Hello,

This summer break will bring one or two guest posts from writers that I appreciate. I will sometimes have this when I am on holidays. I just have another weekly update for premium subscribers by end of week to send before I switch off. I am bringing my kids to my hometown for the first time..

The first one is by Guy from New Zealand. We talked a lot on twitter, starting from common positions. His newsletter covers many EM or UK value stocks, and shares interesting and often funny market analysis.

There are two types of investors; those that puke at a chart like that below and those whose eyes widen and start sharpening a pencil.

Something has clearly gone very wrong here, with the company in question at ten-year lows and down 2/3 from pre-Covid levels.

But there’s really nothing wrong with the business. Ashmore Plc just happens to tick almost every box that investors hate in the current climate.

Firstly, it’s a UK value stock and, even worse, a financial, which already puts it in one of the most hated sectors on the planet. Further, Ashmore is an investment manager specialising in … Emerging Markets … credit. It would actually be hard to imagine a company with more reason to be out of favour in this market.

Despite this, the company is a high quality manager, with most funds ahead of their benchmarks over the long-term. Ashmore also maintains a liquid balance sheet, holding half its market cap in cash and seed investments. This supports a very stable dividend which has now risen to unreasonable levels of 8.5%, purely on the back of the falling share price.

Some brief background

The company was formed within ANZ (Australia & New Zealand Bank) in the early ‘90s to handle their Emerging portfolio and was bought from the bank by its internal managers in 1999. Mark Coombs, who led the buy-out, remains CEO today and owns 31% of the company, while 40% in total is owned by employees. No doubt it is of great frustration to them that the company trades unchanged, today, from its 2006 IPO at 200p/share.

Like many wealth managers, the company is asset light with only 318 employees globally. This allowed the group to achieve a 59% operating margin last year (though this will be lower this year, on depressed earnings). The firm currently manages $56b in assets, split fairly evenly across central banks, sovereign wealth funds, pension plans and institutions. Interestingly, 27% of these funds are sourced from clients domiciled within EM, themselves.

To this end, Ashmore has established local operations in Colombia, India, Indonesia, Peru, Saudi Arabia and United Arab Emirates, which it believes will be beacons for attracting further local capital as these markets broaden. The Indonesian subsidiary has already been IPOed, with Ashmore maintaining a 30% stake. This should be a very replicable model going forward and a great way to leverage Emerging Market outperformance over the next cycle.

The vast majority of AuM is invested in the debt markets and this has traditionally been Ashmore’s speciality. However, management is now targeting equities and alternatives with extremely promising recent growth in these divisions. Equities in particular are up to 11% of AuM and saw expansion last year, despite the market weakness. As further motivation, alternative asset strategies garner much management fees than traditional debt funds.

The company has a buyback authorisation of up to 5% of share capital, but management has been loathe to use this aggressively in the past. Shares outstanding are roughly flat since IPO, but with the market price at decade-lows, this could be one avenue to create value going forward.

Investment merit

While I don’t think it would be quite right to call Ashmore a high-quality business, it does have many high-quality attributes. For example, despite the cyclicality of its returns and flows, the company maintains stable and enviable EBITDA margins. The chart below shows how much cost flexibility the company has to aid in tough years.

It takes a lot to turn a business with mid-60s margins loss-making on an EBITDA basis. The revenue decline would have to be precipitous and I don’t view it as likely, given the company is already deep into a lean patch for its style.

It is worth noting, that when Ashmore reports “Adjusted” metrics, there isn’t any bullshit going on. They are only removing forex effects and the returns achieved on capital invested in their own funds (seed capital), to accurately present the operating fundamentals of the asset management business. However, it does mean that statutory earnings could be drastically higher in years where EM returns are strong. An outcome regular readers will know I view as highly likely over the next cycle.

Ashmore are also highly skilled investors. As of their 2019 Annual Report, 97% (not a typo) of their AuM were outperforming their relative benchmarks over five years-unbelievably strong performance in a “normal” environment. However, they are staunchly contrarian within EM and have struggled during the Covid years (sigh), to the point where now only 48% of funds are showing outperformance.

The time to invest in good managers is when their style is out of favour, but they have proved their patience and process remain rock-solid. I believe the company’s future performance will be excellent, from a low tidemark and with very cheap portfolios.

Ashmore is also relatively low-fee for an active manager working with the extra constraints of the EM universe. Ashmore’s average management fee across total AuM was 39bps for 2022, a highly competitive number. Interestingly, the fees on their equity products are all lower than the 69bps charged by Blackrock’s EEM ETF (a passive product). Of further note, only 12% of assets are eligible for performance fees, which may be a drag in the good times, but has helped stabilise earnings in recent years.

I view Ashmore’s corporate governance as excellent. As noted above, a long-term, effective founder owns a huge chunk of the shares and many of his colleagues are also highly aligned. Coombs pays himself a base salary of only £100k/year and stock incentives granted to him in 2022 have a vesting price of £3.75/share (87.5% above current levels). The largest possible contributor to his net wealth, would be a much higher share price.

Ashmore’s last, but possibly most outstanding, attribute is its liquidity. Against a market cap of £1.43b, the company boasts £481m in cash reserves (only £84.5m is considered a restricted capital requirement) and £261m of seed capital (used to start and still invested in Ashmore’s funds). To be clear, half Ashmore’s market cap is in liquid reserves.

Valuation and the dividend

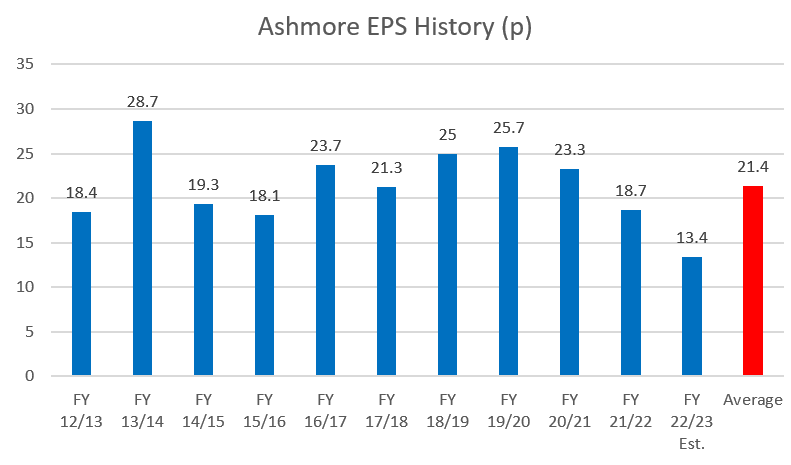

I wanted to chart back to 2012, to capture Ashmore’s performance over the entire EM cycle. As seen below, the company has averaged 21.4p in EPS over the last 11 years.

I believe this year will prove to be something very close to trough earnings for Ashmore. They have been buffeted by Brexit, currency and EM-cycle headwinds for the best part of a decade, still achieving solid performance and preserving a pristine balance sheet. The table below supports this view, with only Covid derailing good momentum in revenues and AuM.

Results could be stellar if some of these factors turn into tailwinds this decade. Mean-reversion in cheap EM currencies alone could significantly boost AuM.

To illustrate just how cheaply I view Ashmore today, if we subtract out the cash and seed capital (but leave the £84.5m in statutory reserves), we account for 92p of of the 200p stock price. This leaves the operating business on a 5x P/E of average earnings, as illustrated above.

While I don’t think it’s strictly correct to take the cash off the market cap and calculate a P/E, as the cash has been sitting there for some time and is unlikely to be returned to shareholders in its entirety, it does provide an excellent support to the 8.5% dividend Ashmore is currently yielding. The company mentions its progressive dividend policy frequently in its filings and are strongly committed to it.

There could be a lot of things wrong with a company and a sustainable payout that large could get you over the line. It just so happens, capital appreciation should be excellent too.

In my view, Ashmore’s fair value today is 385p/share or 18x average earnings. This would give reasonable credit to the liquidity on hand and the asset light nature of the business, while maintaining a FTSE-beating yield of 4.4%. Over the decade, I envision this fair value to grow steadily, as Emerging Market assets return to favour.

Thanks for reading,

Guy

Here is Guy Substack.

https://superfluousvalue.substack.com/

This isn’t investment advice. Please do your own due diligence and seek professional advice if you’re unsure about your finances.

Great write up and idea. What is the plan with the cash position?

Beautiful piece thanks. I already own this one and hold high hopes for it. I’m not convinced on performance against benchmark by a number of its funds but as you say tailwinds should gee that along. Their website offers some deep insights eg the case for local currency bonds article on 28 July