Quick update; I am already up 20% YTD in Euros. Some picks recovered and some picks went very well.

One that recovered was Bastide Le Confort. But Sometimes you have to realise when you make a mistake, and I sold Healthcare company Bastide Le Confort after it rerated to a Forward P/E around 12.

My return was positive after I added during the 2024 crash, but my initial buy was still underwater and losing money, so it was a bad investment overall, despite the ability to recover.

I am expecting more good things in the long term from Bastide, but ultimately the returns on invested capital are a bit too low and comparing to other opportunities in the market, it cannot grow while returning capital at the same time.

Bastide needs to use all of its capital plus debt to grow. They still get positive growth because of the spread between cost of capital (in the 5% when using debt and 0% when using cash flow), and returns (in the 8-10% range).

But after exiting the deep value range, it became an average compounder that can grow earnings at 8-12% a year while using all its capital. So I sold.

I want either cheaper, or better. This is key to aim to continue to perform well.

My repositioning was based on my portfolio letter where I wrote that I wanted to position myself more for a commodities cycle exposure.

TASMEA

The first company I bought, after some research, is Tasmea limited (Australia). This company was brought to me by substack newsletters so it’s fair to keep the name public.

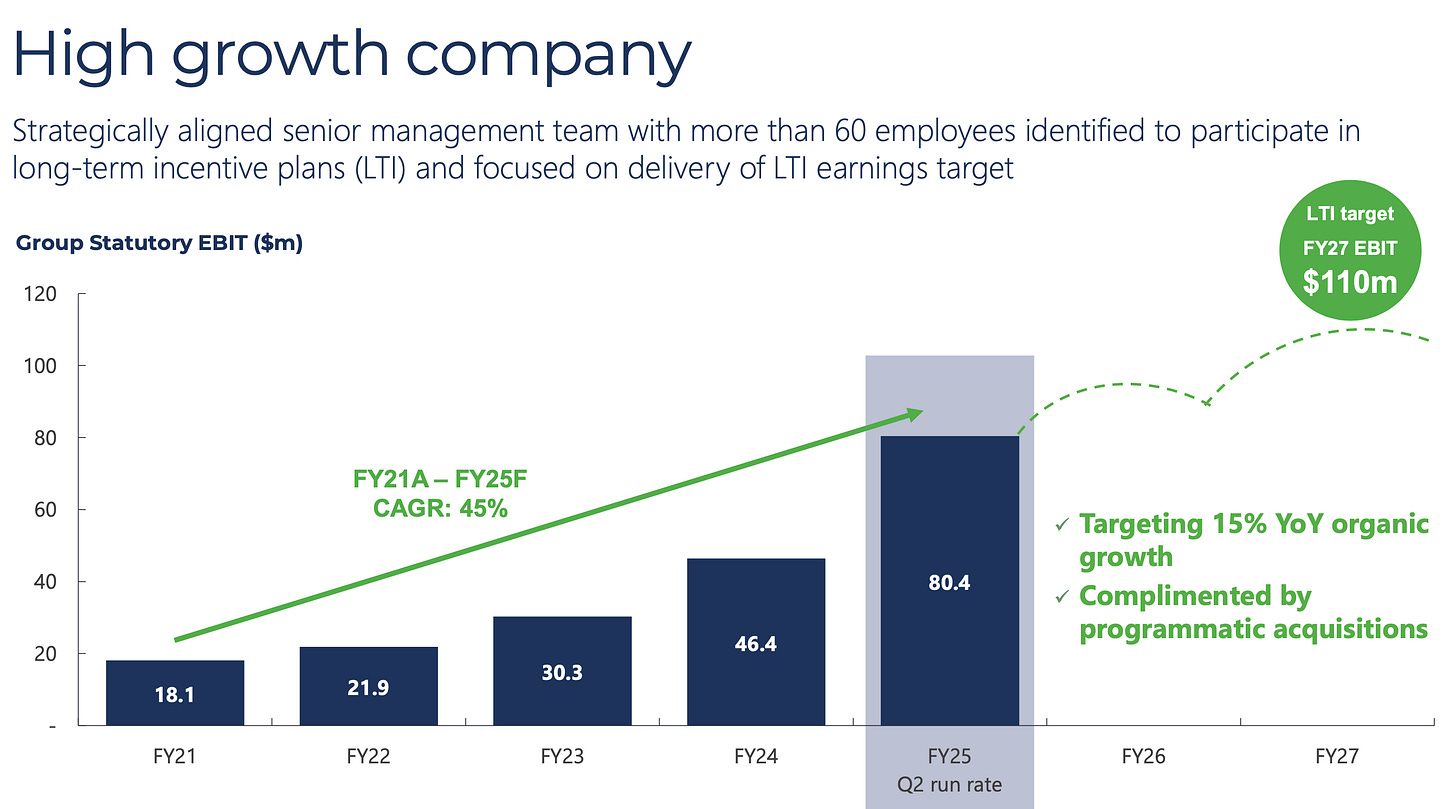

-Tasmea is a forward P/E 13 company (similar to Bastide), exposed to the mining, gold, and infrastructure electrification cycle. It is a hidden champion, acquiring and growing mining and electricity maintenance companies while also growing organically.

I am skeptical of the whole “software serial acquirer space” at current valuations, but I find the Australian mining maintenance serial acquirer space interesting due to lower valuation and organic growth capacities.

