Fat pitch: Korean Telco that is a diversified holding company in Finance, Telco, Content and Tech services, while pivoting hard to tech with acquisitions and investment startups. Extremely cheap under 7 PE, 2 times EV/EBITDA and rewarding shareholders at the same time.

Overview - From a telco to a conglomerate

Historically, KT or Korea Telecom Corp was the state owned monopoly telecom company until 1991. It was fully government owned and gradually the government disposed of all its shares. It also diversified in a large quantity of tech and consumer businesses.

Ownership: As a result, 66% is owned by the public, so we have a public company, with cons in terms of drive for growth, investment discipline, and long term thinking in general. But as we will see later, it does not affect KT corp which follows a long term strategy, maybe due to cultural specificities of Korean Culture versus fully public companies in the West that are often short term oriented.

Business overview

Here is how the company breaks down the business in Q2 2022.

It’s quite confusing, so let’s break down the 4 segments:

Telco B2C

Wireless: Majority of the segment revenue.

Broadband: Decent growth.

Fixed line: Small and in a slow terminal decline

Telco B2B

Broadband+Data: Majority of that segment and positive trends.

Telephony: Still significant, to handle business calls or calls from customers.

Digico B2C

IPTV (Television over the internet): This is cable TV with about 260+ channels. The growth is ok but I have no idea about the long term potential because it is a competitor to OTT services like Netflix.

Various small media platforms: insignificant.

Digico B2B

Entreprise DX (Digital transformation): The biggest segment with decent growth.

AI/New Biz: This is declining over the past three years. However there is some AI capacity there, like on AI secretary for business, so it may take off in the future.

Real Estate. Yes the company owns real estate from the legacy telco business and they put it as digico B2B. (?) There is no communication about what it does there, what are the assets. The contribution to the business is small but sort of recurring.

Subsidiaries (aka KT Consolidated vs Separate)

BC Card: 69% owned. It is a major card payment provider in Korea. The company earns stable income but is a challenged mature business. Competition is rising. Link. BC Card says that they will respond by innovating and becoming a digital service and data company “Business transformation from ‘Processing’ to ‘Digital Financial Enterprise”, but so far it is mostly talk and not a transformed business. We also have little detail from this subsidiary. BC card has the highest revenue but about 100B won of annual operating profits only.

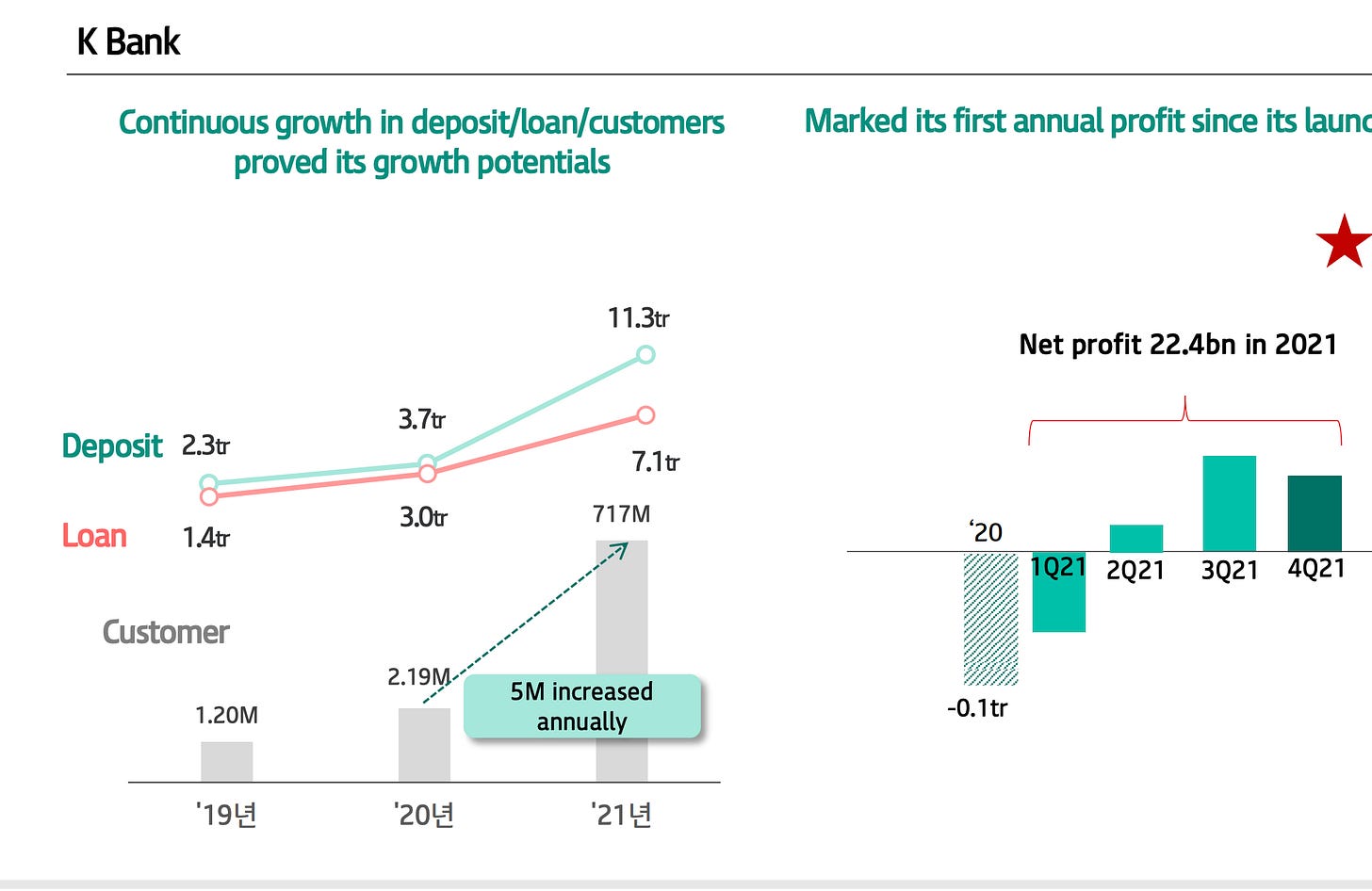

There is also KT Bank, a digital bank that is showing some promise and is profitable with over 7 million customers.

Skylife: Satellite broadcaster with around 3 million subscribers.

Content companies. This segment shows good growth and has international revenue potential. Korea is an expert country in exporting content. We have no idea about profitability in the short term. The company will invest a lot in growing this segment.

KT Estate: Real estate: I found zero information about this segment that is insignificant. I found online that the asset value of its real estate alone exceeds 30 trillion won, bigger than the market cap. Ok, but then the cap rate must be very low because earnings do not reflect that, or it is a balance sheet land bank that produces no earnings.

KT Cloud, a Korean cloud business. They will have difficulties to compete with AWS and Azure and Google cloud in terms of Integration and services due to the FAANG’s scale, but at least KT is not out of the game in AI and developing capacities in that regard. It is appealing to public companies to have the cloud being hosted with a national company and in Korea. Competitor SK Telecom also has cloud services. Good growth in this segment.

The operating income from these subsidiaries together represent about 32% of KT’s operating income.

Overall, do we get a growth company, a declining company or a stable company?

I put the rest behind my paywall, but if you really want to read it all without committing, no problems. There is a 7 day free trial. You will also discover the other write-ups and obscure ideas discussed.