Odyssée Technologies IPO

Guest post: Shooting for the Stars with Empty Pockets?

Hello, Continuing on a tradition here on my Substack, I introduce new writers during holidays seasons that are starting up. It is difficult to find readers and make connections at the beginning when you have few followers. Today it is Yassine from his French language Substack covering small caps, notably Mersen and Macompta.fr.

As usual, this is totally free.

He will cover a small cap recently introduced:

Hi, I’m Yassine, a 32-year-old French private investor with a background in electrical engineering. Since 2017, I’ve been navigating the stock market with a focus on European equities, particularly French companies. My strategy? A value-driven approach centered on analyzing companies’ cash flows. I have a special focus on uncovering hidden gems in the European markets, consolidating my analysis into just a few pages with the most essential insights. You can find my work on All in One Investing. I’m currently preparing an article on a promising small cap that recently went public—don’t miss it!

https://allinoneinvesting.substack.com

Recently, the French YouTube finance scene has been abuzz with numerous appearances by Christian Mary, CEO of Odyssée Technologies. These interventions aimed primarily to introduce his company to the YouTube Finance France community in preparation for the group’s stock market listing.

Links to some of his video appearances are included below :

Il INTRODUIT Son ENTREPRISE en BOURSE 👀 Les Raisons DERRIÈRE L'IPO d'ODYSSEE TECHNOLOGIES

Introduire sa PME en bourse | Christian Mary #219

In this article, I provide a brief personal analysis of the group.

1. Overview & History of the Group

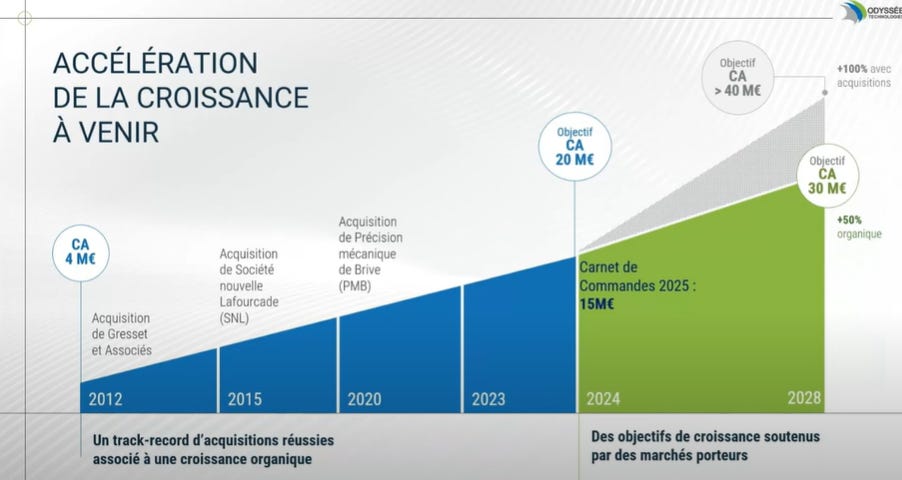

Christian Mary, a textile engineer by training, transitioned into entrepreneurship after nearly two decades working for major industrial groups. In 2012, he acquired Gresset Associés, a company with annual revenues of €3.7 million at the time.

While attracting new clients proved to be straightforward, he quickly identified a key challenge for the company: increasing production capacity. To address this, he invested in industrial equipment and pursued a strategy of external acquisitions.

In 2015, he acquired SN Lafourcade, a company of similar size to Gresset Associés but with a completely distinct client portfolio. This acquisition strategy continued in 2020 with the purchase of PMB, a company that generated €7.5 million in revenue in 2019.

Today, Odyssée Technologies generates €18 million in revenue with a workforce of 175 employees. The company recently went public on Euronext Growth Paris on December 13, 2024, with an initial share price of €13.

The company aims to achieve €20 million in revenue for the year 2024 and is currently trading at €14.5 per share, with a market capitalization of €23 million.

2. What Does the Company Do?

Odyssée Technologies specializes in high-precision machining, meeting the stringent requirements of strategic industries. The group has expertise in a wide range of mechanical processes, including turning, milling, grinding, and electrical discharge machining, among others.

All these operations are carried out to produce mechanical components requiring extremely high precision, primarily for OEMs (Original Equipment Manufacturers) or equipment suppliers.

Odyssée manufactures approximately 100,000 parts annually and boasts a highly diversified client base.

Due to its business model, Odyssée Technologies operates in a cyclical industry. Its performance fluctuates with the general state of the economy. Additionally, the company’s operations are highly capital-intensive, requiring significant resources.

3. Why Go Public?

The IPO involved the issuance of 615,000 new shares. According to the company’s admission document, the goal was to raise €7.2 million net of expenses, allocated as follows:

35% to finance organic growth (notably working capital requirements).

35% to seize external growth opportunities.

30% to invest in machinery and equipment.

As we’ll see later, an analysis of the company’s balance sheet suggests that it has exhausted its bank financing options, which likely explains its interest in an IPO. This is evidenced by its financial debt of nearly €7 million over five years and a significant deterioration in working capital.

Moreover, the CEO has not ruled out potential future share issuances, which, naturally, is unfavorable news for shareholders.

4. The Sector

Odyssée Technologies operates in the industrial mechanics sector, primarily composed of specialized subcontracting activities for major clients who have outsourced these services in the past (e.g., Safran, Airbus).