Here are quotes from their IR presentation

The majority of Tasmea subsidiary revenues is derived via Master Service Agreements with its blue-chip customer base for maintenance services on a schedule of rates basis

The majority of Tasmea subsidiary revenues are generated from a high repeat customer base and are annuity in nature

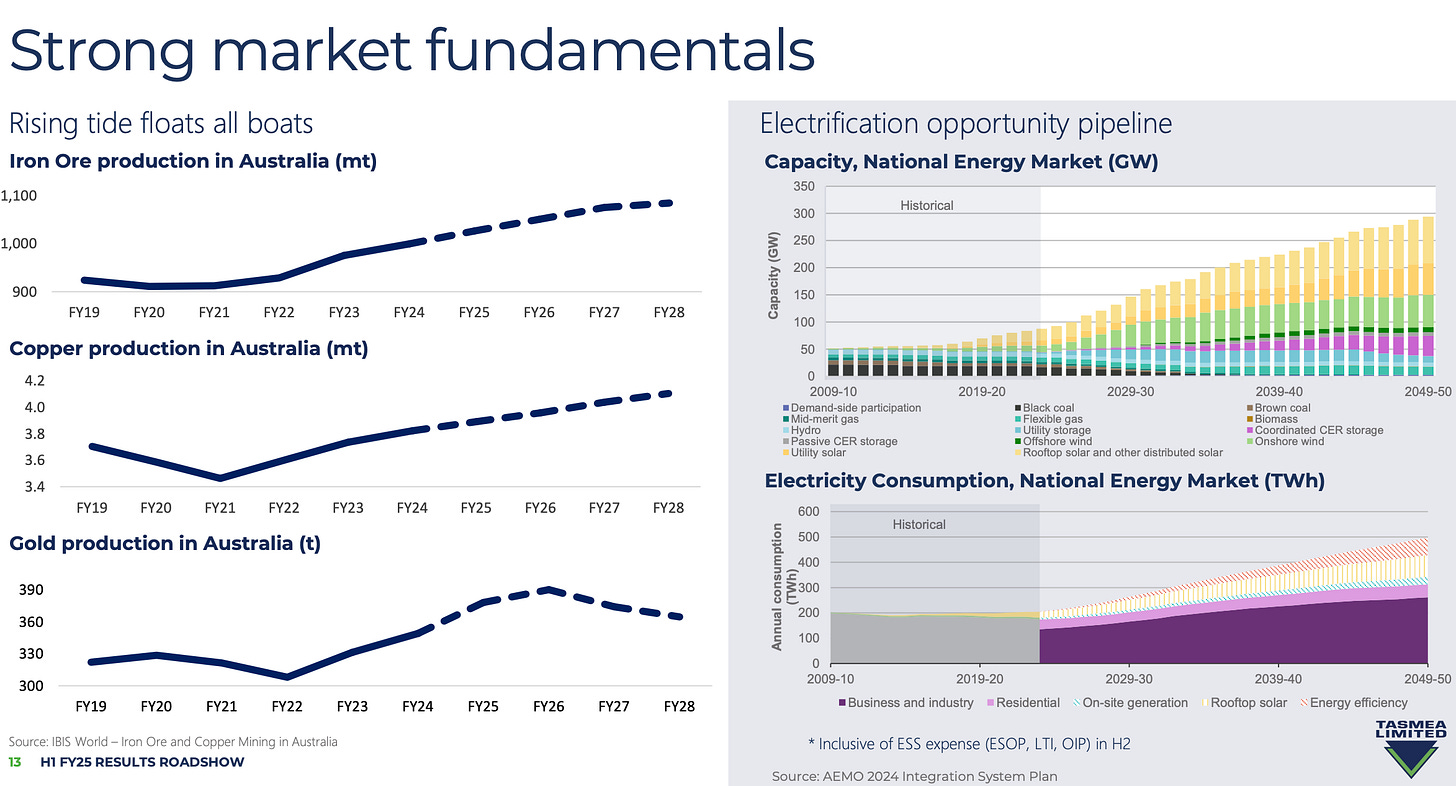

By way of emphasis, Tasmea subsidiaries focus on maintenance, not construction, and production, not exploration, which isolates Tasmea’s exposure to commodity price risk

Now, In my “understanding the compounder cycle” article, I caution against taking past growth for permanent growth when it could be a temporary cycle. However I want to be exposed to this commodity cycle more, so it is a deliberate risk. I believe that I have better overall opportunities than Tasmea (see my best buys series) but none exposed to Mining and these commodities, and this is a portfolio positioning.

Electricity and mining markets are well oriented in Australia.

For more information on Tasmea, I recommend searching Tasmea Substack in google.

Emerging market compounder

-The second company is small, in healthcare, it is extremely cheap at 7 times forward earnings, very high quality, and in a weak economy country.

Contrary to Bastide, it will be able to grow and pay dividends at the same time thanks to a much higher ROIC - in the 20% range and growing. Here, there are no existing write ups.

A basket of these should perform well ✅. The reason I also diversify is because I find the best fundamental stocks often in some emerging markets and smaller caps carrying more risk. This works, and it will work even more and more as the SP500 is bloated at elevated valuations while my portfolio is much cheaper.

My other additions are to my existing holdings on the commodities/tech exposure.

Cheaper, higher return on capital.

Details below: