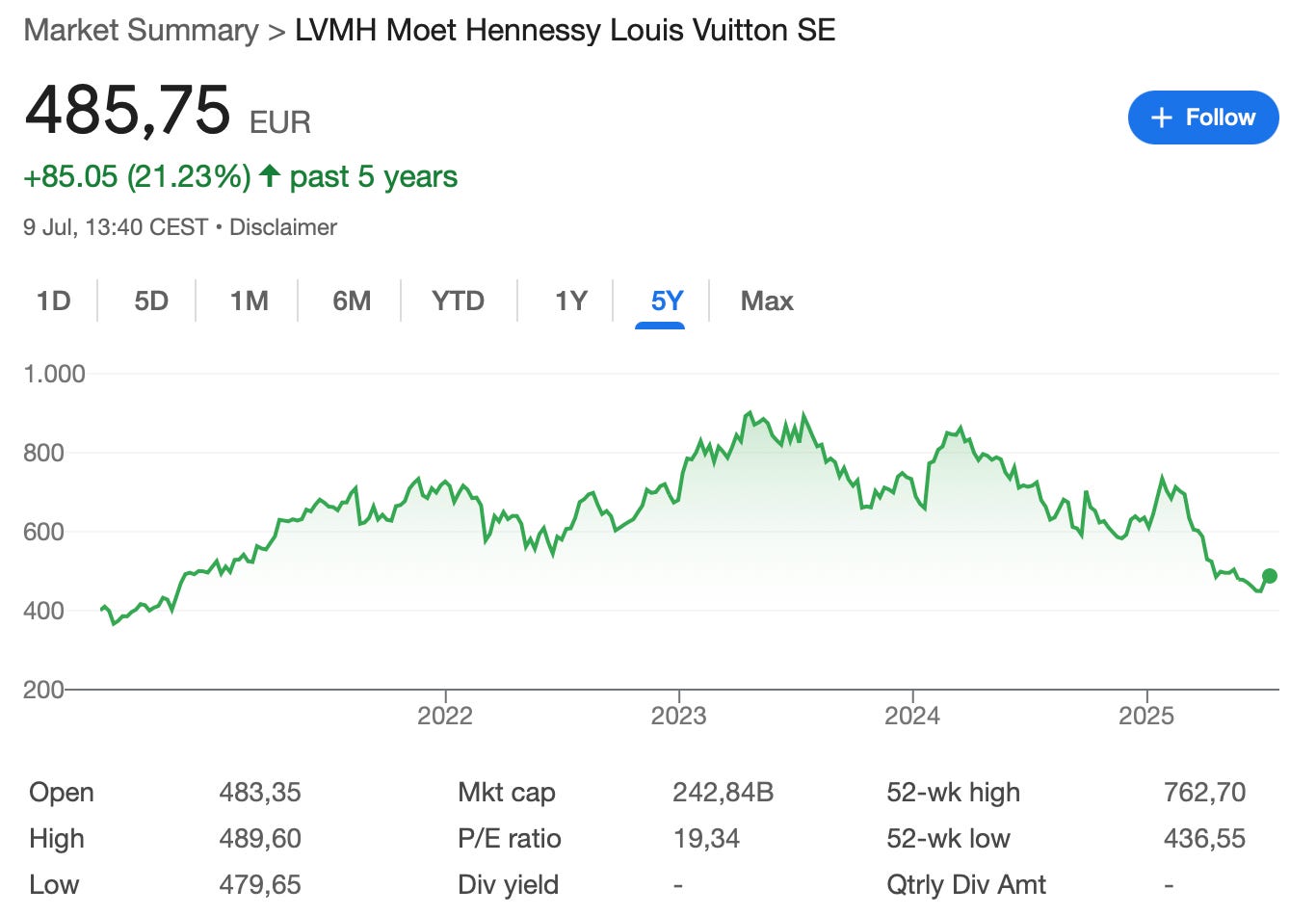

LVMH has had a large drawdown, a fall, from 900 to 450 Euros in June 2025. It went back a bit to the 480s.

It was a favourite stock amongst quality investors, and for a good reason. It is a long term quality company.

However, some dark clouds came on the horizon, a deep recession in China, luxury fatigue, tariffs in the USA, and sales went down.

LVMH, for those who may not know, is a French luxury powerhouse, with Brands like Louis Vuitton, Dior, Tiffany, Bulgari, Tag Heuer, Moët in Champagne, and Hennessy. (Hennessy is a French Cognac spirit with Irish name because the family name is of Irish origin).

