Hello,

After this clickbait title got some of you interested, I will present my review on PayPal, a company that has been misunderstood forever (even if it was hyped up a lot in 2021). I have held it for 10 years (pre split eBay) in family accounts on a buy and hold basis, when it was value. I am not a genius on PayPal, but I have seen enough earnings releases to get an understanding of the business.

Usually I am more into purely value investing, but I am exposed to some growth stocks and these can provide good returns if the growth runway is clear.

Most analysis on PayPal was of very weak quality after Q4 earnings and price tumble. It’s just putting numbers in some charts and tables and showing multiples. Obviously the stock crashed a lot.

In order to analyze a growth stock you have to understand if the compounding machine is working or broken, and what are the drivers of the revenue and margins. I am not going to focus on numbers, and will not predict future earnings (false precision), I am going to explain the business key transformation.

First on the earnings:

Earnings were pretty good, forward earnings are weak because of

Tough comparison (2021 stimulus checks and lockdowns)

eBay volume business ramp down: This will affect 2022 only.

Non operating and tax changes planned for 2022.

The market is also confused because there is a change of strategy from growing users at any cost to lower user growth and focus on engagement, and the management gave up on the user base target of 750 million, which was given less than a year ago! It seems that the management was misguided.

In addition to that, prior to the earnings, some events weakened the stock.

PayPal attempted or said to buy Pinterest at a very high multiple showing lack of fiduciary duty for shareholders.

Then PayPal walks back when shareholders complained, showing no strategic conviction.

The management lacks credibility as stewards of shareholders funds, doing buybacks or planning acquisitions at high multiples.

The valuation coming into the earnings was very high, the shareholder base was weak and shaken by the big 2021 tech bust.

In my opinion, there is nothing wrong with the business. It grew very fast in the pandemic years, and now it is digesting the growth. It is still planned to growth 15 to 17% revenue this year, and FCF to grow as well.

The concerns should be about management of shareholders funds (I will cover that further down in the article).

PayPal business dynamics compared to Payments companies

Let’s take Payments companies: typically, Visa and Mastercard, plus Stripe and Adyen.

These companies handle payments. They have their fees stable across their business mix.

I am not an expert on these companies, but I think it goes like this:

They have online/offline payments, maybe the fees differ a bit, and the mix changes a bit, but overall it is stable. The take rate is fairly stable, revenue grows and earnings grow.

On top of that ,Visa and Mastercard, with their duopoly, implement or raise fixed fees such as chargeback fees, dispute appeal fees, monthly fees and the like, with no business churn.

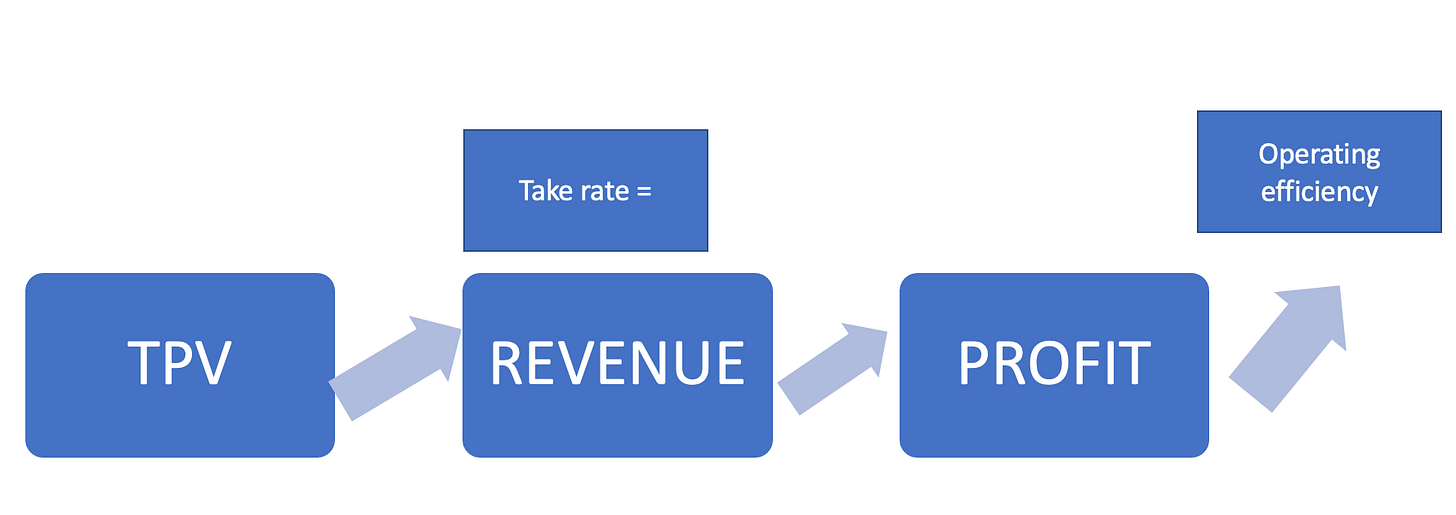

So we can see a business where everything is well correlated. Excuse the crude designs.

TPV: Total Payment Volume.

PayPal is totally different. The take rate goes down and good growth in TPV does not show in revenue. Typically, TPV goes up 30% and revenue 18-20%.

Why is the take rate going down?

If you read online commentary, it is due to competition, or that PayPal is too expensive, etc. Usually mixed with some comments like “on my website, I pay a lot of fees with PayPal, competition is cheaper”.

There could be some of that of course. but the main reason is the the payment mix.

I have done some quick illustrations to demonstrate PayPal’s TPV, with made up numbers.

2016, my average take rate is 2.2%, my TPV is 100:

Two years pass, the eBay and small merchants volume who pay a higher fee decreases because Ecommerce gets more professionalised, and due to the eBay move to Adyen, PayPal signs more deals like Uber, Ali express, and Venmo grows. My take rate is now 2.1%, TPV is 160.