Hi all, In the second and last of the summer guest posts, Iggy joins. He impressed me with his search for deep value but with growth, in hidden corners of the market. He is relatively new online.

Hi Iggy, can you present yourself?

My name is Iggy. I am a 23-year-old value investor from the Netherlands. I recently completed my master's degree in Econometrics. I have a passion for sharing my insights and ideas, which I express on Twitter through my handle @IggyOnInvesting, as well as on my Substack platform, iggyoninvesting.substack.com.

On my Twitter and Substack, I aim to provide valuable content that not only reflects my investment strategies but also educates and engages with a wider audience. I believe that sharing ideas fosters a collaborative environment where investors can learn from each other and collectively grow their understanding of the financial landscape. As I continue to evolve in both my professional and personal capacities, I am excited to connect with like-minded individuals, contribute to meaningful discussions, and explore new avenues within the world of finance and investment.

How long have you been investing for and how did you get started?

I entered the world of investing relatively recently, beginning to allocate my personal funds towards the summer of 2021, well after the surge in markets following the COVID panic, which led to record highs in most major indexes. Looking back on my journey, it likely started, as for many young people, I stumbled upon a video discussing the magic of compound interest or the life of Warren Buffett, and found the concepts fascinating. I recall reading 'The Intelligent Investor' back in 2018 or 2019. While the underlying philosophy resonated with me, I still grappled with a sense of uncertainty. The notion of purchasing assets below their intrinsic value made sense, but the intricacies of determining this intrinsic value remained elusive, particularly given my lack of an accounting background and absence of business-oriented individuals within my family or friend circle.

The tide began to turn with the onset of COVID lockdowns. Suddenly finding myself with ample free time, I capitalized on this opportunity in two distinct ways. Firstly, I secured a relatively well-paying part-time job as a student, which substantially bolstered my savings rate. This newfound financial stability provided the confidence I needed to start deploying my savings more effectively. Secondly, with the majority of my time spent indoors, I had the luxury to delve into various books and absorb insights from talks by seasoned investors. Among these resources, two books stood out, significantly contributing to my ability to independently evaluate companies. The first, 'Rule #1 Investing' by Phil Town, a book that often doesn't receive much recognition from veteran value investors, yet remains my foremost recommendation for anyone venturing into self-guided value investing. The practicality it offers empowers individual investors to roll up their sleeves and immerse themselves in the actual groundwork. Additionally, it offers insightful examples of the elusive 'moat' concept that Buffett consistently emphasizes. The second book, residing at the opposite end of the spectrum, serves as a veritable bible for numerous value investors – 'You Can Be a Stock Market Genius' by Joel Greenblatt. Bridging the insights from these two books with over a hundred hours of podcasts consumed during gaming sessions finally granted me the self-assurance I needed to begin picking my own stocks.

As I previously mentioned, we've now entered the second half of 2021, and I found myself rather cautious about the valuations of major indexes, particularly those of growth-oriented companies. This cautious sentiment nudged me towards adopting a more traditional, old-school approach to investing – one centered around low P/E ratios or book values.

My initial inclination to express my ideas in writing took shape during Edwin Dorsey's stock pitch competition for students. I chose to present my analysis on Monnari Trade, a Polish nano-cap deep value play. As one might expect, my submission, highlighting an illiquid, non-euro denominated European nano-cap, was far from the frontrunner in a stock picking contest organized by an American entity. Nonetheless, this experience provided me with a glimpse of the joy that comes from sharing investment insights with a wider audience. This realization prompted me to consider launching a Substack platform. However, I hesitated, as the thought of writing for an audience that might not exist was somewhat discouraging. To address this, I decided to create a presence on Twitter as well. The amalgamation of Substack and Twitter not only offered me an outlet to showcase my content but also a platform to publicize my Substack. This journey has been immensely rewarding, and I'm excited to continue sharing ideas and engaging with fellow investors in the online realm for the foreseeable future.

What brought you to small caps or companies in unusual countries?

As I mentioned earlier, the two books that instilled the confidence in me to begin selecting my own stocks are 'You Can Be a Stock Market Genius' and 'Rule #1 Investing'. These books emphasize the advantage that individual investors possess when venturing into markets that are less accessible to large or sophisticated investors. The strategies of young Warren Buffett, who focused on smaller, less liquid, and often overlooked stocks, along with the wisdom of his partner Charlie Munger, who advised to "fish where the fish are," have also been sources of inspiration for me.

