is mispricing Round1. They are not accurately forecasting cash flows because they are not accounting for depreciation properly. The true cash flow potential of US stores won’t show up 7 years from the date they are opened. Luckily, the impact of giga crane game conversions on cash flow will reveal itself in financials by FY2026/2027.

The main indication that the company is growing in a healthy manner is that revenues and operating profit are growing, while operating profit margins stay consistent or increase due to operating leverage. Given shorter depreciation schedules, new stores lower the group’s operating margin in the short (JP) to medium (US/CN) term.

Scenario 3: Better Case (What the company is forecasting)

-Continued US regular/Spo-cha store expansion

-Halt expansion in China

-Small amusement stores prove profitable in the US. The company targets opening 150-200 stores in the US

The region where we want small amusement stores to be profitable the most is in the US. As mentioned before, the US has a growing population, a strong currency (great when converting back to JPY), a growing fan economy (good for crane game revenue), and better profit margins.

Small amusement crane game stores are relatively simpler businesses than R1’s typical regular or Spo-cha stores. All a staff member needs to do is help with membership sign-up, refill prizes into crane games, and monitor players to ensure they walk out a winner.

“Share Research” mentioned in their research report (1/10/2024) the following:

“In the US, a typical city (trade area) with a population of 0.8 to 1.0mn has four large shopping malls. In the past, the company opened stores in one of the four malls per trade area, and refrained from opening stores in the remaining three malls to avoid cannibalization. However, at the Q2 FY03/23 results briefing, the company mentioned that it was considering opening smaller stores under a different format from conventional stores in the three remaining large shopping malls in each trade area.”

What I will discuss later is the fan economy. A lot of stores in malls nowadays have overlapping products. GameStop, Spencer’s, Hot Topic, Sunrise Records, and Chapters/Indigo all sell collectibles, figurines, and plushies. I have also seen specialty gift stores (Treehouse Toys in Canada) that source collectibles, toys, figurines, and plushies from Korea and Japan to sell in Canada (items North American customers do not get). My personal observation is that the reason R1 is investing heavily in crane games is because consumers enjoy acquiring collectibles or IP products via crane games rather than purchasing them outright. My view is that R1 will take collectibles market share from the retailers I named above and those similar to them if they enter the “remaining” shopping malls in the region. More on this later in my analysis.

Another observation is that the opposite strategy can be used in China. R1 is struggling to open stores in China due to a lack of traffic. In cities where the company has not entered, the company can first pick one shopping mall in the city as a test candidate for its small amusement stores. If amusement revenues meet the company’s minimum threshold for producing profits, the company can pick one of the “remaining” shopping malls as a candidate for a larger regular/spo-cha store.

Scenario 4: Best-Case Scenario

-Continued US regular/spo-cha store expansion

-Small amusement stores prove profitable in the US, JP and CN. The company targets opening 150-200 stores in the US. The company will be opening more amusement stores in JP and CN as well.

-Recovery in China’s retail sector. The company continues regular/spo-cha store expansion in China.

In this scenario, FCF takes a major hit due to the number of stores we are opening. This result is perfectly fine, given that we have all this opportunity for growth. The reduction in FCF is due to growth capex, so if we were to extend the model another 3-5 years out and halt store openings, FCF would increase due to the elimination of growth capex and the existence of only maintenance capex.

Scenario 5: Free Lottery Ticket

On December 12th, 2023; R1 held a press conference introducing their new concept store “Round One Delicious” (R1D). Taking inspiration from R1 amusement stores with many forms of amusement entertainment in 1 single location, R1D offers 7 Japanese restaurants under 1 roof.

The cuisine that will be offered includes the following:

Sushi

Japanese Cuisine

Chinese Cuisine

Creative/Innovative

Yakitori

Tempura

The point of differentiation of R1D is that it offers high-end authentic Japanese cuisine with ingredients sourced from Japan.

