Hello, well, after my last crisis report article, everything went back to bullish and calm in 3 days. Tesla was up 25% in a few days. Madness.

Today I will present one of my few companies in Japan and I believe it has a decent risk vs reward.

Japan companies tend to hoard cash, pay little dividends and have no growth. These are value traps unless you are a successful activist.

So my criteria for Japan are strict:

no cash hoarding

cash used for dividends and acquisitions

if low dividend: fast growth, in that case cash hoarding is ok because business growth trumps everything.

Japan lifeline uses cash for dividends and business growth.

Fat pitch

Japanese Medical device company at a PE of 11

Dividend yield of 3.5%

Good track record of growth

No trend to hoard much cash

Recently struggled to reach targets

I got interested in Japan lifeline a long time ago, when I was exploring the medtech space, with companies like Medtronic and Becton Dickinson, or Striker, because these are generally good performers.

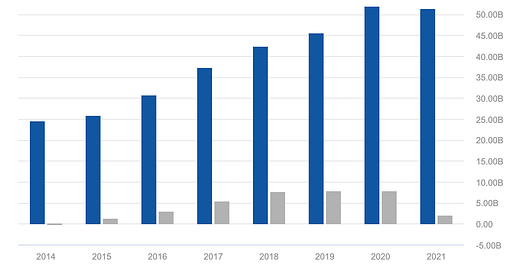

Japan Lifeline has a history of Revenue and profit growth until 2018.

(2021 reduced net income is due to non cash items, with operating profit at +0.6%).

Net profit margin is a bit under 20%, showing good margins, and a ROIC according to Gurufocus of 13%.

The business

It almost exclusively serves the Japanese market, and is mostly selling heart medical devices.

The elderly population of Japan continues to grow in absolute numbers:

https://www.japantimes.co.jp/news/2021/09/20/national/japans-older-population-hits-record-high/

Covid is sadly associated with increased heart issues (nature).

The company was started in 1981 as a distributor only of Pacemakers. But after some time, in 2001, in launched its first in house products, these moving to become half of revenues right now.

Japan Lifeline, for in house or distributed products, always strives to differentiate on innovative technology and improvement of outcomes for the patient rather by price.

By being a reliable partner for global brands, it can get access to their latest products. It has speed, local knowledge, commercial links and regulatory experience, all which can help international companies. For example in the chart above, we can see that in FY 2020 it launched CRM (Cardiac Risk Management) by Boston Scientific.

However, it was an Agreement with a 3B Yen upfront payment by Japan Lifeline for a 10 years exclusivity. Japan Lifeline pays to have the right and exclusivity to distribute Boston Scientific products, and it hurts profitability a bit while growing sales.

Challenges:

The company published a 5 years sales plan in 2018, aiming for Yen 63B in sales by 2021 vs 42B, but they only reached 51B. The operating income is a big miss from 14.9 to 10.4B.

They hopelessly failed to meet the plan targets.

The forecast for FY 2022 (ended march 2022) is also weak at +3.3% sales and +2.5% operating profit.

here were the challenges:

The revenue growth was helped with a distribution agreement with Boston Scientific, but Japan Lifeline had to pay 3 Billion Yens upfront for the agreement, and is now amortizing this payment, reducing net income. They also had extra costs to start up the execution of this new product range distribution.

Covid19 reduced the volume of a lot of interventions.

Price revisions down by the NHI, the regulator in Japan.

Strategy

The company strategy is to:

“develop therapeutic areas, branching out from the cardiovascular field by applying our proprietary technologies”

The company wants to grow in new therapeutics areas like Gastrointestinal aka GI (launched in 2021 and still a very small percentage of sales). It plans to launch many new products in that area in FY 2023, which started already for Japan lifeline in March 2022.

It also plans to continue in cardiovascular growth.

the target is 15% annual operating income growth. If they can reach it, it would mean good returns for shareholders. The problem is that they did not meet the 2018 plan by a large margin.

To summarize,

distributing better products

developing new products in house

Especially new therapeutic areas.

expand abroad with in house products (new).

-strategy by segments:

1-Cardiac Rhythm Management: 25% of sales

The goal is to increase marketshare.

2-EP/ABL: 49% of sales

Expecting good growth, new products and internationalisation:

3-CV Surgery: 18% of sales

Launching new products.

4-TV Intervention: 7% of sales including GI 0,8%.

Focus on GI growth with new products. (Growing 92% YOY from a very low base).

Overseas expansion:

it was mentioned in the mid terms plans but its not in the latest earnings releases and presentations. I guess it’s due to Covid making face to face sales work very difficult if not impossible in Asia.

The company has established a subsidiary in Korea, has manufacturing plants in Malaysia and in China. It plans to export some of their products to Europe and the USA with distributions agreements.

I do not speak Japanese so I cannot listen to the earnings call to know the status of this, but I am sure that it will be a future positive development for the company.

First international expansion agreement

Capital allocation priorities:

Look very sound and conservative, with the business strategy execution first, the shareholders return second.

With the price slump towards 1000 yen at the end of 2021, the company is currently executing some share buybacks.

Third party opinions:

I found this recent fat pitch on a Japanese blog in Japanese thanks to google and @cachethatcheque keywords: https://wariyasukabuhakkutsu.hatenablog.com/

Japan Lifeline (7575) 0 shares → 1000 shares (@ 1063 yen)

Operating income has been flat since 2018 due to factors such as the revision of insurance reimbursement prices and the new corona, but the number of AF (atrial fibrillation) cases, which has the greatest impact on our business performance, is expected to continue to increase. Therefore, it is highly likely that our business performance will grow again.

Considering the high competitiveness of our products & exclusive sales contract products, high operating profit margin, attractive dividend yield , valuation well below the past low average PER, etc., I feel that it is a very attractive stock price level. Therefore, I bought 1000 new shares.

Analysts estimates 7% and 6% earnings growth for 2023 and 2024, which is lower than company plans but good for 11x PE. https://www.marketscreener.com/quote/stock/JAPAN-LIFELINE-CO-LTD-14116166/financials/

Conclusion:

Knowing and understanding the different areas and dynamics of the business is complex due to distribution agreements and different dynamics in the separate segments. The English decks aren’t very clear on expansion plans and capex per segments. Making a DCF or earnings projections table is foolish to the non sector specialist that I am. But I identify value at this price.

We have a defensive company at a 11 PE ratio officially, but lower due to D&A and amortization of Boston scientific deal payments, and 8 times operating income.

It is very product and innovation oriented, expanding to new areas.

There is no net debt, with a bit of net current assets.

A tendency to pay out a growing dividend (flat dividend from 2017-2021, but grew in 2022 and paid special dividends in 2021), which is important for Japanese equities, yielding 3.5% now.

The company plans to double operating income in the next 4 years. We will see if they can achieve this or not, but we do not need it at our current prices.

Opportunity in new products and overseas, and some risk due to termination of distribution agreements. Overall it is very difficult to predict outcomes and future growth.

At this valuation, with a defensive business model, it is worth a position in my diversified portfolio. Sure there are cheaper things in HK, but I limit geographic exposures.

Links

Disclaimer: This is not an investment advice and conduct your own research to validate a thesis before buying a stock.