When I initially delved into stock analysis, major market indexes were at all-time highs, making it seemingly improbable to discover undervalued options within these indexes. I distinctly recall pondering: Where can I find opportunities? Given the substantial influx of passive investments into U.S. indexes, I turned my attention towards European stocks. To narrow down my focus, I researched the quantity of publicly listed companies within each European country. One country stood out prominently: Poland. Surprisingly, Poland ranks 7th within the OECD in terms of publicly listed companies. With nearly 800 companies listed, it boasts nearly double the number of listed companies compared to economic giants like France or Germany. This observation marked Poland as a promising territory for exploration. I had never heard of any mention of investment activities in Poland, a nation that only emerged from communism in the 1990s. This led me to believe that inefficiencies in the market were likely to exist. Drawing from my positive experiences during a recent visit to Poland, I was inspired to conduct a comprehensive A to Z stock screening.

I certainly didn’t pull the trigger on enough stocks, as I lacked the confidence that comes with experience. However, my experience with screening companies in Poland turned out to be incredibly positive. I stumbled upon situations where profitable paper companies were trading well below the assessed value of the logging land they owned in Sweden. Similarly, transportation companies were available at a significant discount compared to the valuation of their fairly liquid fleet of trucks. Furthermore, I encountered numerous companies with price-to-earnings ratios as low as 5 and even lower. This experience solidified my belief that these lesser-explored opportunities offered prime prospects for individual investors, in contrast to the more well-known exchanges such as the New York Stock Exchange or the NASDAQ.

Talk about your portfolio construction, concentrated or diversified?

My portfolio is highly concentrated. So much so that in the remainder of this interview, I will briefly go over all my stock holdings. Which is well… Only five.

But first, a short note on why I am so concentrated. I have been slightly more diversified when I started (think 8-15 stocks). However, I had less conviction in my marginal stocks and noticed I had a much harder time holding these stocks when markets became more volatile. With Buffett and Lynch whispering in my ear about "diworsification" and aided by the fact that I am young and have plenty of time to make up for losses, and with my future income being (hopefully) significant to my portfolio, I believed it was right to concentrate on my highest conviction ideas.

Now for the juicy stuff let’s have a look at my portfolio of small-nano cap stocks. I will go through my stocks in the chronological order that you will find write-ups on my substack.

#1 Monnari Trade S.A.

Monnari was my first foray into Polish stocks, and it provided a valuable lesson in market inefficiency. During my screening in 2021, I stumbled upon this company trading at approximately 0.5x book value, with a market capitalization of around 70 million PLN. However, a closer look at its financials on TIKR revealed an intriguing inconsistency stemming from a substantial entry on the balance sheet labeled 'Other Long-Term Assets,' valued at roughly 90 million PLN.

To unravel the mystery, I decided to search the company's name on Google News. The results uncovered one of the most straightforward investment opportunities I had encountered in my relatively brief journey as an investor. A local newspaper from Lodz, where the company is headquartered, reported that Monnari, a women's clothing retailer, had been involved in the redevelopment of a parcel of land containing old industrial buildings known as "The Geyers Gardens." The real gem was the revelation that the company had recently inked a deal to sell an undeveloped portion of this land, bringing in a tidy 75 million PLN in cash—surpassing the entire market capitalization of the company. Astonishingly, the stock had not reacted to this news.

In essence, by investing in a company valued at 70 million PLN, I stood to gain exposure to:

75 million PLN in cash

Ownership of the remaining part of the Geyer Gardens, which not only boasted similar acreage but also featured meticulously restored, irreplaceable industrial structures, potentially rendering it more valuable than the sold portion

The entirety of the clothing business, which had exhibited a decade of growth in gross profit prior to the pandemic but had grappled with challenges in managing bottom-line costs. Notably, like numerous other companies, Monnari had utilized the pandemic period to implement cost-saving measures. You paid 0.25x sales for the core clothing business that had operating margins around 10% many years pre covid.

