Intrum is a Swedish collection agency.

It is a debt collection business out of Sweden and the leader in Europe.

Intrum makes revenue through servicing (Collections for third parties), and investing (Collections where it buys portfolios of debt from financial institutions and companies: their own book).

The split in EBIT is about 50-50 between servicing and investing. Intrum has been a mistake in my investing journey so far, but a great way to learn about a new industry.

In the past, they grew their own debt that was used to fuel acquisitions of the “investing” book, and this debt started to cost them more in terms of interest rates.

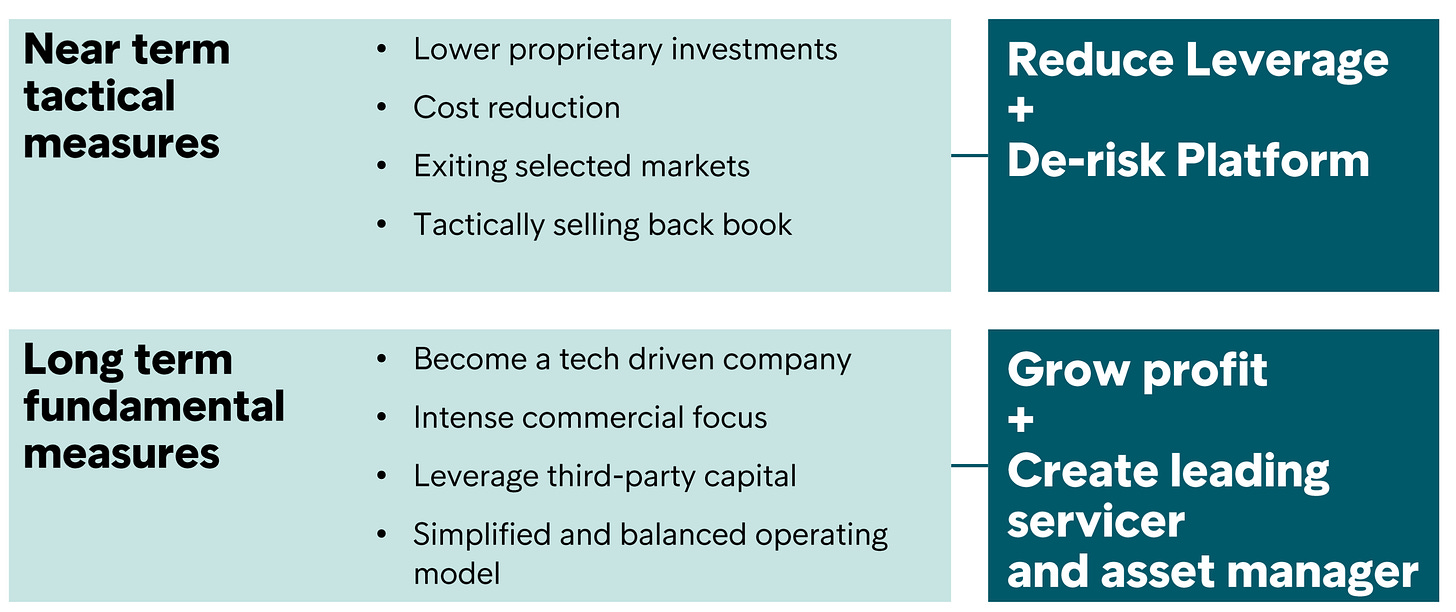

Due to higher rates in 2023, the new management wanted to reduce leverage. They decided to stop this profitable investing growth to turn capital light and it was ill timed.

In order to become capital light, they sold some of their book at a discount to what they could have been recovering through collections.

In 2024, it entered the Cerberus partnership where Cerberus and Intrum are investing together, in order for intrum to limit the capital needs of its business. Intrum also collects some servicing revenue from the partnership.

With the investing business, as the debt is collected, the future revenue is expiring, similar to an oil well that is depleting reserves. So if you sell your book at a discount ,you are killing future profits like a oil company selling their reserves at a discount, and you are not deleveraging if the discount is higher than the value of future profits.

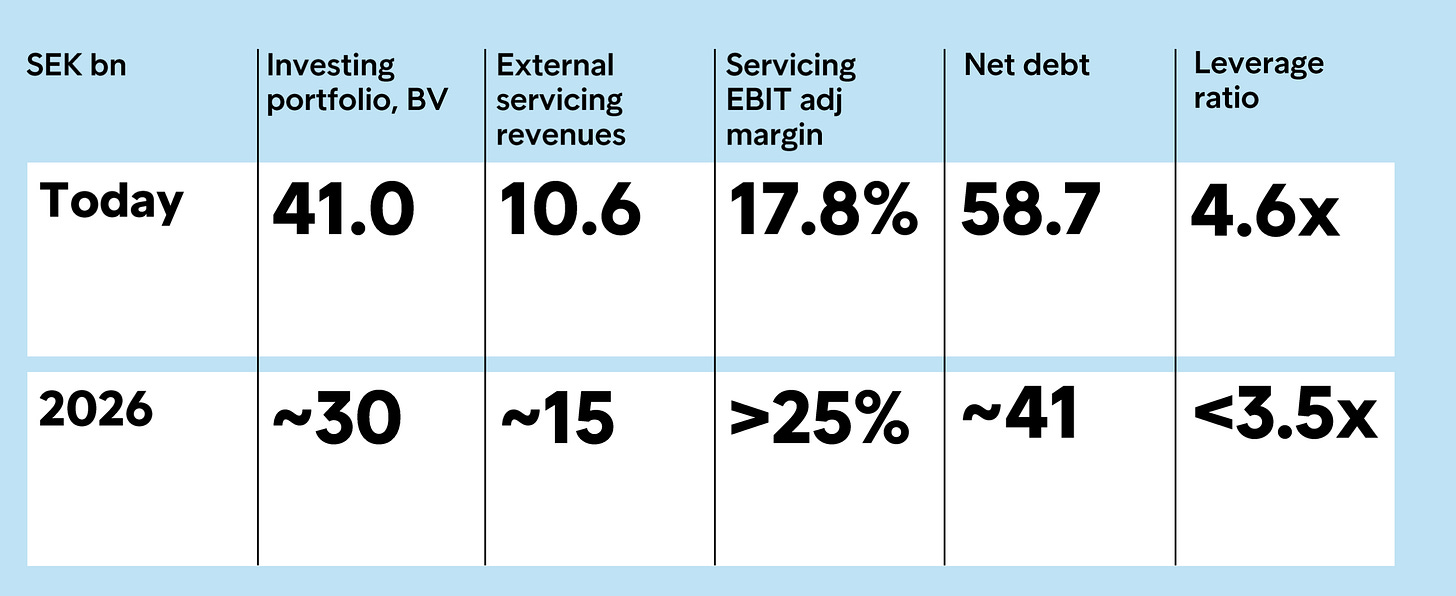

They wanted to replace Investing, with Servicing. It has not worked out fully as external servicing revenues are around 12.2 SEK bn.

A slight recapitalisation later, and with debts pushed back 2 to 3 years out, Intrum is now at the crossroads. The leverage is still very high, but the valuation is very low at 0.3 times sales, if they can de-lever and become capital light.

This is a proper turnaround with risks and rewards. The rewards, a future AI based tech company. The risks, stagnation with little profits, or decline until oblivion.

What am I looking forward to see in the Q3 Earnings release at the end of the month?

Here are my thoughts: