Hello, I have recently entered several 1% value positions quite quickly. When value appears, I like to strike. It is unrealistic to pretend to be an expert on these companies yet. With time, I can complete my knowledge and eventually add to the positions.

So I will email some Fat pitch value thesis when they occur in addition to my monthly write up. Some will be for supporters, especially for the names never head on Fintwit. Eventually, I can cover the same stock in a detailed write up later on. Value does not wait..

Fat Pitch: Grupo Aval is a leading diversified Colombian banking group, listed on the NYSE, led by the founder’s son, and available at a depressed 5 times earnings and 0,7 times book value. The panic over a leftist president has depressed the share price.

Size and perspective:

I Always put things in perspective. Just like when Fiat, Chrysler and Ferrari were together trading for an 8 billion Euros market cap, sometimes, a few billion $ market cap is too small for the scale of a company.

Colombia is a relatively small economy, exporting many commodities including oil and gold, and with 51 million people. Grupo Aval has 18+ million customers and its market cap is below $3 Billion USD. $3 Billion USD is small for such a large group.

The GDP is 4 times smaller than Spain, not exactly a huge economy either, for a similar population. Over the long term the development is positive.

Grupo Aval:

A large group with not only banking, but investments.

The business is about 2/3 banking and 1/3 other businesses in terms of profits.

There is a constant history of growth, organically and with acquisitions. It is also known to be conservative in its underwriting.

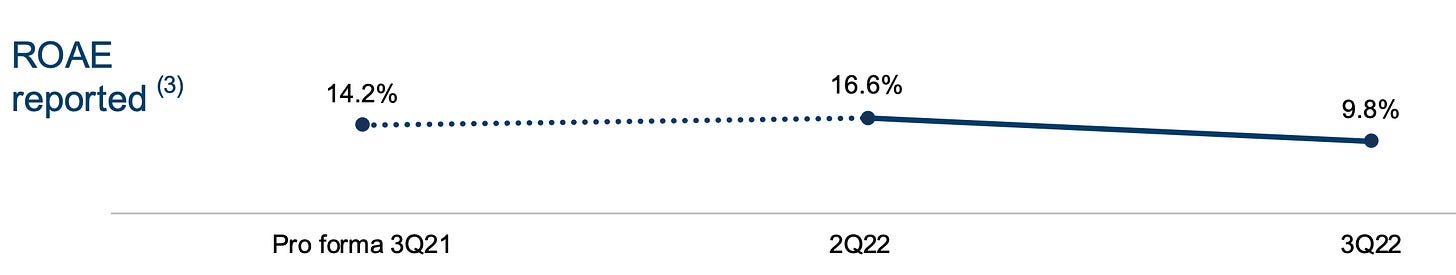

ROE is usually very high, dropped a bit in a hard Q3 on the currency and investments returns.

Management:

The company is owned and controlled by the founder, Luis Carlos Sarmiento Angulo, 90, the sort of Colombian Warren Buffett and richest person in Colombia. His son is the current CEO, Luis Carlos Sarmiento Gutierrez.

Returns: It historically paid a monthly dividend, representing over 10% at current prices. In 2022, it changed to an annual forward dividend in prevision of tax increases. I expect future dividends.

If you look at the stock chart, there was a spin off in H1 2022 of the Central American assets, that explains part of the drop. The company still owns a small stake in it.

Opportunity:

-Colombia is a oil exporter, a spike in oil prices supports the economy and currency.

Risks:

-Colombian macro economy gives risk to assets in a deep recession

-Colombian leftist government

-Debt of the company

Conclusion

-Considering the recent panic on Colombian Assets, I bought a 1% portfolio stake in the company. I did similar things with Chile last year, when they elected a leftist president, with a higher percentage due to the fact that there are listed Chilean Beverage companies, and it served me well. The Colombian banks are tested for any kind of macro environment and should just be fine unless things go really wrong. It is both a value and a growth company in my opinion.

Read further on Colombia and AVAL 0.00%↑ from a local investor here

https://www.grupoaval.com/es/presentaciones

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

If you like value ideas, consider subscribing to the premium tier. My next Value Fat Pitch going out this month is about a Nano cap UK serial acquirer in the making, currently at a normalised PE ridiculously low.

Free trials are available.

Thanks for reading. Any opinions on AVAL 0.00%↑ ?

Thanks for the write-up. That's a good summary of the situation with Aval.

Very good write-up. Colombia's GDP is only 50% of the current market of Tesla. Regardless of the political situation, I can see the Colombian economy growing enormously over the coming years.