Add to this that the CEO and largest owner seemed like an above average capital allocator, who made great money on the real-estate investment and had bought back 15% of the company in the years before the pandemic and I believed this was a no brainer.

#2 Eurosnack S.A.

Eurosnack S.A. marks the second addition to my portfolio resulting from my ventures in Poland. The company specializes in the production of savory chips, a business that shines brilliantly when distribution falls into place. While Eurosnack faces customer concentration, it's worth noting that these customers are among the most desirable to partner with. Biedronka and Dino, Poland's leading value supermarket chains, stand as Eurosnack's major customers. These chains have consistently secured market share dominance over the past decade or more. Eurosnack's strategy of expanding its retailer base and introducing new products annually for these very customers has translated into remarkably impressive growth over the last ten years. In fact, the company achieved an astounding 40% compound annual growth rate (CAGR) in revenue starting from 2014.

Here was a stock that not only achieved self-sustaining profitable growth but also operated within one of the most coveted sectors for investors: the fast-moving consumer goods industry. Astonishingly, it was trading at a mere 0.6 times my projected revenues for the upcoming year. Considering the ongoing trend of numerous fast-moving consumer goods companies being taken private at multiples of their revenue, this particular stock presented an absolute no-brainer opportunity.

#3 Kistos PLC

Kistos PLC, the North Sea oil and gas company led by the esteemed chairman Andrew Austin, is perhaps the most recognizable stock in my portfolio for many of your readers. Thus, I'll keep it concise and pepper in some amusing personal anecdotes. Kistos holds the distinction of being the longest-standing member of my portfolio. Despite my initial lack of knowledge about oil and gas, a VIC (Value Investors Club) article managed to convince me of the undervaluation of Kistos' assets and the remarkable skill of Andrew Austin and his team in the realm of deal-making.

Recalling the moment I shared my recent purchase of this promising gas company with my colleagues at my student job, their reaction was intriguing. The mention of the Dutch Tulip Oil raised a spark of recognition. Following a brief contemplation, one of my colleagues casually remarked, "Hey, isn't their office just across the street?" While I held a fondness for Kistos partly due to its assets being located in my home country, this connection hit even closer to home than I anticipated. As weeks went by and I biked past the Tulip Oil office, a peculiar sense of satisfaction washed over me as I noticed the Kistos logo adorning the front door, replacing the previous sign.

With my the price of my original purchase in 2021 being around 207p and averaging up in 2022 this stock was a long time the top performer in my portfolio. But has now almost round tripped back to my original price, now being the main laggard in my portfolio. However, I believe Andrew is still doing great work and has completed 2 great acquisitions since my original purchase. Sadly the tax changes have really hurt this industry, but my belief in Andrew and his team who delivered a 100x in roughly 7 years remains.

https://twitter.com/IggyOnInvesting/status/1636997118186475521

#4 Card Factory PLC

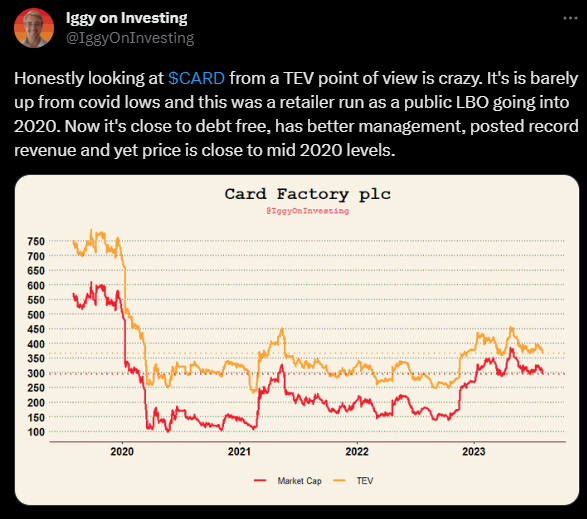

Card Factory is probably the highest-quality company in my portfolio, in my own opinion. The company primarily sells greeting cards (constituting 30% of the volume in the UK). Moreover, it holds the leading position in helium balloon sales within the UK market, and it also offers other party-related items such as wrapping and gifts. Just last week, the stock reported yet another increase in guidance, marking the fourth one since November of last year. It's firing on all cylinders and executing its strategies effectively. However, despite these positive indicators, it trades at a surprisingly low valuation multiple, hovering around 7-8 times earnings. But let's take a step back and revisit how I became interested in it.