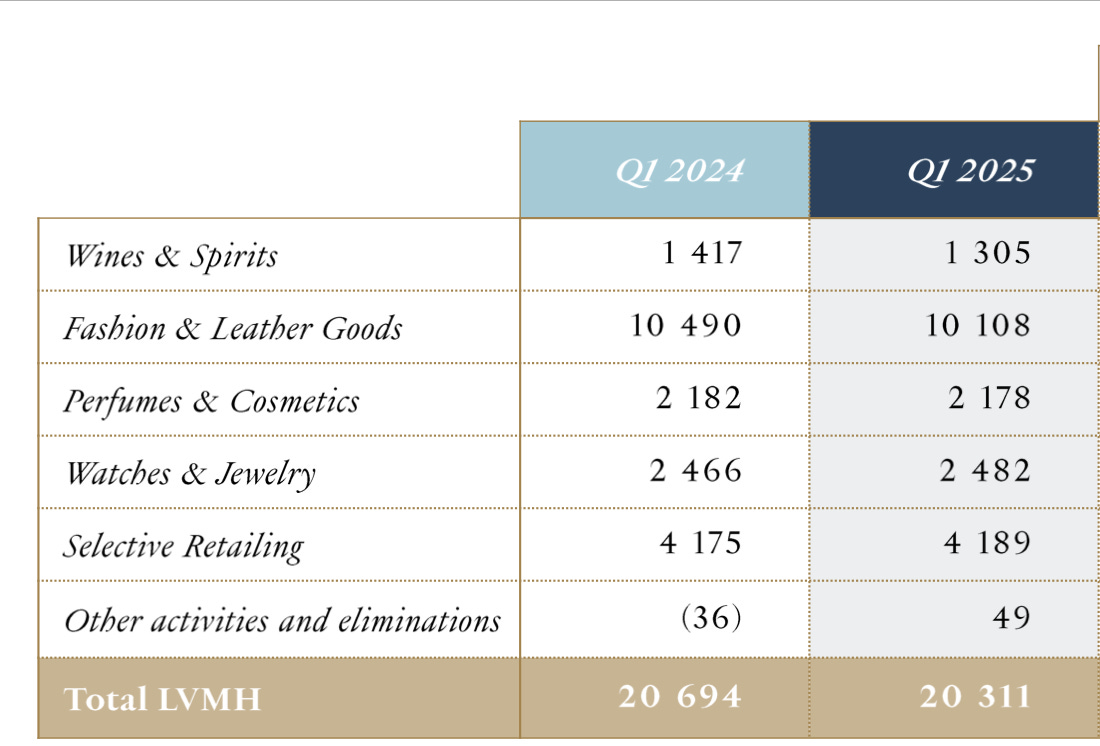

Sales breakdown:

We can see in terms of revenue that Louis Vuitton is the biggest segment by far. Selective retailing does a lot of revenue but little profit.

Profits by group

Around 78% of profit is Fashion and leather goods (Louis Vuitton). Analysing the rest of the business is not that relevant.

MOAT

I will be short here: This has been written 100 times already.

Louis Vuitton is an Iconic brand with top of mind place in consumers.

Distribution: Prime location allows for LVMH to showcase not only Louis Vuitton but also their other brands. As you visit Paris for the trip of your life and see Louis Vuitton in La Samaritaine, you can also see other brands from the group and this is prime exposition.

This is also a real online Moat in terms of events: LVMH size attracts news and influencers to covers the events that the group does.

Integration: LVMH can acquire brands and market them worldwide with the distribution and with marketing.

LVMH: The Yen trade

The 2024 revenue shows a particular story.

Weak yen seems to have been calling many other Asian shoppers into Japan to do some price Arbitrage and buy the items in Japan. Other than this, sales are stable. Asia Ex Japan is 28% of sales.

According to percentages and the Annual report, we find that Japan did 6B of sales in 2023 vs Rest of Asia 26.7B

In 2024, Japan did 7.6B of sales vs Rest of Asia 23.7B.

So Japan Siphoned 1.6B of sales from China at lower prices due to currency depreciation, and another 1.4B of sales was lost due to the economy in China. This is approximate.

In Q1 2025, Japan sales went down 1% year on year, but keeping on gaining share versus rest of Asia.

This article from May 2024 explains the cheaper shopping in Asia.

https://jingdaily.com/posts/chinese-luxury-shoppers-new-favorite-destination

(There is also tax refund for overseas shoppers).

Here I went to LouisVuitton China and Japan website and compared some items.

The conversion brings the price in to 16160 Yuans, a bit cheaper.

The price comes up to 18900 Yuans, still only a bit Cheaper. It seems that LVMH have adapted and stopped this pricing arbitrage going on and that hurt sales in 2024 by increasing the prices in Japan.

I cannot compare many items as it would require to speak Chinese and Japanese to compare the references. I did it visually by looking for matching items. And there are many designs, all over the place, it is not easy!

Revenue shift to Japan caused the tax rate to increase.

Champagne and Spirits is Cyclical.

Profits in the segment dropped 36% represent now less then 7% of profits. The risk is more on the upside with a possible rebound.

One off hits on margins

During the Q4 2024 conference call, it was explained that a few one offs hurt the margins.

LVMH almost did not raise prices last year.

They opened stores that were planned during the covid boom

They Increased marketing spend, notably olympics special marketing spend

Signs of over earning?

The company margins are still elevated versus pre-covid.

I drew the long term Trend line of earnings and profits but I stopped pre covid. According to this, we are still over the long term trend. It is a graphical indicator and not predictive, but it shows that we are still over pre covid earnings growth path.

It is possible that we go further down.

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too! The chart above was made with the free version. I use long term views to see book value evolution and share buybacks, as well as revenue and net income.

Conclusion:

I went into this review thinking that LVMH business would be really bad at the moment.

But LVMH Seems to have gotten hit by a currency issue mostly and one offs mentioned in the conference call.

It shows that it is a very strong franchise in a tough economic environment.

I like LVMH because it has an iconic brand, reaching the status of an Apple for example, that is strong and provides defensiveness.

Valuation is not really cheap. It is a 20 times earnings.

Timing is an issue: since LVMH Q1 sales were bad, we could expect H1 profits to be lower than last year. With the earning release coming in July, we could wait for this even to decide to enter a position progressively. It is rare to have the stock up on bad news. Especially since the crowd in LVMH is not exactly hardcore value investors. There are many newbies in LVMH who are unfortunately buying high and selling low. Us newsletter writers are here to remind them the virtues of long term investing. HOLD!

The very long term investor could buy LVMH from current levels of 20x forward earnings in a semi depressed environment. That should do well in the long term, with the drivers still here for Luxury and Semi Luxury.

The investor who wants to maybe get a more perfect buy zone would wait for sales or earnings to show a positive trend, or for valuation to get ridiculously cheap.

The last option would be to wait for Terry Smith of Fundsmith to sell. This would mark the bottom.

Ultimately, I think the Healthcare testing market offers quality companies with less cyclical earnings, cheaper valuation and good growth, but I am watching LVMH.

This includes names like Thermo Fisher Scientific at 18 forward Earnings and Eurofins Scientific at 15.6 forward, despite the run up.

Eurofins scientific - story of a 100 bagger

Hello everyone. First, a word on the markets, tariffs, and the economy: I have no idea what’s going to happen, or what is going on. I believe that it is nearly impossible to rebalance a portfolio according to tariffs impacts in real time. I am a stock investor, therefore, I ignore all of that and focus on companies.

Moncler

It is another good quality company is Moncler at 22 times earnings.

It produces semi luxury Jackets.

It has good dynamics and could be a buy. I have no idea about Moncler fashion, sorry. I favor LVMH for the iconic brands and distribution.

Other Lower quality luxury names:

These are Kering (Gucci), and Burberry. These two companies are troubled brands. I have no opinion on these two.

I think that these almost mono brands belong to the luxury and fashion specialists rather than the quality or value investors. I would caution any investor that is not a fashion specialist to invest in apparel and lower level luxury. It is very easy to lose money in fashion.

Thanks

🌟🌟🌟

For the full list of quality companies and the weekly top buys, please consider upgrading below.

Weekly best buys (Tuesdays)

Monthly portfolio snapshots

At least one Thesis a month

For really hidden gems, cheaper compounders, and cheaper unknown quality names: It’s below!

In June I received my best feedback so far. It’s only the start.

🌟🌟🌟

Very snarky comment on Terry Smith. :-)

I don't think so. Discretionary will be under pressure.