In 2 years, R1 will launch Round 1 Delicious. There is too much uncertainty in regards to whether this will work. I believe the reasoning is sound, but the forecasts the company gives are, in my opinion, overly optimistic. It is comforting to know that we do not need R1D to work out for our investment to make sense, but if it does, then that is gravy on top.

The analysis on R1D is quite long; hence, I will discuss R1D in a follow-up post on my Substack later on.

Thanks for reading Continuous Compounding! Subscribe for free to receive new posts in regards to Round 1 and support my work.

Subscribed

In summary, the company has the following advantages opening R1D:

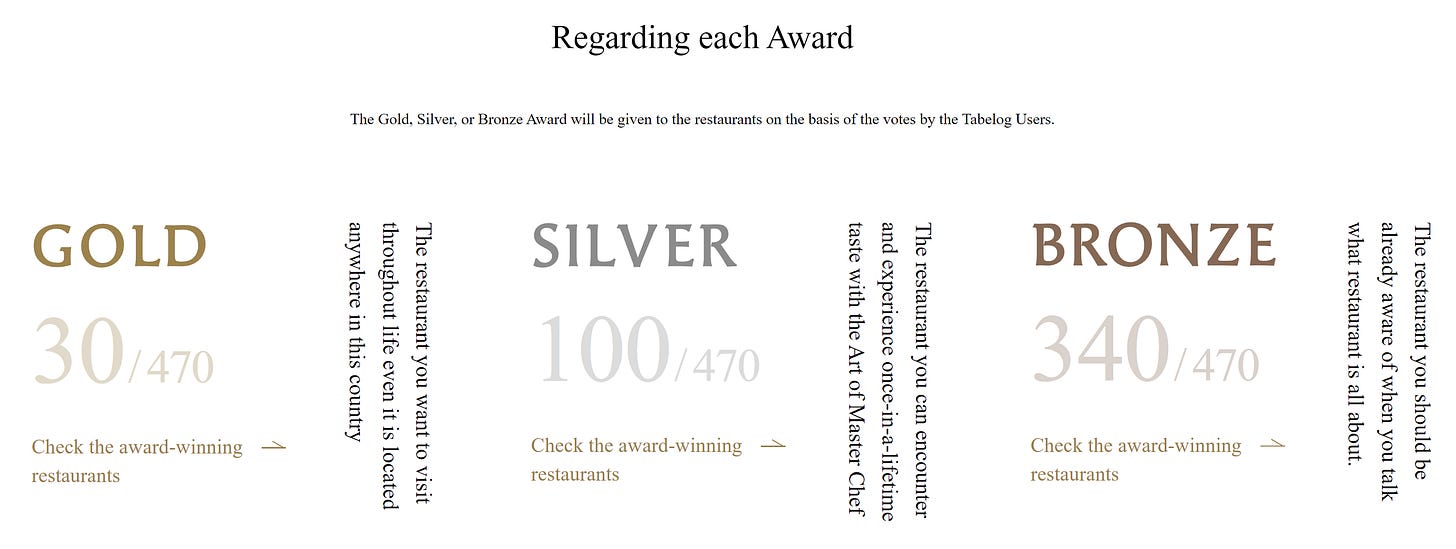

-R1D has assembled the “Avengers” of Japanese cuisine. Partnering up with primarily 2023 Tabelog Gold and Silver winners, with a few Bronze restaurants included.

-Having opened 48+ stores in the US, they know how to conduct business in the US. R1 handles all the paperwork and logistics, while partnered restaurants focus on menu curation and chef training. Each party focuses on their strengths.

-R1D is a completely new concept. There is nothing like this in the US. The customer of the sushi restaurant at R1D, may want to try the yakitori restaurant the next time they visit the location.

-Partnered restaurants have equity interests and revenue royalties in each restaurant opened in the US. Incentives are aligned.

-If concept is successful, R1 would have established themselves as the go-to partner for restaurant expansion for high-end Japanese restaurants looking to expand overseas.

Disadvantages:

-Amusement company with no restaurant opening expertise. They are venturing into a new industry.

-The restaurant business is a high-risk and high-reward business.

-There are minimal, if not zero, synergies with current core operations

-Opening a high-end Japanese restaurant requires the hiring and training of extremely skilled chefs. Almost everyone can flip burgers at McDonalds. Controlling turnover is a hurdle the company must overcome.

To get a sense of the calibre of chefs R1D is working with, here is a video on “Sushi Saito” which is not only a Tabelog Gold winner, but a 3 Michelin star restaurant.

Why Round1 is not a value trap:

A lot of Japanese publicly traded companies have EVs that are below their market cap and appear cheap relative to their earnings. The reason for this is that the company hoards cash and cannot allocate cash into investment projects with return characteristics that match or exceed the company’s current core operations. This results in balance sheets that have more cash than debt. ROE is often reduced if cash is not redistributed via dividends, buybacks are not made, or there are no new projects the company can reinvest such cash into. The cash is kept on the balance sheet as sort of an “emergency” fund.

The above scenario is not the case for Round1. The company has proven it can be profitable in the US. In fact, the US region is more profitable than the JP region. Furthermore, I would not write off China just yet, as their initial openings were during COVID. China’s zero-COVID policies have been extremely negative for R1. The company will be opening stores in locations with proven traffic volumes going forward. I believe R1 has a long runway until full market penetration in the US and China. Looking beyond these 2 developed countries, I personally believe Canada is another candidate for store expansion (more on this in a subsequent post on my Substack), along with European countries. In summary, R1 is not a value trap because cash can be used for store openings.

Dividend yield:

From FY2017 to FY2022, the company paid 6.66 yen per share on a split-adjusted basis. In FY2023, the company increased dividends to 8 yen per share. Recently, the company has raised its dividend twice in 1 year. In the beginning of FY2024, the company raised the quarterly dividend to 2.5 yen per share. In Q3 FY2024, the company is raising dividends to 3.5 yen per share. This is equivalent to an annual dividend of 14 yen per share, or 2.5% dividend yield.

Buybacks:

The company has performed opportunistic buybacks over the years.

In FY2021, the company repurchased 6.5mm shares (19.5mm shares on a stock-adjusted basis) for 5 bn yen, or an average share price of 254 yen per share on a stock-adjusted basis.

In FY2023, the company repurchased 6.9 mm shares for 3.5 bn yen or 508 yen per share.

As of Q2 FY2024, the company has repurchased 11.2mm shares for 6.5 bn yen or 581 yen per share.

Given that the company currently has 269mm shares outstanding (excl. treasury shares), the roughly 38mm shares they have repurchased over the last 3 years demonstrate to me as an investor that the company does know when to opportunistically perform buybacks.

It is good to know the company has purchased shares at around the current market price. I believe the company will continue to opportunistically perform share buybacks at prices that create shareholder value.

If the market continues to misunderstand R1’s cash flow generation potential, then the company can easily use its cash reserves to repurchase shares.

Qualitative Analysis:

Japan Market:

In a recent press conference, the CEO was asked why they were considering R1 Delicious, and to paraphrase his reply, he didn’t see much growth potential domestically for the company, so he was thinking about what offerings he could bring from Japan and share with the world. The CEO believes the know-how his company has gained through its profitable US operations, coupled with the lack of authentic Japanese food outside of Japan, will make R1 Delicious a worthwhile opportunity.

On a side note, I personally agree that there are limited opportunities for R1 to grow in Japan, besides potentially small crane game stores. I disagree that success in opening amusement centers in the US, correlates with success in opening restaurants in the US. They are partnering with some of the best restaurants in Japan, I will give them that, but the restaurant business is a difficult business.

A couple of macrotrends are unfavourable to R1:

-Japan’s population is declining with an aging population

-The company’s target age demographic is 10-29 year olds (50-60% of customers). 30–40-year-olds account for 30-40% of customers. Fewer births result in fewer customers entering this age pool and more people leaving it.

Trends in favour of Japan:

-Travel permitted post-COVID. Tourism is one of Japan’s biggest industries. Foreigners who grew up with arcades, watch anime, are part of the fan economy (more about this later), or need an activity to fill up their trip itinerary are also potential customers of R1.

-Yen is cheap. USD and CAD have strengthened relative to the Yen. Back in 2019, when I went, I exchanged 1 CAD for 84 yen (currently, 1 CAD = 108 yen). Despite the more costly air fare, USD and CAD go further in Japan. Anecdotally, the cost of food I see in vlogs and YouTube videos hasn’t changed much since 2019, so inflation hasn’t increased like in some western countries. A bowl of ramen is easily $15-$20 CAD or USD in Canada or the US, while you can still find ramen for around 1000-1200 yen ($9-11 CAD or $7-9 USD) in Japan. This might have something to do with the 1000 yen per hour average minimum wage in Japan.

The company’s transition to “Giga Crane Game” stores has been a success, and sales have increased as a result of this large-scale store conversion. Given they have already converted 73 out of 100 stores and the rate of conversion has slowed to low single-digits, I believe the crane game revenue catalyst is nearing maturity.

They are trying out small amusement stores with crane games on a small scale to see if the idea can work. While this in and of itself has potential for growth for the company, I see it as a free lottery ticket. There is additional upside if the concept works and the store count grows as a result of the proof of concept. My only issue with this idea is the potential cannibalism of revenues (more on this later).

To summarize, I believe the state of the domestic business is optimizing the operations of its existing stores, defending current market share, maintaining profitability, continually looking for market opportunities to generate additional revenue, and increasing operating leverage.

US Market:

The US market is the key market for R1 at the moment. US stores are more profitable than JP stores. US stores have higher gross profit and operating profit margins when compared to JP stores. The US population and economy are still growing.

As increased traffic is key to operating leverage, having a population that is growing via childbirths and immigration is a positive trend. Another important factor is disposable income. Keeping traffic constant, if average disposable income increases, customers are willing to capture more prizes at the crane games, give their kids more tokens to play at the arcade, or host a birthday party at R1 for their kids.

I will be doing a comps analysis in a subsequent post on my Substack, but another thing worth mentioning is that stocks such as Dave and Busters (PLAY), and Bowlero (BOWL), Round 1’s closest comps in terms of business model, all trade at multiples greater than Round1 (4680). PLAY trades at 11x FY2024 EV/EBIT. BOWL trades at 16x EV/EBIT. R1 trades at 6.4x FY2024 EV/EBIT.

Dave and Busters (207 stores) and Bowlero (345 stores) have far greater store counts than Round 1 (48 US stores) and trade at higher multiples. It is much easier for R1 to double its store count from 48 stores to 100 stores, whereas it is far more difficult for PLAY and BOWL. Having watched videos of store tours of PLAY and BOWL on YouTube, I can confidently say there is no competitive advantage PLAY and BOWL have in their amusement offerings over R1. I am willing to go one step further and say that PLAY and BOWL’s amusement offerings are quite similar, and R1 arcade amusement offerings are more unique than those of PLAY or BOWL. If the market sees growth potential in PLAY and BOWL, then there should be growth potential for R1. PLAY and BOWL are also highly levered; R1 could have no debt if it wanted to by simply tapping into its cash reserves.

China Market:

The company states the main reason 3/4 of their stores are unprofitable is due to a lack of retail traffic and a lack of residents in neighbouring real estate developments. Due to speculation in the Chinese real estate market, the bankruptcy of real estate developers led to condos being unfinished. Investors in these condos take losses, reducing their spending power. Retail malls that were built solely on the basis of an expected population in close proximity to the retail space due to new condos being completed suffered from lower than expected traffic.

