Monthly recap Dec 2022

Newsletter update

Company update

Quantitative watchlist

Write ups

European Language Ideas

Manual deck (watchlist)

Movements and ideas

Hello! As you can see I made some changes! I rethought the balance between the public and private emails by deciding to send a part of the monthly recap to all subscribers and have the second part for the paid supporters in order to bring value to everyone. Also comes with more structure in a template to benefit me as a writer (focus) and you as a reader. It is simpler for the readers and for me to know that I have one monthly update and that’s it. I am a private writer so the date of the delivery will be affected by days of the week and holidays.

This was greatly inspired by my subscription to a Spanish newsletter (Quality value) and by emails from other writers such as valuesits and Asian Century Stocks.

Each month I will update several companies. I will comment when there are relevant ones in my opinion.

First Pacific, the defensive holding company in South East Asia, has not reported earnings but has reported earnings for main three subsidiaries here. These were excellent. It has also invested more in Voyager, the fintech arm of the Philipinnes telecom it owns, which has a tremendous future in my opinion. It still trades at a ridiculous 4 PE.

Ambra, the polish wine company, had good revenue growth but flat earnings due to rising costs. The defensive nature of the business helps to weather a difficult inflation time for Poland. 10 PE ratio.

Bastide Le Confort, the French Health services compounder returned to good growth (+13% revenues) now that difficult covid comps are no longer hurting too much. The stock has started to bounce back as a consequence.

Tianyun International: I have a write up for the fruit and fruit snacks and juices producer from China. The Stock was at 1.4 HKD but suspended for accounting issues, which were unauthorised transactions and missing money. That is quite a red flag. Well the issues are resolved and the stock is trading again, with a big drop to 0.9. I don’t know where does that count for Substack performance since nobody could buy at 1.4 and I wrote it up in the middle of a problem. However, I reviewed things and I am holding still above my cost basis and I like the business still. It was impacted by zero covid. I still have another HK stock suspended (Ecogreen) where I am not as positive and will mark it at zero for my performance. It still trades under 10 normalised PE.

CK Hutchison has started buying back stock, which is great because it takes advantage of cheap stock prices to grow EPS and helps to wait while the price languishes, probably due to the GBP exposure. 5 PE.

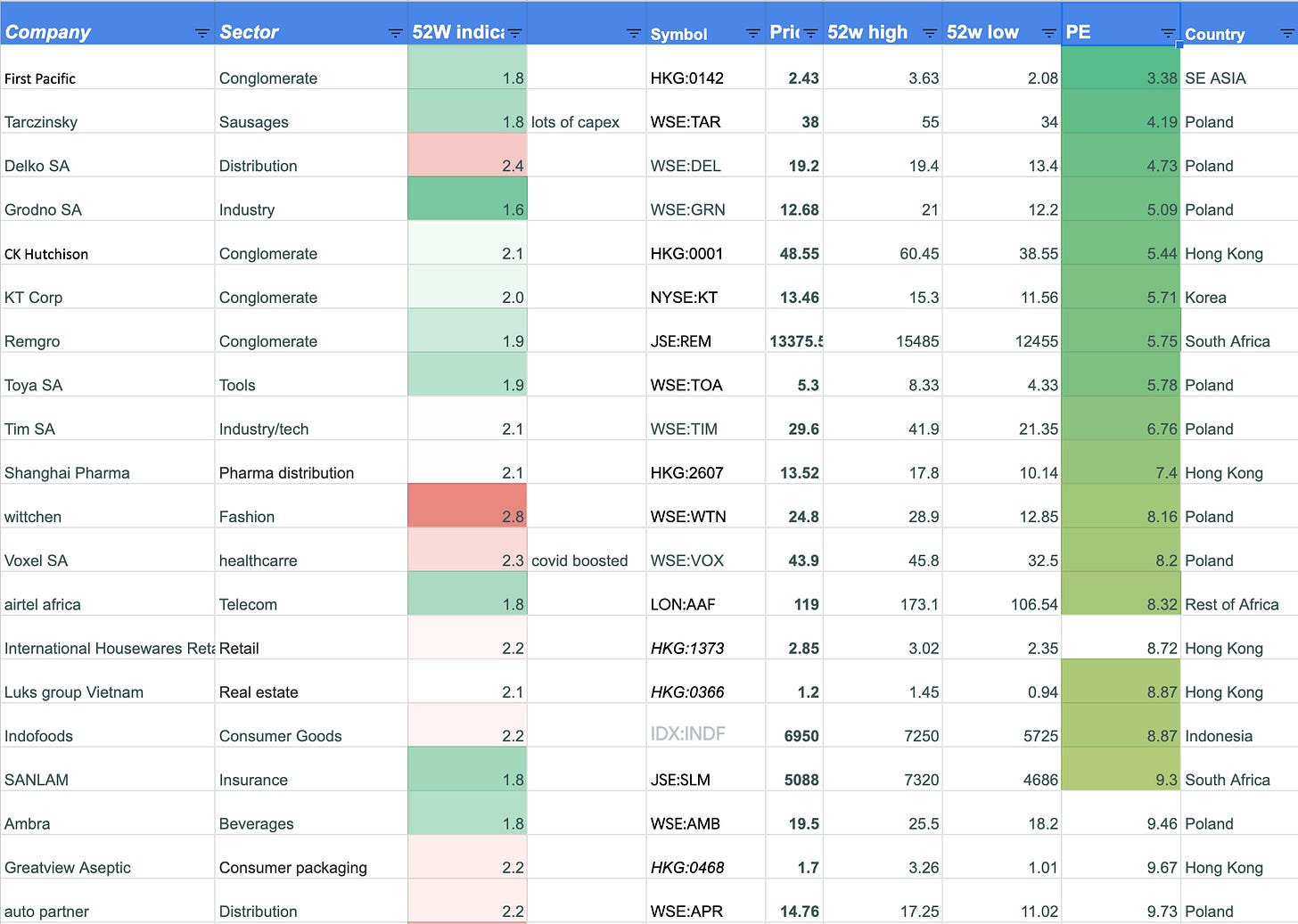

Here I manually selected stocks for quality or hidden champions characteristics and track movements and PE from google finance or other providers, and can eventually investigate further.

This month I want to focus on the EM’s table which I believe offer the best risk rewards because the Western European companies are more affected by the macro risks at the moment and valuations are really low.

EM’s

I had write ups in November but not in December.

Zholdings - Tech berkshire in Japan ($)

Other write ups that I need to cover and add to my watchlist, or review.

Trifast PLC - UK Hidden Champion

Honestly, I think Asos is a great buy if one has the patience to hold stocks that reinvest all their profits in growth a bit like Amazon. I like to see money flow to the cash flow statement at least before it is reinvested. It is a matter of what you are comfortable with.

Marlowe PLC - Uk again ! Compliance company Interesting company that I will add to my watchlist.

Canadian ideas are on fire! It’s a great market with undervalued stocks imho.

Three Canadian Ideas from Alluvial

Not much here last month I’m afraid.

FR - Annual report with 2 Norwegian quick thesis

In this table I have a list of potential buys that I do not own.

There are also many gems from the links above that I haven’t even classified yet. Value is plentiful in the markets these days.

I haven’t had time to do deep dives in most of these and that will be my goal for the year.

Subscribe fully to have full access, including past thesis and portfolio reviews.