Intrum is a financial service multinational out of Sweden. I always knew the company because I had some familiarity with the sector due to people I know who worked in banking collections after the 2008 crisis, but never invested in it until lately it was brought to my attention again. I thought “I knew this company for a while, it would be nice to finally investigate it”.

The company trades at 4.7x EPS 2022 and 12% dividend yield. The EPS is also stable and steady. The EPS for 2023 is supposed to decrease a bit however.

Intrum was established in 2017 as two companies, Intrum Justitia and Lindorff, merged. The original Intrum dates 1923 and grew organically and with acquisitions.

Acquisitions have slowed down after 2017 and the Merger, but were a constant method of growth prior to that and remain a possibility in the future:

https://www.intrum.com/investors/financial-info/mergers-acquisitions/

Business

Essentially, it is a debt collection business and it is the European leader. It has two main ways of doing that.

1-It acquires portfolios of debt and then services the portfolio to recover part of the funds owned and in the process earn a profit. “The portfolios are purchased at prices significantly below their nominal value, and Intrum retains the entire amount it collects, including interest and fees”. In this segment, the company generates cash, but must keep a portion of the cash generated to replenish the portfolios of debt.

2-It services debt portfolios as a service for financial or commercial companies.

Although it is not broken down in the financials, this segment also includes credit scoring and credit information, which is an excellent business.

Combined, bank receivables represent 69% of the total.

And the businesses are about half acquiring portfolios and half servicing.

In the end, its the same business done on or off balance sheet, as Intrum states in the annual report that sometimes the clients prefer to sell the debt (receivables) portfolio to offload them from their balance sheet, and sometimes they just want the portfolio to be serviced.

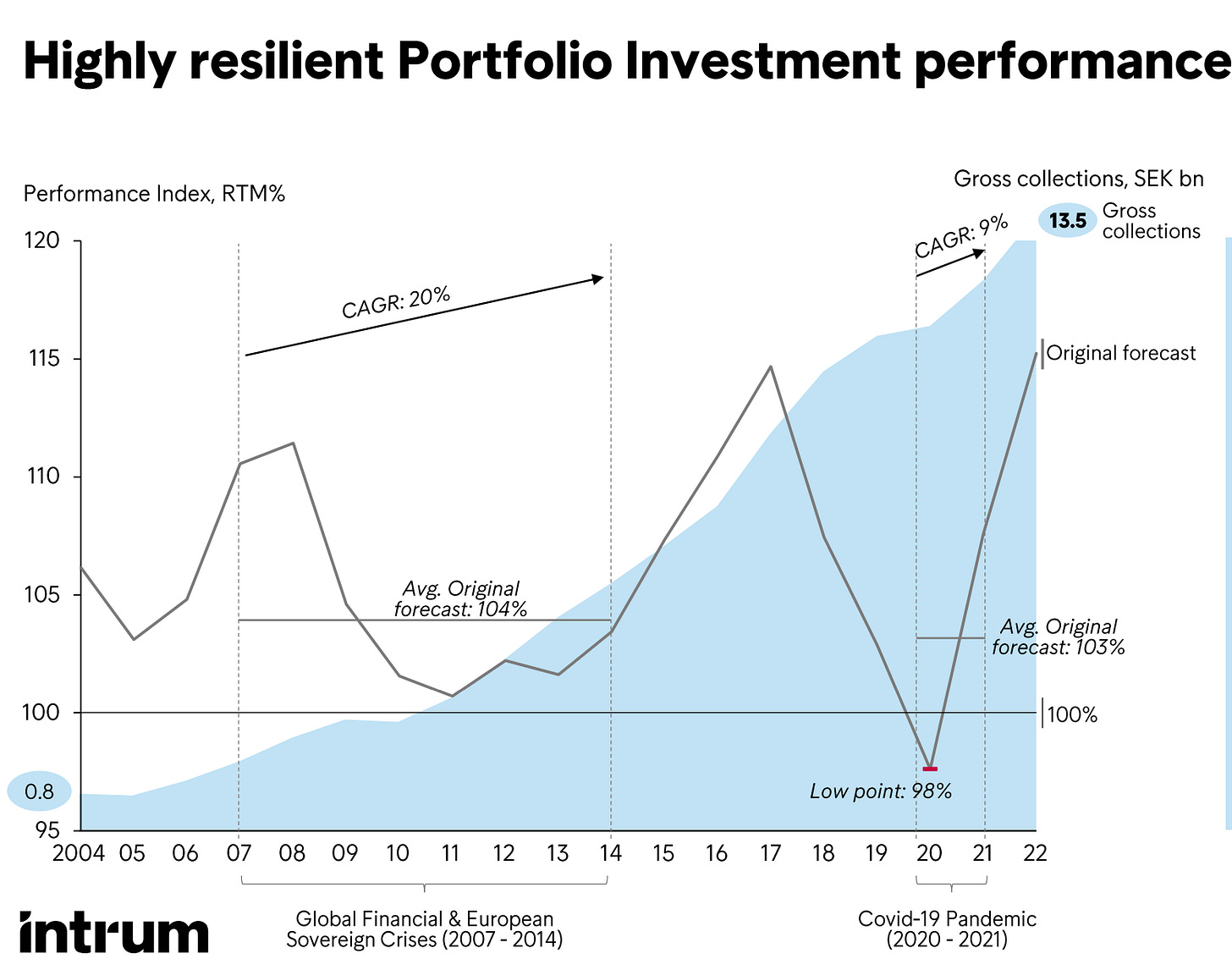

As the company highlights, collections are up 17 times in 19 years, and survived the financial crises extremely well as collections is counter cyclical. A good crisis fuels growth for the years ahead, while stalling recovery rate (or performance index) temporarily.

I rate the company as a verified compounder.

This is with constant share repurchases and dividends. There was a large share issuance for the Lindorff Merger of 2017 however.

A proven compounder at a valuation multiple of 5-7 (2023) is a no brainer as a diversified position. Even recently, the business is incredibly stable.

Recently, the company notes that new claims are of lower balance, addressed by efficiency plans.

Strategy:

After this introduction, I will analyse further: