I reviewed a Japanese company from my previous screening. It is an interesting situation.

History

Beaglee Inc, 3981 in Japan, started as a mobile game company but switched to manga.

Then it purchased Bunkasha, an editing company, the company took a lot of debt. From then the business changed with a big part of editing Manga books and content.

Business overview

The company makes sales from manga publishing and manga ebook platforms.

Most of the sales are from the manga ebook platforms, but most profit is from publishing.

My guess is that it records the third party manga sales on the platform but gives back a lot of that sale back to the creators, and only keeps a small marketplace fee.

Manga publishing is owning the IP, releasing titles, signing artists.

The market is expected to grow, according to the management.

Strategy

continued growth in content, with many collaborations, like with TV producers to adapt the content to video format.

overseas expansion of content platform distribution business with the launch in 2023 in the US.

Management

The CEO is in the company since 2007, occupying different subsidiaries executive officers roles. I haven’t seen much about shareholding, but as a small cap it is still in build and acquire mode rather than cash cow mode.

Risks

-AI is very good at writing fiction stories. will AI replace the moat of manga writers? I see a big risk here.

-People moving on to new or other Manga franchises

-Money spent on some acquisitions.

Valuation

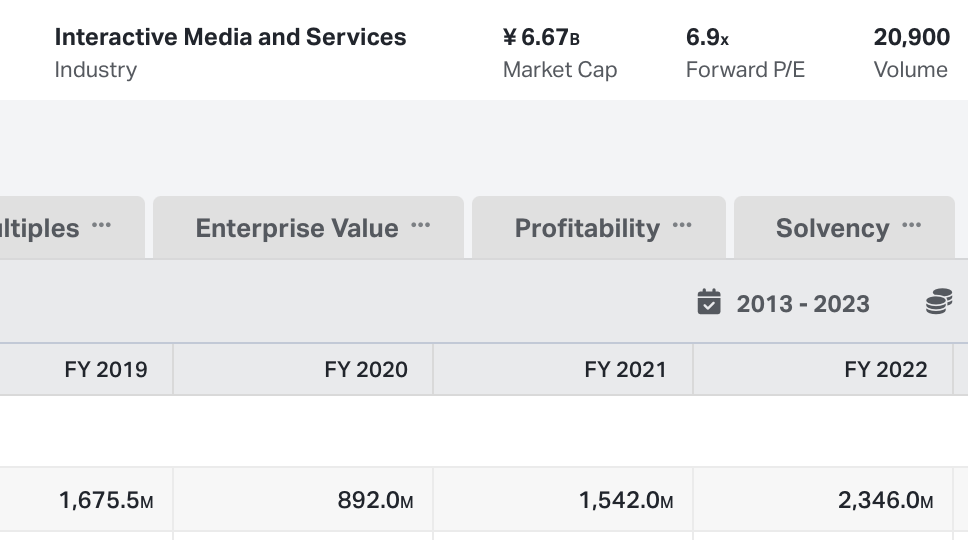

The company has debt, and despite this, trades at a super low EV/EBITDA ratio. The P/E forward is also quite low.

Bu the Free cash flow is even higher due to a lot of D&A Amortization.

(compared to the market cap of 6.6B yen, the FCF of about 1.5 B yen a year is enormous )

The problem is all that FCF is only used for growth or debt payments, and not much in dividends or buybacks.

We can confirm a bit the FCF profile of the company by looking at the plan for the next two years to “Reduce debt by 3 to 4 billion yen”, after M&A and dividends. (mcap 6.67 billion). The operating cash flow is planned to be 6 billion.

Holy goodie it’s cheap. Will the company rerate because debt is paid back? This is Japan, so probably not. Yen debt should preferably not be paid back because the interest is very low on yen debt. But it shows the earnings Power of Beaglee.

Conclusion

Well, I think it is good value, but there are stuff that make me observe and not want to buy it. The AI risk and the idea to just repay debt is kind of making me hesitate. Me not being Japanese and knowing nothing about Manga as well. Is this company a fad?

The inability to care about shareholder payouts or buybacks is another problem. What will they do in two years when the debt will be close to zero? Hoard cash, grow or pay a dividend? That is the most important point.

As for the AI risk, AI is pretty good at writing stories, or even making interactive stories. Who knows what will happen in two or five years with AI? Looking at the images, the mangas look kind of low quality to me.

But it is really cheap. It could be fitting well in a value basket at 1% position, or researched by an analyst who speaks Japanese and knows the Manga culture. The Japanese investor base is not rating this company highly. In the end, I have no strong opinion.

This is a fat pitch, I do no own the stock, and I do not know everything about the company.

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

Fidelity

This is the type of write up I love, thanks! It's not compelling enough to sell my ALTO or REYSAS but it seems worth keeping a eye on!