The sector is highly fragmented, with approximately 45% of companies employing fewer than 10 people. Only 6% of companies in the sector have over 50 employees, yet they control nearly 50% of the market share, leading to intense competition.

The industrial mechanics sector is experiencing a modest growth in France with some fluctuations :

The sector benefits from both volume and price increases. In 2023, it recorded a 5.5% growth in France (a mix of volume and price effects). It remains highly fragmented, with 42% of companies employing fewer than 9 people, accounting for only 9% of the sector's revenue. Odyssée Technologies falls within the larger category of companies with more than 50 employees.

A consolidation and external growth strategy appears to be well-suited to this environment. Companies like Mecachrome exemplify this, growing from €120 million in 2020 to €450 million in 2022. This strategy helps companies achieve critical mass, but Odyssée still starts with a relatively small market share compared to its competitors.

The sector's health is closely tied to the general state of the economy. Competition is intense, with major players like Figeac Aero and Mecachrome (each generating hundreds of millions in revenue) as well as similarly sized companies such as Halgand, HPM, and Mecapole.

5. Clients and Business Sectors

Odyssée Technologies operates across several growing sectors, including aerospace, defense, and space industries. The company serves a diverse client base, though 64% of its revenue is generated in the aerospace sector.

The group’s clients are primarily OEMs (Original Equipment Manufacturers) or equipment suppliers. While all revenue is generated in France, 15% of production is destined for international markets.

An analysis of the IPO document highlights a heavy dependence on its top three clients, which account for nearly 50% of the company’s revenue. The top 20 clients collectively represent about 96% of total revenue.

6. Management

The management team of Odyssée Technologies is highly experienced, with decades of expertise in the industry:

Christian Mary, Founder and CEO, brings 25 years of international experience, having led business units in Europe and America.

Pierre Paget, Head of GRS, has 15 years of expertise in industrial flow management.

Patrice Clavel, Head of PMB, has over 20 years of experience in defense and mechanical subcontracting.

Maxime Glize, Head of SNL, specializes in industrial performance improvement, with 9 years of experience at Daher.

Catherine Fleury, CFO and HR Director, has 30 years of experience in financial and human resource management for international groups.

This complementary and solid team is a key driver of Odyssée Technologies’ development and success.

7. Medium- and Long-Term Objectives

The management aims to achieve 50% growth by 2028 (excluding external growth), a goal that motivated the IPO to support this expansion.

As previously mentioned, the team does not rule out pursuing external growth opportunities if they arise. However, they plan to focus on consolidating their core business rather than diversifying into other sectors.

The only financial target disclosed so far is an EBITDA margin of 15% by 2028.

In my view, achieving this goal will largely depend on the state of the economy, given the company’s industry, which is a factor beyond its control.

8. Financial Performance

The company’s cost structure is divided as follows:

42% raw materials and subcontracting costs.

48% salaries.

10-12% EBITDA margin.

Odyssée Technologies is highly sensitive to raw material costs, as observed between 2020 and 2023. The company’s core operations are also subject to long operating cycles, leading to significant delays between supplier payments and customer invoicing. This results in high working capital requirements (WCR).

Due to its size and competitive position, the company cannot demand upfront payments or invoice at the time of order. WCR is further strained by increasingly long processing times from subcontractors, tying up more cash in operations.

The company’s contracts, while providing activity visibility, often have fixed or minimally adjustable prices, making it challenging to pass on cost increases to clients. This was particularly evident during the 2020-2023 period.

With 40% of revenue tied up in WCR, the company has had to build significant raw material inventories, further burdened by volatile raw material costs.

Although Odyssée Technologies reports positive accounting results, the significant rise in WCR and investment needs have strained its cash position, leading to negative free cash flow of over €1 million annually for the past three years. This situation prompted the company to raise capital through its IPO. For example, €800,000 was invested in WCR in 2023 to support growth—a situation the company cannot sustain indefinitely.

Despite only publishing results for 2022 and 2023, we reconstructed consolidated financials for the group’s subsidiaries from 2015 to 2021 to establish pro forma accounts. The findings reveal:

Revenue has more than doubled, aligning with the company’s growth.

EBIT has grown modestly, at a CAGR of 3.1%, far below revenue growth.

Capital employed has nearly tripled, driven by significant balance sheet changes, particularly in WCR.

As a result, return on capital employed (ROCE) has declined from 20% in 2015 to 10.5% in 2023, highlighting the sector’s cyclicality and growing competition.

9. Conclusion and Personal Opinion

Odyssée Technologies executed a strong marketing campaign in recent weeks, with the CEO’s appearances on financial media contributing to a successful IPO.

However, a deeper analysis of the company’s financials paints a mixed picture. Operating in a highly competitive, capital-intensive sector with significant WCR demands, Odyssée Technologies does not align with my investment criteria.

This is reflected in its financial performance.

Of course, this is purely my personal opinion and should not be taken as investment advice.

Thanks Yassine!

For my premium subscribers, I finished putting a whole interactive portfolio summary document in google sheets with links to write ups, updates, and company categories.

With this you can really map the large diversified EM/DM hidden champions portfolio and articles. You can also filter the companies by country/style/industry and will make it easier to track things.

It will be sent out soon separately.