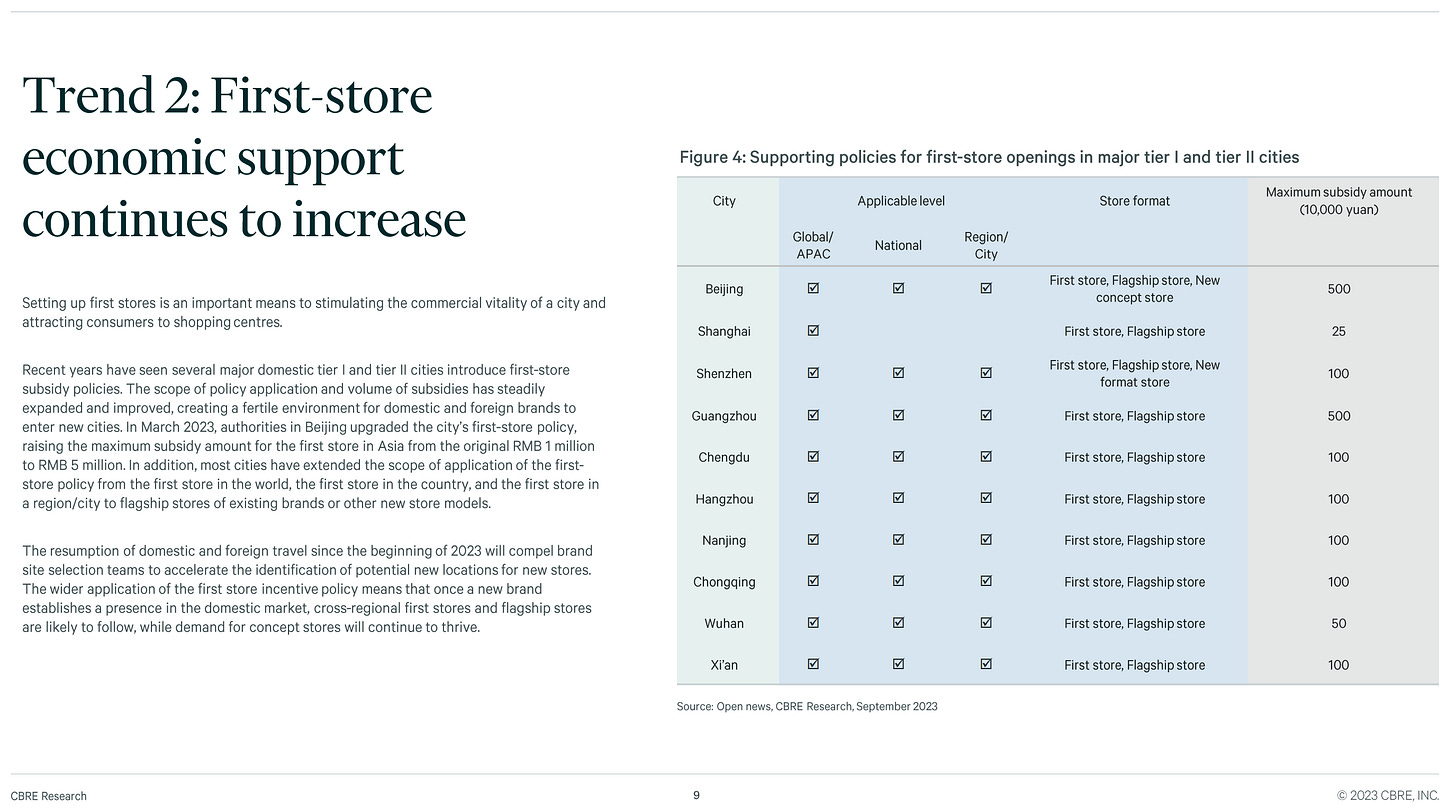

Following COVID, retail is slowly recovering. There are incentive programs in cities throughout China that offer a subsidy for first-store openings. This helps attract domestic and foreign brands to open up shop in China.

Hidden Catalyst:

I believe a hidden catalyst is that the company can definitely expand north of the border into Canada. This is something the company has not alluded to, but as a Canadian, being Asian, having grown up playing at arcades, and being their target age demographic, R1’s offering would be very unique in Canada.

For the same reasons R1 is successful in the US, here are the reasons it would be successful in Canada:

-Completely unique offering, providing a one-stop amusement center that caters to families, children, teenagers, and young adults.

-Canada has a growing population. Population growth via births and immigration

-Many major cities have a sizeable Asian population

-Fan economy present in Canada is similar to that in the US. More and more people watch anime.

-No existing arcade provider offers the latest arcade machines or crane game machines. My impression of the Seattle location, which is an “above average profitability” store, is that they are well managed, staff provide a decent level of customer service, adequate levels of sanitation and cleanliness are reached, and you see customers of all races.

-The “Rec Room,” a comparable amusement offering with arcade games, has opened 10 stores across Canada. In my very humble opinion, Round 1’s offering is superior to that of Rec Room’s. “Rec Room” offers a low/mid-tier arcade experience. The “Rec Room” is a decent option for a couple or family looking for something to do. The market they uniquely fit is individuals who have no prior expectations of what a “great” arcade experience is and are just looking for a form of entertainment. This is parallel to taking a Chinese friend to Panda Express and asking them what they think of the food.

All that rambling aside, I simply believe R1 has a market in Canada. If I were R1, I would initially expand into predominantly Asian communities that can appreciate quality amusement offerings and have disposable income.

Small Amusement Stores:

In Japan, US and China, the company is experimenting with smaller format amusement stores. These stores are focused on providing crane games.

In Japan, they want to open up these specialized crane game stores in high-traffic areas like train stations, but finding such locations is difficult. R1 is also considering opening stores in suburban stations and shopping malls.

I fear their small stores will be cannibalistic to the company’s bigger stores. There are some levels of revenue synergies if we think about R1’s offerings. An individual going to Spo-Cha, bowling, or KTV may window shop by walking past the crane game machines. And an individual looking to play crane games may want to play some driving games or fighting games too.

If there is a smaller crane game store that doesn’t require you to make the trip out to a bigger store, you may not get those revenue synergies.

In the US, in cities where there are multiple shopping malls, they plan to open smaller-format stores in malls that are not already occupied by an existing regular/spo-cha store.

Capable Capital Allocators:

The CEO has shown a tendency to only invest large sums if a project is proven to be profitable. This is evidenced by its initial gradual store openings in the US. Once R1 proved their initial US stores could be profitable, they aggressively opened stores. This was also the case when the company initially converted stores in Japan into giga crane game stores.

In China, the backdrop of COVID, housing surplus in real estate, and a lack of traffic due to a lack of residents made a majority of its locations unprofitable. The company has halted the expansion of regular large-format stores in China and is experimenting with smaller crane game stores at malls with proven traffic.

The above are examples of efficient capital allocation and demonstrate to me that the CEO is a capable capital allocator.

I believe this pattern will hold true for the company’s small specialized crane game stores and R1 Delicious stores.

Sources of Return:

Price Appreciation:

The share price will appreciate if the following occur:

More store openings than expected

Continued regular/stadium store openings in the US, JP and CN.

Small amusement stores are proven to be profitable, and the company ramps up small store expansion in the US, JP, and/or CN.

Expanding and opening stores in other countries. i.e. Canada

The market realizes what the company’s true cash flow generating capabilities are

The year is 2026/2027 and investors see with their own 2 eyes what the company is earning once crane game finance leases are over.

There are 207 Dave and Buster (PLAY) stores and 345 Bowlero (BOWL) stores. We need investors who are simultaneously customers of Round 1 to realize the unique amusement experience R1 offers and to look into R1 as an investment. Ignoring R1’s 100-store JP operation, R1’s 48-store US operation is expected to generate 10.3 bn yen in operating profit in FY2024. If we apply PLAY’s 11x EV/EBIT multiple (the lower of PLAY and BOWL), that is roughly 110 bn yen or more than 2/3 the current EV of the company. Given how many more stores R1 can open in the US, and how competitive I believe R1 to be in taking its competitors lunch, if R1 were a US listed company, it’s multiples should trade for higher than 11x EV/EBIT. Of course this is a Japanese stock, so this shows us the upper bound of the value of our US operations.