I recall a YouTuber conducting a live stream during which he provided snap judgments on various stocks based on recommendations from viewers. At that time, this particular stock was trading at 150 million, and the last pre-COVID year had yielded 50 million in post-tax earnings, resulting in a price-to-earnings ratio of 3, assuming it weathered the pandemic. I momentarily forgot about this stock until it spontaneously crossed my mind one afternoon weeks later. I retraced my steps to the recorded live stream in order to discover the ticker symbol. Upon a cursory examination of the long-term financials, the company appeared promising due to its substantial cash generation and history of issuing substantial dividends, including special ones, in the years before the pandemic.

I then turned to Value Investor Club (VIC) and came across two excellent write-ups. This unassuming UK-based retailer had something extraordinary about it. It had consistently been ranked as the number one value-for-money retailer in the country for several consecutive years. Nevertheless, there were certain challenges. Being a brick-and-mortar retailer, its stores had been shuttered for nearly two years due to prevailing circumstances. The company had transitioned from private equity ownership to becoming publicly traded, effectively operating like a publicly managed leveraged buyout (LBO). Consequently, it lacked the ready cash reserves to withstand the pandemic's impact. Although the company secured a temporary refinancing agreement with its banking syndicate, this arrangement necessitated the raising of 70 million in either equity or subordinated debt to repay the loan.

https://twitter.com/IggyOnInvesting/status/1687720544983003137

The new CEO who came in 2021, basically at peak panic/pessimism, has managed to pull so much cash out of the business that he prevented dilution. The company also posted a record revenue year and has been consistently beating analyst estimates since he joined. With most of the debt now paid down and the EV only moving slightly compared to COVID lows, I am very comfortable to keep owning this stock.

#5 Interlife General Insurance S.A.

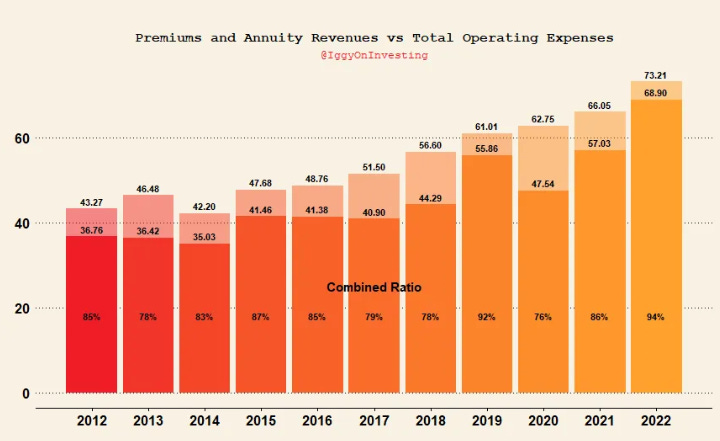

Interlife General Insurance S.A. is the most recent addition to my portfolio. The stock initially came onto my radar as it screened as selling below net cash. This turned out to be true, as the management of this insurance company had been hoarding cash during COVID, as they didn't feel compelled to buy bonds at record high prices, even though the economic situation seemed more uncertain than ever. This cash has now been deployed in much higher yielding bonds. Furthermore, Interlife has an incredible history of underwriting profitability.

Based on the historic underwriting ratio and a slightly higher than historic yield on the investment portfolio, this high-quality company is actually selling for 3x EBIT. Interlife has compounded its book value at a 15% clip since going public and created incredible shareholder value. Again, at current prices, I am extremely happy to own this company.

Here is Iggy’s Publication.

Great value+growth ideas I think. I like Eurosnack and Interlife best. Eurosnack, my broker does not have access to the Polish new market, and Interlife, I could buy it, I just wished that I knew how to read greek, but that would not stop me. Kistos is not my circle of competence, but with the right work, I seems like a great idea with a seriously good manager.

5 interesting ideas for sure. It’s great to see a young investor so advanced on investing.

Thanks

Thanks. I looked at interlife, tried to translate the statements, but don't come up with the necessary detailed information about the business I needed. I needed an overview of operations, the investment porfolio detailed. Maybe the problem is the XHTML format, not sure.