Introducing the IC card system in Japan. Allows for more flexibility in pricing and the transfer of costs to customers.

R1 Delicious business model works

Share buybacks: the company uses excess cash, not needed for growth capex, to aggressively repurchase shares at undervalued levels

Dividends: continue to raise dividends as long as there isn’t a better use for cash, such as for growth capex

More support for foreign investors by providing more filings in English

What is the market missing?

All the avenues for growth available to the company

Round 1 being a continuous compounder with a long runway for store openings in many foreign countries

Willingness of the company to repurchase shares

Cash flow generating ability of the company if accounting depreciation accurately reflected the true useful life of assets

Catalyst:

Small amusement stores are proven to be profitable. This would allow the company to substantially grow its store count.

Garnering the attention of more investors. Recently, I noticed the CEO had an interview with TV Tokyo Biz. Also held a press conference introducing Round 1 Delicious and its partnered restaurants.

Effective utilization of cash through expansion, buybacks and dividends

Change in investor sentiment in investing in Japan

FY2026/2027, when true earnings are revealed (unless massive amounts of growth capex keep FCF low)

Better foreign investor support via English filings

Risks:

Lower than expected growth or decline in “fan economy”

Effects of an aging and declining population are more severe than expected

Crane games are a one-time fad, and demand for crane games die down

Crane games are seen as a form of gambling or face stricter regulation.

Slower pace of store openings in the US due to competition or rising costs

R1D is a money pit

*I will address all the above risks in a subsequent post

Disclosure: I am currently long shares of Round One Corporation/4680 Shares.

Thanks for your support!

To stay up-to-date or receive notification of when I release my latest stock pitch, please follow:

Substack: https://continuouscompounding.substack.com/

Twitter: https://twitter.com/compoundersEX

Instagram: https://www.instagram.com/compounders.ex/

YouTube: https://www.youtube.com/@continuouscompounding

Want to enjoy paid memberships for free? Help me grow by referring a friend!

1. Share Alan’s Substack: Continuous Compounding.

When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 1 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 10 referrals

Appendix:

The accounting is very time-consuming to unravel, especially since I don’t know Japanese. With the aid of Google Translate, coupled with my semi-fluency in Mandarin, I was able to navigate the Japanese filings. I spent quite a bit of time unravelling the financials to get at the true earnings of the company. (For those who have read Quality of Earnings, iykyk)

Data sources used:

Round1’s English IR library

Round1’s Japanese IR library (*Used Google translate to translate text)

Shared Research (A research provider listed on the company’s IR page)

Limitations of data sources:

Full quarterly and annual security/financial reports are only reported in Japanese.

A condensed version of the Japanese security/financial reports are translated to English

The English IR has all the Japanese investor presentations translated to English

Other:

The company's fiscal year ends on March 31st of any year. The company’s upcoming fiscal year end is FY03/2024 or March 2024. Given that the fiscal year ends in 2024, we are currently in FY2024. The most recent period of reporting is Q2 FY2024.

*Legal disclaimer: The post, the attached Excel model, and all its contents herein are the exclusive property of Continuous Compounding. This post is intended solely for informational purposes and is not to be distributed, reproduced, or transmitted, in whole or in part, for commercial purposes or sale without prior written consent from Continuous Compounding. Any unauthorized use, dissemination, or sale of this research is strictly prohibited and may be subject to legal action. Continuous Compounding assumes no responsibility or liability for any errors, inaccuracies, or omissions in this post or for any actions taken based on its contents. Recipients of this research are advised to conduct their own independent analysis and seek professional financial advice before making any investment decisions.

Nice write-up, enjoyed reading it.

Hey Alan

A very detailed analysis. So what's the upside potential here and where do you see its price in the next 2-3 years when the lease obligations are fully depreciated? Why do you think the debt will remain consistent and not increase as they expand into new markets like North America? How will they finance their expansion ? Do you think the funding will come from within i.e., through organic growth and if that's the case, would it suffice? thanks!